Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I finished How to Fail at Almost Everything and Still Win Big: Kind of the Story of My Life, by Scott Adams. I covered a lot of what's in this book in the previous NOW. As previously mentioned, I really liked his follow a process mantra--and make sure that you keep that simple. This sounds a lot like "Trading Simplified" (tm) to me.

My biggest take away was his discussions about affirmations. This seems to go somewhat against his, and I quote "goals are bullshit" discussions, but he does address that later in the book.

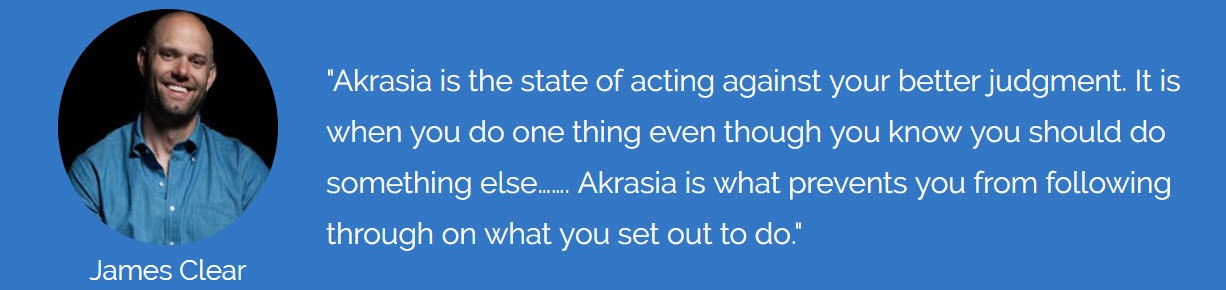

The affirmations discussion got me thinking about big picture affirmations, but more importantly, that much smaller affirmations could be the conduit that gets us there. We all would like X million dollars in Y years. Unfortunately, our short-term actions will often go against our longer-term plans. There's actually a name for this: akrasia. See this article: Take These Simple Steps To Overcome Your Trading Temptations. We might trade in less than ideal conditions, take mediocre (at best) opportunities, and bust our trading plan as soon as the market goes against us even though our stop has not been hit. Shorter-term affirmations can help us overcome the short-term temptations that sabotage our longer-term dreams. Further, seeing these micro affirmations come true could help to trick our brains that these things might just work! For me, my short-term affirmations would look something like this: I, Dave Landry, in today's analysis will pick the best and leave the rest. I, Dave Landry, will make a well-thought plan from that analysis. I, Dave Landry, will follow my carefully thought out trading plan today. And, if I, Dave Landry, cannot find anything short of a fantastic opportunity, I will sit on my hands tomorrow. I can obviously go on and on, but you get the idea.

One more point: Taken one-step further, I think even more "micro" affirmations could be useful. I, Dave Landry, will place my orders after the open and then go about my life. Confession time! As I was writing this, I was keeping a loose eye on the screen. I decided to get up and place the necessary orders (e.g., on AVTR, keep reading) so that I could STOP watching the screen! Ya see, it's working already! One more: I, Dave Landry, will read the big ass sign on the wall of my office before placing the next order!

I really think there's something to these affirmations. I've been repeating mine daily in writing them often in my "morning pages." Now, let's not start kissing each other just yet, but so far, I haven't busted my trading plan since this exercise began. I guess "the day ain't over yet!"

Source: Wikipedia Commons

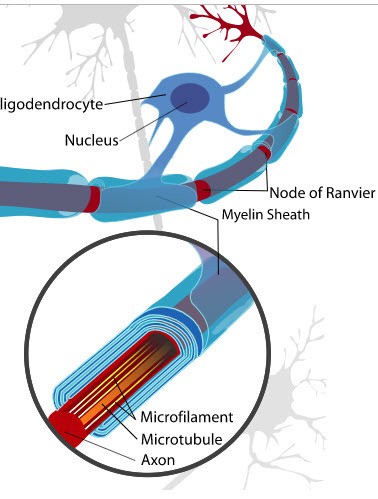

In researching affirmations, I've discovered that there is actually some neurology at work here. MRIs have shown positive changes in the brain during affirmations.* Like any "learning," something physical and long lasting takes place*, especially if you keep up with your affirmations. I'm a firm believer in the Hill "you cannot make a thing until you think of thing mentality." Affirmations create attraction and action.

If you "wire" your brain with enough positive affirmations, you'll be drawn toward the best opportunities. I used the word "wire" as a metaphor because axons become "myelinated" as you affirm things. This is similar to wrapping insulation around a wire, except that in this case, the "insulation" creates a superconductor. These "myelinated sheaths" transmit 10x (and some say up to 100x) faster than non-myelinated sheaths. You can make your own positive pathways by simply stating your affirmations.

I'm a big believer in the "laws of attraction." If you think positively, you will attract positive things. As previously mentioned, over the years, I have collected a shit ton of books that I plan to read someday. I'm guessing the aforementioned affirmations helped "mental chemistry" by Haanel to fall out of a box I was digging in (my temporary office is in boxes). Anyway, it's a little esoteric, but based on the physical brain changes, it's not that far fetched. I had bought this book after reading the "Master Key System-" another one of those "Tim Ferriss finds." I'm sure I'll have more to say about this one. So far, it has dovetailed nicely with my affirmations.

As I edit this NOW, I realize that I might seem like I'm "out there" a bit. No, I don't believe that as "The Secret" (who ripped off Haanel, Wattles, and others) suggests: if I wish for a shiny new red Ferrari just once, one will be in my driveway next week. My point is that there is power in positive thinking. Think negative thoughts, and you will become a negative, depressed person. Think positive thoughts, and you will attract positive things. "I was going to be a pessimist, but I figured it wouldn't work out." Wright.

See books to read for more trading and books on becoming better.

What I'm Working On...

Since it's been a while since, I've done a NOW, a lot of content has been published/repurposed. Sign up below to access the six latest podcasts, articles, and other content. Become a Gold member, and you'll get access to 18 recent publishing's, four member's courses, live and archived Q&A sessions, interact with the Facebook "mastermind" group and enjoy a plethora of other benefits.

Speaking of the Q&A, we had another great session if I say so myself. I covered TKOs, Moving Averages, stocks "priced for perfection," using ATR(s)?, trading with a day job, micro patterns?, orders revisited, risk on OGRes?, "hands off” trading?, and much more.

What I'm Thinking About

I'm thinking that there's a fine balance between trading an inefficient IPO with pioneer patterns vs. risk. I made a comment channeling Linda Raschke (discussed in the last NOW): they always let you in, but they never let you out. John Z. from the Facebook group has dubbed these "Hotel California" stocks. Bastardizing the song, you can check in anytime you want, but you can never leave. I got creamed on one IPO that turned out to be super thin/volatile. And, I'm holding another one that turned into a big winner, but the spread is abysmal and the stock is all over the place, mucking with my daily P&L. "What stock" you may ask? Well, I'll tell you if they ever let me check out. Trust me, you don't want to check in!

I remain on my "the importance of the micro versus the macro kick." I'm thinking that the micro affirmations might just be the solution and secret to success here.

I continue to keep up with my "morning pages" religiously. Every morning I wake up and write three handwritten pages. I would urge you to do the same. From them, I have a book idea, ways to improve my business, my trading, and my life. Obviously, a lot of this has been filtering into Random Thoughts, this column, podcasts, etc. In fact, restarting the podcasts came directly from the morning pages. Also, as I mentioned before, another great thing about the morning pages is a lot of what I worry about never comes true. And, when some of it does, it's never nearly as bad as I feared.

Mark Twain

"I have had many troubles in my life, most of which have never happened."

Based on the Larry Williams' quote (which I got from Jake Bernstein in a panel that I was on), I've also been thinking a lot about how I need to become "clinically dispassionate." This is especially true every time I drop an F-bomb!

Larry Williams

"To make money as a trader, you have to not care. As soon as you start caring, you have emotional attachment. It's counter-intuitive. The more you care, the less you make. The more you're clinically dispassionate and less attached to your trades, the more you will make. It's really quite simple, but very hard to accept. "

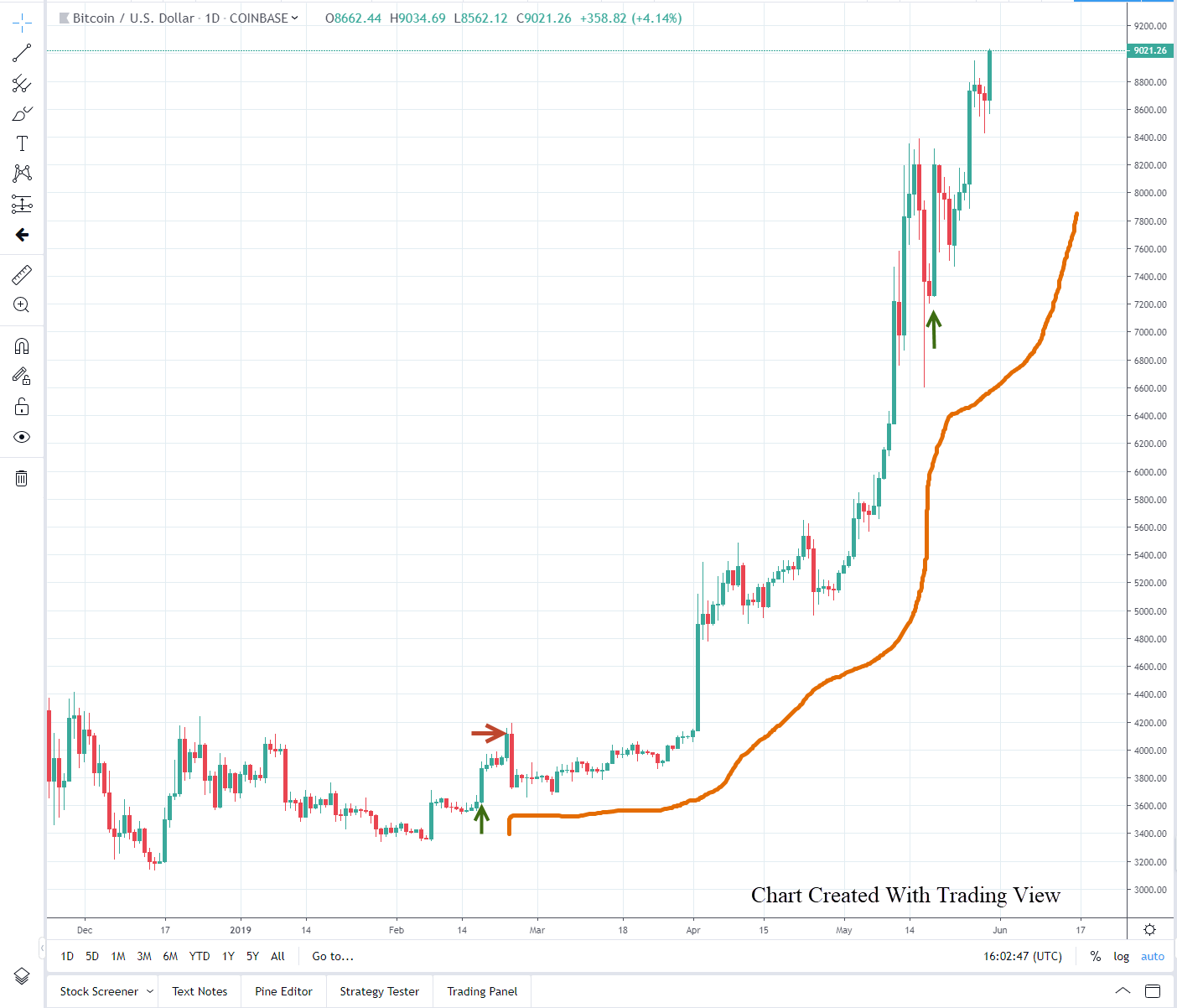

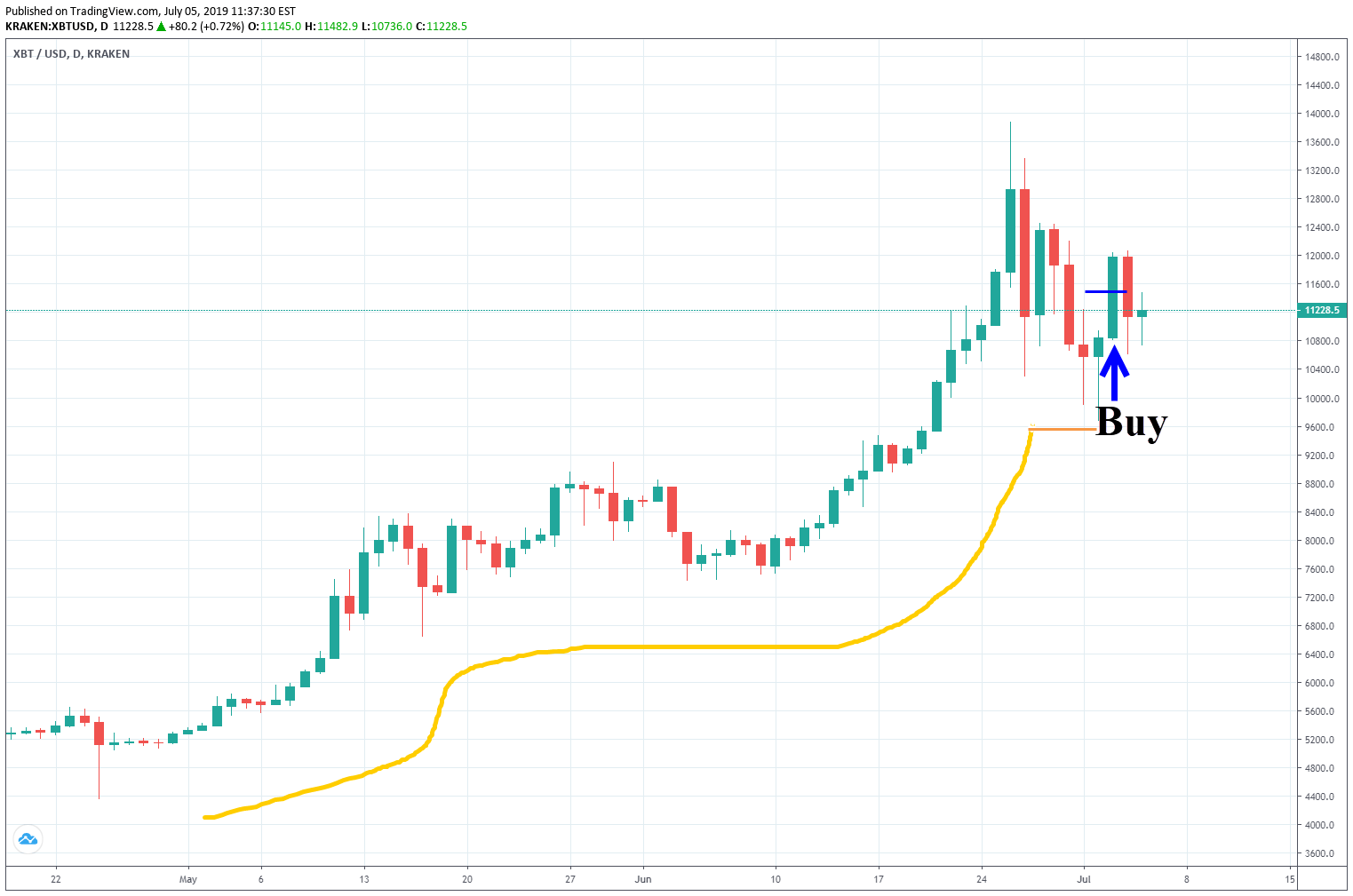

Lately, I've been thinking about how much fun it's been trading the Cryptos (some trades illustrated below). This is obviously because they have been in a great trend, but more importantly, it is because I've been very flippant. I simply do not care! I just place my orders, and if they get filled, I get filled, and if not, so what! I've been clinically dispassionate. I've had an incredible run up in a small account. It's been a fun game. I wonder if I can continue doing the right thing and having fun playing the game if the account gets much larger? I need to remember how I feel now and make sure I continue to "play the game." I also need to remember to play the game in my other accounts.

What I'm Trading*

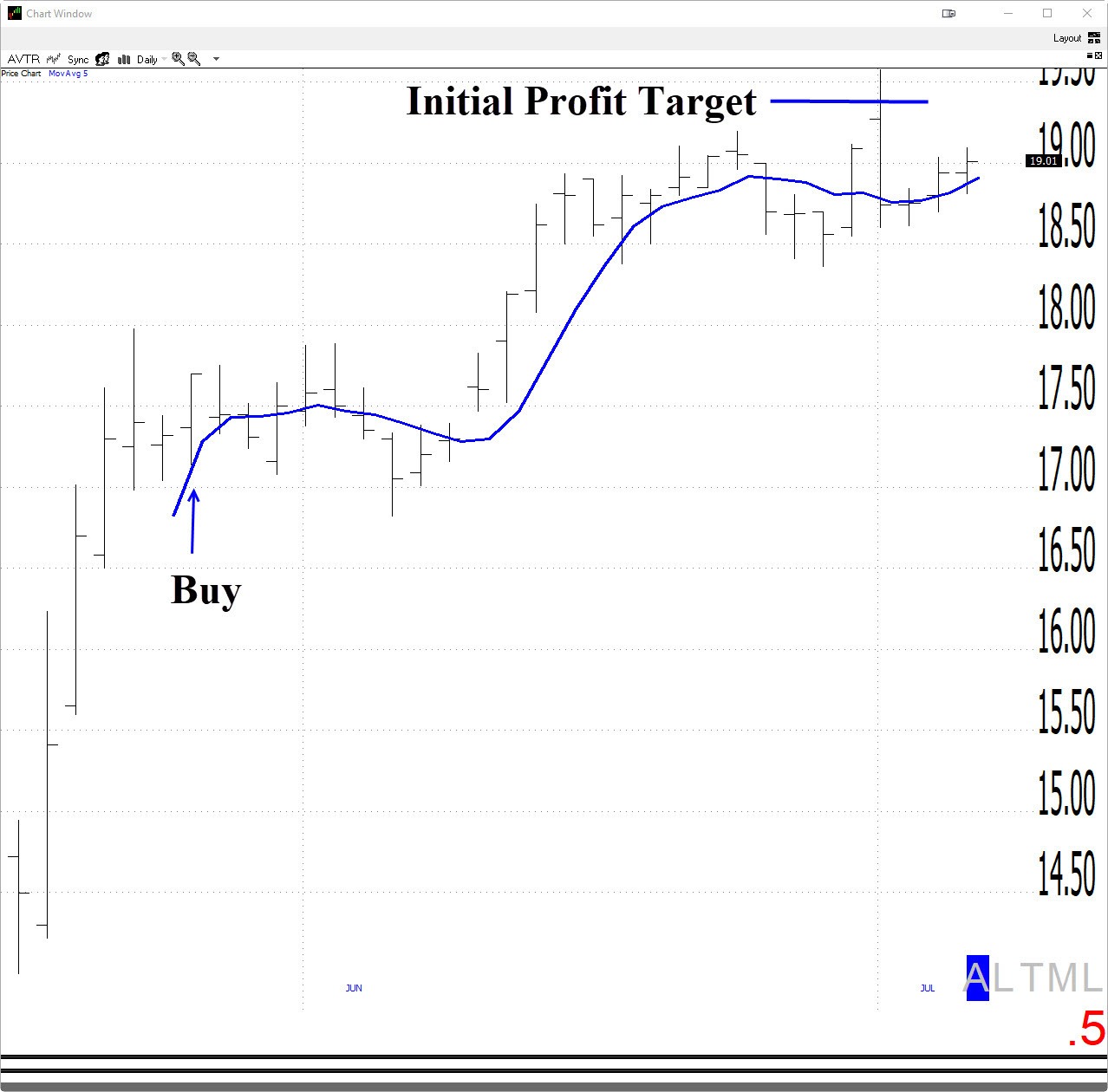

I'm continuing to trade my IPO "Buy At B" and IPO LandryLight setups. As often mentioned, I love these "pioneer" setups that get you into hot IPOs early, but often keep you out of stinkers (e.g., LYFT, APRN, SNAP, etc.). I'm long Avantor (AVTR) based on this pattern. BTW, the stock was first mentioned, before it triggered, in my Facebook "Mastermind" group. See this interview with Mary Ellen McGonagle's StockCharts.com show for the rules of this setup.

Confession time: Notice above I have the initial profit target level marked. I was so busy trading opening gap reversals (OGRes) on the big gap (07/01/19) that I neglected to lock in partial profits. SHAME! Maybe a micro affirmation is in order? I, Dave Landry, will check to see if ANY existing action needs to be taken/orders that need to be placed on existing trades before chasing any new opportunities.

Other than the IPOs, there hasn't been a tremendous amount of opportunities in stocks. This is normal for a market making new highs since the methodology requires a pullback. I am a little concerned that the database might be talking. I would feel a heck of a lot better if the market would break out and not look back for a while (i.e., follow through).

I continue to be a good little Trend Following Moron in the Cryptos. In this last trend, I started buying Bitcoin around $3,600 and have been taking partial profits and putting back on shares to "swing trade around core positions" ever since. I flipped out the last "add on" trade (below) at $9,700.

Source: Pintrest, Original Source: SNL

Since the above, I narrowly avoided getting stopped (at $9,500) and actually did another "add on" trade at $11,475. You might be wondering: "Why would you sell at $9,700 and buy back at $11,475?" Well, like the hokey pokey, that's what trend following is all about. You can't "anchor" prices. Each trade has to be considered independently. The market doesn't care where you bought (or could have bought!). You also might have done the mental math to see that I rode out a 40-something percent correction. In my best Brian Fellows voice, you might be saying "that's crazy!" Well, that's another hokey pokey TFM-thing. That's what it called for. Put a piece of paper over the scale, and it doesn't look so crazy-just another pullback.

I'm still working on my "residual" strategy code-named: "crumbs in the cryptos." The idea is to leave behind small positions on each successful trade. See this NOW for a lot more on this. Also, see the 05/31/19 NOW for the "million dollar bitcoin" talk. Now, I'm not going to drink that Kool-aid, but I am going to continue to follow along like a good little TFM just in case!

The Holistic Trader*

Obviously, I've been a little holistic with my affirmations. I've also been thinking that Big Dave, being fat AF, might need to trim down a bit. I think, like athletes, we need to operate at peak performance. There's a gym less than a mile from my office, so I have no excuse. I have been keeping up with the cardio, doing 10-mile "sprints," 20-something mile distance rides here and there, and Peloton-ing on hot/rainy days. Oh, funny story: I bought my wife a shiny new I-talian commuter type of bike. Since then, I've had a hard time keeping up with her. I brought my bike to the bike store to have it checked out. I pretty much knew that they would talk me into buying another I-talian commuter bike. I even rehearsed how I would object a bit before pulling out my debit card. Anyway, they checked the pressures, checked the brake drag, and a few other things and then said: "Your bike is fine! Have you thought about losing weight?" Groan!

Upcoming Appearances

Nothing has changed since last time: I'm still open to restarting my international travel. So far, that process seems to be pretty slow-there's been lots of interest, but nobody seems to be getting around to wiring the money (I don't fit well in the cheap seats). I may be doing some online international work soon (Italy), so maybe that'll help to get the ball rolling. I will be playing the role of Dave Landry in Dave Landry's The Week In Charts and have a live Q&A Session for members on 07/10/19. I've been asked if I'd be open to appearances on a major website and I agreed. I'll have more to say about this once I'm scheduled.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*Notes and References

The Holistic trader means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

My goal with "What I'm Trading" isn't to report every trade on a blow-by-blow account, but to rather shed some light on recent lessons, screw-ups, and current opportunities.

Social Cognitive and Affective Neuroscience: Self-affirmation activates brain systems associated with self-related processing and reward and is reinforced by future orientation. Sounds like solving for that aggravating akrasia thing?

US National Library of Medicine, National Institutes of Health: To Learn is to Myelinate.