Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I reread Trading Sardines: Lessons In The Markets From A Lifelong Trader by Linda Raschke. Disclaimer: I'm a little biased. Linda's a good friend. And, I'm a huge fan. I reread the book because the first time I was reading the manuscript for flow and errors. And, I didn't want to let Linda down, so I took it very seriously. The reread has been very relaxing and enjoyable. In this day of get-rich-quick gurus, it's good to read about someone who's worked her ass off to grind it out through the years. I'll have a lot more to say about this one over time. Below is my testimonial that I submitted to Linda:

"Not since Reminiscences Of A Stock Operator has there been a no holds barred tell-all book about the life of a trader. In this day and age of get rich quick false prophets, it sure is nice to read about a real trader-someone who dedicated her life-at all costs-to become successful. Linda gives you an in-depth look into the trials and tribulations of being a trader-warts and all. Interspersed throughout her amusing anecdotes and hard knock life lessons, she gives you some gems about trading and how the market really works. Whether you’re new to trading or a seasoned pro, Trading Sardines: Lessons In The Markets From A Lifelong Trader is a must read, destined to become a Wall Street classic. "

I started reading How to Fail at Almost Everything and Still Win Big: Kind of the Story of My Life, by Scott Adams. I tend to buy a lot of books. It's borderline a sickness. I probably have enough books to last a lifetime. In the final days of our last move, it drove my wife Marcy crazy (don't worry I'm not stupid enough to make the "short trip" joke). Every time she'd see another book in the mailbox. She say, "Seriously!?, ANOTHER book to move?" If you've ever moved, then you'd know that towards the end packing goes out of the window and you just start throwing shit into your vehicles. This book was one that didn't get packed away. I found it tucked in between the seats.

I suppose my point is that it's great to always have an endless supply of books around, even though the chances of me reading all of them are slim and none (and Slim just left town). You never know where the next great idea or inspiration will come from. I think that you increase your chances of stumbling upon that elusive idea or inspiration by having plenty of books right under your nose.

Where was I? oh, the Scott Adams' book. The book is fantastic. Scott Adams is the creator of Dilbert. His somewhat sick sense of humor comes through nicely. He starts off in a self-deprecating fashion (almost to a fault) to avoid coming across as pretentious or having THE secret formula to success. He then goes Into his failures and what lessons he's learned from them.

I'm about halfway through and just getting to the meat. His following a system mantra and keeping that system simple dovetails nicely with my constantly striving to maintain my title as THE Trend Following Moron (i.e., to avoid over complicating or trying to outsmart the market).

I like his thoughts about creating "energy:"

"I'm suggesting that by becoming a person with good energy, you lift the people around you. That positive change will improve your life, your love life, your family life, and your career. ....When I talk about increasing your personal energy, I don't mean caffeine-fueled, bounce-off-the-walls type of energy, I'm talking about a calm, focused energy. To others it will simply appear that you are in a good mood. And, you will be." He then went on to discuss the sources of his "energy."

For me, my energy sources are treasure hunting for my next day's trading and service peeps, following my trading plan to a "T" (often by doing nothing when there's nothing to be done-e.g., letting orders work), chiming in on things such as hot IPOs in the Facebook Mastermind Group, and pontificating my random thoughts to electronic pages like this.

See books to read for more trading and books on becoming better.

What I'm Working On...

I'm continuing to add content to the Member's area. We had a great Q&A session if I say so myself. We covered entering simple pullbacks, OCO brackets for mechanizing trades?, discretionary trading in a mechanical way, Karats (gold) for hedging, "trade walk throughs," and a rehash on trading the best opening gap reversals (OGRes).

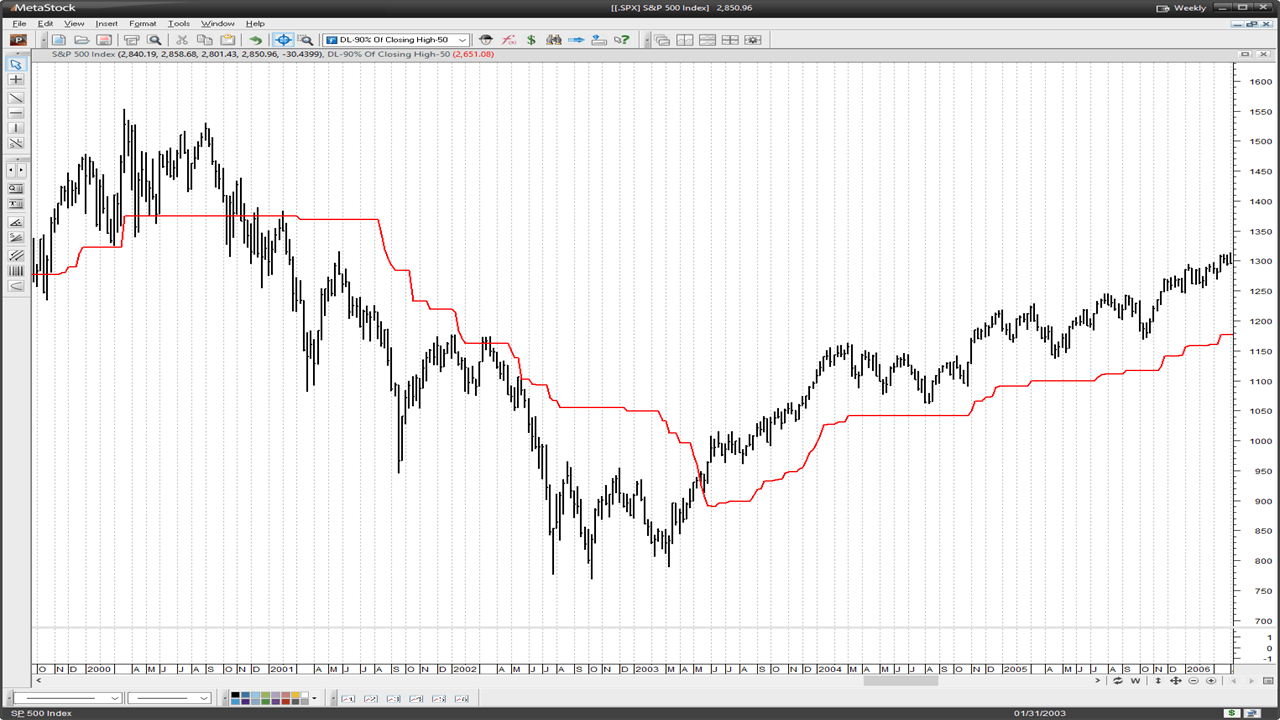

Speaking of content, I'm still getting tons of questions on the TFM 10% System. I never dreamed that something so simple would create such intrigue. Therefore, it has remained a central theme of my Week In Charts for quite some time. With the indices looking dubious at best, now might be a good time to check out simple market timing systems like this. And, while you're at it, take the free market timing course.

I also messed around a little bit with an indicator that I created based on the 10% TFM System. Essentially, you want to be long when you're above the line and short when you're below it. As you can see, it's not too shabby, especially in major bull and bear markets. See the aforementioned Week In Charts for a lot more on this.

I'm continuing to play with Finviz*Elite. As mentioned in the last NOW, I've been like a kid in a candy store here. I've been using it to create visual momentum list, running IPO screens, opening gap reports, and some other stuff. Anyway, so far, my elite account is paid for itself 10 times over. Check it out below.

What I'm Thinking About

In Trading Sardines, Linda talked about "profit centers" where her staff and associates traded systems in specific markets. This got me thinking about my current and potential profit centers such as hourly Bowties in FOREX, my core methodology outside of stocks (e.g., Crypto), longer-term market timing, pioneer and secondary signals in hot IPOs, and OGRes in various markets. I'm just thinking about ways of expanding Big Dave's Enterprises.

Inspired by The Artist Way by Julia Cameron, I have been keeping up with my "morning pages" religiously. Every morning I wake up and write three handwritten pages. In reviewing them, I noticed that I have been wasting some time letting the get-rich-quick scumbags aggravate me. This is especially true since trading, for the most part, has been a bit of a grind lately. I've done well in Crypto and mostly okay in IPOs, but otherwise it's been a grind (keep reading). And no, it hasn't been "eat, sleep, and trade baby!" I'm probably the first guru in history to show some bum trades (keep reading).

Recently, I had the privilege of having dinner with a very successful entrepreneur. This is someone that I admire and is wildly successful. I was discussing the aforementioned scumbags in this business that are fleecing clients. I explained to her that in reality, it's a grind. There is no getting rich quick. And, I went on to say that, unfortunately, reality doesn't sell. Anyway, I was shocked to learn that she had the same exact feelings about her business. In spite of her success, she often has doubts and even though she appears to have it all figured out, it's still a daily grind. This got me thinking about the Pressfield quote:

Steve Pressfield

"The counterfeit innovator is wildly self-confident. The real one is scared to death."

What I'm Trading*

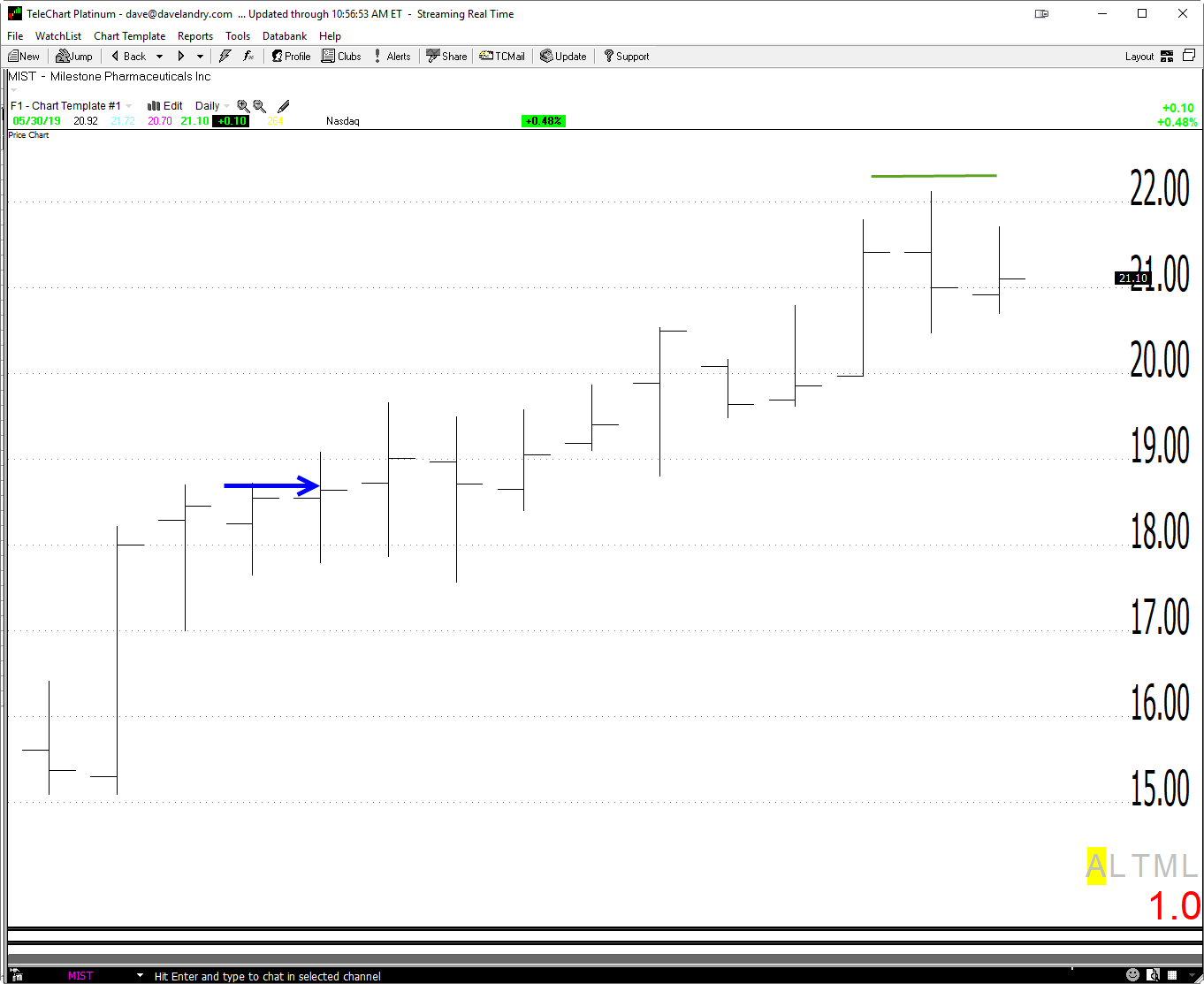

I'm continuing to trade my IPO "Buy At B" set up. As mentioned, I love these "pioneer" setups that get you into hot IPOs early, but often keep you out of stinkers (e.g., LYFT, APRN, SNAP, etc.). I'm long MIST on this pattern, mentioned in my Facebook "Mastermind" group. This one turned out to be a little thinner than anticipated. I'm using a limit order to hopefully (I know I said hope) squeeze out the initial profit target.

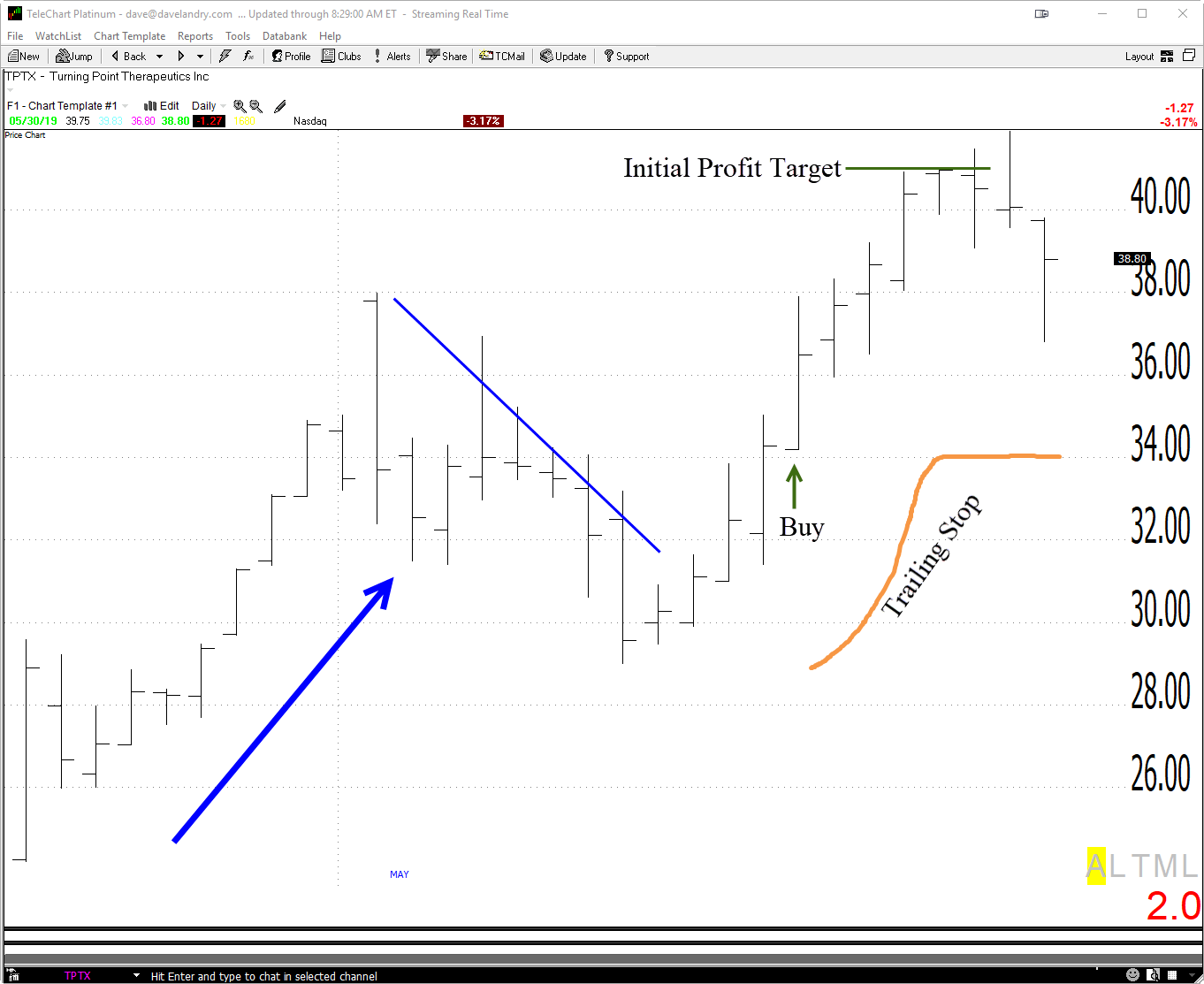

I recently took a long trade in TPTX based on an IPO Deep Retracement/Pullback. Partial profits have been taken and all I have to do now is sit back and relax (I know, ha ha!). That is the secret to trading: establish enough "free" positions and you'll do fantastic longer-term. You're welcome!

Update: As I was publishing, this one began to implode. Oh well, back to the grind! Channeling Churchill, I suppose success is moving from one failure to the next without any loss of enthusiasm! (after a few F-bombs of course!)

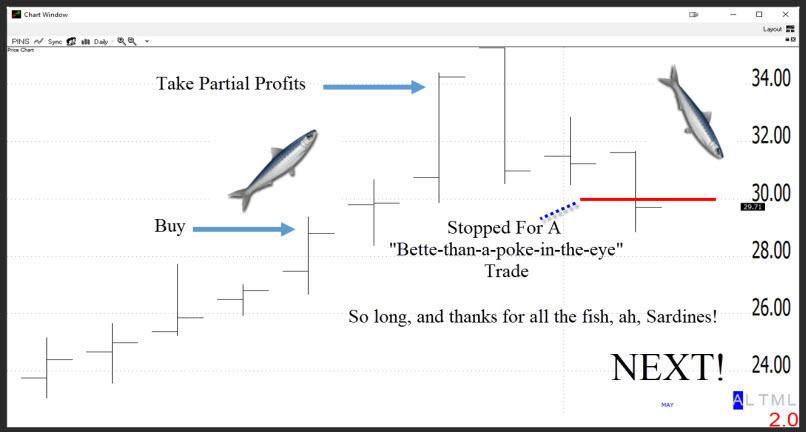

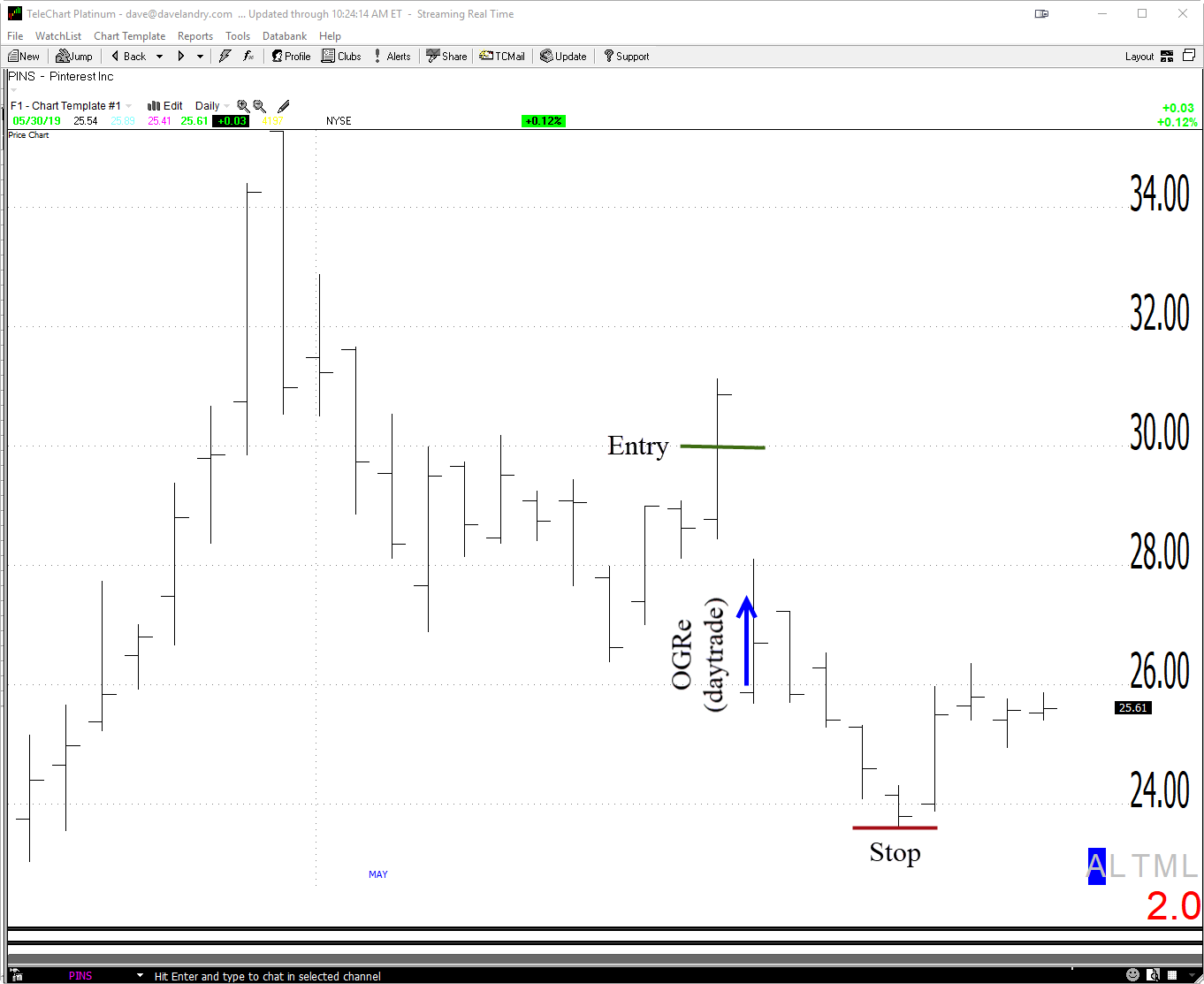

In the last NOW, I talked about the successful Pinterest (PINS) trade. Unfortunately, going back to the well on a secondary set up (a pullback), didn't work so well. Although I did recoup a few pennies on an opening gap reversal(OGRe), the new trade overall stopped me out to the penny (I was exercising a little discretion on the original stop).

Here's the Buy At B trade:

Here's the secondary (pullback) trade (and OGRe in between):

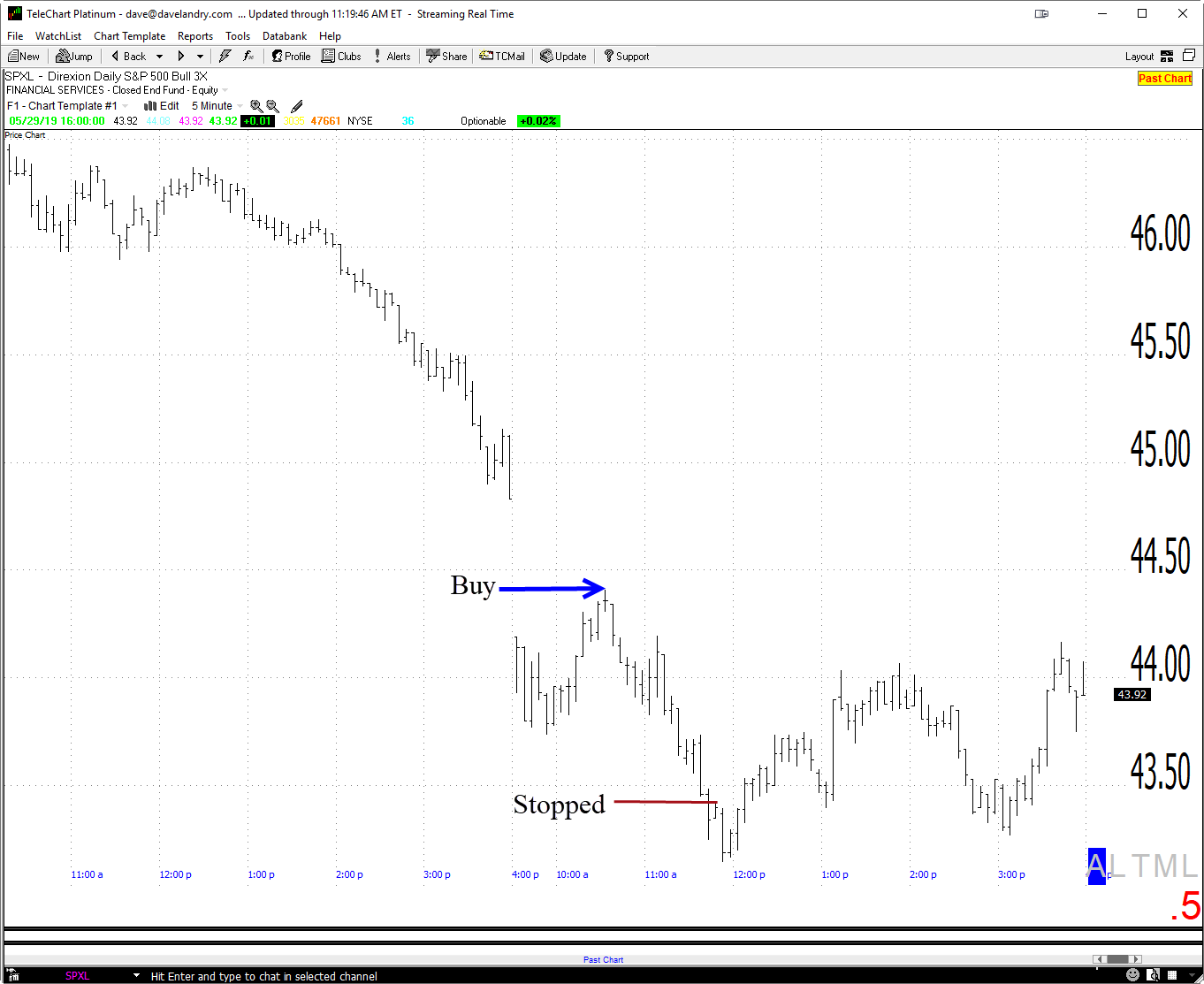

Speaking of "to the penny," I got filled "to the penny" at the exact top of the SPXL before it promptly reversed.

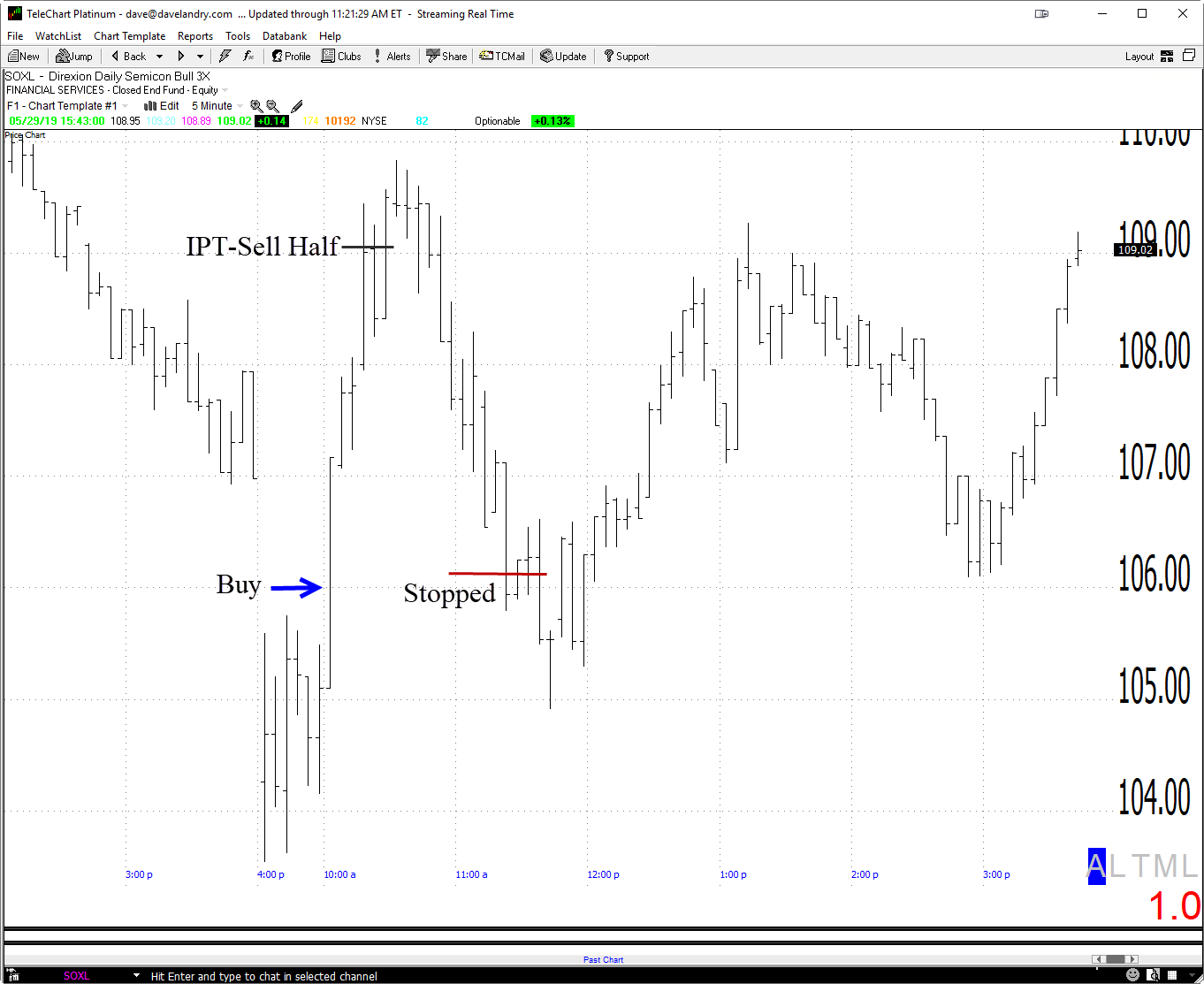

I did have one decent trade on the same day. I played the reversal in SOXL. Although this one didn't turn into a big winner, I'm proud of the trade because I remained very hands-off: using a stop to enter, a limit order to take partial profits, and the trailing stop to take me out of the remainder. I know that by following the plan and continuing to grind it out, I'll catch the occasional and often quite elusive trend day.

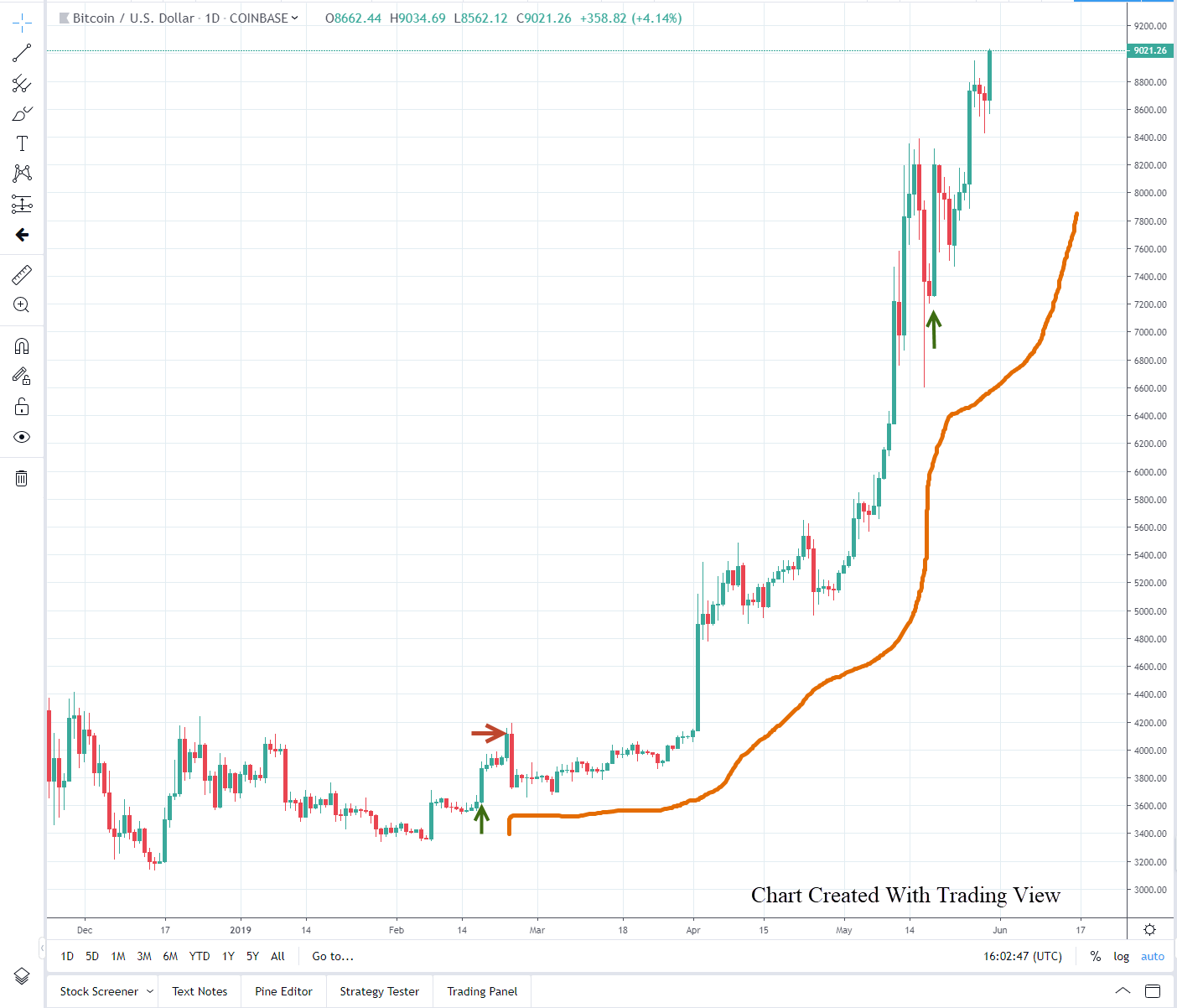

I remain active in the Cryptos. I've been following simple pullbacks to swing trade around core positions. I'm still working on my "residual" strategy code-named: "crumbs in the cryptos." The idea is to leave behind small positions on each successful trade. See this NOW for a lot more on this.

Speaking of Bitcoin, as I wrote in this article: "According to Blockchain.info, there are approximately 16.7 million Bitcoins in circulation today. In theory, there can only be around 21 million total. Put into perspective, that’s just enough for everyone in Florida (or every other person in California) to have just one. Since some coins will be and have been lost, one could argue that the supply is not only limited but will eventually shrink. "

There's a lot of "million dollar Bitcoin" talk out there. Of course, you have to take these (or any!) parabolic projections with a huge grain of salt. However, what's interesting is that one of these articles reference a tweet which pointed out there is not enough Bitcoin for every client of Coinbase (a Bitcoin broker) to own just one. Now, I wouldn't bet my life savings on this one fact alone, but it does show should the demand increase there wouldn't be enough supply to meet it. I know, "what would the world be without hypothetical questions?" (Wright) It is very interesting, nonetheless. Again, I'm not in a rush to invest my life savings, but I am going to continue to trade this and any other trending market (like a good little card carrying and button wearing TFM!).

One more point: Ultimately, supply and demand will control the price, regardless of hypotheticals. Looking back to my 2017 article: Bitcoin: Should You Invest, Trade, or Avoid?, I found the infographic where Larry Page could buy the entire supply of Bitcoin very interesting. If my calculations are correct with the coin tripling since then, it would now take a "Jeff Besos" to buy the entire supply. Even still, again, it all boils down to supply and demand, but supply is limited.

My FOREX trading continues to be like hitting your head against the wall: it feels so good when you quit. Due to the fact that it is a very efficient market, I'm looking to catch an inefficiency-a major trend change off the hourly charts (see Member's Methodology for my FOREX approach and more on understanding inefficient vs. efficient markets). And, as often happens, I'm questioning my sanity in this. I've lost count of how many failed trades that I've made in the EUR/USD and AUD/USD in attempt to catch a major trend change. I know that one big trend pays for them all, but in the meantime, my head hurts!

The Holistic Trader*

I'm not going to bore you (too late?) with my discussion on repetitive use injuries. Just remember to take care yourself if you spend a lot of time slouched over a computer because eventually it will catch up to you. See the last NOW for a discussion on ergonomics. I'm getting better but have a long way to go.

Upcoming Appearances

Nothing has changed since last time: I'm still open to restarting my international travel. So far, that process seems to be pretty slow-there's been lots of interest but nobody seems to be getting around to wiring the money. I may be doing some online international work soon (Italy), so maybe that'll help to get the ball rolling. I will be playing the role of Dave Landry in Dave Landry's The Week In Charts. I also have a live Q&A Session for members on 06/05/19. I have some online appearances outside of DaveLandry.com such as being the host of the Crowd Forecasting News webinar on Monday 06/03/19 and some other appearances/interviews that I'll be announcing once I have the details.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*The Holistic trader means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

**My goal here isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons, screw-ups, and current opportunities.