Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I finished Sway-The Irresistible Pull Of Irrational Behavior by Ori Brafman and Rom Brafman. Yes, it's yet another one of those "we're pretty messed up as humans book," but it's certainly worth the read. A lot of what he discussed has reaffirmed my recent quest to conquer the micro to get to the macro. He gives chilling examples of how short-term loss aversion inspired bad decisions can lead to great tragedies-costing hundreds of lives! A lot of this dovetails nicely with our often bad trading decisions. I borrowed heavily from it for a recent Week In Charts (below). This has also morphed into several lessons in my Member's Area.

I've nearly finished Dollars And Sense-How We Misthink Money and How To Spend Smarter by Dan Ariely and Jeff Kreisler. Hey Big Dave, another behavioral finance book? Well, yes, a few years back I stopped reading these behavioral finance/economic/science books because they all started to sound the same. And, they all tended to draw heavily on the same research (e.g., Kahneman's Thinking Fast and Slow). However, I did enjoy the last Dan Ariely book that I read-Predictable Irrationality (which also provided fodder for a recent Week In Charts and for the Member's Area, See this NOW column for more on this one). Ariely did a good job in the previous book by using his life experiences (e.g., a horrible burn incident from a flash mortar) to make his point. So, I figured I'd give this one a shot. The book can best be described as "behavioral finance light." It's obviously, targeted more toward the masses. If you haven't read any of these types of books, it's probably not a bad place to start. Kreisler adds a bit of corny humor to the book which is good for quite a few groans and an occasional chuckle. I'll give him a pass. Humor's not easy. I work really hard for the (very) few groans that I get! They did manage to cover a lot of the same, as expected: endowment effect, sunk cost fallacy, anchors, etc. It did serve as a renewed reminder to be leery of these pitfalls in trading. So, it was good to hear it again. They did hint at buy and hold, but I rolled my eyes and skimmed over that. Anyway, my litmus test for a good-for-trading book is one good thought or idea. Dan and Jeff talked about how Thaler's "mental accounting"-which I call "mentally monetizing"-is better defined as "emotional accounting." So, that's one big takeaway for me. Also, their discussion about how things end (drawing upon Kahneman-surprising!), frame our entire experience. This motivated me to create a Random Thoughts on Unhappy Endings along with a Week In Charts, and lessons for the Member's Area.

Dan Ariely

The positive perspective…is... If we do understand when we go wrong….If we understand the deep mechanisms of why we fail and where we fail, we can actually hope to fix things. (TED Talk)

See books to read for more trading and books on becoming better.

What I'm Working On...

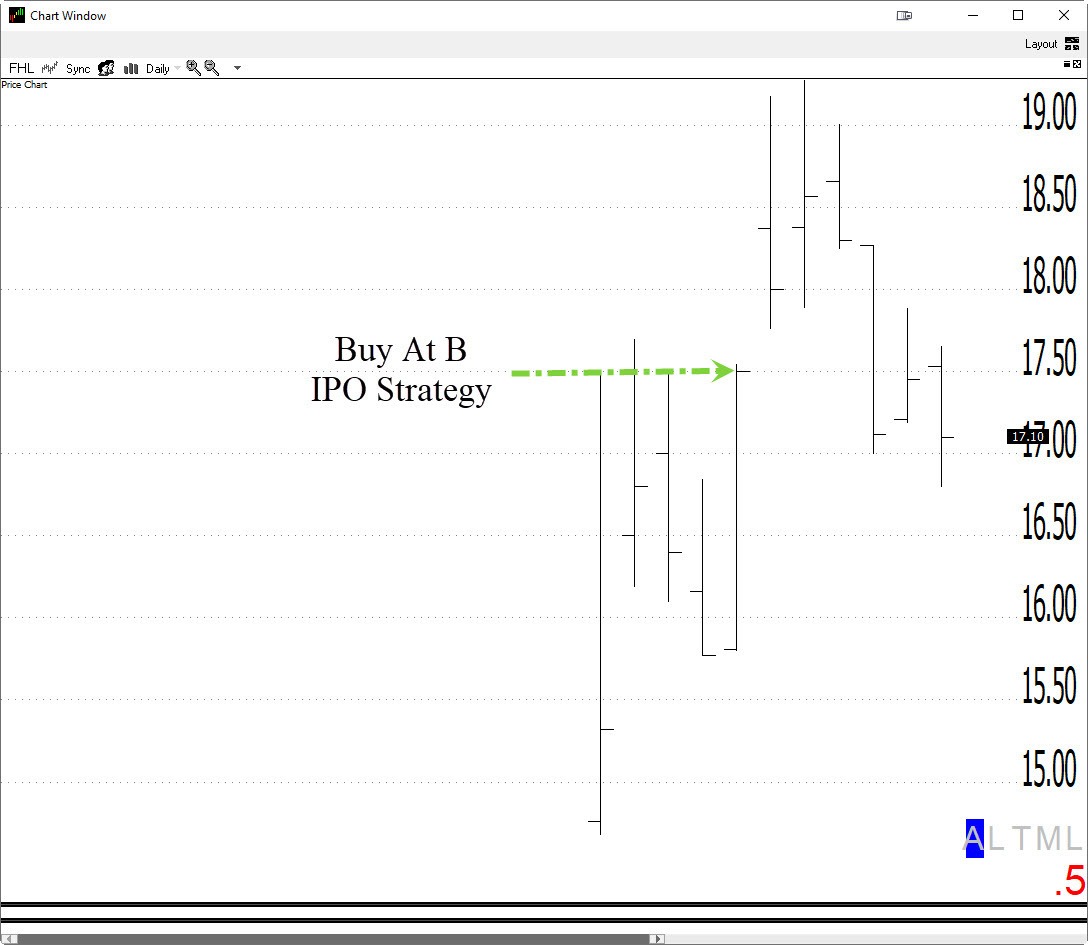

I'm continuing to add content to the Member's area. Since it's been a while since my last NOW, there's too much to mention it all. Some highlights include recent trade "walkthroughs" in a hot IPO and a few OGRe trades (keep reading). I'm excited that this new segment is becomming very popular. I also covered trading ONLY the BEST OGRes, times not to trade?, depth of pullbacks, the Landry List, Ground Rules, Position Sizing, Tracking Trades Spreadsheet, and the origin of Trend Following Moron. Whew! I've been busy!

What I'm Thinking About

I'm stuck on the importance of now, especially the micro vs. the macro. Doing the right thing at this moment is crucial. We all dream about that better self in the future, but the future is now. This was a reoccurring theme in the aforementioned Upside Of Irrationality. Applied to trading, take a few seconds to sit on your hands when tempted by the Siren call of unnecessary day trades or micromanagement. Take a few seconds to recognize when you think that you're using intuition but really are using "into wishing" (Market Wizards). Believe me, I'm not immune. I recently sold my house and moved into a rental while my new house and office are under construction. There were tons of unforeseen expenses. I felt like maybe Mr. Market could pay for these. I received yet another lesson on the fact that the market doesn't care about my expenses (or yours). In fact, just the opposite happened: I went into a drawdown! (keep reading).

The market operates on its own time frame.

From Dollars and Sense: "In the present, however, our emotions are real and powerful. They get us to succumb to temptation time and time again, and they cause us to make mistake after mistake."

With the many unexpected expenses of building my new home/office, moving, and all the associated stress. I've been thinking a lot how your trading will spill over into your life, and your life will spill over into your trading. Again, the market doesn't care about my newfound expenses. One of the tough things to deal with recently has been drawdowns to open profits. Since all trades eventually end badly, it just comes with the territory. This doesn't mean that I'm happy about it!

Now that I'm working out of the same house as my smokin' hot wife, Marcy, she's learning that a certain word can be used as a noun, transitive verb, intransitive verb, an adjective, adverb (and an adverb enhancing an adjective). Do a YouTube search on how to use that word, funny as, well, you know. Anyway, my exclamations have prompted Marcy to ask me if I needed a little of Dave Landry's preaching? What the?, well, again you know. I think I used it as a gerund in this case, but WTF do I know? LOL I'm a trader, not a writer. Where was I? Oh, I suppose that I'm not immune to the same stress that we all go through. Things that are perfectly normal-drawdowns to open profits that we have already emotionally accounted for-still can be stressful. Of course, this made it into several of the aforementioned presentations.

I've dipped my toe back into crypto (keep reading). Through the process, I noticed that my accounts have some "residuals" left over from prior trades. When I buy, I use a fixed dollar amount. However, when I sell, I sell in "whole numbers" of crypto, thereby leaving some fractions behind. With the recent upticks here, the crumbs are actually worth a few dollars. I think I might leave more crumbs behind just for S&Gs. I suppose if crypto had "end use" value (keep reading)-which, at this point in time, we don't know if they will, then this could be viable longer-term.

I've wondered about the same thing in stocks. IF an asset had some "end use" value, then accumulating it would be a good idea. According to dictionary.com:

Borrowing Mike Moody's example of toilet paper(TP)-from an AAPTA meeting, TP has "end use"-I guess pun intended. Let's say that you decide to trade in TP. You think it's a good value at 50 cents per roll. So, you buy 1,000 rolls. If the price rises to $1.50 and you sell, then you scored $1,000 on the trade. If it never rallies, then at least you have a lifetime of TP for it's intended end use (or about a month's supply if you have any women in your house).

Marcy has often said to me, "You tend to be right, but early. How do you fix that?" I dunno. I guess that's another one of those things that if I solve for, you'll never see my fat ass again! (you being you people and not my bride) LOL! Even though I know that stocks have NO end use value, it's hard for me not to emotionally monetize after the trade. Take GH for example. This was in my trading service and my own portfolio. I followed the rules and did okay for a "better-than-a-poke-in-the-eye" trade. The stock then took off without me. Even leaving just 100 shares on would have been as much as an additional $6,700. In the back of my mind, I've been thinking about these "house money" type of strategies. This is the idea behind my hybrid approach to money management-turning a swing trade into a longer-term "free" big winner. What I'm wondering is if there could be a "residual" strategy here? I keep coming back to the end use problem. Further, could the trader in me watch these residuals evaporate? I'm just throwing this out there. Any thoughts? Scroll down and leave a comment or better yet, let's take it up in the Facebook Group.

What I'm Trading*

As mentioned above, I did dip a toe back into the crypto waters. I bought Bitcoin on a transitional pattern and flipped out half for a swing trade. Now, "all I have to do" is to hold on, for a "house money" trade. I'm also long Litecoin with a similar pattern.

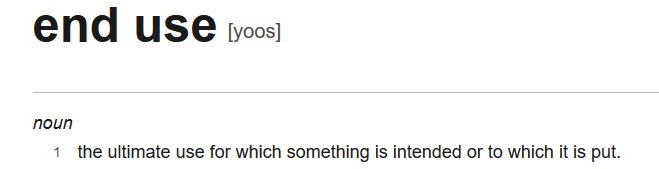

There hasn't been a tremendous amount of opportunities lately in stocks. I did fire off a couple of opening gap reversal trades lately (I used the SPY below to illustrate but actually traded SPXS,SPXL,TVIX and LABD as proxies). None have paid off big. I got knocked out of one big trend day and was one day early for the "mother-of-all" trend days 🙁 You see, there's that right but early thing! It has been tough to force myself to take the best "money lying in the corner" trades only. I explained this in detail in the last Q&A and how to trade OGRes in previous Q&As.

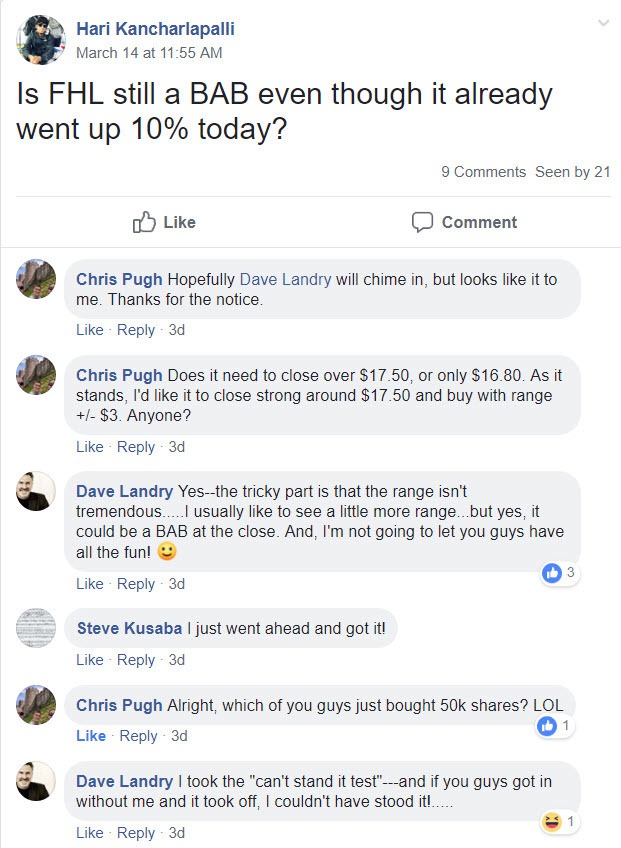

Based on your interaction in the Facebook Group, I took a second look at FHL and deemed it worthy. Since this is a wild one, I put in a limit order to take partial profits. Unfortunately, it spiked close but no cigar. Should it have stayed there a little longer, I would have been inclined to take partial profits. Oh well. A lot of imaginary fortunes are lost on "shouldas." I'm still in, so we'll see.

The rest of my portfolio is a little uglier than the above. No, trading isn't as easy as "EAT, SLEEP, AND TRADE, BABY!" I've gotten knocked out of a couple (e.g., BE today) and the rest are having a serious drawdowns to open profits. See the aforementioned "Unhappy Endings" for more thoughts on that. Also, in the next "Now," I'll give you a report-good, bad, or ugly.

The Holistic Trader

As mentioned before "holistic" means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

Well, I need to do a better job of taking care of me. I'm working on that! I finally went to the doctor for my carpel tunnel from years of banging on my keyboard and it's not good. I never knew that this could lead to permanent damage and even loss of motor function!-the doctor was surprised that I still had grip left! I'll know more next week. They want to hook me up the the most expensive piece of equipment in the hospital, you know, the one that goes "ping." This is yet another expense that the market probably won't care about-to add insult to injury, I have really bad insurance, the last time I got a cat scan, they used a real cat! My carpel tunnel, in part, has me moving more and more to the one-to-many business model for my educational business. I simply can't continue as I have for the last 20-something years. I think more of you will benefit from this. I eluded to this in the Start course (free).

There's a 30-something bike trail a stone's throw from my house, so I now have no excuses! With this is mind, I took a break from this column to log a few miles. Now, I just need to getting the habit of doing that daily! Maybe after the third F-bomb I need to jump on the bike. That should be good for a few thousand miles!

Upcoming Appearances

Dealing with issues in my personal life has tapped the brakes on my travel for a bit. I am starting to get out there a little bit with a web appearance or two. I should have a few announcements soon.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*My goal here isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons, screw ups, and current opportunities.