Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I started Fortune's Formula-The Untold Story Of The Scientific Betting System That Beat The Casinos And Wall Street by William Poundstone. Linda Raschke recommended this one to me (which was recommended to her by David Stendahl). So, of course, being a huge fan of Linda, I immediately ordered it!

94% of my reading is about trading, so I view the books I read through that lens. With that said, so far, not much has applied to trading. The book begins with stories of mobsters. These are interesting but more of a history of facts than a story--this guy was shot at and they missed, but they later killed him, etc. I suppose there are other books here that read more like novels and that's not their intent. I'm guessing that they are setting the stage for their attempt to take down the casinos through blackjack and roulette. Their edge being card counting and a computer to time un-level roulette wheels. Their money management is based on the Kelly Formula. The nerd (and greedy bastard) in me is beginning to find it more interesting now that the stage has been set and their money management is being discussed.

Admittedly, I'm a little biased going in. The Kelly Formula depends on a defined edge and a statistical normal distribution. The financial markets have neither. When people ask me what my edge is, I tell them that I have no idea. I know that I have to pick the best, take small "bets" to ensure that I stay in the game when wrong, and then scale and trail loosely (see Money Management) to stay in when I'm right. Through doing that, I know that I will eventually hit a homerun or two to make this all worthwhile. These "outliers" are often few and far between but they come along just enough to keep me keeping on. And, in the meantime, the partial profits on the swing trades help to keep the lights on-that plus the occasional OGRe or hourly FOREX trade (keep reading).

Anyway, where was I? Oh, the Kelly Formula. The Kelly Formula is the fastest way to make money-in theory at least. I have written many trading systems back in the day where a hypothetical 10K account is parlayed into $10,000,000 using this formula for money management. My magical systems would have me waking up early and staying up late Grail hunting. Unfortunately, the map is not the territory-yes, I've been there, done that, and got the T-shirt. The future is much different and uncertain. The defined edge does not carry forward. And, the lack of normal distribution quickly begins to rear its ugly head. Case and point: In 1987 Larry Williams entered a trading competition and obliterated the competition. He used the Kelly Formula as his money management to parlay 10K into over $1,000,000 by the year's end. The “Paul Harvey” rest of the story is that at one point he was up over $2,000,000. In a speech given by Larry, he said his wife defines 1987 as the year that “he lost $1,000,000.” This is NOT to take anything away from Larry's amazing feat. It took brains and brass balls to parlay like this! The point is that risking high percentages will work “until it don’t.” The question is: had the contest not ended, how far would have the drawdown have gone? I suppose that this conversation is hypothetical but “what would the world be without hypothetical questions?” (I think that’s Wright).

I guess I need to keep an open mind. And who knows? Maybe for S&G's I'll take a simple system with a “spitballed” edge, fund a small account, and mess around with the Kelly Formula to (hopefully) have my wife bitch because "I lost a $1,000,000." I suppose the point I'm trying to make is all this is a lot of fun but is not viable longer-term. At the least, the book has me thinking. Scary.

I finished Dollars And Sense-How We Misthink Money and How To Spend Smarter by Dan Ariely and Jeff Kreisler. Ariely is becoming one of my favorite behavioral scientists. He makes this dull subject interesting by adding in the occasional anecdotes. See the last NOW for more on this book. I view this book as "behavioral economics light." It's a book intended for the masses while still hitting upon many of the important behavioral science "notes:" endowment effect, sunk cost fallacy, anchors, and other psychological pitfalls that we all must overcome. Since it did spark some ideas and presentations, I'm going to add this one to my "book club."

Dan Ariely

The positive perspective…is... If we do understand when we go wrong….If we understand the deep mechanisms of why we fail and where we fail, we can actually hope to fix things. (TED Talk)

See books to read for more trading and books on becoming better.

Speaking of Dan Ariely, he chimed in on human nature in the documentary Theranos-worth watching fwiw.

What I'm Working On...

I'm continuing to add content to the Member's area. Since it's been a while since my last NOW, there's too much to mention it all. Some highlights include continued "walk throughs" in trades such as FOREX, hot IPOs, and OGRe trades (keep reading). I'm excited that this new segment is becoming very popular. I also covered how to create IPO watchlist and scan through them for opportunities.

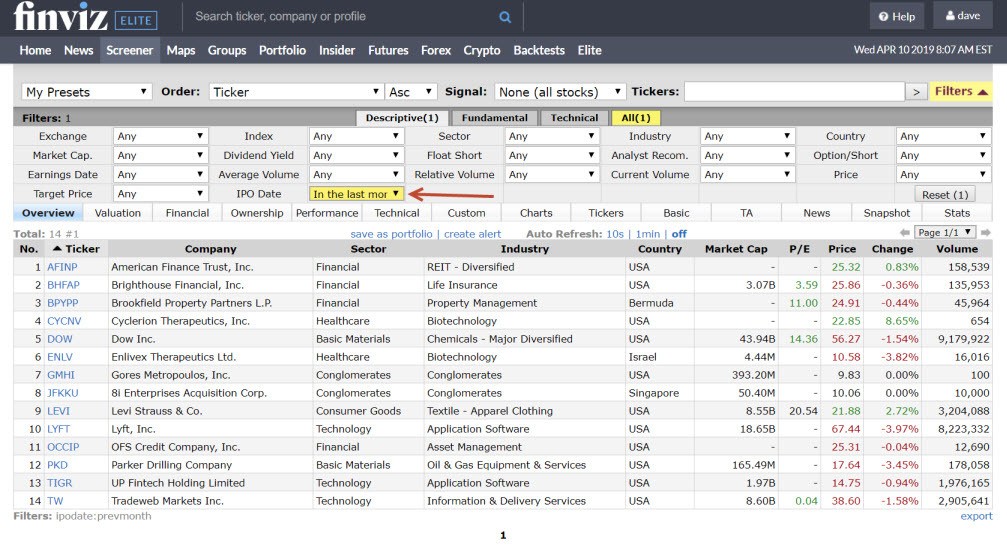

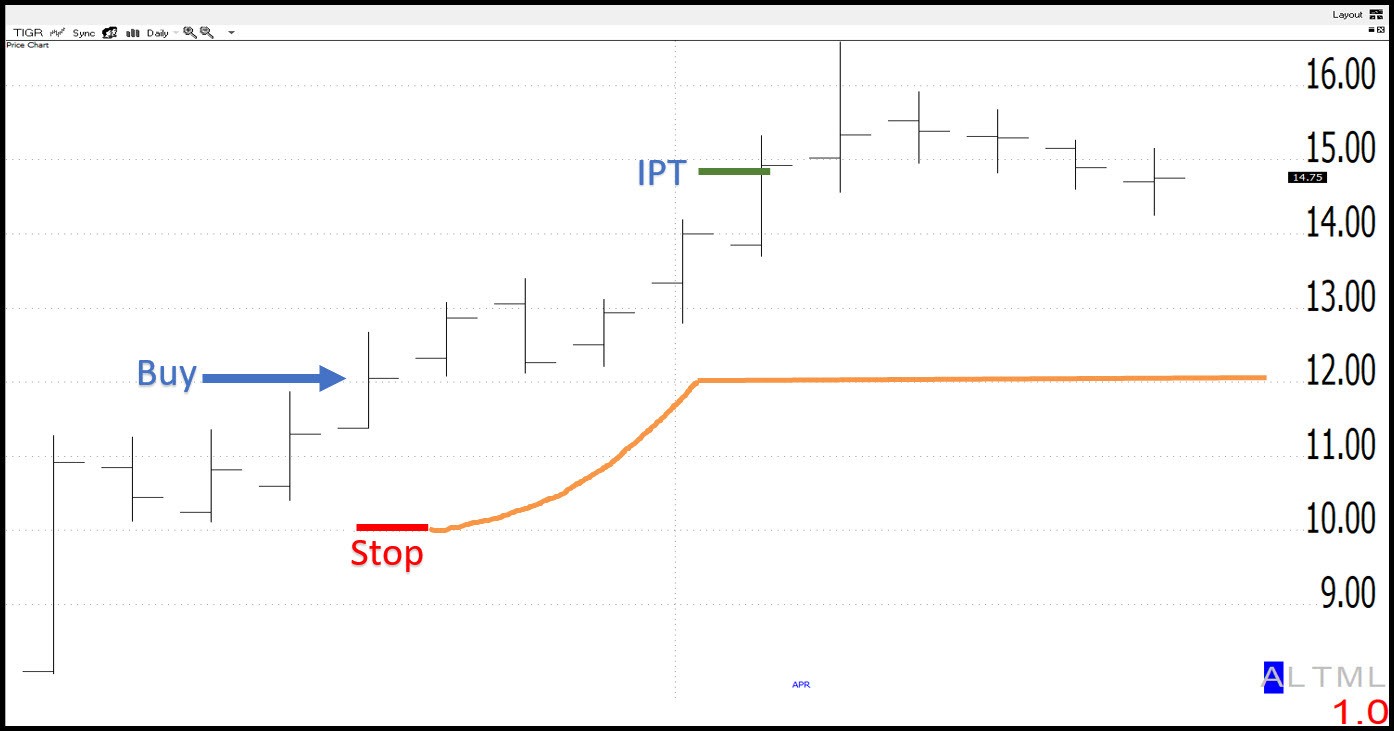

I've used FINVIZ for years to get a "thumbnail" overview of markets outside of stocks such as FOREX and commodities. I recently bit the bullet and upgraded to an "Elite" account. So far, I've been having a lot of fun with it. One cool feature is that you can see recent IPOs by setting the IPO date. I'm just scratching the surface here, but I think this and other features such as charts created on the fly from watchlists could be worthwhile. If I catch just one winner (e.g. like TIGR, keep reading), then it has paid for itself 10x over. I'm also experimenting with thumbnail charts of various other watchlists (e.g. small cap stocks). Full disclosure: I am an affiliate (but do have to pay for my own account). If you do decide to check it out, please click on the banner ad above so I'll get a few cents-which supports the free areas of my website.

What I'm Thinking About

I'm still hung up on the importance of now. Long-term dreams are warm and fuzzy, but you get there through the less exciting short-term nitty gritty. I won't bore you too much here (too late?) since I've already beaten the dead horse. The point is, take less-than-a-minute to ask yourself: Is this a trade that you should be making? Should you continue to hold on even though the stop has been hit? And, in general, are you violating your well-defined trading plan?

From Dollars and Sense: "In the present, however, our emotions are real and powerful. They get us to succumb to temptation time and time again, and they cause us to make mistake after mistake."

I've been letting the get rich quick gurus get under my skin lately. Their fleecing of aspiring traders really bothers me. I think the cream will eventually come to the top and this latest round of scumbags will soon go away. So, I need to "let it go" in my best Frozen voice. I did notice that one from the gang of scumbags has been indited for $700k of criminal action (embezzlement). Although this is outside of trading, it is "exhibit a" when it comes to their character. There also appears to be some class action lawsuits in the works. I think the SEC, FTC, and a few other 3-letter federal agencies are beginning to catch wind of this-a wind which smells a lot like BS.

Just use common sense. If it sounds to good t0o be true, it probably is! As I preach, I have friends who manage 100s of millions of dollars and even billions (since retired). I also have the privilege of knowing many of you successful private traders. Not once has any of these REAL traders bragged about their greatness. If anything, they do just the opposite-complain about trades. Seriously, if I could print money like these gurus claim, you'd never see my fat ass again! I know, the chickens will come home to roost. Unfortunately, a new flock will emerge soon thereafter. So, just in case I get hit by a beer truck, caveat emptor!

I continued this discussion in the latest Week In Charts:

I started reading The Artist Way by Julia Cameron a while back. She recommends writing three hand written "morning pages" every morning, first thing. The book has since gotten packed away in the move, but my journaling has continued. Years ago, I used to do these "brain dumps," but for some reason, I quit. I picked it up again and so far, it has been a great exercise. Give it a shot! When you wake up, before firing up a computer or anything, write three hand written pages. Do this for six weeks or so before reading them. You'll be surprised at the ideas that will come from them. Don't expect anything right away or on any given day. Don't worry about grammar. Just write! Write about anything. Write about everything. Since my dog is now in the same house as my office, she occasional comes in here and farts while I'm writing, so I write about that. Some days they'll seem like a colossal waste of time, but other days you'll get breakthroughs. Even little things I've noticed like me constantly reminding me to only take the best OGRe trades has been very helpful!

What I'm Trading*

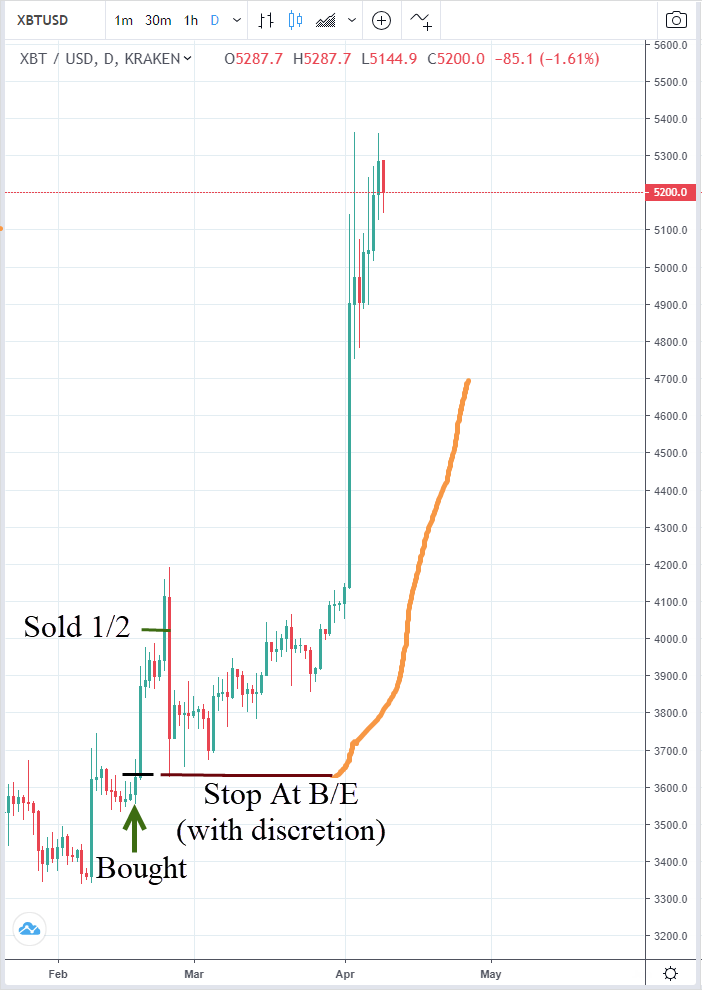

In the last NOW, I mentioned that I was back into the crypto. I'm long Bitcoin on a transitional pattern and flipped out half for a swing trade. Now, "all I have to do" is to hold on, for a "house money" trade. I'm also long Litecoin and Etherium with similar patterns.

I'm also looking to swing trade around core positions (e.g., re-enter). For instance, I have an open order to buy ETH/USD at 172. And, God willing, I'll flip it out soon for a swing trade.

My goal is to leave some "residuals" behind when these trades eventually stop out. See the last NOW for more on this.

Speaking of Cryptos, the naysayers are out in full force once again. Is Crypto BS? Probably, but who cares? I just like making money. Don't you? 30-years ago a good friend of mine said that "If Dave heard that intravenous drug use was on the rise, he'd start buying companies that made hypodermic needles." Well, I'm not that bad. Drug use isn't on the rise, is it? Are the needle charts trending? I'm half kidding! Seriously, see my Facebook post below the last time we had a crypto bubble. Here's the Bitcoin article referenced and watch the recent Week In Charts (scroll down) for more thoughts.

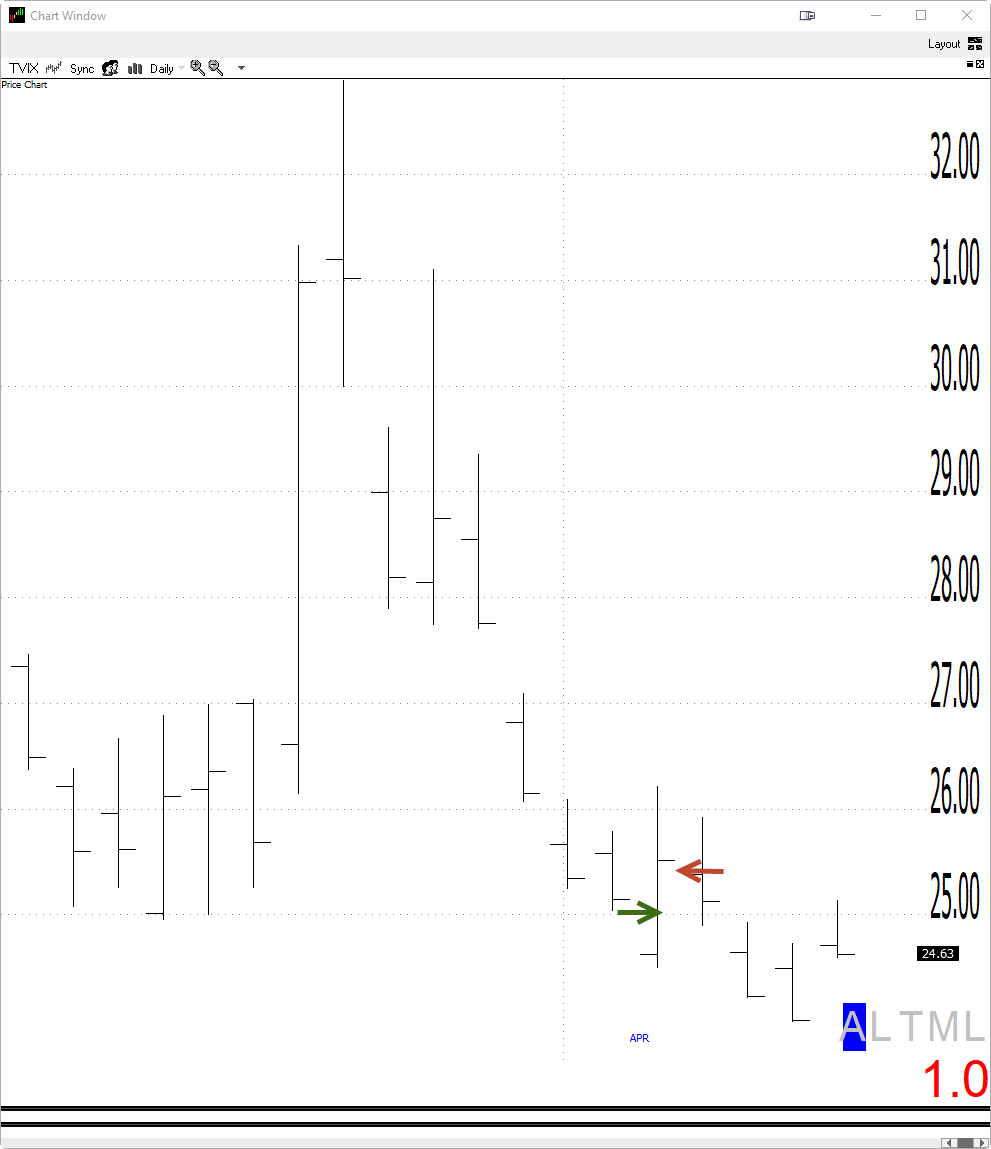

I've been practicing the fine art of sitting on my hands when it comes to trading the indices. I think that if you can take only the best of the best opening gap reversals (OGRes), then you'll do fine. You're not going to get rich doing this, but you could pick up a little here and there while waiting for the best stock setups. With that said, I played the gap on 04/03/19 with SPXS and TVIX for scratch and a small gain respectively-better than a poke in the eye I suppose. Since then, I've been back to sitting on my hands. My goal is to only take high probability OGRe trades: when the market is very overbought, oversold, or set up (e.g. a gap into a pullback). See the last NOW and the last few Q&A sessions for a lot more on this. Speaking of the Q&A sessions, since this one wasn't "cut and dry," I did a walk through in the last Q&A.

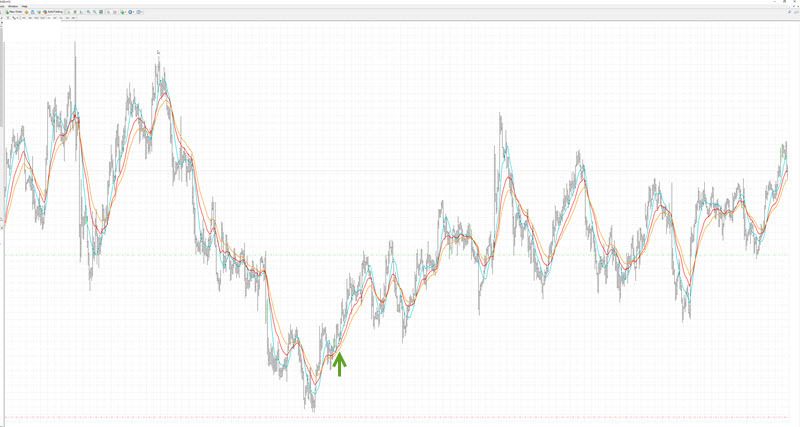

I'm not a huge fan of trading efficient markets like FOREX, but I will occasionally take an hourly Bowtie when the currencies are making very significant lows (or highs) on the weekly and monthly charts. My goal here is to capture an inefficiency-when the most amount of people have the wrong opinion or position in the market. Notice below that the AUD/USD is making decade plus lows.

Below is the hourly Bowtie buy. I missed the original signal but figured it was still worth a shot. I have a love/hate relationship with the Aussie dollar. I love it! And, it hates my account!** It's been a wild ride (as usual!), but I'm hanging on. I'm long the EUR/USD on a similar pattern. So far, so good there! Knock on wood!

Here's how I found the EUR/USD. Notice that it was making MAJOR new lows on the weekly chart. I then begin watching for hourly Bowties. See the last Q&A for a lot more details. You might have to take a few stabs at these markets, but eventually, you'll catch a nice trend!

Here's the hourly chart with the Bowtie setup. It's been anything but a route higher, but if you can close your eyes, sometimes you can catch some really nice trend transitions.

I'm still long TIGR, mentioned in the Dave Landry's Trend Traders Facebook group. BTW, please make sure to join if you are a member of Dave Landry Members! Anyway, this was on a "Buy At B" setup. Now that the initial profit target has been hit, I just need to hold the "TIGR by the tail" via a loose trailing stop.

The rest of my portfolio isn't quite as great as the above, but that's what stops are for! And, I promise to show some of these, warts and all in the next Now. NO, trading isn't as easy as "EAT, SLEEP, AND TRADE, BABY!"

The Holistic Trader

The Holistic trader means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

My exercise has improved, but the diet, not so much! And, unfortunately, I'll be going under the knife next week. You can use and abuse your body for quite a while, but eventually, it catches up. I have carpal tunnel issues in both hands and now have nerve damage in my elbow (cubital tunnel) which could become permanent if not treated. So, you might not hear from me as much for a while-I'll see if I can find some Dave Landry's classics to re-purpose and re-publish early next week.

As previously mentioned: My carpel tunnel, in part, has me moving more and more to the one-to-many business model for my educational business. I simply can't continue as I have for the last 20-something years. I think more of you will benefit from this. I eluded to this in the Start course (free).

Upcoming Appearances

Dealing with issues in my personal life has tapped the brakes on my travel for a bit. I have agreed in principle for eventual (this fall?) trips to India and Hong Kong. "In principle" means that they agree to buy a seat big enough for Big Dave. I have starting to get out there a little bit with a web appearance or two. I will be hosting the Timing Research show on Monday (04/15/19). And, BTW, no Week In Charts next week (04/18/19). After that, I'm going to have to play everything by ear for a while.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*My goal here isn't to report every trade here on a blow-by-blow account, but to rather shed some light on recent lessons, screw-ups, and current opportunities.

**A line stolen from Doug Newberry.