(a popular) Random Thoughts

Recently, I wrote about the 4 billion dollar Ackman loss. Again, I didn’t do this to be schadenfreude but rather because of a valuable lesson to be learned. I went to bed thinking about trends and woke up thinking about them (as you get older, what you think about all the time changes). Following trends isn’t easy but it’s a lot easier than fighting them. Mr. Ackman’s debacle is exhibit a.

Something as simple as a moving average or even simpler—a big blue arrow would have saved Mr. Ackman 4 billion dollars. In fact, he actually originally bought with the trend and would have made a substantial sum with simple money management.

As I write this I’m asking myself, am I just beating the dead horse?-a habit which drives the wife crazy (don’t worry, I’m not stupid enough to make the “short trip?” joke) Yeah, guilty as charged but there’s something much bigger. There’s a valuable lesson that needs to be fleshed out further. Trading isn’t rocket science. It’s not easy but it’s not nearly as difficult as people make it.

In 2015, I began working on a beginner’s course. Since it’s a “beginner’s” course (at least that's how it started), I thought I could bang it out in a few weeks. Here I am 2 years later and I’m just beginning to go to production. I think the reason it took me so long is that I keep having a renewed epiphany. Yes, there’s more specific knowledge like proper stock selection and trading Initial Public Offerings (IPOs) but getting the basics down will go a long ways toward making you successful. In fact, if you're not profitable with the basics, you won't be profitable with more complicated techniques. I then realized that in the tens of thousands of emails that I've answered over the years, virtually all of your struggles have resulted from losing sight of the basics (and my own struggles for that matter!). All that's needed to return to profitability is to return to the core fundamentals of trading. Specifically:

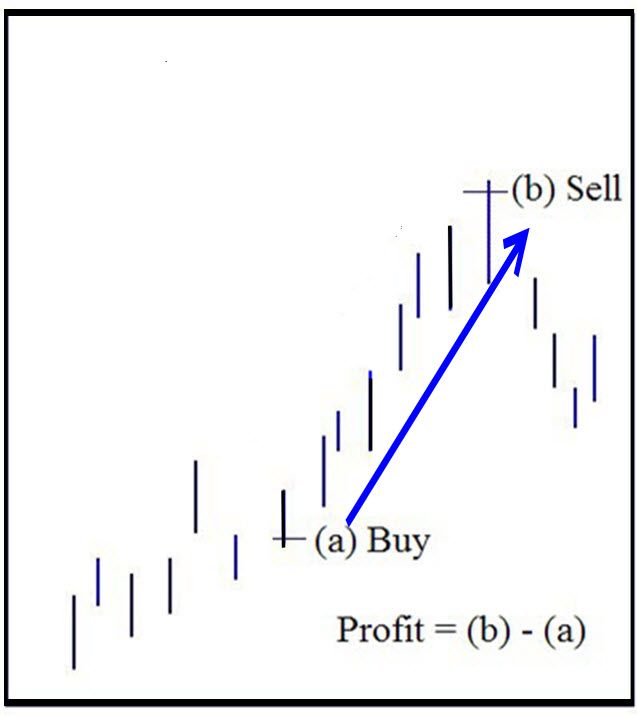

1. The ONLY Way To Ever Profit From A Trade

You must remember that the ONLY way to ever profit from a market is to capture a trend, period. I don’t want to go all “Captain Obvious” on you but you MUST sell a market higher than you buy it. So, if you buy at “a” and sell at “b”, then “b” must be higher than “a.” If the trade is profitable then from “a” to “b” is a trend. Now, since the only way to profit from a market is to capture a trend then why not trade trends ALL of the time? You’re not going to look smart just following along but that’s the thing to do. People might even call you a Trend Following Moron.

Many work harder at trying to look smart than to make money. I noticed a professional that’s been calling a top for months. Each week he gives the top date and then each week the market has surpassed that level. Predict early and often I suppose. Fast forward to yesterday (the original column was published on 05/18/17) and in a Henny Penny fashion he talks about how the sky is falling-and of course, that he called it. Well, make no bones about it, it was a crappy day but a roughly 1% loss after a nearly 10% straight up move isn’t the end of the world-nor can you see it from here. Channeling Yoda: “One bar does not a top make.” Even if it is THE top one has to wonder how much money he has lost by swimming against the tide for months. Well, he probably didn’t lose anything because it’s much easier to predict than to put capital into harm’s way. Before I digress too far (too late?) the point is that your life is going to get a lot easier when you forget about looking smart and just follow along. As I preach, channeling Carlin: like buying a pet, in the end it’s going to end badly. In fact, all trend trades will end badly. You will have to give up some profits in the end but that’s okay. We have to remember that's what we signed up for.

2. Money Management Is Key

Sam Behr, Source: Orlando Magazine

Sam Behr was probably the best tire pitchman on the planet. No one wants to buy tires but like death, taxes, and now kale* you can’t avoid it. Mr. Behr didn’t sell tires by trying to make them look sexy. He did just the opposite. He told it like it is: “Tires ain’t pretty, they don’t make you look good, they don’t smell good, but you gotta have ‘em.” Experience was the best teacher for me here. I put a perfectly good car into the woods just a few hours after a mechanic told me that I really needed new tires. Money management is the tires of trading. You “gotta have it” because trading is unfair. If you lose 10% on an account you have to make back 11.1% just to get to breakeven. And, it grows geometrically from there. Never forget that no matter how much you make, 1,000%, 10,000%...., a 100% loss will decimate your account.

3. The Battle Is Often From Within

Trading looks a lot easier on the surface than it actually is. All you have to do to be successful is sell higher than you buy (or cover lower than you shorted). I know, yet another Captain Obvious moment. Yet, many fight trends, pull their stops and hope-forgetting that “as in birth control, hope is not an option,” and take mediocre setups/trade in less-than-ideal conditions. Many wing it vs. mapping out a trading plan. And, when they do make a plan (or use the one that I make for them), they’ll abort it at the first signs of adversity or take the first tiny profit thereby assuring that they will never catch a trend. They’ll do these things along with a plethora of other bad behaviors. The good news is that these bad behaviors can be avoided by simply not doing them. You might want to write that down.

As I’ve said ad nauseam, whenever someone calls me in frustration I think, gees, how am I’m going to figure out what this guy/gal is doing wrong? Well, I first ask and 99% of the time they tell me-exactly what they are doing wrong. The other 1% when they simply “don’t know” a quick look at their trades unearths the problem. Upon reporting back the answer is “I know, I know.” Many years ago Jessie Livermore said that “A speculator makes mistakes and knows that he is making them.” My favorite email along this vein was from a nice lady who said: “Dave…..You know that passage from Paul? I know not to do but I keep doing it?.....” Dusting off (literally) my bible I see that she’s referring to Romans 7:19:

Obviously, there’s a little more to trading than the above but if you start with the above you’ll be well on your way. You certainly won’t make 4 billion dollar mistakes and you’ll recognize when your making much smaller ones.

May the trend be with you!

Dave Landry

P.S. PLEASE give me a Tweet because the more popular the column becomes, the more free content I can provide. It only takes 2.5 seconds! Click on the little tweety bird below.

If you really did like this column, you'll LOVE these related posts:

If you didn't like it, go have no fun somewhere else! I'm half kidding!

*A (rather poor) take off on a Jim Gaffigan joke.