Random Thoughts

By Dave Landry

Through my world travels, I’ve learned that everyone wants to know the same thing: the secret to trading. Everyone wants to make as much money as fast as possible. What you want to hear and what you need to hear are oceans apart. While getting ready for my next trip across the pond, I’m thinking, how do I gently break the news to these people? Further, how can I give them something they can use? Well, maybe there are some secrets to trading:

1. Keep It Simple And The Trend Is Your Friend

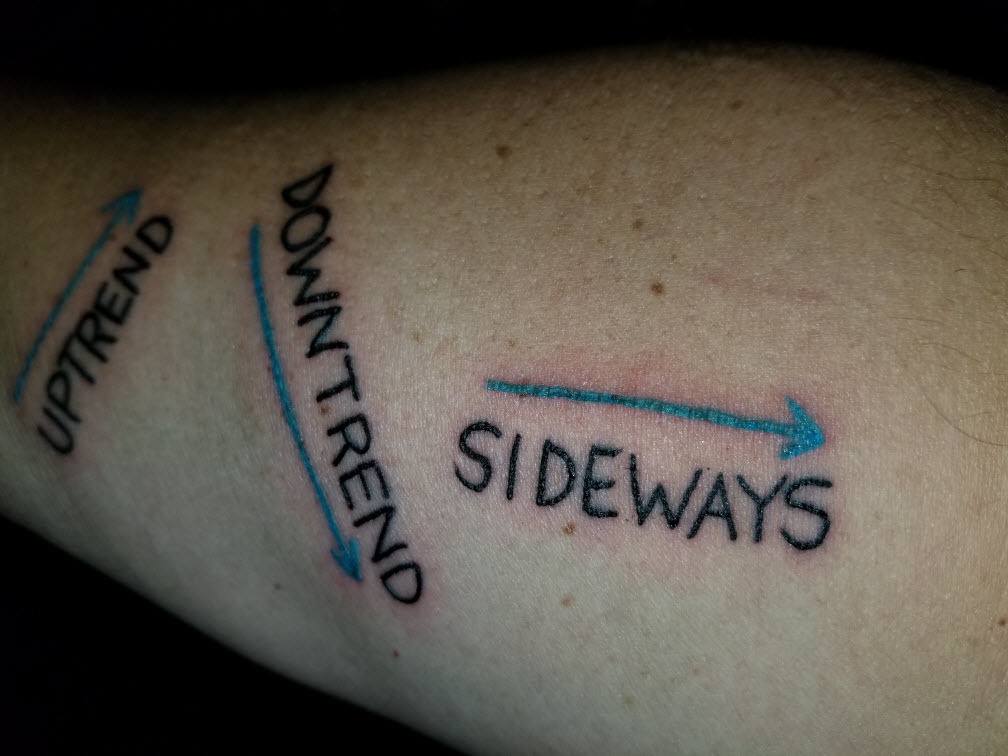

A market can only do 3 things: go up, go down, or go sideways. You can only profit from a trade by catching a trend. You must sell higher than you bought (or cover lower than you shorted). So focus on just that—finding trends and getting on them. Look at price, and only price, and ask yourself: Is the market headed in an obvious direction, and if so, where can I get on? Forget about the wave count, what the Stochastic is saying, and above all THE SITUATION IN NIGERIA (i.e.,news).

2. Be Consistent-Find ONE Viable Trading System And Stick With It

I’ve told this story ad nauseam, and, I’m going to keep telling it until you people get it. I used to spend a lot of time programming trading systems. Every day, I’d come up with a new system, sometimes more than just one. I’d tell my bride Marcy how excited I was about my latest discoveries, spouting off the statistics. And, she would usually suffer a fool gladly until one day. She had a question (note to self, delete browser search history to avoid more questions). As married guys know, sometimes your wife can ask some tough questions. She asked, "How many trading systems do you really need?" That was an epiphany for me. You need one, just one: the one that’s conceptually correct, the one that makes sense to you, and above all, the one that you can follow consistently. If you can’t trade one system, what makes you think that you can trade a dozen? Do one thing and do it well. My work is done. Peace out….dropping the mic as I walk off the stage.

Well, Dave hasn’t left the building. My work isn’t done. Most are off to chase rainbows at the first signs of adversity. The flip side happens, too. When things are good, people begin to enter early, overleverage, and a host of other bad behaviors that come with a God-like complex. Yeah, I have that T-shirt too.

3. Once You Accomplish #1 & #2, Wait For Your Pitch

Patience is probably the best-kept secret when it comes to trading. I often quote Jimmy Rogers who once said:

Jimmy Rogers

" I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.

Despite all my teaching and preaching, whenever I suggest that we mostly sit on our hands, my inbox begins filling with emails: “There has to be something we can do!??…What if we…..?”

Psychologically, this behavior is perfectly normal. And, the more successful you are, the tougher it is. You didn't become successful in your current or prior career by sitting on your ass.*

Trading a methodology properly can often be quite boring. Don’t expect the market to entertain you. Go to Vegas or find something else exciting, to do if you’re craving action. Not only will you have more fun but, it’ll be much cheaper than trading yourself into a hole during less-than-ideal conditions. I bet you thought I was going to make the "If you want excitement, have an affair. That way, you only lose half of your money" joke. Nope. Not today. I've beaten that dead horse too much.

If you’re running money or providing a trading service/consulting, then you will have some pressure to perform and provide. You must put those pressures aside. If you’re a private trader, then you must not succumb to your self-imposed time constraints. The market doesn’t care about your (or my!) time frame.

4. Speaking Of Patience, Once You Do Get In, Let Things Unfold

You come across a beautiful setup. The stock is not only trending, but it's accelerating and persistent in its trend. There’s no overhead supply to muck things up. The overall market and sector (and most stocks within the sector) confirm your analysis. You plan your entry, your protective stop-if triggered, and where you will take partial profits. You also know how you’re going to trail your stop to hopefully be in the trade for a long, long time. You’ve left nothing to chance. Big Dave would be so proud of you! The stock triggers, and you’re in! However, 10 minutes later, the trade goes slightly negative, and you bail. You then watch in anguish as the stock promptly reverses and then takes off without you.

Micromanagement is probably the biggest sin that I see. You must “Obsess before you get into a trade, not afterward.”

5. THE Secret To Trading Is That There Is No Secret

Marketers love to prey on you because they know you’re searching for the secret. And, I quote: “Make 10 million in just 10 minutes a day.” You can’t make this stuff up. Shoot, if I could do this, 11 minutes from now you’d never see my fat ass again. On a serious note, joining the American Association of Professional Technical Analysts (AAPTA) has reaffirmed that there is no Holy Grail—other than hard work and all the things I preach like being consistent and keeping it simple. Some of my AAPTA brethren run millions and even billions of dollars. These are some of the brightest minds in the industry. If there were a grail, one of these guys/gals (e.g, Raschke, Morris, McMillian, McClellan, to name a few!) would have found it.

The bottom line is no one knows exactly what a market will do—(here it comes, again!) not you, not me, and certainly not the guy who screams on TV. We take educated guesses based on experience. For me, this just means following along—and, BTW, there has to be something to follow in the first place—either an emerging or existing trend.

6. You Have To Embrace, But Not Try To Eliminate Your Emotions

Martina McBride performing at 3rd and Lindsley in Nashville, TN on August 31, 2014 Source: Wikipedia, posted by Bruce Comer Jr - Own work

Through illness or injury, the unfortunate who have had their emotional part of their brain damaged can no longer make decisions-ANY decision (Shull, Damasio). One decision has no emotional consequence over the other, so they arrive at a stalemate. Therefore, you must embrace and not try to eliminate your emotions. At some point, ALL trades will go against you. You’ll either get stopped out or give up some open profits in the end, or somewhere in between. On the unavoidable adverse moves, acknowledge, accept, and like Martina once said, “just breathe.” Refer back to the plan (you do have a plan, right?). Assuming you have obsessed by picking the best going into to the trade, AND conditions are conducive to your methodology, then cussing and fussing is a total waste of mental energy. AND BTW, it won’t do a damn thing to help your position. Believe me, if it did, I'd be the most successful trader in the world.

7. Be A Student Of The Markets, But Realize That The Market Can Be A Really Bad Teacher

The market is often a bad teacher. It’ll encourage you to take small profits before they evaporate. Sooner or later, though, the stock will take off without you. It’ll encourage you to not use stops because the last 10 times the stock came right back after stopping you out. And then, you'll succumb to the mother-of-all losses. BTW, system sellers sell a lot of systems that don’t use stops. That’ll "work until it 'don’t'." In the meantime, they (the system sellers, that is) make a lot of money. I get a lot of new clients right after the “it don’t” happens. Anyway, before I digress too far, the market will also encourage you (again) to exit at the first signs of adversity, long before your stop is hit. Further, it’ll also encourage you to leave your viable system because it appears to be no longer working, or worse, switch to the latest “church of what’s happening now" system vs. just staying with The Church Of Trend Following.com. In good conditions, the market will encourage you to leverage up because your system is printing money. I can go on and on, but you get the idea: the market often encourages bad behavior.

8. You’re Going To Be Wrong A Lot-Get Used To It

A few years back, when the market was looking quite iffy, I received the following:

“You have been pounding the table the past month saying that the market is in a lot of trouble. Have you ever thought about picking another line of work?”

Yeah, I think about another line of work every time I get my ass handed to me, when I get stopped out to the tick and then watch the market take off without me, when the market is trendless, when I hit buy instead of sell, and, of course, when the SHTF. I also, albeit briefly, think about another line of work when I wake up and find a turd like yours in my inbox. I’ve given up trying to look smart many years ago and now just follow along. This has earned me the badge Trend Following Moron. Although initially offended, I’ve since taken that ball and run with it. I’ve acquired the domain, put arrows on the back of my business cards, and on my right arm just in case I forget. It also inspired me to trademark "Trading Simplified."

Gary Kaltbaum was once kind enough to say that although I’m not right all the time (and will admit when I'm wrong), I’m right over time. And, like the hokey pokey, that’s what trend following is all about—being right over time.

In Summary

The secret to trading is that there is no secret. That's liberating. That means that a simple methodology can work. And, keep it simple. Embrace your emotions, knowing that you will be wrong quite often. Be patient waiting for setups, and waiting for the market to move once you get into a trade. You won't be right every time, but you'll be right over time.

May the trend be with you!

Dave Landry

PS Let me know what you think. Leave me a comment below. I read (and respond to) all comments promptly.