Want To Become A Successful Trader? Just Take These 5 Easy Steps On Your Next Trade

By Dave Landry | Daily Commentary , Random Thoughts

Random Thoughts

By Dave Landry

Your Successful Journey Begins

A journey of 10,000 miles begins with the first step. Your journey to becoming a successful trader starts with your next trade. I challenge you to do the following five things on your next trade, and only your next trade. If you can’t do that for just once, then you might need to rethink your trading career. After all, it’s just one trade. However, if you can—and, seriously, we’re only talking ONE trade—then you have proven (in my best Bela Karolyi voice) that “YOU CAN DO IT!” (which, I admit, probably based on my Coonass genealogy, sounds a lot more like "The Townie" from Waterboy).

Einstein once defined insanity as doing the same thing over and over and expecting a different outcome. I receive emails from people who repeatedly make the same mistakes. Even worse, they continue to make mistakes and know they are making them.

The following assumes that you have carefully studied a methodology and know the good, the bad, and most importantly, the ugly but are still struggling. If you’re new to trading, no worries! That's actually a good thing. Starting with a blank canvas is much easier than with someone who should know better. Just take your time. Work on your attitude before your aptitude. Take a step back, and read this article (before continuing) and you'll be well on your way.

Don't Trade With The Rent Money, But Do Get Educated!

I'm also assuming that you are adequately capitalized and that you are not trading with the rent & grocery money. If you can’t afford to trade, then use what money you have to get educated. Trust me, trying to trade while being undercapitalized is far more expensive than getting educated. Legally, I can’t guarantee much in this business, but I can all but guarantee that the cost to get educated will be far less than the money thrown at the markets. Bok said it the best, “If you think education is expensive, try ignorance.”

It's Okay To Fail, Just Be Careful Chasing The Grail

In keeping with the theme of Random Thoughts, here are some random thoughts: I've been working my way through Tribe Of Mentors by Tim Ferriss for a while now. The reason it's taking me so long is that I often stop to research (and often buy) books and products mentioned, take notes, and sometimes just start writing. In the book, he asked everyone about their favorite failure-something that may have seemed like a failure at the time but ultimately helped to make them successful and who they are. Last night, I began writing about my failures. After about three pages in, I started to get concerned, but I then realized that I needed those failures to grow-channeling Nietzsche.

I began thinking about even more failures when I opened my eyes this morning. I had neglected to add in my trading failures--and there's been a lot!

Yes, I have failed a lot in trading. As soon as I thought I had something, I'd go straight to the markets, get my ass handed to me, and then would quickly jump right back in with my next "Holy Grail." Even worse, sometimes I'd hit it just right, finding something that printed money, until it didn't. True, eventually, you have to have skin in the game, but you don't have to put capital into harm's way until you fully understand your system (again): the good, the bad, and most importantly, the ugly. And, btw, I've seen things work for a long time and then fail miserably (e.g., wave/bar counting, naked option selling, pure reversion to the mean trading). Anyway, the point, and I do have one!, is to get educated. Again, the money spent learning about the markets will be far less than paying the market's "tuition." I have purchased plenty of books over the years that turned out to be totally worthless. That's okay! I've also found a lot of great gems along the way too.

Before I digress too far (too late?), let's get to those five things that you need to do.

On your next trade, and only that one trade, agree to do these five things:

1. I Will Pick The Best And Leave The Rest

Just for the next trade, and only that one trade, I will pick the best and leave the rest. For a trend resumption pattern (i.e., pullback), the stock should be in an obvious trend. Only pick stocks that trade cleanly and do not look like an electrocardiogram. Ideally, it will be in a persistent & accelerating trend and will have trend qualifiers such as strong closes/gaps/laps/wide range bars in the direction of the trend. Regardless of how great the setup looks, I will not take the trade if there is overhead supply that could cap my gains. The pullback will be significant enough to have knocked out some participants, allowing for a possible reversion to the mean move (i.e., a bounce) back in the intended direction. For emerging trend patterns, I will resist the urge to pick bottoms and only look to trade stocks that are obviously in developing trends-such as those with Landry Bowties. They will also have many of the above characteristics on a smaller scale.

I watched the stock selection course again last weekend. It's amazing how it seems so "basic" the first time I watched it long ago but now after looking at lots and lots of charts and re-watching the course several times I see the genius of the methods. Great course!!

Matt Slater

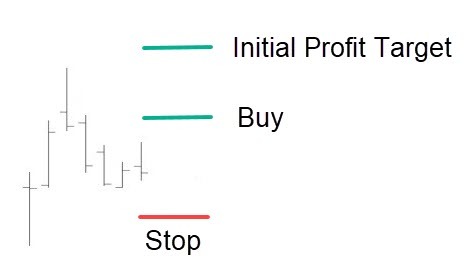

2. I Will Plan My Next Trade

I know things will begin to change as soon as the market opens. Prices will move up, down, or sometimes just sideways. I know stress will rise when information is uncertain or changing (Montier). I know the stress of making decisions on the fly will cause me to make emotionally charged decisions. Therefore, on my next trade, and only that one next trade, I will plan while things are static. I know where I will get in, where I will place my protective stop, and where I will take partial profits. I know how I will trail my stop both before the initial profit goal is achieved and then afterward. I will leave no guesswork.

Most people don’t plan because the moment you put a plan in place is the same moment you have to admit that you could be wrong. And, if you do turn out to be right, you also have to admit that you will take partial profits, which might limit your gains if you are right big. You must accept the fact that the future is uncertain, and you must plan accordingly. Write that down. Your plan must have a stop in case you are dead wrong, an initial profit target just in case you are right but not right big, and a trailing stop just in case you just got aboard the mother-of-all trends.

In my Core Trading Service, I lay out the plan daily. True, occasionally, a little discretion can and is used to make things work even better, but that’s mostly just a small “tweak”-(and only for the more advanced who have proven that they can follow the plan to begin with). However, in spite of all this planning:

Client: Dave, I’m down 50% in XYZ. What should I do?

Me: XYZ? That’s not in the portfolio. Why are you in that?

Client: Because you recommended it.

Me: Really? When?

Client: 6 months ago.

Me: Oh, yeah. I see it now. I remember that stinker. It stopped out at a small loss.

Client: Yeah, I know but what should I do now?

Wait, did I admit that I could be wrong? Of course! Yes, I am occasionally wrong (just ask my wife, Marcy!). If I were never wrong, you’d never see my fat ass again. Either that, or I’d come back to “taunt you a second time.” Now, assuming that the trade triggers and subsequently turns into a stinker (i.e., hits the stop), there’s nothing to do but take your lumps and get out at a small loss. Again, follow the plan. It’s much easier to exit at a small loss now than to deal with both the monetary and psychological problems of a growing loss down the road. Write that down too.

Hoping that a bad trade will come back is an innate flaw within us. We just have to deal with it. What about a good trade? Well, quite often, the plan still isn’t followed. I give you exhibit A:

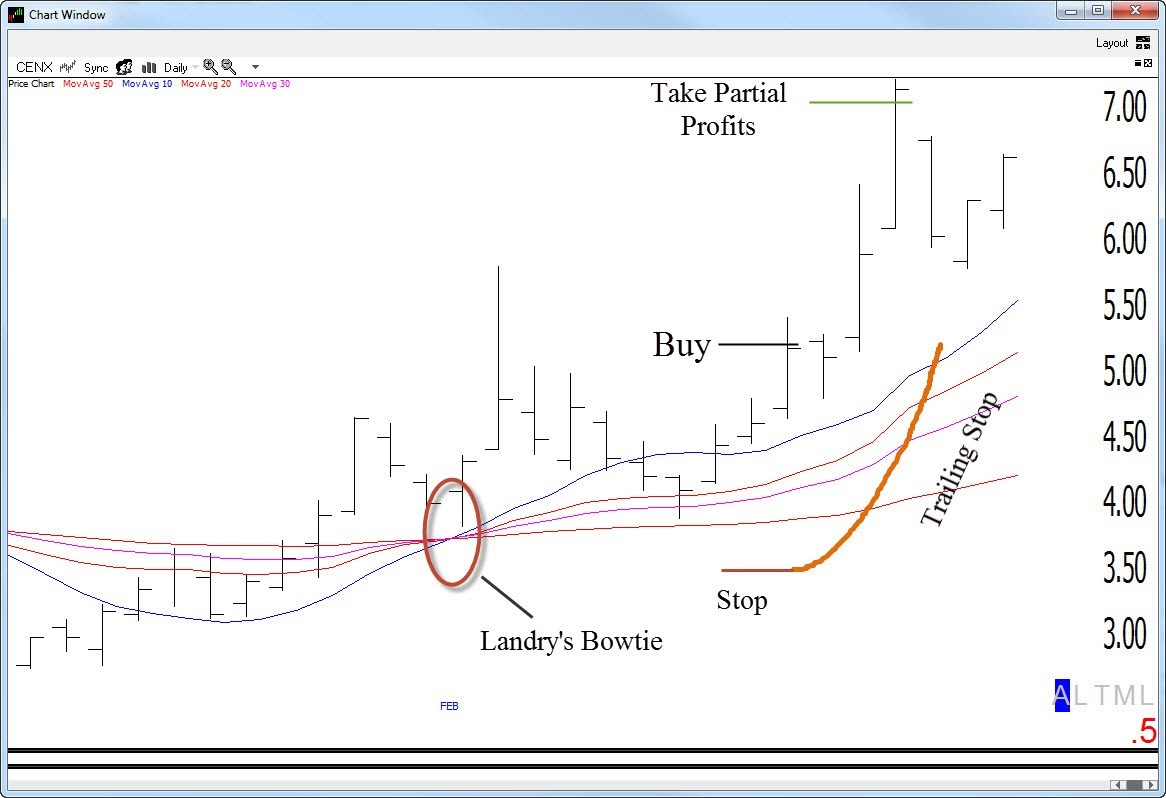

(note, the example is a little dated-the original column was written in early 2016-but you get the idea)

As you can see in the above video, the plan was:

Stock | Action | Entry | Initial Profit Target | Protective Stop |

|---|---|---|---|---|

CENX | Buy | $5.20 | $7.00 | $3.40 |

And, here is what that looks like in the chart:

Client: CENX hit 7.00 yesterday. What should I do?

Me: Uhhhhh, you should have taken partial profits(?)

I can go on and on, but I don't want to bore you. Too late? Seriously, by now you should get the point. Even when I put an exact plan out there, many still can’t follow it.

3. I Will Not Try To Beat The System By Getting In Early

Just for the next trade, and only the next trade, I will not try to outsmart the system by getting in early. I will wait for a trigger. This means that the stock has turned back into the intended direction. True, I will not be getting a “bargain” on price, but this confirmation will help me to avoid a potential losing trade. I will let the market tell me what to do. No trigger, no trade. Unless we are in the mother of all rip-roaring trends (and the last one was 1999 btw), I will not “front run” setups.

Like the aforementioned email thread, here’s another common theme:

Client: Dave, I’m down 50% in that turd you recommended, XYZ!

Me: XYZ? I never recommended that stock.

Client: Yes, you did!

Me: When?

Client: Around 6 months ago.

Me: Digging through my records and looking at the chart: Oh, I see it. Yes, it never triggered and should have been avoided in the first place.

4. I Will See The Next Position To Its Fruition

Just for the next trade, and only the next trade, I will see the position to its fruition. Things begin to change as soon as I enter a trade. The trade may go in my favor--or not. I will not get out at the first signs of adversity because I know the market might just be trying to shake me out. I know that if it is truly a reversal, my stop will take me out. I will not watch every tick, living and dying by the ups and downs. The “market’s gonna do what the market’s gonna do” regardless of whether I sit here watching it or not. I know that it doesn’t care about you, me, or the guy who screams on TV.

If the position goes flat, I will not see it as “dead money.” I will not micromanage and take myself out early. Maybe the stock is just resting, allowing players to position before it makes its next move. Rather than boring myself by watching the stock trade sideways, I will use my idle time to find the next potential big winner.

I will let the market make decisions for me. Stops will take me out of losers and keep me in my winners. Other than taking partial profits if blessed and trailing a stop higher, there isn’t much to do other than letting it unfold. As I preach, trading, done properly, can be quite boring.

If I had a choice for a protégé, I’d choose someone patient over someone smart any day. The patient waits for an opportunity. And, once the patient finds that opportunity, they let things unfold. The “smart” will try to force something to happen in less-than-ideal conditions. And, when they do finally catch a decent trend, they will reason why a position should not be seen to its fruition.

5. I Will Do An Honest Post-Mortem

Just for the next trade, and only the next trade, I will do a post-mortem. I will go back to the original chart and honestly ask myself, if I saw this trade today, forgetting about the outcome, would I take it again? This so-called “deliberate practice” will make you a much better trader. Every now and then, I look back at a trade and think “What in the hell was I thinking?” The good news is, that now happens less and less. And, I promise that if you are brutally honest, you’ll soon experience the same thing.

I will be process-oriented vs. end result-oriented. I will congratulate myself-regardless of the outcome, if and only if I followed the process. I will recognize that if I did not follow a prudent process and was profitable then I just got lucky. And, eventually, that bad behavior will catch up with me because the market can often be a bad teacher. Watch this classic Dave Landry’s The Week In Charts for a lot more on being “process vs. end goal” oriented:

Note: As mentioned recently in my Now column, I have been reading Annie Duke's Thinking In Bets. In it, she talks a lot about outcome biases. This dovetails in nicely with the work of Terrence Odean, mentioned in Trading Full Circle. I think the secret to trading may be through careful post-mortems, figuring out the difference between good luck on bad decisions and bad luck on good decisions. It's a lofty goal, but I think honest post-mortems will go a long ways to getting you there.

So, You Want To Become A Successful Trader?

Do the five things listed above on your next trade. Did you do it? If not, keep working at it until you do. Then, congratulations! You've proven that you've got what it takes. Now, rinse and repeat on your next 10,000 trades!

May the trend be with you!