The Only Three Things That You'll Need To To Become A

Successful Trader

Which Trader Are You?

As a trader, you're either searching, have lost your way, or simply want to become better.

If you're searching, you'll reach a point where you realize that the get rich quick gurus are getting rich quick-off of you! We've all gone on a "Holy Grail hunt," but, like me, your true enlightenment will come when you realize that simple techniques can work quite well in real markets.

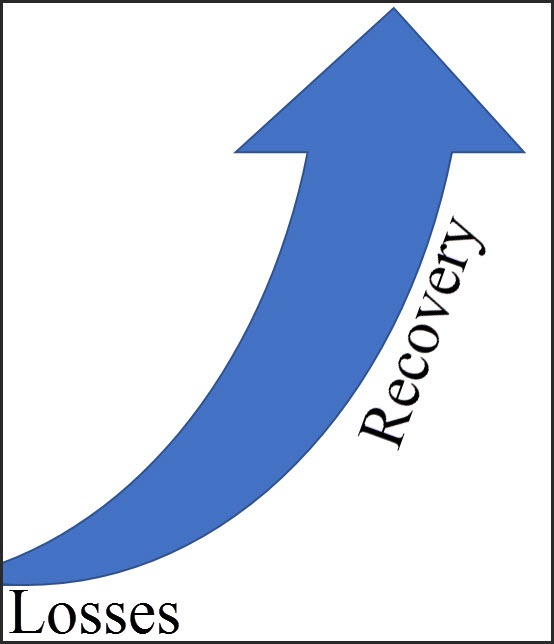

Even if you've been trading for a while, you'll hit some tough times. We all do. It's what happens during those tough times that define us. There are pitfalls that we can easily fall into to "get back" what the market "took" from us: taking excessive risk, trading in less-than-ideal conditions, attempting to use complex methods to outsmart the market. If we're not careful, we could easily spiral downward during these inevitable bad times.

We all must strive to constantly improve. Missing a big trade, micromanaging yourself out of a soon-to-be big winner, trading when you shouldn't, not following your trading plan, and a plethora of other bad behaviors are always tempting us to do the wrong thing. Let's face it, in spite of what the get rich quick gurus spout, trading is often a constant struggle. None of us are immune. Therefore, we must constantly strive to get better at what we do to operate at peak performance. So how do we do that? Well, we must focus on the only three things that make us successful traders:

The Only Three Things That You'll Need To

Become A Successful Trader

1. A Simple, Easy To Follow Methodology

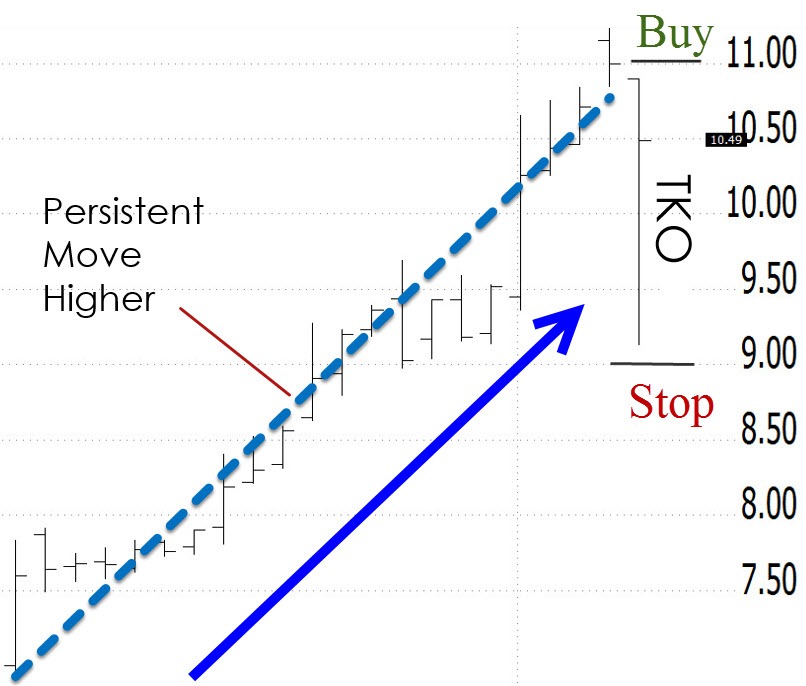

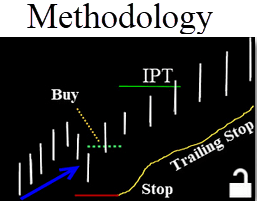

The only way to make money trading is to capture a trend. Period. You obviously must sell a market higher than you buy it. Therefore, setups must be trend following in nature. Simple systems are much easier to follow than complex ones. With that in mind, the setups must also be simple and easy to recognize. It never ceases to amaze me that virtually all of my best trades come from the simplest of setups. The stock will be in an obvious and persistent trend and then have a sharp move lower. Looking to enter after traders are "knocked out" can lead to explosive moves.

Here's a setup that turned into a big winning trade.

The Trend Knockout (TKO) setup above along with my other favorite setups are explained in detail in my member's area. I often use live example "walk throughs" to drive the point home.

2. A Hybrid Approach To Money & Position Management

"You cannot predict trends, but you can follow them forever." Dave Landry

Money management isn't sexy, but you have to have it. All trades, even well-thought ones, eventually end badly.

Trading is unfair. You have to make back more than you lose. For instance, if you lose 10%, you'll have to make back 11.1% just to get back to breakeven. And, unfortunately, it grows geometrically from there. This unfair nature of trading is why ALL systems that only make small gains WILL eventually fail. The good news is that through proper money management you can keep losses in check while still allowing for potentially unlimited gains.

Stock price forecasting is akin to predicting the weather. Only short-term forecasts are viable. However, your gains are limited because big trends take time to develop. And, something bad can still happen shorter-term. Trading where the gains are limited and the losses are potentially unlimited is a recipe for disaster, with ANY methodology.

The real money is in longer-term trading. Unfortunately, so is the risk. The longer that you're in a market, the better your chances of getting soaked. We all read about these famous long-term traders, but a quick Google search shows that many of them subsequently blow up.

There is a dilemma between short-term and longer-term trading. Short-term trading doesn't make enough. Longer-term trading is too risky. So what's a trader to do? Both! It doesn't have to be a mutually exclusive decision. You truly can have your cake and eat it too by trading for both short-term AND longer-term gains. Through my hybrid approach to proper money and position management you can take short-term profits just in case the trend is a short one but stay with the remainder of the position should it turn into the mother-of-all trends.

My hybrid approach to money management along with more details such as exercising discretion to squeeze out additional profits and damage control strategies in Dave Landry's Members (keep reading). Live examples are often used so that you can follow along in real time.

3. A Proper Mindset

"We have found the enemy, and he is us" Pogo

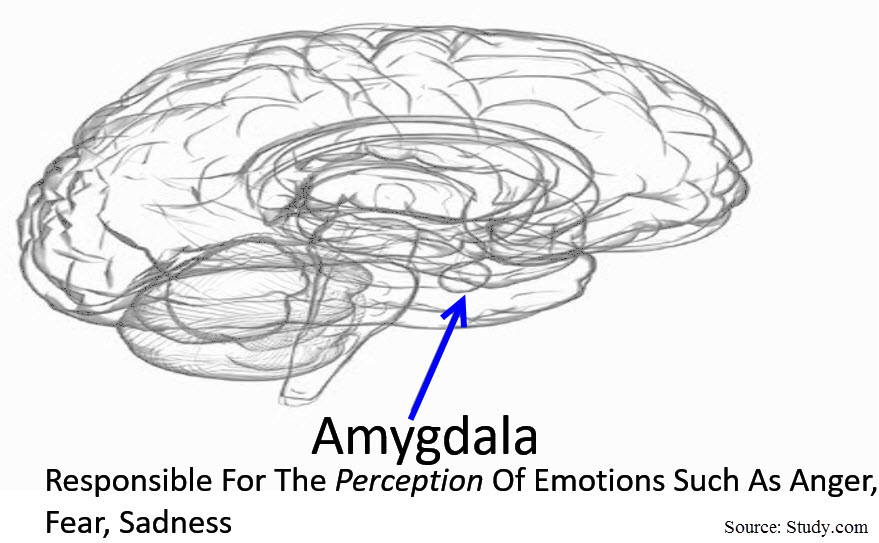

The bad news is that we’re simply not made to trade. This is on both a psychological and a physiological basis. The things that are keeping you alive and making you successful in your career are often detrimental to your trading account. That's the bad news. The good news is that once you accept these facts, you'll instantly be able to identify the bad-for-trading behaviors and take simple steps to correct them.

In the member's area, I go into a "deep dive" into the unnatural nature of trading. And, more importantly, I discuss how to overcome these psychological and physiological urges to follow the trading plan.

In Summary, You Must Approach Trading

Holistically

With These Three Things:

- 1. Methodology: You'll need a conceptually correct methodology. And, since the only way to profit from trading is to capture trends, that methodology should be trend following in nature. Further, since it is much harder to follow a more complex system, it must be simple and easy to follow.

- 2. Money Management: Since trading is unfair, you must limit losses while still allowing for unlimited gains-not just the opposite! You must be willing to get out when you're wrong but stay the course when you are right.

- 3. Mind: And last, but certainly not least is you. The best methodology in the world is useless if you don't have the proper mentality to follow it. You must accept the fact that you can't control the markets. You can only control yourself. By trading only when conditions are conducive, planning the trade and trading the plan you can overcome the battle that's from within.

So, How Do You Become Successful With These Three Things?

What Does The Member's Area Include?

Four Member's Trading Courses

Ready to start trading but aren't sure where to start? Have you been trading for a while but have begun to lose your way? Or, are you ready to become a better trader?

The comprehensive member's courses start small and build...and build. Even if you've never traded before, it's all there from the ground up: Setups, Money & Position Management, and last but not least you: Trading Psychology.

1. Learn how markets really work. Technical analysis has the word "technical" in it, but it doesn't have to be that technical. I'll show you fully disclosed simple patterns that use psychology to take advantage of the emotional nature of market participants.

2. Minimize losses and maximize gains. The only way to be successful longer-term in the markets is to keep losses in check while still allowing for potentially unlimited gains. I'll show you how to do just that through my hybrid approach to money & position management.

3. Handle your biggest enemy. Once you understand the mechanics, all that's left to do is to just follow the plan. This can be difficult, but it doesn't have to be. I'll show you simple steps to train your brain to conquer the physiological and psychological pitfalls of trading.

4. Learn how to think holistically. The three aspects of trading: mind, money management, and methodology do not exist in a vacuum. All three are intertwined. The great news is, if you get better at one, you get better at all! Staying with winners and cutting losers from your portfolio through my hybrid approach will give you confidence in the methodology. Having confidence in the methodology will help you to recognize new opportunities. And, from a psychological perspective, you'll be more likely to take those setups and then follow the trading plan. In this course, I'll show you how to think holistically by being aware of all three aspects of trading.

You'll get full access to the above four courses. The courses are continually being updated based on market conditions and my latest research.

These courses are designed around you! I've worked with thousands of individuals over the years, so I know what you need to know. However, if there's something you'd like to see, we'll add it. Much of the new content comes directly from your requests in the bi-weekly Q&A.

There's a ton of information there but don't worry. Through our learning management system, it's all presented in an easy to digest format. Most lessons are 10 minutes or less. Each lesson has a quick quiz to ensure that you fully absorbed the material. Your progress is tracked so you can start any course and quickly pick up where you left off.

Interact With Other REAL Traders

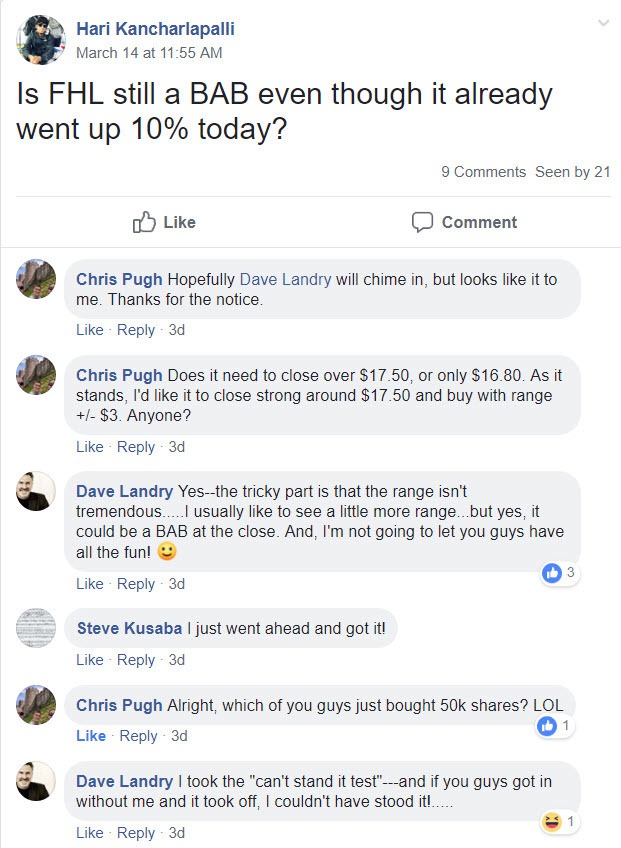

Have you explored social media stock groups only to discover "pump and dump" stock "recommendations," spam, and BS get rich quick posts? Well, at Dave Landry's Trend Traders there's none of that and plenty of valuable interaction. I personally moderate the group to make sure that we all stay on track, keeping the following goals in mind:

1. To find the best setups

2. To discuss trend following techniques

3. To discuss money & position management techniques

4. To discuss trading psychology based on the above

Above are just several of the many posts discussing potential opportunities. Of course, I'm biased about my group, but I have personally profited from many of the stocks mentioned by my members.

LIVE Q&A Sessions

Have a trading question? ASK! Every other week I host a live Q&A session. This has become one of the most popular features of our member's area. Can't make the live session? No worries! All sessions are recorded. Recent discussions included position sizing, what you must think about before considering trading full time, trading opening gap reversals, using discretion to improve performance, plus much much more.

Loyalty Benefits

The longer that you remain a member of Dave Landry.com, the more benefits that you'll unlock. During your first month alone, you'll get electronic copies of all three of my books. After your second month, you'll receive access to my Trading Psychology Micro Course. In your third month, to ensure that you're on track, you'll receive a private 1/2 hour consultation with me. Additional benefits include "911" calls for those "deer-in-the-headlights" moments where you might need a little help to follow your trading plan, access to my premium courses including Trading Full Circle and Trading Hot IPOs.

Ready To Get Started?

Ready to learn how to trade properly? Been trading for a while but have lost your way? Or, are you just looking to become a better trader? Join Dave Landry.com and become a better trader.

What People Are Saying About

Dave Landry's Approach

"

“now up over 62%”

The second half of the trade is now up over 62%. I find this trade to be the poster child to the methodology and also a fantastic example of being patient 'till being proven right or wrong.

Chris Agresta-Trader

"

“what you need to hear”

Dave is not going to tell you what you want to hear. He’s going to tell you what you need to hear. He explains the importance of money management and the need to eliminate losing trades. He teaches the discipline to wait for the proper time to enter a trade. He also teaches you when to accept a loss and move on to the next trade. He is both a successful trader and a remarkably talented instructor. Dave has the temperament, knowledge, and experience that is needed in this industry. He’s also a genuinely nice guy with a wild sense of humor.

David M. Taucher- Money Manager, CFP, AIF

"

“knows his stuff”

Dave Landry is a real trader who knows his stuff. Too many in this business are fakes. Anyone who can teach others to trade must also trade. Dave's books and courses are valuable; I have no problem recommending them.

Greg Morris-Former Money Manager who oversaw over $6 billion in assets using technical analysis

"

"

"

“is gold”

The psychology that you go through and the money management that you tie into it is gold, something I definitely think people aren’t spending much time taking to understand.

Bret Matsumoto-Trader

"

“..turned my whole trading world upside down and fixed it"

You turned my whole trading world upside down and fixed it. You may use anything you want that I said. You could also add that I was using one plan, then another, then another, then back to the first one. I wasn't always using stops and was placing them too tight. I just didn't have the cocktail napkin: stop, entry, move stop, target, take 1/2 and move stop up, in place....my money management was horrible, with no idea of risk factors. Thanks! You've made me a better trader. Also, thanks for the education section of your website.

Rick Palumbo - Private Trader

"

"

"

“...can't thank you enough”

First of all, I can't thank you enough for making so much sense about trading but even more importantly your ability to make the complex simple with humor AND patience. Those are truly gifts.

Jon Dearborn - Private Trader

About Dave Landry

Dave Landry has been actively trading the markets since the early 90s. In 1995 he founded Sentive Trading, LLC--a trading and consulting firm. In 1998 he founded DaveLandry.com-a site designed to help educate traders on the realities of trading. He has worked with several hedge funds and thousands of individual traders. He is the author three best selling books on trading including The Layman’s Guide to Trading Stocks. His books have been translated into eight languages total. He has made several television appearances and has written articles for many magazines including Technical Analysis of Stocks & Commodities, Active Trader, Currency Trader, Traders Journal-Singapore, and TRADERS' (Italy, Germany, UK, Greece). His works have been referenced in many books on technical trading including Technical Analysis: The Complete Resource For Financial Market Technicians and the Chartered Market Technician (CMT) study guide. He has been publishing daily web-based commentary on technical trading since 1997. He has spoken at numerous trading conferences both nationally and internationally-including Russia, Australia, Hong Kong, Germany, and Italy. He has a B.S. in Computer Science and an MBA. He was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. He is a former board member of the American Association of Professional Technical Analysts (AAPTA) and is currently a member in good standing.

Here's What You Get

- Four courses on trading which include market timing, trading IPOs, money management, trading psychology, and much more! We are constantly adding valuable new content weekly.

- Membership Rewards: The longer you remain a member, the more membership rewards that you'll reap. These include unlocking ALL premium courses, private consulting, "911"calls, and much more.

- Live Q&A Sessions: Ask questions and get well-thought answers from Dave himself.

- We listen! Is there something that you'd like to see? We'll address it in the Q&A session or add it directly to the member's area.

- Trading psychology explained in a way that will help you to identify problems and more importantly, take simple steps that you can take to remedy them.

- Access to member's only trading group: Discuss potential setups and trading ideas with other real traders. I personally moderate this group.

100% Satisfaction Guarantee

Trading is not without risk but becoming a member of DaveLandry.com is 100% risk-free. You have nothing to lose and everything to gain! I strongly believe that my common sense approach to markets, money management, and trading psychology is the best way to trade. Period. However, if for any reason you're not completely satisfied, I'll refund 100% of your purchase price within the first 30-days.

Ready To Get Started?

Ready to learn how to trade properly? Been trading for a while but have lost your way? Or, are you just looking to become a better trader? Join Dave Landry.com and become a better trader.

Frequently Asked Questions

What Makes Your Approach Different?

Will I Get Rich Quick?

Will The Techniques Work In Other Markets Like Forex and Bitcoin?

Will The Courses Help Me Plan My Trade And Trade My Plan?

Do You Use These Techniques In Your Own Trading?

How Do The Courses Work? What Should I Expect?

What Happens During A Bear Market?

If I Have Questions, Can I Ask Them?

There is a risk of loss in trading. See disclaimers at DaveLandry.com