Random Thoughts

By Dave Landry

I think about trading-a lot. Even in my downtime, I constantly think about how simple yet elusive trading can be. When you boil it all down, you just have to sell higher than you buy. I know, easier said than done, but that's it. Note: notice that I didn't say "buy low and sell high"-that's a loser's game and fodder for many of my columns and presentations. Anyway, this thinking led me to an epiphany. Trading is really only two things:

1. Find A Viable System

2. Trade It

Number 1 isn’t easy, but it’s much easier than number 2. A hedge fund manager once said that he could publish his system on the front page of the Wall Street Journal and it would not affect his fund’s performance. The reason is that people wouldn’t follow it. A while back I was speaking at a trading conference in Germany. They couldn’t believe that this crazy American was showing them exactly what he does.

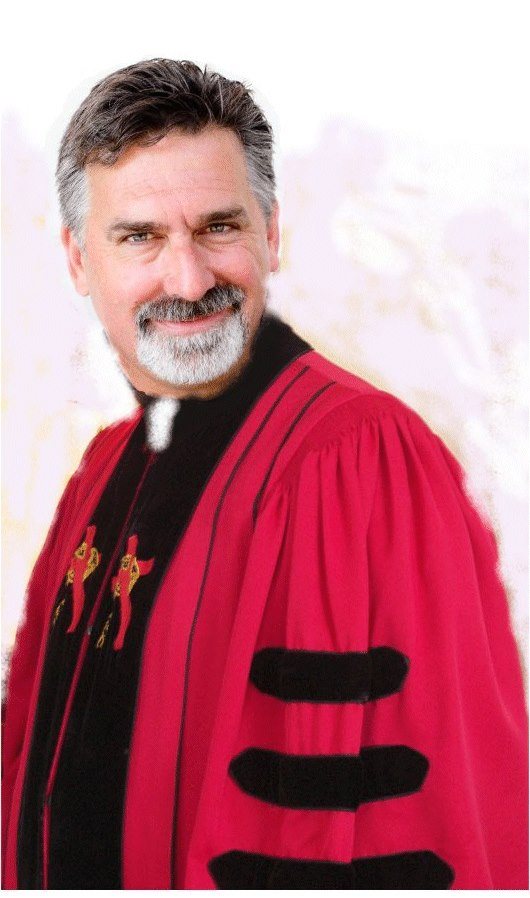

Here at DaveLandry.com I preach and teach a viable methodology daily. One of my most frequent sermons is patience. If there is a secret to trading, then that's it. In spite of my ramblings on this, people try to make something happen in less than ideal conditions vs. sitting on their hands. They try to get in early to “beat” the system. Once in, impatience causes them to exit at the first signs of adversity/at a tiny profit/as soon as the market begins to consolidate. This often gives me fodder for lessons on the dangers of micromanagement and my "dead money reports." The point is that you'll never succeed at trend following unless you catch the occasional home run. And, you do that by mostly letting trades unfold which means that you're often not doing anything.

Finding a system is important, but finding one that you’ll actually follow is key. As my bride Marcy once said-back when I used to program systems and brag about my system de jour: “How many trading systems do you really need?” Just one babe, just one–the one that you’ll follow. You might want to write that down.

The distance between you and your success isn’t very far. In fact, it’s only the distance between your ears. At the aforementioned conference, I met two young traders. One was successful while one was struggling. Did one have a superior methodology? Nope. They were trading partners. One was following the system while the other was micromanaging the trades.

So, how do we fix that? First, you have to make sure the methodology fits your psyche. Do you want to be in and out all day long? Can you handle the emotional burden of making all those decisions? I can’t. And, I'd be willing to bet that neither can you-at least not for long. I spoke at a daytrading conference a few years ago. I was the oldest fart there-by a long shot (and I'm not that old!). Like air traffic controllers and inner city ER doctors, we're just not wired for that many emotional round trips. Conversely, if you’re trading a methodology like mine where patience is really key, can you sit on your hands waiting for opportunities? Once in, can you see the trade to its completion by honoring your stop vs. exiting early? And, if you make it that far, can you continue to wait patiently for the initial profit target to get hit and then stay with it via a trailing stop? As I write this, I think, that's it! I know, again, easier said than done!

Now, assuming that you have a viable methodology—viable because you’re watching someone else trade the signals successfully, or, you have thoroughly tested it through a variety of conditions—but you’re still struggling with it:

1. Get Small

Trade at ½ the normal size. If you still aren’t following the system, then get smaller again-half that. When the amount of money is meaningless, it’ll be much easier to follow the system. Taken to an extreme, as mentioned in the Layman’s Guide To Trading Stocks, “I’ve never met an unsuccessful paper trader.”

2. Just Do This One Thing On Your Next Trade

On the next trade, and just that one trade, follow the plan—no matter what. If you were successful in doing that—notice that I did not say successful in the trade—then congratulate yourself. Maybe give yourself a small reward. And, then, on the next trade and just next trade, rinse and repeat. The point is that you don't have to see the next 1,000 trades, just the next one in front of you.

3. Make decisions passive ones and not active ones

Passive decisions are much easier to make than active ones. Let the market make decisions for you. So how do you do that? Well, that's fairly easy. Once the market opens, a stop order can be used to enter a trade. A protective stop order can take you out of a losing trade or keep you in a winning one. I was stressing over a losing trade just last night, watching it go against me, pip by pip. I realized that I was not practicing what I preach, so I put in a hard stop. This brings us to our next point.

4. STOP Watching The Screen!

Roth Metal Flake Dude

Watching every tick doesn’t help the market move in the intended direction. I’ve ruined a perfectly good set of eyes trying to do just that. So, if you are staring at your screens, don’t. Place the trade and then turn them off. If you're disciplined, use alerts to notify you when, and only when, you need to take action. If you have to, physically remove yourself from your office. Or, occupy your time by doing some research. Only you will know what has to be done.

For me, I keep myself extremely busy. I travel the world speaking the good word on trend following, write articles, develop courses, etc.. I do all of this because I know if I just sit here I will answer the Siren call of daytrading and micromanage my perfectly good position trades.

5. Make Fewer Decisions

If you are not following the plan by making numerous decisions, then make fewer decisions. Maybe the system, in its present state, is not for you. Find a filter that will reduce the amount of trades-or ideally, get better and more selective at your stock selection* (or other markets). Be selective. And remember, the system has to make sense to you. Again, you’ll never be able to trade a system, no matter how great it is, if it doesn’t fit your psyche.

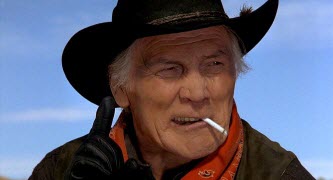

"City Slickers" MGM Studios

The methodology that will work best is the viable methodology that you will follow. Like Curly said in City Slickers, find the “One thing..” Focus on that.

My nephew has a fresh degree in finance. And, now he wants to trade. That poor bastard. He's trying to factor in fundamentals (my apologies for saying the F-word), world events, and of course, the SITUATION IN NIGERIA (classic Big Dave). I showed him one simple thing in IPOs. I urged him to do that and just that until he became successful. Is he doing the one thing? Wait, it's him-my phone just dinged. Nope, he's asking for my take on the trade wars (I wonder what that is?).

In Summary

Trading is really just two things: find a methodology and trade it. That's it! First, make sure the methodology fits your psyche. Then, if you still can't follow it, get small, make sure you're doing just one thing until you're successful, make fewer active decisions, stop watching the screen, and focus on the next trade--and only the next trade. Damn, I'm worried that my work here might just be done-dropping the mic. Big Dave has left the building.

May the trend be with you!

Dave Landry

P.S. Have you found a system? Are you following it? Leave a comment below to let me know.

*If you purchase the course, I'll also give you a year's access to the member's area 1-year and one-year free to my Trading Service. That way, you can learn and see the methodology in both theory and practice!