Here is the second part of my interview with World Finance-Markets of 2016, Outlook for 2016:

My good friend and mentor Greg Morris along with his lovely wife Laura recently visited. In between beers, good food (thanks Marcy!), and raunchy jokes-which could best be described as 8th grade boy’s humor, we talked markets. While discussing trend following, Greg gave me this gem: “Whipsaws are frustrating. Bear markets are devastating.” He went on to say that you can survive frustration but not devastation.

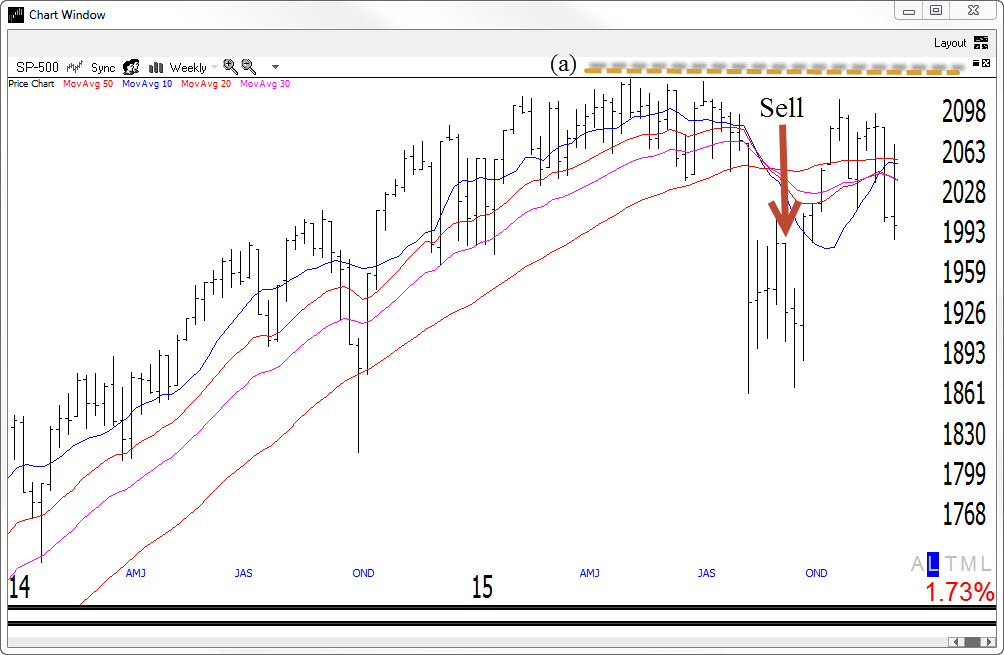

Greg’s right. Sometimes you just have to get out of the way. As I preach, he who fights and runs away lives to fight another day. My mantra since September when the weekly bowtie signal triggered has been “…treat all signals as if it will be the big one..” (Elizabeth implied)-yet another gem from Greg.

Big Dave’s front yard

The signal really hasn’t worked just yet but remains in effect until/unless the market goes on to make new highs-see (a) above and the last Dave Landry’s The Week In Charts (scroll down). The sell signal (or any signal for that matter) does not mean that you bet the farm-which for me, has somewhat of a literal connotation. It means that you pay attention. It means that you become selective on the long side. It means that you consider a short or two when presented. And, as Rush once said (the band on their 401k tour, not the fat angry white man), “If you choose not to decide, you still have made a choice.” That’s not necessarily a bad thing. Sometimes it’s better to be on the dock wishing that you were out to sea than to be out to sea wishing that you were on the dock—something I can personally attest to after nearly sinking in the middle of the Atlantic.

Continuing my love affair/bromance with Morris, I came across this gem during the library hour this morning while flipping through Investing With The Trend: “Remember: All of the financial theories and all of the fundamentals will never be any better than the trend will allow.”

In a recent interview with World Finance I was asked about a rich and famous value player’s approach to the markets. My point what that he had accomplished some amazing things but when the market loses half of its value, so does his fund. And, based on history, the market can lose as much as 80% of its value.

The Blue Bonnet Of Markets

This leads me to everything works better with trend. I’ve seen some very complex methods that seem to magically print money. However, if you peel away the wave counts and multiple oscillators, you’ll notice that something as simple as the slope of the moving average or my infamous big blue arrow also leads the way. The complex systems tend to break down when the trend ends. My point is that when trend following becomes trend fighting things get tough. So, regardless of the method, it “will never be any better than then trend will allow.”

Don’t confuse brains with a bull market is one of the few stock market adages that is true. Since ’09, this market has mostly gone up. And, a new batch of buy and hope (oops, I mean “hold”) has been born. Unfortunately, markets don’t always go up. Trust me, I’ve drunk plenty of my own Koolaid in the past. Been there, done that, and “got the T-shirt.” Now I just follow along.

Don’t confuse brains with a bull market is one of the few stock market adages that is true. Since ’09, this market has mostly gone up. And, a new batch of buy and hope (oops, I mean “hold”) has been born. Unfortunately, markets don’t always go up. Trust me, I’ve drunk plenty of my own Koolaid in the past. Been there, done that, and “got the T-shirt.” Now I just follow along.

The market is now back in the negative column for the year. Those who bought into (literally) the buy and hold over the past 6 years are being forced to rethink their investment. They’re beginning to get a taste of the harsh reality of markets. Markets go up and markets go down. Sometimes return of capital is more important than return on capital. Maybe the market will continue to go higher. And, I hope it does. In markets though, it’s often hope in one hand and, well, you know….

To The Markets

It’s amazing that the market initially rallied on the fact that the Fed raised rates. What ever happened to “Don’t fight the Fed?” Well, unfortunately, the market turned right back down and based on Friday’s close it is now at its lowest level in months.

Santa Might Not Be Coming

That fact that the market is now at its lowest level since October, suggests that the so called “Santa Claus” rally might not happen this year. You have to be careful with these seasonality things. They can not work for years but still be statistically valid. My litmus test for any method is to ask yourself “can you time off of it?” And, if you can’t, toss it out. Academics are interesting and make great fodder for columns but if you can’t time off of it….

That fact that the market is now at its lowest level since October, suggests that the so called “Santa Claus” rally might not happen this year. You have to be careful with these seasonality things. They can not work for years but still be statistically valid. My litmus test for any method is to ask yourself “can you time off of it?” And, if you can’t, toss it out. Academics are interesting and make great fodder for columns but if you can’t time off of it….

I don’t see the need to get into in-depth sector analysis. See recent Random Thoughts for that. To summarize, not much has changed: Most are still headed lower or at best, stalling short of their prior highs—like the market itself.

So What Do We Do?

Click “2” below to continue reading….

Free Articles, Videos, Webinars, and more....