Random Thoughts

by Dave Landry

I’m often asked about “exacts” when it comes to trading. Where exactly should I place my stop? Exactly how many days constitutes a trend? Exactly how deep should a stock pull back? The list goes on and on. Unfortunately, often, there is no logic that would allow for exacts. True, you must have a general framework to work within, but that’s it. So, how do you operate in such an environment? Embrace it and more importantly, embrace yourself. Let’s explore this further.

Answer The Question

While preparing for a Week In Charts webinar, I initially began working to answer the “exact” questions. Sorting through hundreds of old slides and some graphics that I used in Layman’s, I quickly realized that in many cases, I already have-at least in terms of a general framework. For instance, I did two consecutive shows just on stop placement (see videos). Trading mechanics aren’t hard for those willing to listen. It’s your mindset that’s key. So, my focus quickly turned to how to embrace the irrational nature of markets.

" Trading mechanics aren’t hard for those willing to listen. It’s your mindset that’s key."

Sun Tzu Would Have Made A Great Trader

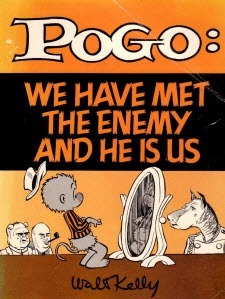

The Chinese general Sun Tzu once said that “If you know thy enemy and know thyself, you need not fear 100 battles.” Tzu’s right. You must understand what you’re dealing with but also know that the battle is often from within. Speaking of Chinese generals, here's a fun fact: Did you know that General Tso was allergic to chicken?

Question: What's Keeping You From Becoming A Successful Trader?

Answer: You

Trading Psychology Micro Course

(A Subset Of Trading Full Circle)

What YOU Can Do About That

Lifetime support! Got A Question? Call or email!

The Enemy

Markets are made up of thousands of emotional beings. You cannot expect these emotional beings to always behave rationally, adhering to exacts. Logic doesn’t always apply. Markets do a lot of irrational things. Sometimes they go down on good news. And, on bad news, sometimes they throw caution to the wind and forge ahead. The list goes on and on. Never forget that “Markets can stay irrational a lot longer than you can stay solvent” (Keynes).

Embrace The Enemy?

Okay, Sun Tzu quotes shows that I did once actually read a book (I’m not bragging, it’s a thin one) and it makes for good prose. However, you really shouldn’t view the market as your enemy. Unlike your evil co-workers, it’s not out to get you. If you choose not to participate, it’s not going to throw you under the bus. It also won’t come knocking on your door and force you to do something.

Perfectionist (and Logic Chip Designers?) Need Not Apply

In a chart show, Michael, a participant, said “I was a logic chip designer in my past life.” You don’t have to stay in a Holiday Inn Express to know that profession requires a high degree of logic, hence the word “logic” in the job description. I thought to myself, that poor bastard is going to have a hard time in the markets. But he then chimed in with “How is that for baggage???” I quickly changed my mind. He’s not going to be Frozen and will be able to “let it go." He knows himself and the enemy within.

Your success in life by saving lives, building buildings, and doing other great things like designing logic chips came from controlling the situation and applying a high degree of logic. Yet, in markets, again, you have to let it go. As a card carrying trend follower, I have learned to just follow along. I accept what it gives and have a stop in place for when it takes. And, so should you.

Do You Feel Like I Do?

Guess what? You’re one of those aforementioned emotional participants. Do you always behave rationally?-probably not. Be cognizant of how you react or often over react. Embrace your emotions. Realize that the market is made up of a bunch of “yous.” Like Frampton, think about the other participants and ask “Do you feel like I do? Knowing how hard it is to control yourself makes it easier to realize that the market is often irrational. You can’t control the markets, only your reaction to them.

Embrace The Enemy Within-Easier Said Than Done

So reverend Dave, are you holier-than-thou? Hell no! I cuss and fuss. It’s probably good that I’m mostly alone in my office. Otherwise, you would learn that I can use a certain word as a noun, an adjective, a verb (both transitive and intransitive), an adverb, and an object of a preposition-often all in the same sentence. I have learned to recognize when I’m losing it and do simple things like changing my reactions. I try to replace my F-bombs with a “whomp whaaa” muted trombone sound. Or, when stopped, I shout in my best Paul Giamatti channeling John Adams voice: “I SAID GOOD DAY SIR!” It’s probably good a good thing that my nearest neighbor is over ¼ mile away.

My point is to understand that you often act emotionally and irrationally so why would you expect all of the other market participants to act rationally and in a perfect manner?

In Summary

Trading is not a game of exacts. Perfectionist need not apply. Markets are made up of many irrational participants, including you. Embrace the imperfect nature of you and the markets and your job as a trader will become much easier.

May the trend be with you!

Dave Landry