Random Thoughts

By Dave Landry

With the market questionable at best (see part 1), now’s the time to be prudent. Don’t panic, keep an open mind, and take the following simple steps and you’ll do just fine. You might even find that you’ll be able to “keep your head while everyone else is losing theirs.” Let’s explore this further.

As mentioned in part one, we could be entering a bear phase. I’m hoping-I know “hope in one and …in the other and see which one gets filled first” when it comes to markets-that it’s only a correction in the longer-term trend (see the weekly “DaveLight” discussion in part 1). We won’t know for sure until after the fact. The one thing that is for sure is that the market has become quite dubious as of late. Maybe it will be just another whipsaw. However, you have to brace just in case.

Will It Be Just A Whipsaw?

Greg Morris

Speaking of whipsaws, as I wrote the last time the market was becoming questionable: 'My good friend and mentor Greg Morris along with his lovely wife Laura recently visited. In between beers, good food (thanks Marcy!), and raunchy jokes-which could best be described as 8th grade boy’s humor, we talked markets. While discussing trend following, Greg gave me this gem: “Whipsaws are frustrating. Bear markets are devastating.” He went on to say that you can survive frustration but not devastation.'

Greg’s right. Sometimes you just have to get out of the way. As I preach, he who fights and runs away lives to fight another day. Later in the conversation, he said to “…treat all signals as if it will be the big one..” (Elizabeth implied)-yet another gem from Greg.

You can argue correction vs. bona fide bear market, but you can’t deny that there are some things that aren’t going so well. So, what does this mean for the trader? Well, as long as you “believe in what you see and not in what you believe,” not much. Just take the following steps—as you would normally do.

Note: Some of the following might look familiar. I “borrowed” a lot from my Winter Is Coming article written the last time the market began to stumble.

1. Don't Panic

Do not make any drastic moves. The first order of business is to breathe. Let the ebb and flow control your portfolio. Let protective stops take you out of positions that may be turning and keep you in those that can defy gravity. Sometimes, you never know if one of the leftover longs will go on to be the mother-of-all winners, a winner desperately needed for longer-term performance. You can’t have any regrets-I know, easier said than done! In hindsight, you’ll wonder why you didn’t just exit everything. As I preach, shorter-term, micromanagement often pays. Longer-term though, you'll never catch any big winners.

2. Listen To The Database

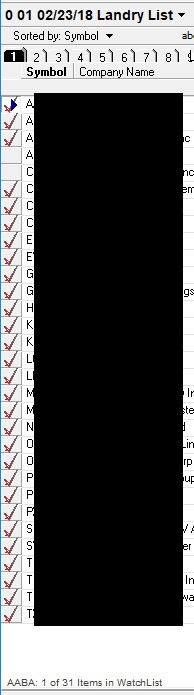

Are you seeing a plethora of shorts setting up and can't find a long to save your life? That’s the database speaking. And, it pays to listen. To the left is a screen shot of my Landry List for 02/23/18-with the tickers redacted :). Shorts are “flagged.” Notice that out of the 30-something setups (and I whittled those down significantly!), only 2 (unflagged) are potential longs. This action suggests that the short side is the side to play.

When conditions are questionable, on the long side, make sure you have the mother-of-all setups-something that can rally in spite of the overall market. Super speculative issues such as hot IPOs can occasionally trade independently of the indices-at least initially. Again though, just make sure that you really like the setup. If you find yourself thinking anything less than “f’ yeah!,” then pass. You’re welcome! Commodity related areas can also trade higher in spite of a questionable market. Just make sure that the sector confirms—and, unfortunately, lately, they have not (see part 1).

3. Consider A Short Or Two (Or Not)

Shorting is tougher than it looks. There are some logistics involved such as borrowing of the shares. Shares can also be "called in"-something that only seems to happen right before the stock implodes (but that’s another story, filled with f'bombs). The same buy side patterns do work, but you have to anticipate moves because they “slide faster than they glide.” Often, by the time you wait for confirmation, the move is over. The retrace rallies quite frankly, suck. You often get knocked out of perfectly good positions and then have to watch them promptly turn right back down. Further, unless you “trade around” core positions, the most that you can ever make is 100%. And, of course, as I wrote in Layman’s “in theory” your potential losses are unlimited. I say “in theory” because one, you’d have to be obstinate and hold on to a big loser—and, btw, if you do that then you’re not a trader! And two, you’d have to have an unlimited amount of cash to keep the position(s). Trust me, brokers are pretty nice about shutting down things for you when you start to run out of cash. Yeah, I have one or two of those T-shirts lying around.

So Why Bother?

I think shorting is a necessary evil for two reasons. First, the "Captain Obvious" reason is that it’s the only way to make money when a market is going down. And, second, going both long and short helps you to see both sides of the market. The money managers that I know who are "long only" oriented seem to always see the glass as half full-at worse. True, they are usually right because the market does tend to go up longer than it goes down. Unfortunately, this, in and of itself, isn’t a reason to always stay long (see this recent Week In Charts).

As a good little trend follower, we follow it up, we follow it down, and we find something else to do when it’s going sideways. As Gary Kaltbaum once said, “Give me an uptrend, a downtrend, or a ticket to Tahiti.”

3. Remember That Cash Is NOT Trash

You don't have to short, provided of course that you can objectively see both sides of the market. Cash is not trash. There is nothing wrong with being out of the market. As I often preach, it’s much better to be on the dock drinking beer wishing that you were out to sea than to be out to sea wishing that you were on the dock drinking beer. This is something that I can attest to after nearly sinking in the middle of the Atlantic. Where was I? Oh, it’s okay to sit in cash. Sometimes “return of capital” is more important than “return on capital.”

In Summary, Here's What You Do

Let’s hope it’s a whipsaw, but brace for a chainsaw. It’s not that hard. I never said it was easy. Honor your stops, consider a short or be comfortable with cash, and above all, breathe. Leave a comment below to let me know what you think. I read all and reply when necessary.

May the trend be with you!

Dave Landry