Random Thoughts

By Dave Landry

Jon Snow, Game Of Thrones. Original source (before really poor Photoshopping): Fandom

I can’t guarantee you much in this business but I can guarantee you one thing with 100% certainty. We will have another bear market. That's the bad news. The good news is that there are simple steps that you can take to not only survive but even prosper when, not if, it comes.

"Winter IS Coming!"

For six years, Game Of Throne's Starks have been whining that winter is coming, especially that bastard Jon Snow. And so far? Nothing. Well, other than a raven carrying a note that said "winter is here." For even longer, there have been some "Henny Penny" gurus out there claiming the same. Predict early, and often I suppose?

"Winter IS Here?"

Just like "You know nothing John Snow," I don’t know what exactly a market will do next. No one does. I can guarantee one thing though. Markets go up and markets go down. Now I know that’s a Capt. Obvious statement, but you would you be surprised at how many people fight trends and refuse to give up when a trend ends.

I’m not a predict “early and often kind of guy.” When it comes to the markets, like life, I truly believe that you can only take things one day at a time. And lately, there’s been a few concerning things.

The Domino Effect From Debacle De Jours

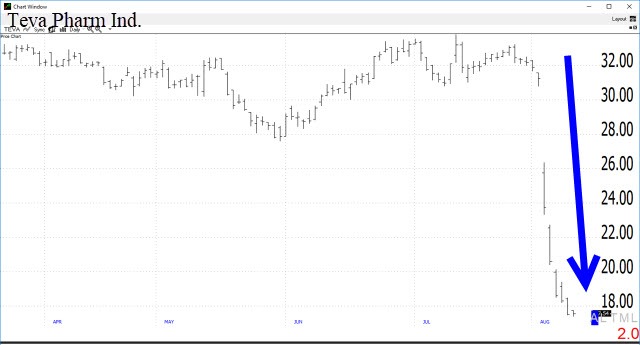

Recently, there have been quite a few individual issues that are getting spanked-and hard! These “debacle de jours” include, but not limited to Office Depot (ODP), Quantum Corp(QTM), Dillards (DDS), Travelocity (TRVL), and Teva Pharmaceutical (TEVA).

Obviously, this is concerning in and of itself. But wait, there's more! Individual issues getting torpedoed creates a domino effect. First, it puts pressure on the sub-sector and creates a negative sentiment for stocks within the sector. Second, it puts pressure on the overall sector. And third, this puts pressure on the overall market.

Never forget that people buy and sell stocks for many reasons that often have nothing whatsoever to do with the underlying fundamentals. For instance, let’s say that you want to retire soon and you notice that your retirement funds are beginning to evaporate. Or, you’re watching juniors Ivy League college fund erode. The sentiment can change quickly when people begin to lose money that they really need. This selling can beget more selling.

Winter IS Coming-Action In The Indices

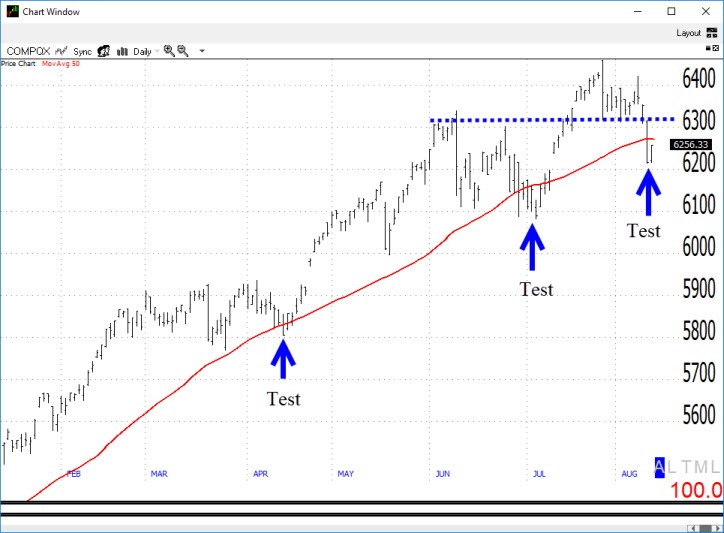

The NASDAQ is now trading below its 50-day moving average. Now keep in mind there’s nothing magical about a 50-day moving average. It does okay give you a point of reference. Obviously, it scores as a positive as long as the market stays above it. Also trending markets will often have many shakeouts along the way. Notice of the last six months that the NASDAQ has tested its 50. And, so far, it has passed these test. Will this would be the big one Elizabeth implied? I don’t know. So for it’s only another test. However, you can't completely ignore it.

The S&P 500 is also trading below its 50-day moving average. Similar to the Nasdaq, it too has tested its 50-day moving average several times since 2016.

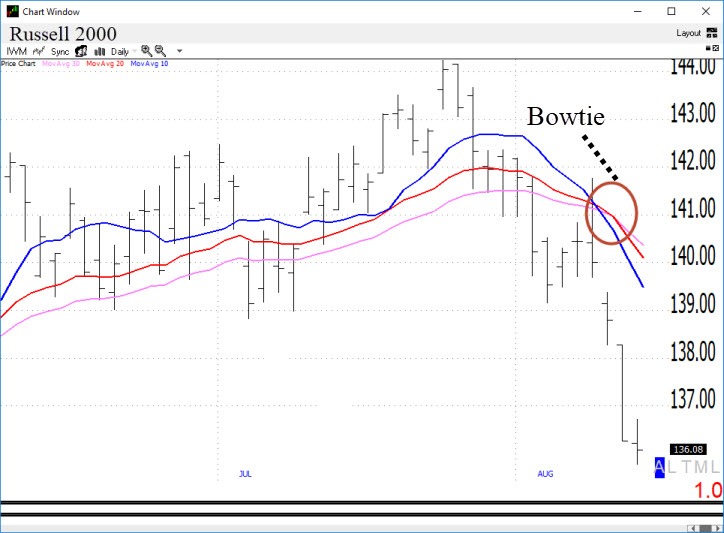

The Russell 2000 continues to worsen. It is now forming a daily Landry's Bowtie sell signal. A small bounce would complete the signal. And, obviously, the mother-of-all rallies would negate this signal. As I preach, quoting my good friend Greg Morris: "we treat all signals as if they will become the big one." So, we need to pay attention here.

Winter Is Coming: The Database Is Speaking

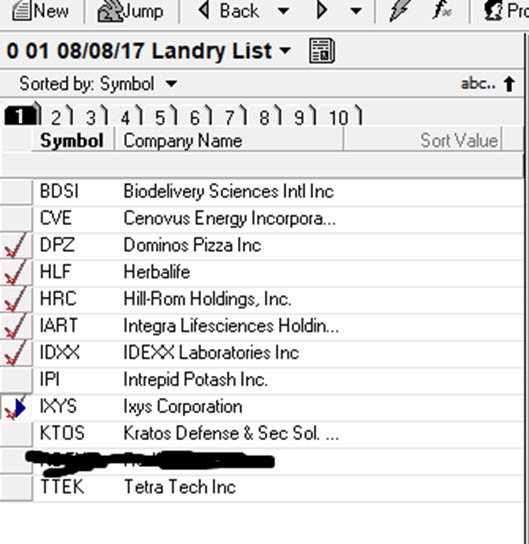

Lately, it’s been very hard to find meaningful setups. And, the ones that I am seeing more and more are on the short side. As I preach, when the database speaks it usually pays to pay attention. Notice that number of shorts (those with a red check mark) in a recent “Landry List:”

Winter Is Coming: Non-Quantifiable But Concerning Nonetheless

You know me, I steer far away from any political discussion. I have clients on both sides of the fence. (Note: I do have a rooster named Donald but that's just because of his striking resemblance to Mr. President.) With that said, the fact that the administration is taking credit for the rally is troubling. That’s a slippery slope that you really don’t want to go down. What are they going to do when the market begins to implode? Blame it on the so called helicopter policies of the past?

BTW, I might not be publicly political, but I'm pretty sure my rooster is. I noticed that he has been wearing a certain hat recently. Speaking of hats, the media has been partying like it’s 1999 because the Dow is over 22,000. They have even gone as far as to imply that you have to just buy and hold, citing the case that the Dow has come back so fast since it hit the 6000s in 09. And, yes, I've seen of picture or two of people wearing Dow 22,000 hats. You kids old enough to remember the Down 10,000 hats and what happened shortly thereafter?

Now, these things are not quantifiable but they are tells that can't be completely ignored, especially when you factor in the aforementioned observations.

Okay, Winter Is Coming: So What To We Do?

1. Don't Panic: Don’t make any drastic moves. Yesterday, I poked my head into a chat room and you would think that the apocalypse was here. Yes, there are some signs but so far, is just one bad day. So, the first order of business is to breathe. let the ebb and flow control your portfolio. Let protective stops take you out of positions that may be turning and keep you in those that can defy gravity. In yesterday's chart show, I pointed out that there was 1 winner the open portfolio and 2 losers. My point was to leave it alone. One (FNJN) then subsequently stopped out at a loss but the other loser (CNDT) somehow defied gravity and actually turned into a winner by the end of the day. Remember, there's always a reason to abort the plan and rarely a reason to stay. That's the thing to do though, stay the course. You might be sitting on a future big winner. Yes, shorter-term, micromanagement pays. Longer-term though, you'll never catch any big winners.

2. Be Selective: Make sure that you are very selective on new positions. Unless you think you have the mother-of-all-setups, something that can shrug off a weakening market, then pass.

3. Short (Or Not To Short?): There are two reasons to short a market. The first and most obvious is that it is the only way to make money when the market is headed lower. The second and less obvious reason is that it helps you to see both sides of the market. I’ve observed that those people who are long only oriented tend to only see the market as “half-full” at worse.

So, should you short? Well, it depends. Make no bones about it shorts are a major pain in the ass. Retrace rallies suck to put it mildly. And, then you often watching anguish as a stock turns right back down. There’s also some logistics such as borrowing and callbacks. Also, unless you’re willing to re-short (i.e. trade around positions), your gains are limited to 100%. Further, if you’re stupid enough to throw caution to the wind and not use stops your losses are potentially unlimited--in theory: your broker will be kind enough to take you out unless you keep feeding your account. Shorts are not for the faint of heart. Make sure you fully understand them. Read "Go Go No Mo" under free reports for some ideas on how to short.

Don't pressure yourself if you're not ready to play the downside. Cash is not trash. It's okay to sit it out and wait.

4. Take Things One Day At A Time Abe Lincoln once said that the great thing about the future is that it comes at you one day at a time. He's right! Don't make any big picture predictions. I didn't write this column to be fear mongering. I wrote it so you would know what to do, when, not if, the bear market begins.

Like Pavlov's Dog And Quasimodo, This Story Rings A Bell

I learned a very valuable and expensive lesson many years ago. Long before Al Gore invented the internet, there was something called Prodigy. I read everything I could find on their stock "bulletin boards." I became very friendly with an older gentleman who was pumping, ironically, a medical pump maker. Any time the stock would drop he would shout from the rooftops that we all should buy more. We became friendly and begin talking on the phone. One day the stock imploded. Since I was one of his victims (in a big way), I called him in a WTF! panic. I'll never forget what he said in a very calm, slow drawl: “DAAA-VVID, no one rings a bell for us when a market has topped. ” No kidding? Gosh! (I think I was a little more cruder) Why didn’t you tell me that a couple of days ago?

So Is Winter Coming? Or, Not?

No, I'm not ringing the bell. "No one rings a bell." (or even sends a raven!) Yes, winter is coming. Again, the one thing that I can guarantee is that there will be another bear market. I’m just pointing out what I’m seeing. The indices are still just a few big up days away from all-time highs. So, there’s no need to sell the farm or even have it appraised. Do pay attention and when winter finally gets here you’ll be ready.

May the trend be with you!

Dave Landry