Random Thoughts

By Dave Landry

Plan your trade and trade your plan is a cliché that’s much easier said than done. Once in the trade, our psychological urges encourage us to exit early to mitigate damages, lock in tiny profits before they evaporate, and a host of other bad behaviors. Micromanagement of the trade is often the one thing that stands between you and your success. Let’s explore this further.

Micromanagement Defined

The definition of micromanagement is “to try to control or manage all of the small parts of (something, such as an activity) in a way that is usually not wanted or that causes problems.” (Merriam-Webster) For traders, micromanagement is trying to outsmart the market by abandoning a simple trading plan due to reasoning or feelings; a propensity to take action when none is necessary. We often feel tempted to confuse the issue with facts by interjecting logic into the equation or allowing the market to lure us into doing the wrong thing.

Interjecting Logic Into A Trade

A high degree of logic was necessary for you to become (and stay!) a successful doctor, engineer, or automatic transmission mechanic. Unfortunately, the same thing that made you successful in life is often a hindrance when it comes to the markets. Logic doesn’t often apply. And, if you think about it, you’re dealing with the psychological urges of all of the participants. People “buy and sell stocks for a variety of reasons” (McClellan), most of which have nothing to do with the underlying company.

Greg Morris

"All of the financial theories and all of the fundamentals will never be any better than what the trend of the market will allow."

Investing With The Trend

The fundamentals of the stock might be worsening, the stock might not go higher for a day or two in spite of a strong market, or the stock might just flat line for days or even weeks suggesting that it is dead money. Quite frankly, there’s always a reason to abandon the plan. Don’t! Your life will get a lot easier if you block out all that reasoning and just follow the original plan.

Bad Teacher (ad nauseam)

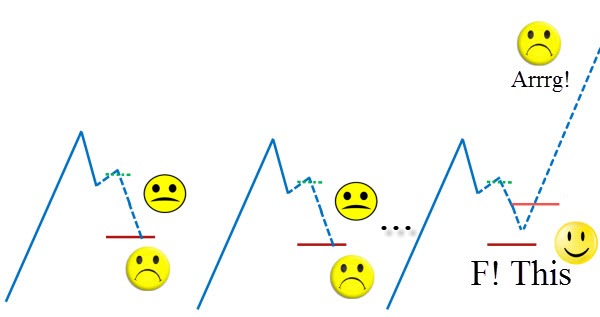

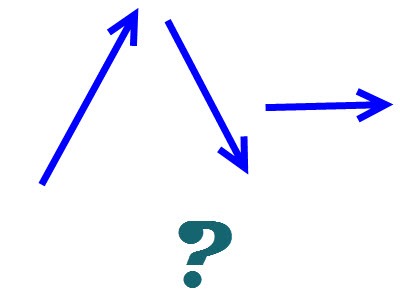

I know I’ve beaten the dead horse on how the market is a bad teacher, but I’m going to continue to beat the dead horse until you people get it. Let’s say you get into a position, and immediately you're staring at a small loss. Your protective stop is still far away, so you follow the plan. The market then continues to drop and stops you out for a full loss. After a few iterations of this, you’re once again faced with yet another small loss. Enough is enough! You take the small loss to mitigate any further damage. The stock then promptly turns around and rallies for the mother-of-all trends without you. That one trade would have paid for all the previous losses, and then some.

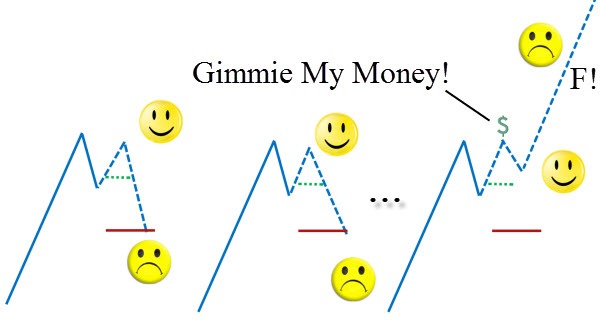

On the flip side, you enter a trade, and you’re immediately blessed with a small profit. You then watch in anguish as it evaporates. Rinse and repeat a few times and then once again, you’re staring at a small profit. This time though, you’re not going to watch it wash away. You lock it in and feel good for a moment knowing that the money is yours. The stock drops further, and you’re feeling even better. Unfortunately, as Murphy would have it, the stock then promptly reverses and blasts higher, again, without you.

Dave Landry

Trend Following Moron

"You don't win by not losing. You win by winning."

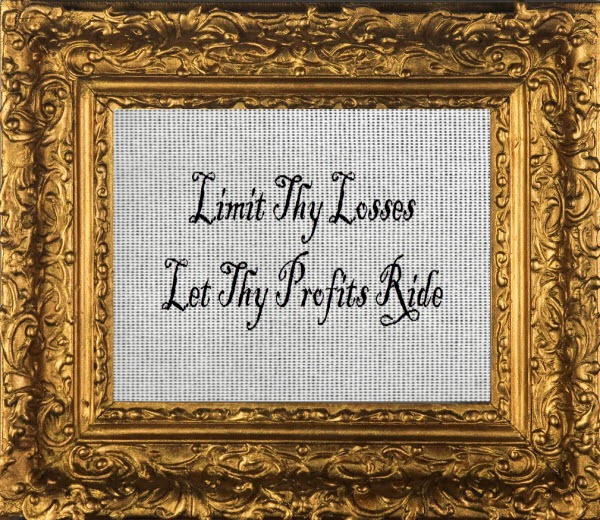

Never forget that the only way to become successful as a trader is to keep losses limited while still allowing for unlimited gains-you might want to write that down, frame it, and stick it on the wall of your office. It’s tough resisting the urge to micromanage because it often pays over the shorter term-yet again, that bad teacher thing rears its ugly head. Longer-term I can all but guarantee that you’ll miss big trends by micromanaging. And, these are trends that are crucial to your success. There are two parts to the trading success equation, and without the second part, you’re doomed from the start. Yes, you have to keep losses in check, but you don't win by not losing. You win by winning. Write that down too!

How Do You Fix It?

Okay Big Dave, you’ve done a great job of identifying a problem, so how do we fix it? Well, on the surface, that’s not that hard. Just follow the plan. Peace out! My work is done—dropping the mic as I leave the stage. Alright, if you still can’t do that then here are some things that will help:

1. Embrace the fact that no one knows exactly where a market is headed.

Again, in my typical beat the dead horse fashion, this goes for you, me, and the guy who screams on TV. This is huge. It’s liberating. Know your edge and trade it, knowing that the market might not always cooperate.

2. “Accept” the loss before going into a trade.

It’s simply a cost of doing business. Just like you don’t stress too much over buying office supplies, you can’t stress over the fact that the next trade might cost you. Provided that your risks are in line, a loss is just a loss. And, if you’re doing the right thing (see #5), each loss means that you’re getting closer and closer to the next winner(s).

3. On the next trade, and only that one trade, follow your plan....

I hate to be “tough love” guy, but I worry that I could get hit by a beer truck before you become successful. So, I must tell you the cold hard truth: if you can’t follow the plan on just the one next trade, then maybe you shouldn’t be trading. I truly believe that anyone can learn to trade if they want to but again, if you can’t follow the plan for just one trade then maybe you should reconsider. Okay, let’s say you do follow the plan on the next trade. Now what? Well, do that for the next 10,000 trades.

4. Are conditions are conducive to your methodology?

If the net net change of the markets, most sectors, and most stocks are virtually nil, then maybe there’s no trend to follow. Just like you can’t catch a tan when the sun's not shining, you can’t catch a trend when there is none. Now, without digressing too far, this doesn’t mean that you should shift methodologies. It simply means that you should wait for conditions to improve and pick your spots carefully.

5. Pick the best and leave the rest.

I’m amazed at the stocks that people pick who should know better. I get a plethora of emails asking me about stocks that look like electrocardiograms. To get where I'm coming from, watch a few of my Week In Chart shows and notice how many people ask about stocks that aren’t trending or worse, obviously trending in the opposite direction. If you’re a newbie, no worries! We all have to start somewhere. Again, I’m referring to people who should know better. I’m not sure why people who have become highly successful in life by seeking perfection will settle for such mediocrity in the markets (note: since this column was originally published, I found the answer for why successful people do this. A client of mine, who is also a psychiatrist, explained to me why this is so. I covered it in detail in the Trading Full Circle Course). So how do you pick the best? Well, I have a 14-hour course on how to do just that so. Get the course by 08/10/17 and I'll give you one year of my Core Trading Service For free! (normally $1497). That way, you learn the theory but more importantly, see it unfold in practice.

Avoiding just one crappy stock or catching just one big winner should more than pay for the course. Okay, enough of the soft sell. At the least, take the time to watch the intro video on the sales page, and you’ll be well on your way. You certainly won’t be asking about stocks that have gone sideways, trending in the wrong direction, or look like electrocardiograms. And soon, like me, you'll be shaking your head at some of the stocks asked about in the Week In Charts.

I often equate mind, money management, and methodology to a three stranded cord. They’re intertwined. Get better at one, and you get better at all. If your stock picking improves then you’re catching more winners. Your psyche improves (mind). You’ll feel better about honoring your stop (money management) because you realize that position is stinking up the joint. Catching more winners will also make you realize that you have to let things run their course. Otherwise, you might be micromanaging yourself out of the next big thing.

6. Turn off your screens.

I’ll let you in on a little secret: watching every tick doesn’t help the market move in your favor. If it did, I would have owned the world a long time ago. When I first got started, I was guilty of literally watching every tick. And, if I had to go to the bathroom, I had the computer programmed to make noises on upticks and downticks so I could hear what was going on. A little TMI? In more recent years I have found myself dropping F bombs to a point where I have to walk away-literally. Not all the time, but many times after a brisk walk I’ll find that the positions have turned back around. I wasted all that mental energy for nothing. I know it's cliche', but "you need to be as close to the market as necessary, but no closer."

Here's A Related Video From Dave Landry's The Week In Charts....

In summary, more-than-often, you'll be tempted to do something other than following the plan. Don't! Stay the course.

May the trend be with you!

Dave Landry