Original source: Paramount. Photoshopping (done rather poorly btw) by Dave Landry

Yesterday, I was working on an article for TRADERS’, expanding upon a series that began over a year ago. While reviewing previous articles, I came across the following “Ground Rules.” For those new to trading, new to me, or my methodology, I think these will help you to understand my philosophy towards trading and the markets. And, I think for those of you who find yourself plotting the 15th oscillator, attempting to implement some arcane price bar counting technique, confusing the issue with facts by interjecting news or fundamentals into your trades, trading during less-than-ideal conditions, picking top tops/bottoms, and generally just trying to outsmart the markets will also benefit.

Dave Landry’s Ground Rules

1. Technical analysis leads the way. If a market is going from A to C and A < B < C, then it will have to pass through B on its way to C. There are no hard and fast rules like this when it comes to fundamental analysis. “…the fundamental factors suggest what ought to happen in the market, while the technical factors suggest what actually is happening in the market” R.W. Schabacker, Stock Market Profits

2. Considering #1, all news and all fundamentals are ignored. Price and only price leads the way. “Remember: All of the financial theories and all of the fundamentals will never be any better than what the trend of the market will allow.” Greg Morris, Investing With The Trend

3. Trade only in the direction of the established or developing trend. Regardless of the methodology, all successful trades must capture a trend. So, why not start with a trend to begin with?

4. It is not “my way or the highway.” There are many ways to trade. If you are already a successful trader then use only what your feel will improve your own trading. If you are not currently successful, then consider the methodology since it is a simple and straightforward approach.

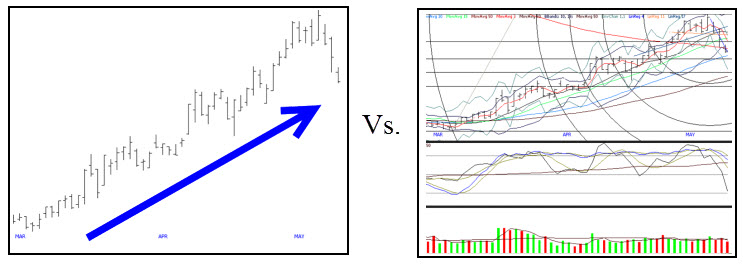

5. Keep it simple. Other than the occasional moving average, no indicators are used.

6. Only the short-term can be predicted when it comes to markets. However, positions can be held longer-term if a longer-term trend materializes.

7. Money & position management are key. You must position yourself for both shorter-term and longer-term gains. No matter how great a trade might look, there is always a risk of loss. Therefore, stops must be used.

8. Although a good defense is crucial, a good offense is often your best defense. Pick the best and leave the rest. Do not take mediocre trades and/or try to make something happen in less than ideal conditions. “Don’t invent trades.” (Peter Mauthe)

9. The methodology is repeatable. There are no secret formulas. Execution is not extremely crucial. With some experience, you should be able to recognize trends/emerging trends and the patterns to get onboard them.

10. Embracing your emotions is key. You do this by understanding the methodology, trading at a reasonable size, planning your trades, and only trading the best. “Obsess before you get into a trade, not afterwards.” (Dave Landry, The Layman’s Guide To Trading Stocks)

To The Markets

When we last left off, things were deteriorating. Then, we had one great day. Unfortunately, for now, that appears to be one and done and now we’re back to where we started. As I preach, it’s important not to get too caught up in the day-to-day action.

As mentioned above and ad nauseam, I ignore all news but occasionally do get some through osmosis. It appears now that Greece-anyone remember that?–will not topple our markets but now apparently China will. Oh well, it’ll be something else tomorrow or the next day-that, I can guarantee. The point is, ignore the fluff and unless you’re Bill Clinton, what is, is. Let the price and only the price guide you.

Okay, Dave, What’s Price Saying?

Well, it’s not looking too good at the moment but never forget to take things one day at a time.

Tuesday was ugly. For all intents and purposes, the market gave back all of Monday’s gains. This action keeps the Ps (S&P 500) and Quack (Nasdaq) stuck in an intermediate-term sideways range and it puts the Rusty (IWM) back below its well-watched 200-day moving average.

There’s a few sectors like Foods and Retail that are hanging in there but for the most part, it’s not looking too good at the moment.

The Semis turned back down. So far, a top remains in place here.

Drugs and Biotech have lost momentum and could begin setting up as shorts soon.

Debacle de jours abounded. Many individual issues were torpedoed. In many cases this was a testament for staying out of this market’s way and waiting for entries if you decided to attempt to jump in. Sounds like some fodder for this week’s Dave Landry’s The Week In Charts.

Computer Hardware, otherwise known as Apple, sold of hard. It is now probing new lows. Speaking of Apple, as mentioned a couple of weeks ago: “Stick a fork in it. It now has a mountain of overhead supply to overcome. Many are pointing to this as a sign of the apocalypse. I think it’s dangerous to predict an entire market just based on one bad Apple but it does certainly score as a negative.”

Energies have woken up a bit lately (yesterday notwithstanding) and Metals & Mining appear to be scraping bottom. I wouldn’t rush out and try to catch the falling knife in these sectors just yet but we could see buy signals soon. Again, don’t anticipate, wait.

So What Do We Do?

Well, I’m hoping that this is just one big shake out before the market bust out of its range and goes on to make new highs. I know. Hope in one hand and… Anyway, again, what is, is. I wouldn’t rush out and sell the farm just yet but you might want to get it appraised. Seriously, just honor or stops on existing positions. As long as the market overall is stuck in a sideways range, be VERY selective on new positions. It’s funny, you’d think that the longer you’re in this business of trading the more you would trade but it’s actually just the opposite. You learn to trade only when an opportunity presents itself.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....