08/16/19 NOW with Dave Landry-Keeping The Lights On While Waiting On Trend Trades

By Dave Landry | Now With Dave Landry

Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

I finished "Mental Chemistry" by Haanel. It's out there and esoteric, but I think there is something to be said for getting in touch with your subconscious. What's interesting is that Dalio talks about doing just that in Principles (keep reading). Here's a man (Dalio) that I have the utmost respect for--and he has given credence to the topic. This has inspired me to study Haanel's ideas further.

As I often preach, our "lower brain" can often sabotage us. Our so-called "lizard brain" is often our worst enemy in life and especially when trading. You must make friends with your subconscious. Haanel discusses that we do this through conscious thought: "....we only have to change our conscious thought to get a corresponding change in the subconscious."

Haanel harps on the Hill's "you must think a thing before you make a thing" mantra. And, if you think about it, any incredible achievement must start with a thought. "Man has accomplished the seemingly impossible because he has refused to consider it impossible."

Charles Haanel

"If we think distress we get distress; if we think success, we get success."

The book is four bucks and 100 pages. I think it's worth a shot.

What I'm Listening To

I gave up on listening to Dalio's Principles, not because it was bad, but because it was so good. In an effort to multi-process, I tried to listen to the book while working on other things such as my nightly analysis. The problem is, I had to keep stopping myself to take notes. I realized that this was grossly inefficient. Knowing a little neurology, I know that we're not wired to multi-process. If we were, then cell phones wouldn't cause wrecks-but, I tried nonetheless. Where was I? Oh, I bought a hard copy of the book and have really been enjoying my single focus here.

I originally bought Principles (audio) to see if Dalio had some insight into the markets. There's a little in there, but not much. So, you might be disappointed if that's what you're seeking. However, there might be something more valuable: How to think.

Dalio encourages you to write your own principles, borrowing as much or as little as you want from his. I'm definitely going to write my trading principles which will become part of a project which has arisen from my morning pages (keep reading).

I'm about halfway through, and I'm sure that I'll have much more to say.

See books to read for more trading books and books on becoming better.

What I'm Working On...

Since it's been a while since I've done a NOW, a lot of content has been published. In the last several Week In Charts, I covered market timing, psychological mistakes (and how to avoid them!), and learning to perceive and receive. You can find them on my YouTube channel. Subscribe to the channel while there.

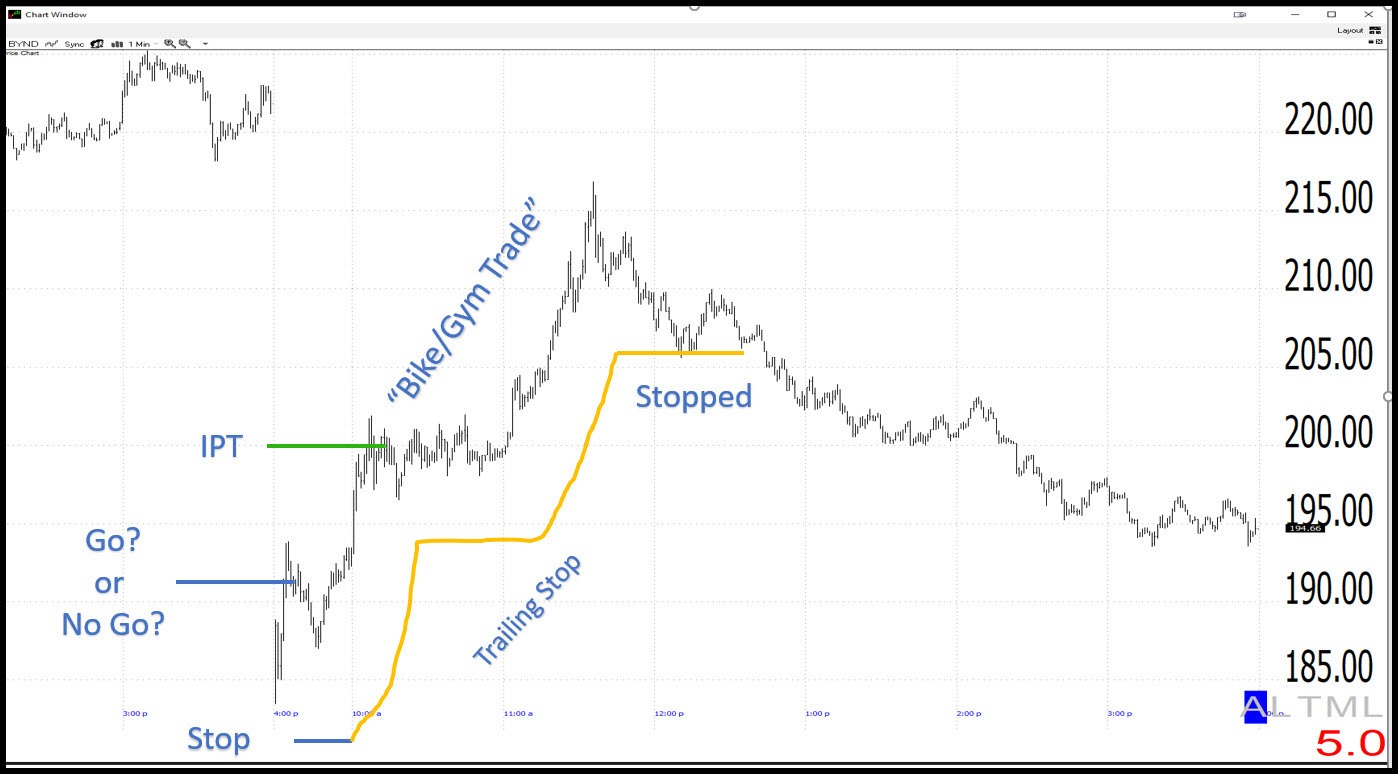

We had another great couple of Q&A sessions if I say so myself. In the last one alone, I took a deep dive into trading opening gap reversals (OGRes). This included how to pick the best and leave the rest, automated ways to take profits and trail stops for a "Bike Trade" (place orders and then ride to the gym).

I've been having a blast interacting with you guys and girls in the Facebook Group. This is morphing into the "mastermind" group that I envisioned when I started this member's project a few years back. I've thrown out some great trades, as have you! The group serves as a constant reminder to pick the best and leave the rest, sprinkle in a little money management, and a plethora of other things such as wait for your pitch. Join here if you haven't already done so (Gold members only).

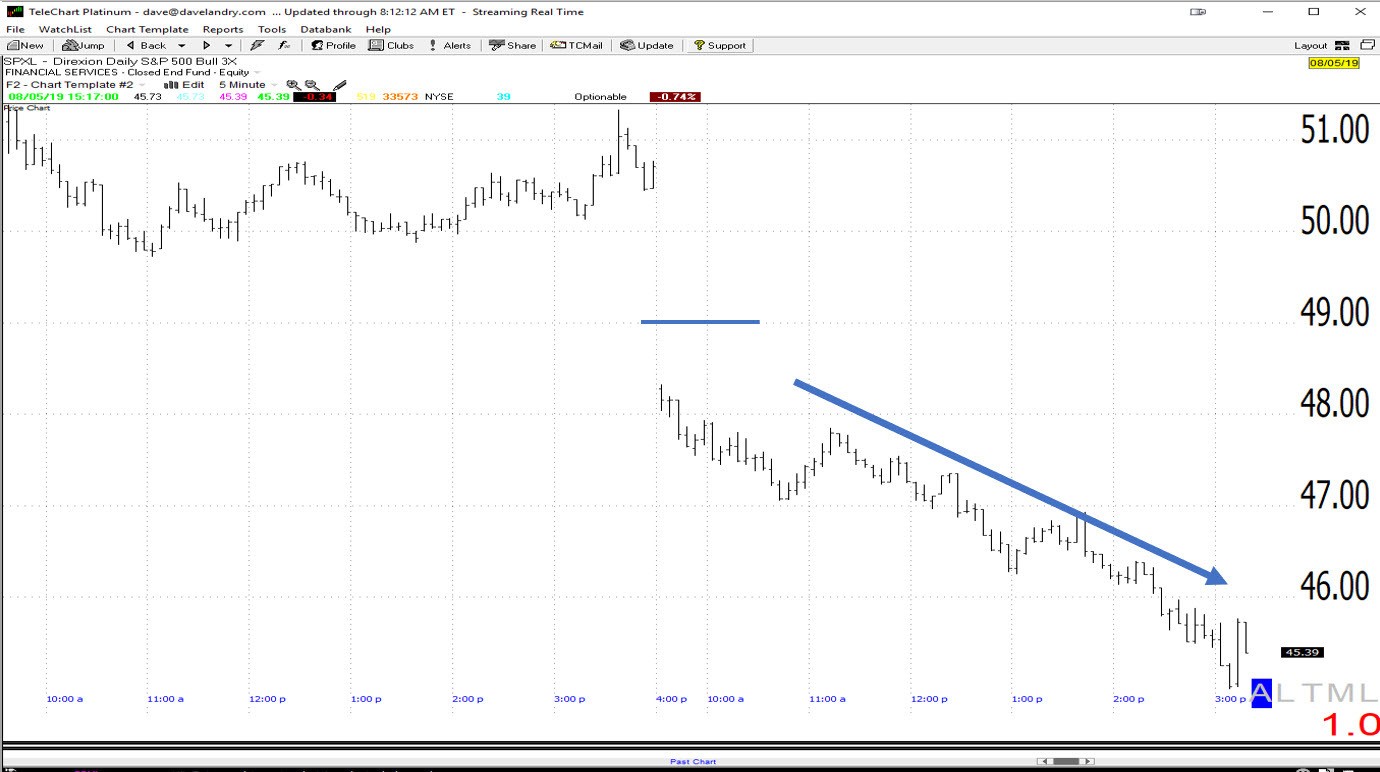

Speaking of the Facebook Group, someone was upset because their potential OGRe trade did not trigger. This is all part of the game! NOT putting capital into harm's way is just as important as knowing when to establish trades. In fact, if you think about it, if you knew when NOT to bet, you'd own the world! You'd never have any losing trades. Now, obviously, this isn't feasible, but you can take steps going in like picking the best and leaving the rest combined with a stop entry order to get you in if the trend has turned in the direction of your intended trade and keep you out if it does not. Below is what I consider a successful "trade." No, my bank account did not grow, but it also did not shrink by one cent. Notice the entry (49) was never touched.

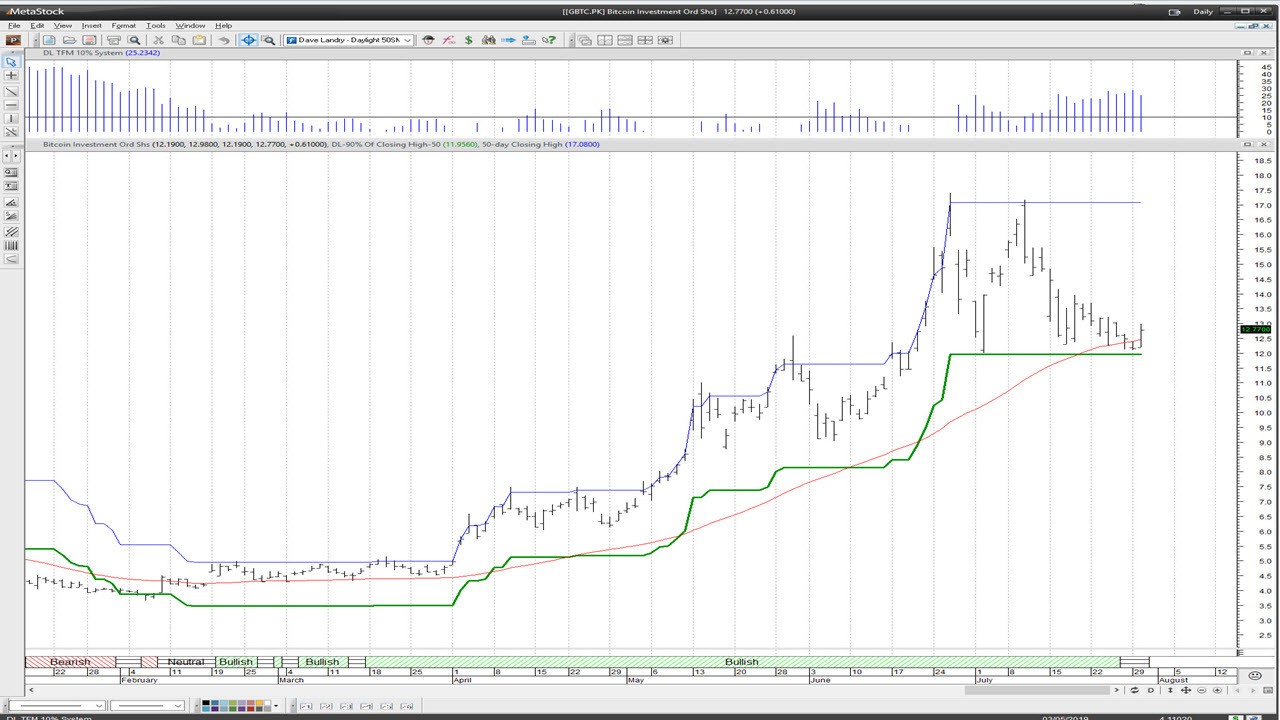

I've been experimenting with using the TFM 10% Market Timing System in Bitcoin, specifically GBTC. I don't like the premium on GBTC and prefer using the "exchanges" (a term that I use loosely), but I figured it would be a good proxy for an experiment. I also wanted to get a feel for it since some of you trade it/have considered trading it. Anyway, the 10% is actually 30% here-the green line below-based on the volatility. See the last Week In Charts (scroll down) and the most recent Q&A.

What I'm Thinking About

I continue to think about affirmations and have been writing and reciting them. As previously mentioned, I think big picture affirmations such as I, Dave Landry, will be worth a gazillion dollars, are important, but the much smaller affirmations are the conduit that gets us there. Short-term affirmations such as I, Dave Landry, will follow my trading plan today will keep me from "stealing from my future self" (i.e., sabotaging my long-term plans). Even more micro affirmations such as I Dave Landry will place the necessary orders and walk away from my screens are crucial. The short-term struggles ARE what keeps us from making our longer-term dreams come true. As mentioned in the last NOW, this is known as akrasia. If you haven't already done so, read this article: Take These Simple Steps To Overcome Your Trading Temptations. And then, come up with your own short-term affirmations to keep you on track.

I was once again reminded that your portfolio might be a microcosm of something much bigger. The model portfolio (my Core Trading Service) has been flat for some time. And, I stopped out of all my positions (which consist of the model portfolio and a few ancillary trades) except one, GSX (keep reading for the setup and trade). Just like the database speaks (e.g., no meaningful setups), sometimes the portfolio speaks. And, when it does, it pays to listen. With the Nasdaq and S&P both recently triggering Bowties down, we need to pay attention. No need to sell the farm just yet. Longer-term signals, so far, haven't triggered. See the latest WIC (below) for a lot more on this and other simplified market timing.

I continue to keep up with my "morning pages" religiously. As previously mentioned, every morning, I wake up and write three handwritten pages. At first, you might find them bothersome. Just do them. You might find them time-consuming. Just do them. You might find them to be a waste of time. Just do them. Don't worry about grammar or if you're solving the world's problems. Just do them. Write what's in your head. Don't stop until the end of page three. Do them for six-weeks before re-reading a word.

I can all but guarantee that 6-weeks from now, when you start reading what you wrote you're going to be amazed. Once I started reflecting on pages past, I noticed that a lot of my time was spent talking about how much I hated doing them. And then, something magical happened. I found myself going from loathing them to loving them. That, and wondering what in the F' happened in the markets overnight is what gets me out of bed every morning at 4:55 AM, sometimes sooner.

As previously mentioned, I noticed that I put a lot of worries into these pages. Channeling Twain, I sure do have plenty of troubles in my life, most of which have never happened! On those that do happen, I deal with them. I've found that they're never nearly as bad as feared. And, the pages help me come up with creative solutions which sometimes means just getting my head out my ass and facing the problems head-on. As Gregorek says, "Easy choices, hard life. Hard choices, easy life." Yes, I still have the occasional sleepless night or two, but more often than not, I've been able to face my problems and then scream NEXT! This is a hell of a lot better than the mental masturbation I used to be plagued with when dealing with problems.

Mark Twain

"I have had many troubles in my life, most of which have never happened."

The pages get the creative juices flowing. Today, for instance, I couldn't resist stopping my pages to do some writing. I ended up writing seven pages on a project. The thoughts flowed freely. If I would had sat down with the intent on working on this project, I would have likely spent an hour staring at a blank page and contemplating my navel.

What I'm Trading*

I'm continuing to trade my IPO "Buy At B" and IPO LandryLight 5-SMA setups. The latest opportunity here was in GSX. With the initial profit target hit, "all I have to do" is to sit back, relax (I know, ha ha!), and let it unfold.

With volatility returning, there have been quite a few OGRe opportunities lately. As I preach, this is not my bread and butter-I'd much rather ride out a longer-term trend-but they can help to keep the lights on in the meantime. I'm amazed that if I'm patient, they are the closest thing to the Rogers' "money lying in the corner" ("if" is the key word in that sentence!) As I wrote this morning (08/16/19) on Facebook, "you win by waiting."

Below are some of the OGRes that I recently took. They were discussed in the Facebook group before they triggered and then as "post mortems" in the Q&A.

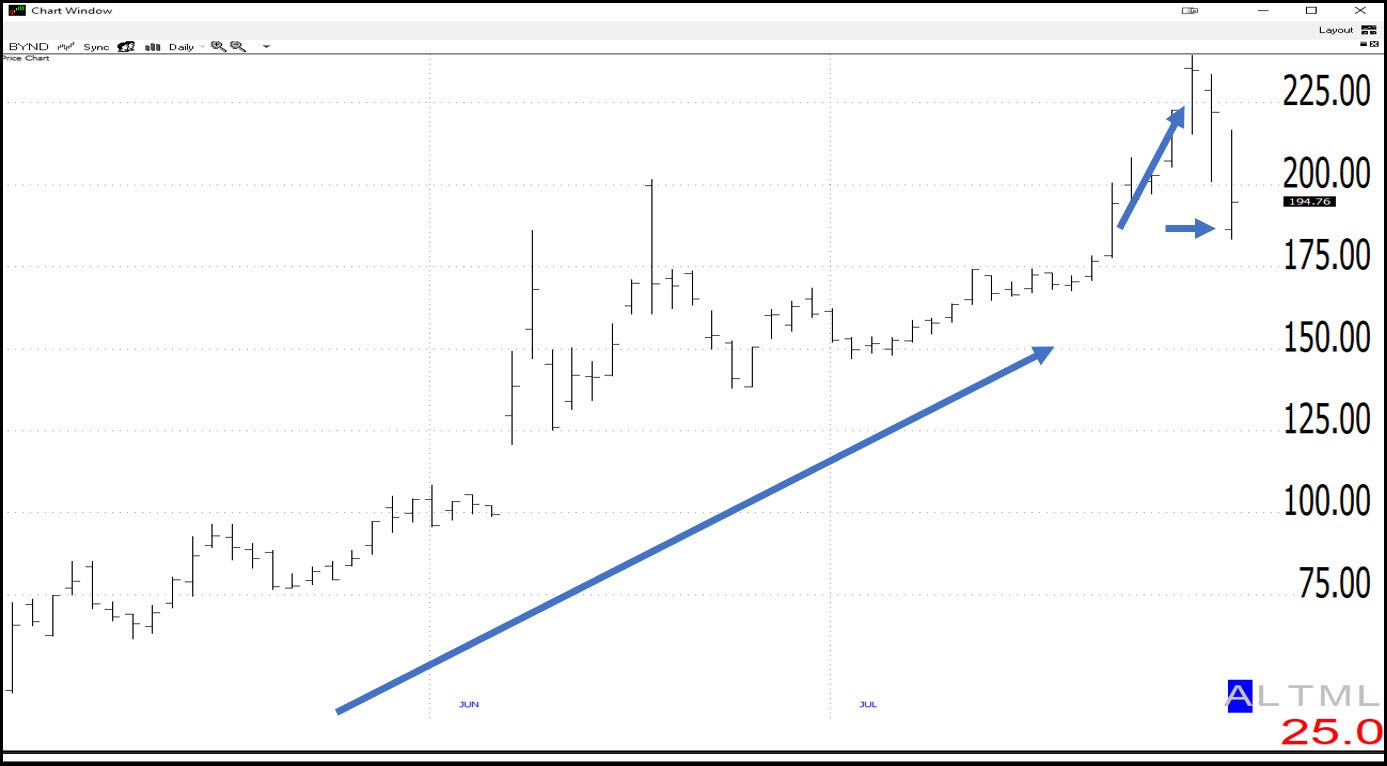

Here is the BYND trade. Notice on the daily chart the stock is in a longer-term trend, making all-time highs. Then, notice that it gapped sharply lower.

Here's how the trade shook out. Once the initial profit target was hit, I was off to the gym, letting an automated trailing stop take care of the rest of the position.

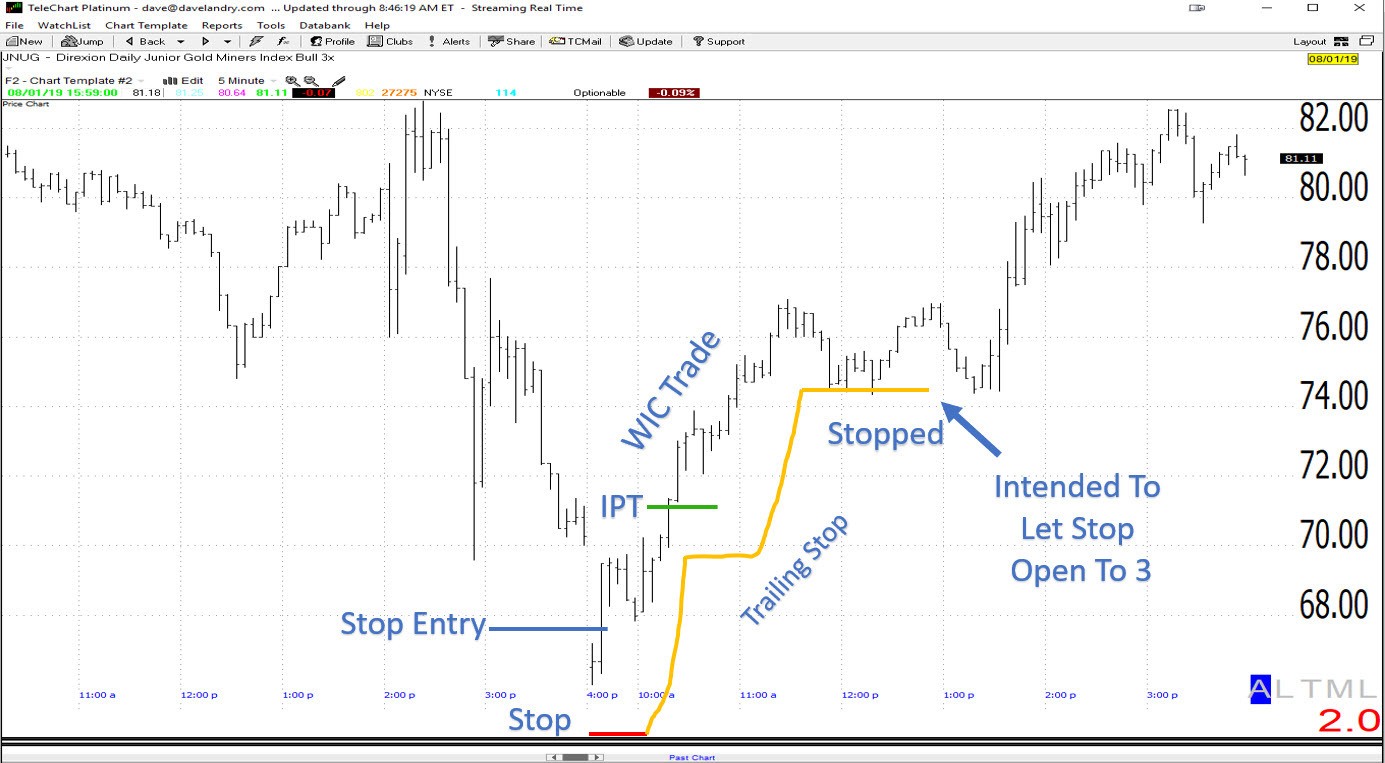

JNUG also set up nicely as an OGRe after an extended uptrend.

Like the BYND trade, I was able to go about my life (in this case, my Week In Charts webinar) while the trailing stop did its thing.

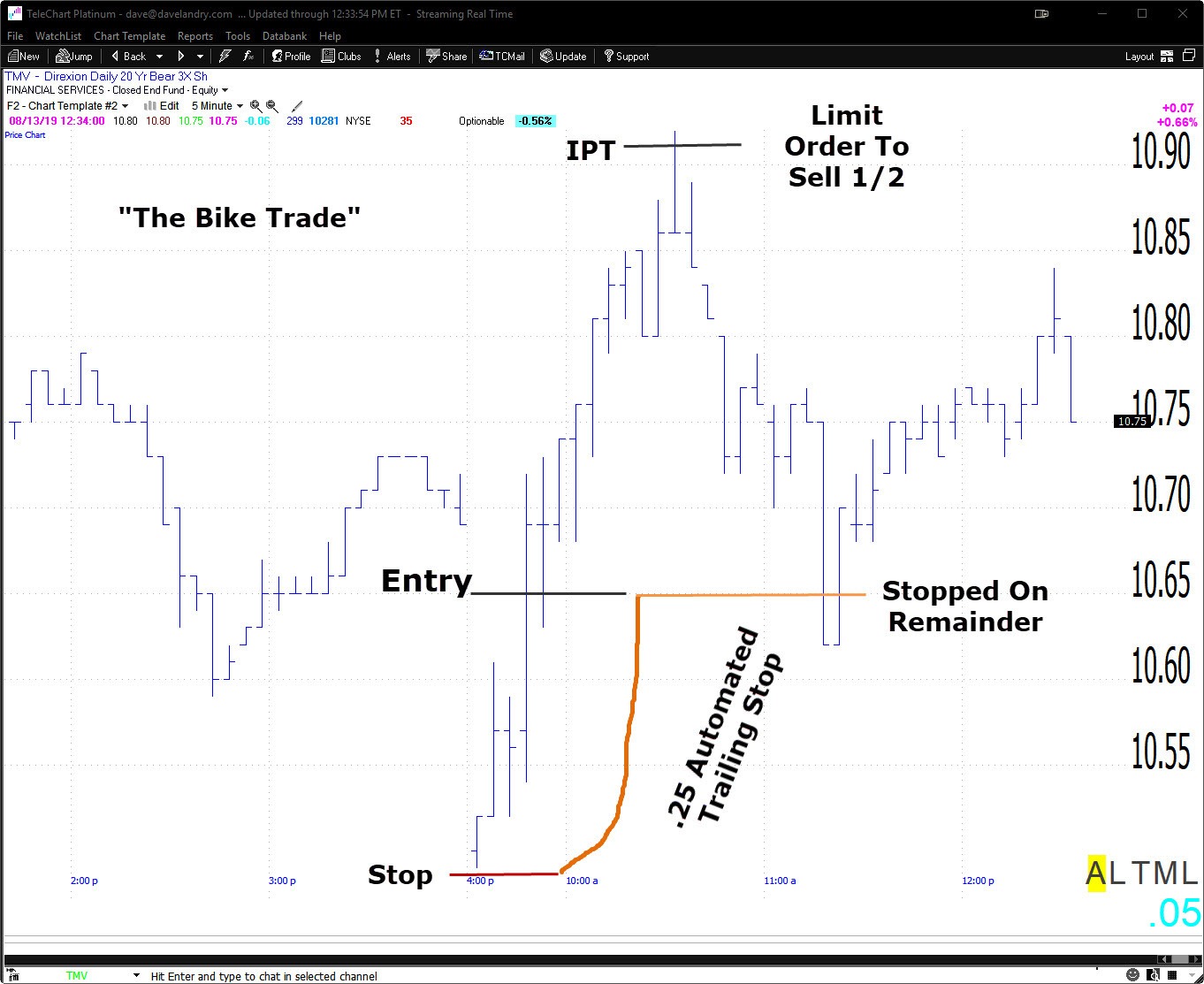

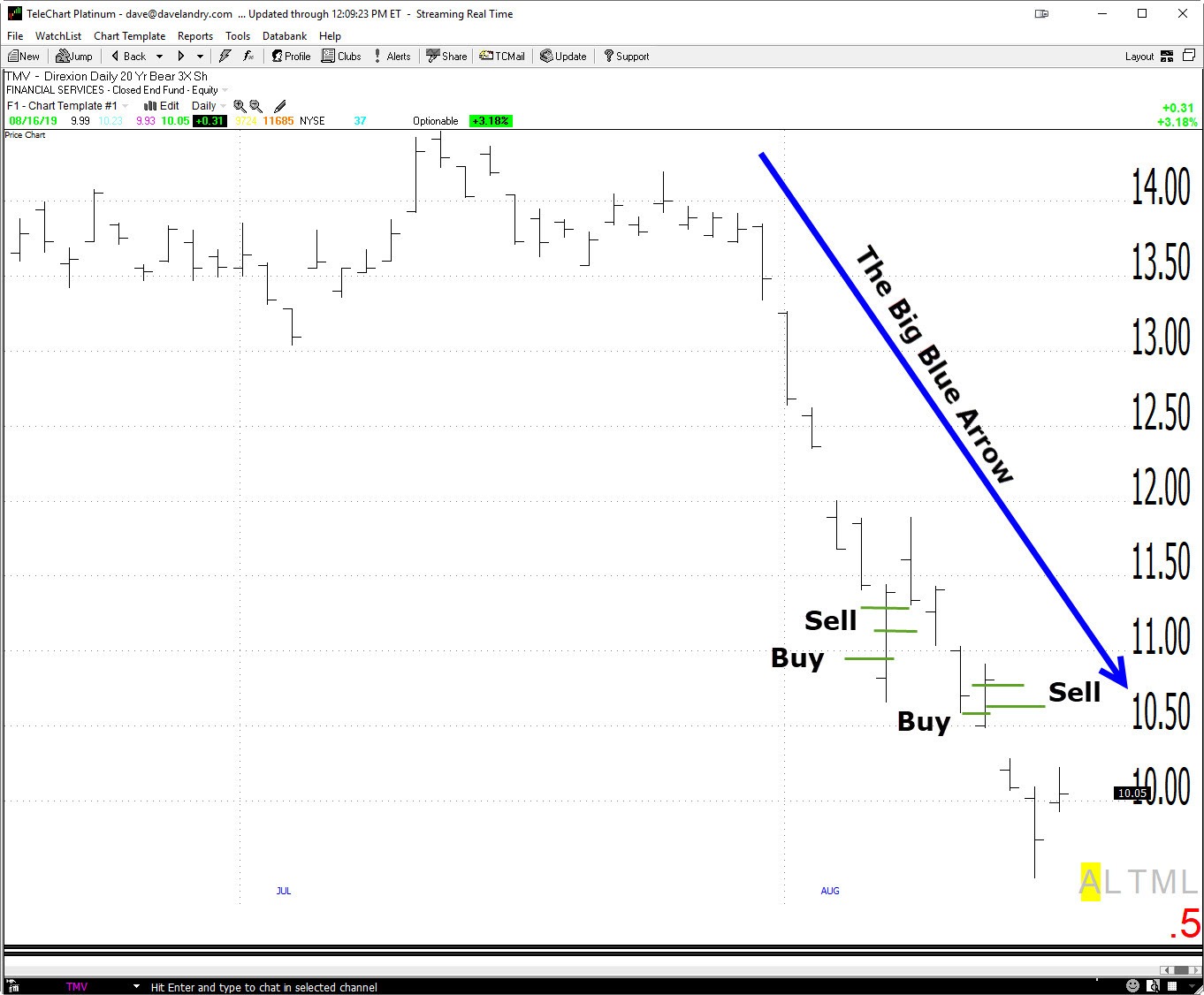

There were a couple of decent opportunities in TMV (08/07/10 show below and also 08/13/19).

If you pop out to the daily chart, you'll notice on the TMV trades that they go against my trend following moron mantra. Borrowing a line from Linda Raschke's Trading Sardines, I call these "Burning Dogs." I would MUCH rather trade in the direction of the trend, like the aforementioned BYND and JNUG, but sometimes these extremely oversold markets (BUT NOT INDIVIDUAL STOCKS IN DOWNTRENDS!) are worth a shot as an OGRe. Just remember that you're petting the "burning dog." It's very easy to get burnt! You have to be extremely prudent because the major trend is against you. Don't worry! I'm not betting the farm, and I'm diligent with my money management (e.g., stops go in 10 seconds after the entry)-and you should do the same should you decide to pet the burning dog.

Once again, other than the IPOs and OGRes, there hasn't been a tremendous amount of opportunities in stocks. I'm seeing a few shorts. Some have imploded a bit without me, but that's okay. If this is the start of something bigger, they'll be plenty enough time to get short.

The Holistic Trader*

Obviously, I've been a little holistic with my affirmations and journey into the subconscious. I've also been thinking that Big Dave, being fat AF, might need to trim down a bit. I think, like athletes, we need to operate at peak performance. I've been doing great with the cardio for the last couple of years but with the diet, not so much! At a biscuit shy of 270 in spite of logging 50-100 miles on the bike each week (I ride a mountain bike, it's a Sledgehammer!). So, in addition to dieting, I broke down and joined a gym. The gym is around 2 1/2 miles from the office so, I've been biking there to get in an extra 5 miles of cardio on gym days. I've also been working hard to place my orders and walk away, using getting to the gym before it gets too hot as an excuse.

Random thought: I was riding back from the gym after playing an opening gap reversal with an automated trailing stop and thought, this is what I want my retirement to look like-place some trades and head to the gym/generally go about my life vs. being hunched over a screen all day.

Upcoming Appearances

I'm pleased to announce that I will once again be speaking at the Technical Securities Analysts Association San Francisco annual conference on Saturday 09/15/19. The TSAA-SF is a GREAT organization, and the annual conference is an awesome event! I often mention things I've learned from this conference in my writings and webinars. Save the date if you'll be in the area and I'll buy you a cup of coffee or a beer.

Online, I will be playing the role of Dave Landry in Dave Landry's The Week In Charts and have a live Q&A Session for members on 08/21/19. In the last NOW, I mentioned that I might be providing content to a major financial website. Ironically, I received a email that just made it "all but official." No need to jinx things further. I'll have more to day once everything's official.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.

*Notes and References

The Holistic trader means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

My goal with "What I'm Trading" isn't to report every trade on a blow-by-blow account, but to rather shed some light on recent lessons, screw-ups, and current opportunities.