11/02/18 Now With Dave Landry

By Dave Landry | Now With Dave Landry

Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Working On...

I'm continuing to add content to the Member's area. This week I added a three part lesson: "Something Simple But Crucial To Your Trading Success" to the Trader's Mindset Course. I'm also editing and updating the Proper Stock Selection-The Real Holy Grail and Trading Hot IPOs courses. Reminder, if you purchased these in the past, you'll have access to the updated versions in the "new improved" learning management system.

I'm still dealing with an issue here and there on the back end. For instance, the free Market Timing Mini Course had a few lessons that locked out the free members. My apologies! I can assure you that this was not to tease you, just a glitch. It's fixed now. Of course I'm biased, but now more then ever is a good time to brush up on your market timing by starting with this course! Sign up below (note: if you are already a "Gold" member than you already have access to this and additional lessons under the Methodology Course). The free courses are on the free stuff page. Once you do sign up, again, take the trend follower's pact (in the free Start Course) while you're there so you'll no longer have to bug me about stocks that aren't trending, or worst, trading sideways (I'm half kidding!)

What I'm Reading

Between the markets, member's area, and the Week In Charts, once again, I haven't had much time to read. With that said, my 2018 goal is to finish more books than I start, so I dug through my unfinished reading pile and found "The Upside Of Irrationality-The Unexpected Benefits Of Defying Logic" by Dan Ariely. As often mentioned, a lot of the behavioral finance type of books all tend to sound the same, drawing upon a lot of the same research. Nevertheless, I think this one's worth reading. The author uses his own personal experiences-e.g. a magnesium flash burned over 70% of his body-to often make his point. The bottom line is that the more we understand our flawed thinking as human beings, the better equipped we are to deal with life and especially life in the markets.

See books to read for more related books.

What I'm Thinking About

I've been thinking about the fact that losses have twice the emotional impact as similar gains. For a method (Big Dave's "TFM" trend following) that depends upon outliers, I'm wondering how to plot that emotional curve-and more importantly, how through not micromanaging, better market selection & timing, partial profit taking, and trailing stops we can avoid the potential downward spiral. I'm also thinking about contrasting this to the nearly constant reward of a reversion-to-the-mean type system until it blows up. All this sounds like fodder for some upcoming lessons.

I've been continuing to put some thought into what I'm going to bring to the Charles Kirk retreat in St. Lucia this December. And, again, I keep coming back to the reality of trading: the only way to profit from a trade is to capture a trend. Keep that simple. And, believe it or not, something as simple as using DaveLight in IPOs, the 10% TFM System in the indices, or maybe just the big blue arrow in general can actually work quite well. Once you identify the opportunity, then plan your trade/trade your plan, wait for an entry, use a stop in case you are wrong, take partial profits in case you are only right small, and trail a stop in case you are right big. Wow, that's pretty good. My work is done. Dropping the mic.... Big Dave has left the building.

What I'm Trading

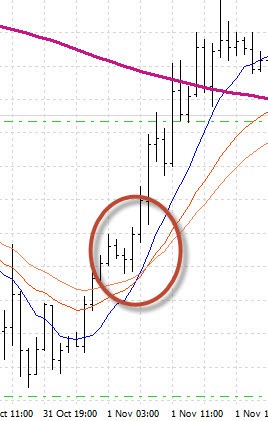

My goal isn't to report every trade here on a blow-by-blow account, but to rather shed some light on lessons and opportunities. With that said, I'm still trading hourly Bowties in Forex off of major highs/lows. I'm currently long the EUR/USD with this pattern (see Member's Methodology for thoughts on trading efficient markets like this). This isn't my bread and butter, just something that I do when the opportunities present themselves.

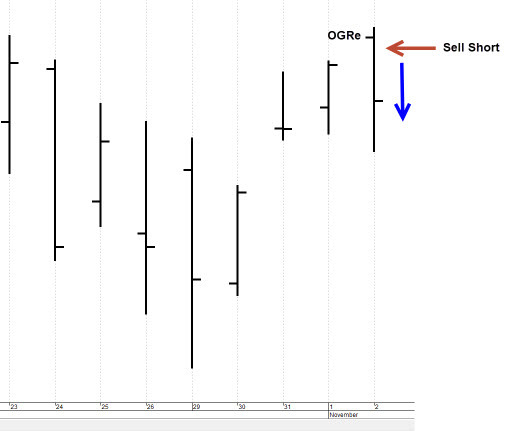

In stocks, I been trying all week to catch an opening gap reversal (OGRe) in the indices. Then, finally, on Friday, I got a decent one! The one thing I've been very cognizant of here is not to watch a screen too much and get sucked into too much day trading. My goal is to set my orders as soon as possible, sometimes a "hands off" stop entry, then to take partial profits (sometimes using a limit order, believe it or not), and then to trail the stop higher. Along those lines, I've been experimenting with a trailing stop feature offered by one of my brokers. So far, it's been pretty neat! And, it's kept me from watching the screen too much. I have found that once I have actual orders in place, my like gets a lot easier. I let the market make the next decision(s) for me. Like my Forex trading, OGRes are not my bread and butter but certainly worth trading when the opportunity presents itself.

In stocks, I still have one lonely left over long (from before the market sold off)-IIIV. The point here is that even though the market has become iffy, you still want to hold on to positions based on your original plan. The model portfolio stopped out of the remaining shares of GDDY for a profitable trade overall (this might make for a good discretionary example-to stay with a trade, stay tuned for the next Week In Charts). Below is the model portfolio. Again, this is not to report each and every trade but to show by example. In this case, notice that we have some shorts on and our longs are speculative/can trade contra to the overall market (e.g. an IPO and an energy respectively).

This Week's Content

I'm still working out some issues with the Week In Charts but I think I finally have it nailed down. Thanks to all of you who haven't given up on getting into the show! Based on the questionable conditions, I focused mostly on the market and potential longer-term timing signals. I also discussed what separates the successful trader from the wannabe.

Based on the market conditions, I published a video taken from the Member's area on should you use the VIX to time the market"

Around DaveLandry.com

Again, I continue to add to the Member's area. As mentioned previously, the ultimate goal is to enhance the user experience. So far, the feedback has been great! I've been filling in the missing pieces in the bi-weekly Q&A sessions. Some of this has worked its way into the courses.

The Holistic Trader

As mentioned before "holistic" means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

I logged 40 miles or so on the Peloton, walked 5 miles or so, and dieted a bit. Again, my goal is to fit in my bikini before St. Lucia!

Upcoming Appearances

I'll be playing the role of Dave Landry in this week's Dave Landry's The Week In Charts.

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.