Random Thoughts

By Dave Landry

Long-term trading is where the money is, but unfortunately, so is the excessive risk. Short-term trading is much less risky, but you don’t make enough, especially since big adverse moves can still occur. The great thing about trading is that it doesn’t always have to be a mutually exclusive decision. You can trade for both short-term and longer-term gains. Let’s explore how to do this further with a focus on the magic of the trailing stop.

Note: The following assumes that you are somewhat up to speed on my hybrid approach to Money & Position Management. If not, read The Only 3 Things That You’ll Ever Need To Become A Successful Trader (part 2): Money & Position Management before continuing.

Letters, We Do Get Letters

“I have to say that all of the ideas I've added from your presentations have been very very powerful. The one idea I'm trying to hone in on better is the one of stop management on the second loaf. I bet you have older presentations on this subject but I haven't found them yet. Thus far I am using about a 36% stop distance while doing the "Keep the change" methodology. Thanks a million for these great ideas and please don't do risky things out there! (Like run into unlighted rigs)

Steve Kusuba

The Secret Sauce

I was once on a project where my job was to provide trades. This was humbling because the lineup read like a “who’s who” of the trading world, including fund managers of millions and even billions of dollars, traders, and signal providers. Most of which used complex arbitrage strategies and/or derivatives. How could I, with my little ole simple trend following, compete with these "brainiacs?" Surprisingly, I did just fine.

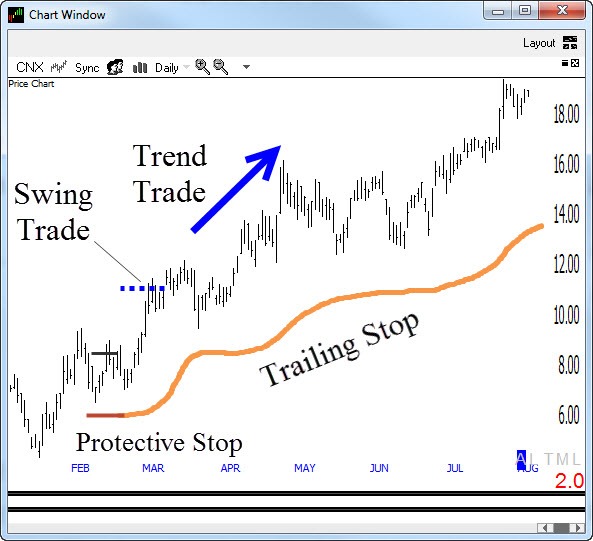

A derivative/arbitrage fund manager was in charge of tracking the trades. In one meeting he pointed out that it was "cool the way Dave transitioned his swing trades to longer-term trades by taking partial profits and then allowing the trailing stop to widen." Like Pinocchio being a bad motivational speaker, I thought everyone knew that. This reaffirmed the fact that I did have something special.

The trading world can be a little lonely and awfully humbling at times (FWIW, I have my ass handed to me quite frequently). Even though no one has “the” answers, you often wonder if you’re doing the right thing. Hmmm, sounds like fodder for another article.

Anyway, it reaffirmed that the “secret sauce” was keeping risks in check but still allowing for the occasional home run. And, the way you did that was to go in for a swing trade but stick around longer-term via a gradually widening trailing stop.

Making The Transition To A Longer-term Trade

First, no one knows exactly where a market is headed-not you, not me, and not the guy behind the tree. I bet you thought I was going to say “the guy who screams on TV.” Well, he doesn’t know either! Determining a market’s longer-term direction is even tougher. As my disclaimer (stolen from Greg Morris) reads: “All predictions are about the future, and a lot of sh*t can happen between now and then.” The longer your forecast, the less accurate it will be. Idiots who come out with books every few years predicting incredible prosperity (usually just before a major bear market) or doom and gloom (usually right before a major bull market) should be shot. Oh, I guess you can’t say that in this day and age. Well, at the least, they deserve a big wedgie, maybe even an atomic one. It does seem to sell books though. Maybe I should get into the grand prognostication business. Naah, I’ll stick to being a Trend Following Moron. Where was I? Oh, it’s tough enough getting the short-term right, let alone the long-term.

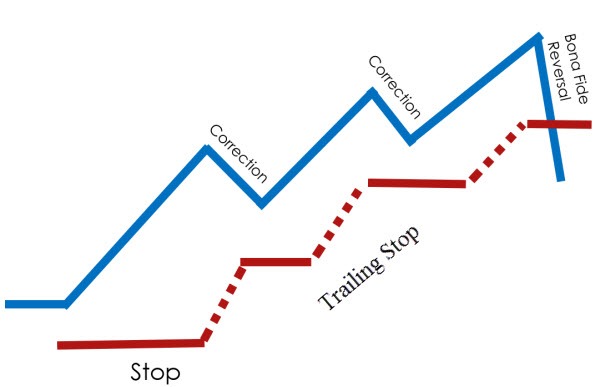

It’s safe to say that you can’t predict trends very far, but you can follow them forever. Write that down. Assuming that you lock in a swing trade profit and your stop on the remainder has been bumped to breakeven, then you’re in a wonderful place. Worst case, barring overnight gaps, you profit overall on the trade and in the best case, you hit a home run on the remainder.

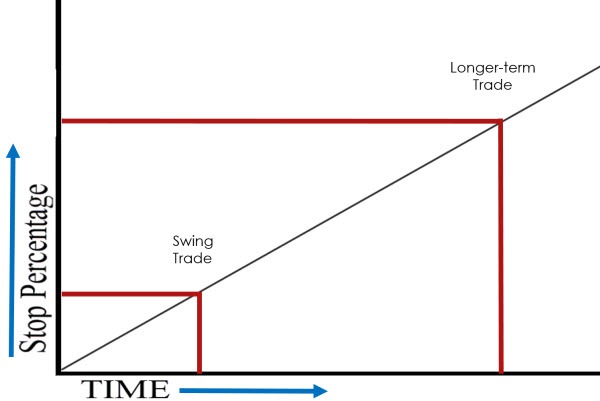

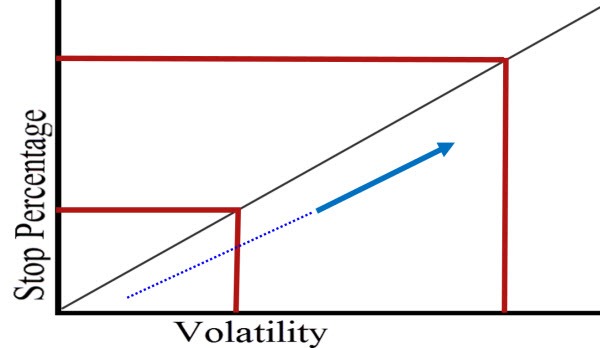

Let’s back up for a minute and look at the intended length of a trade. As a general statement, a market can only move so far over a given period of time. The further out you go, the wider your stop will have to be to accommodate a market’s zigs and zags.

The volatility of the instrument is also important. The more volatile a stock the wider the stop will have to be so that you don’t get stopped out on noise alone. There’s a popular methodology that says we should all use a fixed percentage stop on all stocks. That’s the equivalent of saying that we should all wear a medium sized shirt-something my fat ass hasn’t done since I was a toddler. Anyway, if your stop is within the normal volatility you will get stopped out on noise alone-one of the few things I can guarantee.

It’s safe to say that both time in the trade and the volatility of the underlying instrument must be taken into consideration when setting stops. So, our stops will have to widen as we make the transition to a longer-term trade--due to an increase time held and likely an increase in volatility.

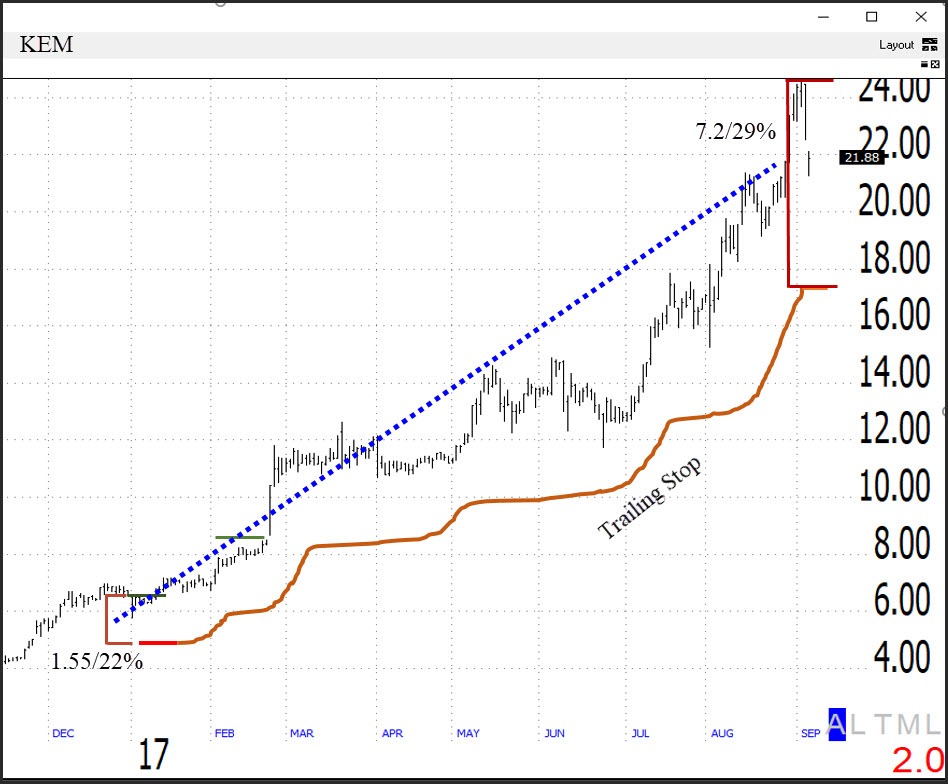

In fact, if you get your timing just right, the stock not only increases in value but it does so quickly. This causes an increase in volatility. Notice in the chart below that the volatility sharply increased as price moved favorably.

Answer The Question

Jack Nicholson-"A Few Good Men" Source: IMDB.com

Back to Steve’s question: First, a 36% trailing stop seems a little extreme, but in some cases that’s what the position might call for. Case and point: CNX a stock we are long (when this column was first published) originally had a 34% stop. That’s what it called for since it easily bounced around 20 and even 30% over the short-term. If you look at the chart you’ll see that even at 34%, it still looked pretty close to where the price was. Again though, you can’t use a fixed percentage on all trades.

Using a current example from the open portfolio (note: this trade has since stopped out), notice that KEM started out with 1.55 points/22% as the trailing stop, and that stop has since widened to 7.2 points/29%.

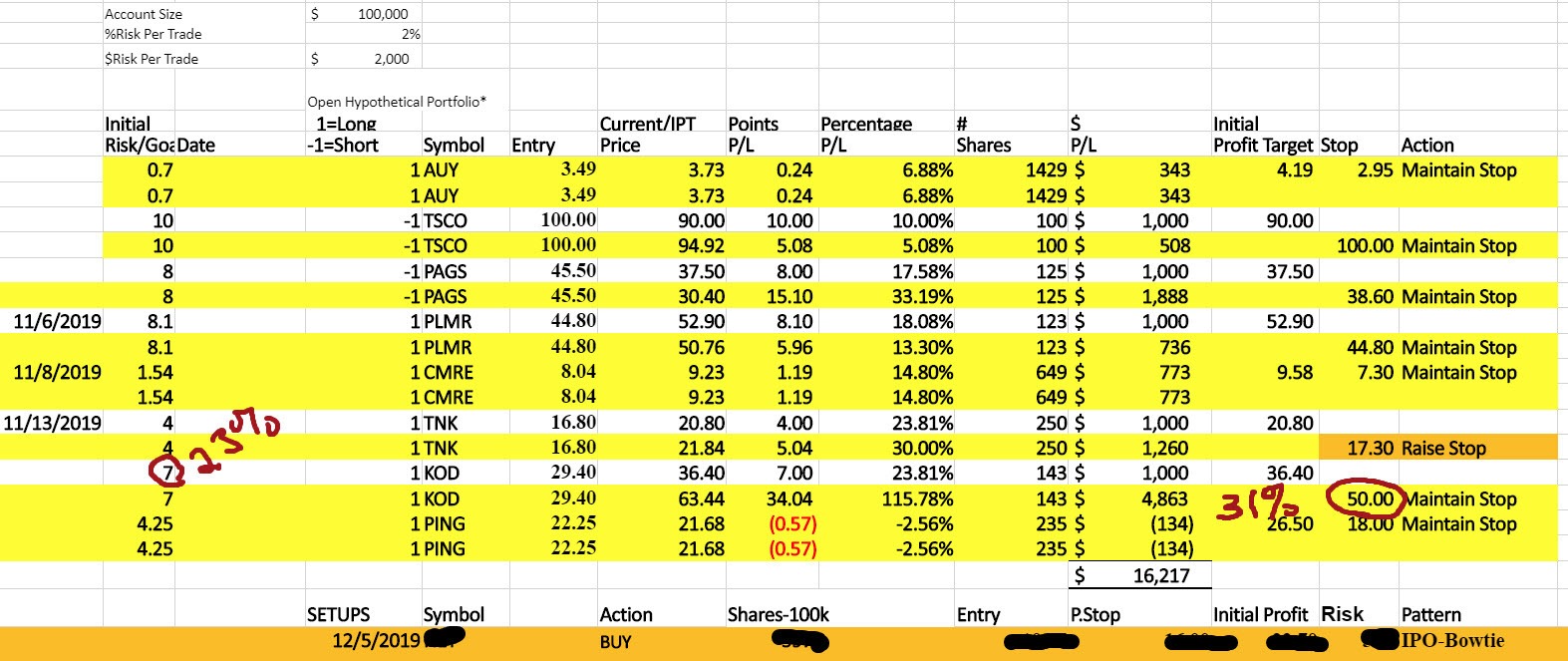

Here's a live example as of 12/12/19. Notice in the Model Portfolio that KOD originally had a 23%/7-points stop. Now, based on the highest close (scroll down), the stop has since widened to 23.41-points/31%. Note, if you get bored, walk thru the other trades to see how the stop has widened. Those trades in white (not highlighted) are swing trades that have been taken. The remainder (highlighted) are still on.

Dave Landry's Core Trading Service Portfolio Snapshot 12/15/19

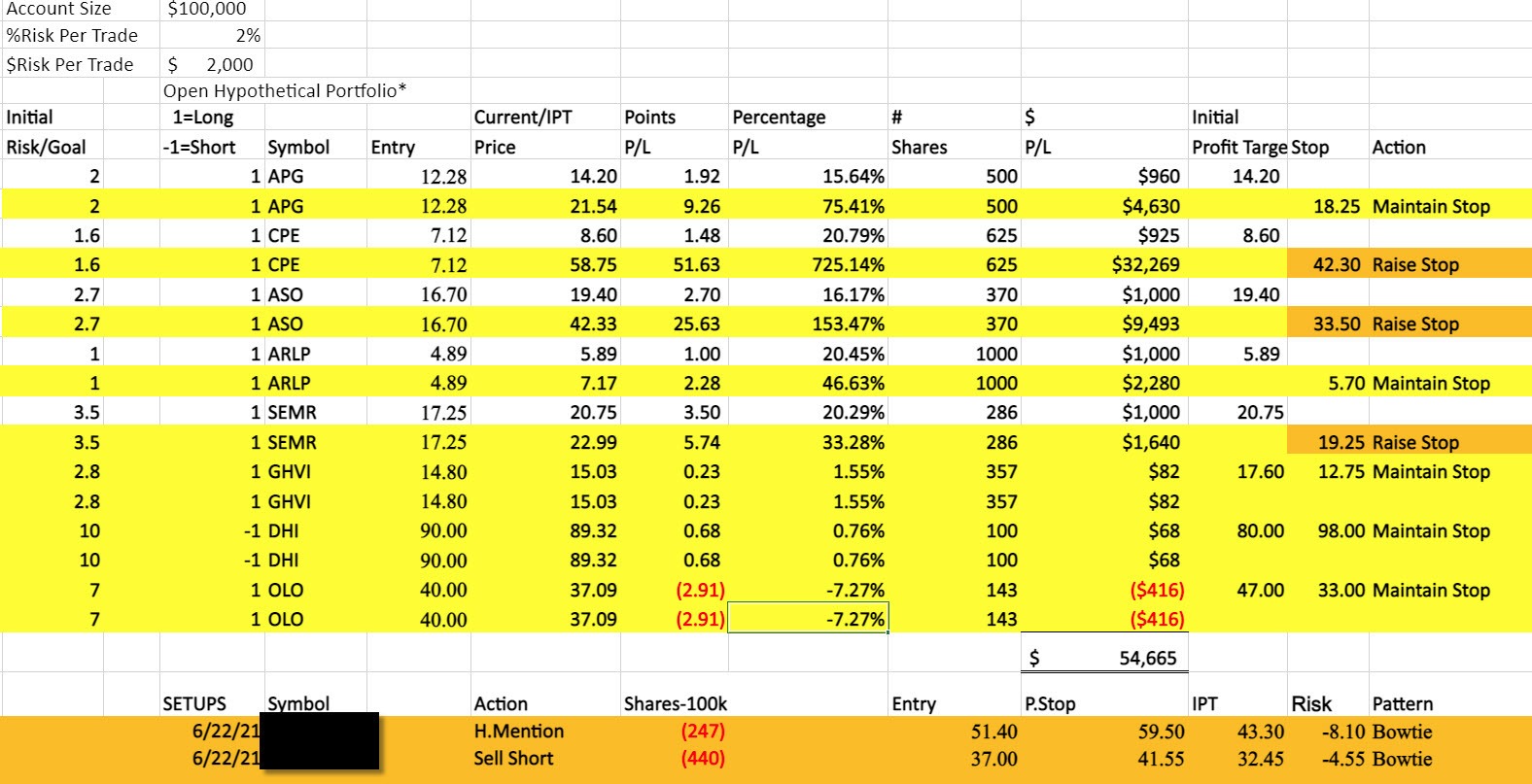

FWIW, below is the current portfolio (as of 06/24/21):

Can you trade for longer-term gains without excessive risk? Yes! You can..

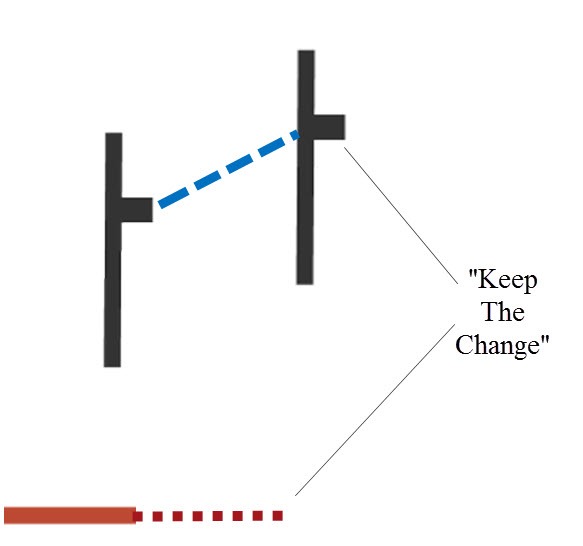

Now, Steve’s looking for tips and tricks on how to gradually widen the stop. He alluded to playing the “keep the change” game. The reason I call it a game is that I have found that it’s easier to implement a plan if you see it as a game. A game is something that’s fun—and seriously, isn’t catching a trend fun? So, how do you play “keep the change?” That’s easy! Do nothing! Suppose a stock goes up a few cents or even slightly more than a few cents on a higher-priced stock. Just leave the stop where it is. You have now effectively widened the stop-not by much, but it can add up over time.

Gaining Ground With Trailing Stops

You have to be careful not to mentally monetize your open profits. You can’t look at them and say, "oh, that’s enough for a house payment" or "I could pay off a credit card with that." The moment you do is the moment that you’ll likely cut your profits short. And, if you don’t take the profit, you’ll have regret if the stock begins to retrace shortly thereafter. The point is, how you view things is vitally important from a psychological standpoint.

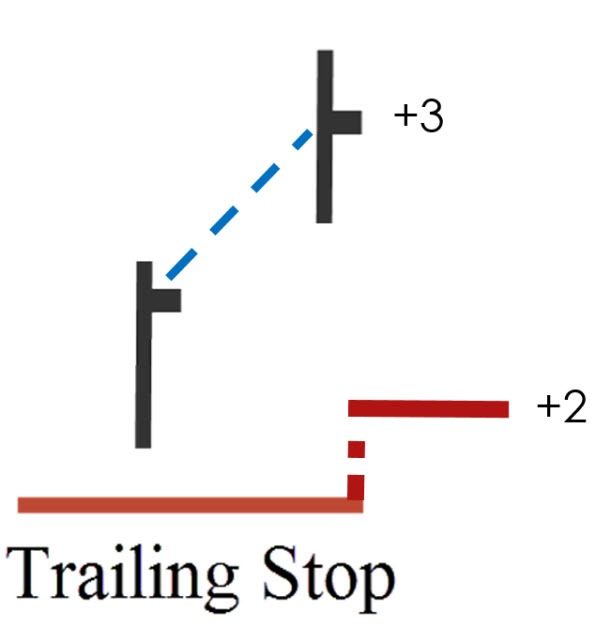

I work hard not to mentally monetize profits but I do tend to view my trailing stop as the amount that I will get paid when, not if, I’m eventually stopped out. Along those lines, I like to see stop tightening as “gaining ground.” Suppose I’m fortunate enough to have a 3 point favorable move then I might only tighten my stop 2 points. This way, I’ve gained ground, an additional $2 if (when!) stopped out, and I have effectively opened up the stop by 1 point. This is illustrated below.

So, to answer the question, you let the stop loosen automatically by playing keep the change or when blessed with a favorable move you tighten by a less proportional amount.

How Much Is Enough?

The next obvious question becomes how wide should you let the stop become? Ideally, you want it wide enough to ride out normal (and healthy!) corrections but not so wide that it would way beyond a bona fide reversal. Sometimes, below the prior pullback or base becomes a good goal to shoot for. The litmus test for me is when I look at the portfolio and think “oh gees,” it’s going to suck if that stop gets hit. I know, I said don’t mentally monetize but when it gets wide enough to hurt it’s probably wide enough.

As usual, in trading, there’s always a tradeoff. Very wide stops could keep you in a longer-term trend that just has "one last shake out." If you went through my trading service archives, you’d see that we’ve ridden some decent trends for a long long time but some trends went on for even much longer after hitting the trailing stop. An even wider stop would have kept you in those trends. There's the dilemma. You will catch much more trends with super wide stops but it's going to hurt more when the trend doesn't resume. Bill Dunn nailed it when he equated riding a trend to riding a bucking bronco.

In Summary....

The accuracy in short-term trading is higher and it's generally less risky but, unfortunately, you don't make enough to survive the inevitable large adverse moves. Longer-term trading is where the money is but it's less accurate and way too risky. The good news is that it doesn't have to be a mutually exclusive decision. You can have your cake and eat it too. Trade for short-term gains, but allow the trailing stop to gradually widen out to ride a longer-term trend.

May the trend be with you!

Dave Landry