“This Market Is Pretty Freaking Far From Okay”…So Why Am I Still Mostly Long?

By Dave Landry | Random Thoughts

Ving Rhames, Source: Wikipedia Commons, Author: user Marend93

Random Thoughts

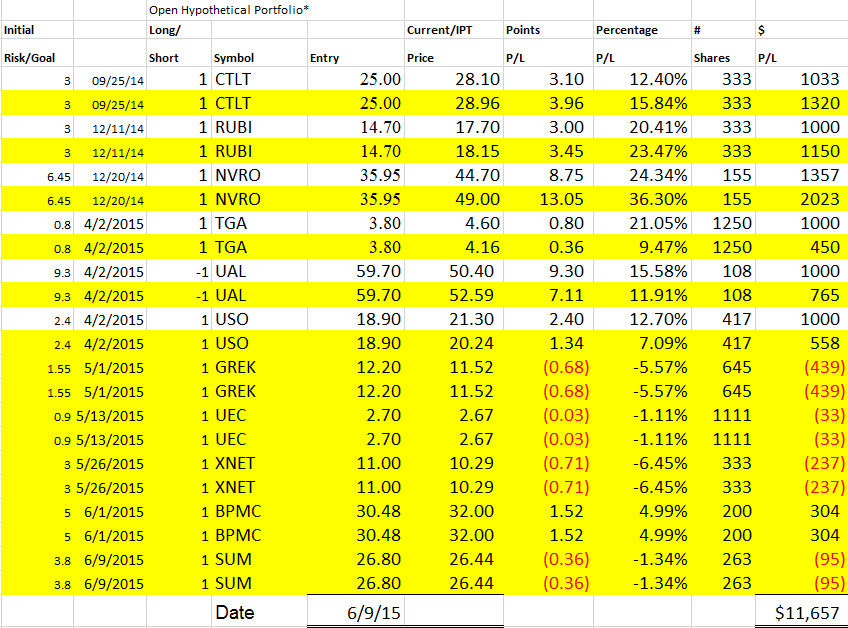

A market’s job is to frustrate the most and this one has been no exception. The continued sideways chop is anything but pleasing. When conditions are questionable—and let’s face it, aren’t they always?—you want to err on the side of the longer-term trend. We do have one lonely short but for the most part, we remain long. Stay the course and follow the plan. Do be picky on new positions. Do wait for entries—and use liberal ones while the market is questionable. And, once triggered, have a stop in place just in case. If blessed with a partial profit (1-to-1 on initial risk basis—see my Youtubes on how I avoid a negative expectancy in spite of this seemingly bad risk-to-reward profile) then take it and then trail a stop higher to stay with that position for hopefully a long long time. I know most people think that I’m just a swing trader because those 2 words are in the title of 2 out of 3 of my books but I will stay with trades as long as they cooperate. “Cooperate” means that they stay above the stop. Right now, we have some positions that we put on last year and I hope to writing about them next year at this time. Below is the open portfolio, warts and all.

This is not to say that everything is okay. I don’t know if Marsellus Wallace trades, but if he does, he would probably say that “This market is pretty freaking far from okay.”

Okay Marsellus, Let’s Look At Why:

After all was said and done, a lot more was said than done in the Ps (S&P 500). It probed lower but in the end it ended about where it started.

Ditto for the Quack (Nasdaq).

The Rusty (IWM) ended off its worst levels but still down around 1/3% nonetheless.

The above 3 remain in a dreadful shorter-term and not-so-shorter-term sideways range.

Bonds banged out new lows and Real Estate followed suit. As I have said ad nauseam, it’s the delta in rates that spooks a market, not the absolute levels. I’m old enough to remember damn good markets with rates at 8%.

The Trannies broke down-please, no transgender jokes. I think we’ve all had enough. Although those new ones about the cereals are pretty funny. Sorry, where was I? Oh, unlike some who subscribe to methods which require confirmation in the transports, I think that the market can rally without them. It can do whatever it wants. This obviously scores as a negative though and can’t be completely ignored.

In other sectors, many are sideways as you would expect. We’ll have to keep an eye on areas like Retail to make sure they don’t fall out of the bottom of their ranges.

The Dollar remains weak and in a downtrend (I am short Dollars, heck, if you have a wife & kids, you’re always short dollars!).

In spite of all the somewhat dubious developments, there still appear to be opportunities. You have to hunt for them but they are there. And, right now, it’s our old friends in the second tier (lower level) Chinese stocks. Psychologically, you always worry a little about going “back to the well” but that’s what the charts are telling you to do. Along those lines, IPOs are still providing opportunities but you have to pick your spots really carefully.

So what do we do?

As mentioned above, stick with the plan. Yes, things are looking a little dubious but just stick with the original plan. It is okay to fire off a short or two if you think you have a great setup (notice above that we have one the portfolio) but again, continue to err on the side of the longer-term trend. Also, as long as this market continues to go mostly nowhere, it’s okay to sit on your hands until you think you have the mother-of-all setups. Said alternatively, be picky.

Best of luck with your trading today!

Dave