Random Thoughts

by Dave Landry

Inspired by Scott Adams' book, How to Fail at Almost Everything and Still Win Big: Kind of the Story of My Life, recently, I began making affirmations. I soon discovered that affirmations must be backed with action. What will you do, “in return?”

What started as a simple affirmation-“I would like a sh*t ton of money”-has morphed into my mission statement. Although I wrote this only a few short weeks ago, so far, I’m amazed by the results. I decided to share it with you for selfish and not so selfish reasons. One, I think you can benefit from my mission statement directly (or, ideally, make your own!) and two, a public declaration forces me to practice what I preach. My sharing is also inspired by the "radical transparency" discussed in Dalio's Principles. I plan on making more and more public declarations.

Here’s the trading related excerpt from my mission statement:

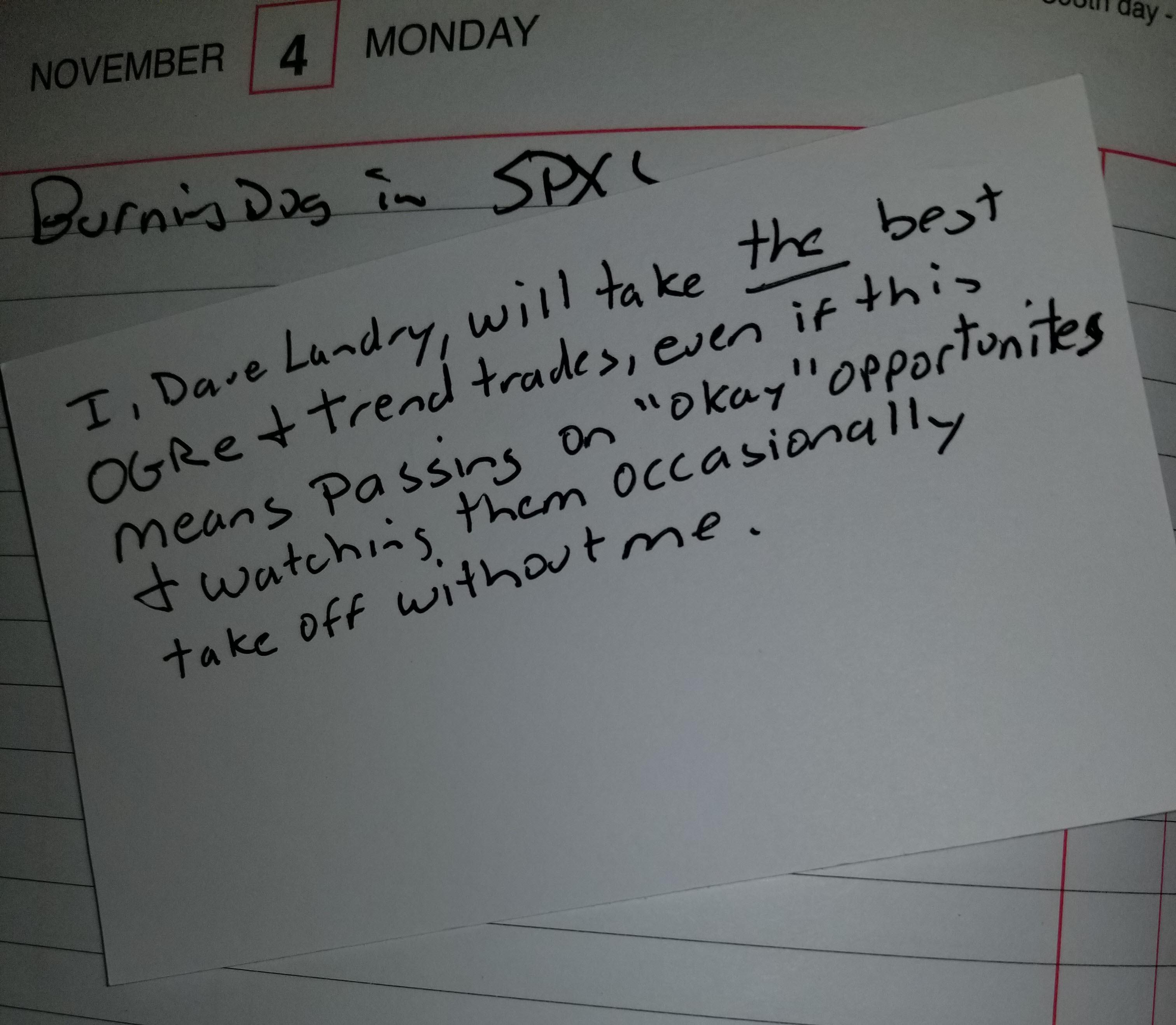

I, Dave Landry, will have a liquid net worth of a slightly absurd amount1 in 2024. In return, I will trade the best and leave the rest OGRe2 and trend trades even if that means occasionally watching a mediocre setup take off without me. I will plan the trade and trade the plan. I will review my plan, the Landry List, and Trading Service spreadsheet before, during, and after the open. I will utilize alerts and hard orders to get me in/take me out of stocks. Before each and every trade, especially those that were not part of the original plan, I will read my 3x5 (trader's journal) bookmark card.

Further into my mission statement, I cover what I intend to do from a business standpoint. I’m not going to reveal that now in case my competition is reading (I actually don’t think I have any competition because I’m selling trading reality and not-and I quote: “make 10-million in just 10-minutes a day.”) There is one thing that I will share which dovetails into this Random Thoughts:

"I will read daily to improve myself on a personal, business, and trading level. I will put into action these things and not just read them once."

Breaking It Down

Affirmations, Attractions, and Small Actions

Scott Adams talked about making affirmations and having those affirmations come true. Inspired, I figured it couldn't hurt to start making some. And, do you know what happened? Absolutely nothing. This had me questioning if affirmations could work, but I kept the faith. In doing so, I found my mindset toward the affirmations was a positive one when I thought about them throughout the day. They created "attractions." Sometimes unknowingly, I made small moves that moved me closer to achieving the affirmations. These were seemingly meaningless little things like checking my junk email-something I haven’t done in years. To my surprise, there was an email in there regarding a business deal that I assumed was DOA. This deal made one of my first affirmations come true. This was an eye-opener for me and a little scary too. Be careful what you wish for because it just might come true.

Over the coming months, the affirmations spawned off more and more attractions. Some of these were conscious efforts (e.g., checking spam more often), and others seem to be pure coincidence. For example, in the process of moving, most of my books remained packed away or in storage. There were two in my nightstand that stayed during the move. One was a Russian version of Dave Landry On Swing Trading, which had ended up there after a hasty unpacking from a speaking engagement years prior. The other one was Think And Grow Rich by Napoleon Hill. Since I can’t read Russian and already know how the story ends, I opted for Hill’s book. I had read this classic years ago and figured that it would be a good idea to keep something positive in my nightstand for sleepless nights. In spite of my good intentions, it remained buried in the drawer for years-until now.

Early in the book, like Adams, Hill talks about affirmations. What struck a chord with me was that Hill discusses what you will do “in return” to make your dreams come true. This is how I came up with what I would do to improve my trading to help meet my 2024 goal. These were not some sort of earth-shattering feats such as discover a Holy Grail, but rather, little “in return” affirmations that would help me follow the proper process. Note: on a re-skim of Adams' book, he also talks about taking action vs. just dreaming. For instance: "If you want success, figure out the price, then pay it" (this is exhibit A on what good are dusty books?-keep reading).

You Want To Make A Big Change In Your Life? Make A Little Change3

John Wooden

When you improve a little each day, eventually big things occur...

So, you come up with your big dream affirmation. You're gung-ho! You start making drastic changes. You might initially have some success, but I can all but guarantee that you’ll end up right where you started, or worse. Homeostasis keeps us alive. It also puts the brakes on abrupt change. Unbeknownst to you, your body, specifically, the primal part of your brain, is going to fight drastic changes. And, eventually, it will win. For example, many of the “Biggest Losers” have since become the biggest gainers-fatter than they were when they started the competition. As an example closer to home, we have friends that are a blast to hang out with-unless they are on one of their tri-annual fad diets. We’ll have ‘em over and they are boring, depressed, peckish, cranky, crotchety, and several other lame adjectives. Then, a few weeks later, we’ll notice in our Facebook feeds that they are partying like rock stars with some of their long-lost friends. The cycle then rinses and repeats. We now ask if they are on a diet before inviting them over, but I digress.

My point is that you can’t shock the system. You can make gradual changes to avoid setting off any alarms up there-a Kaizen approach if you will. You have to "tiptoe past the panic monster.4” Drastic changes won’t likely help you achieve your dreams, but gradual ones will. Knowing this, I began making micro affirmations for my “in return.” If you’re going to dream, you might as well dream big. Make absurd affirmations! Just make sure that you make a plethora of minor affirmations. These micro affirmations are the conduits that get you there.

Let’s Take A Look At My "Conduits"

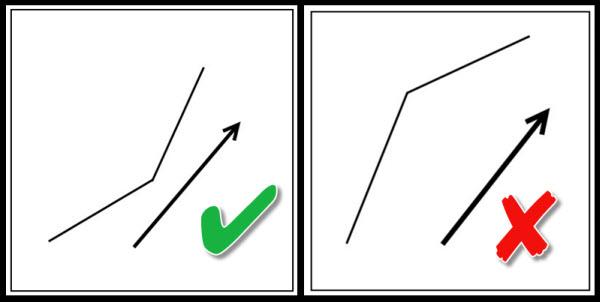

Pick The Best, Leave The Rest-Walk Away And Be Okay

“I will trade the best and leave the rest OGRe and trend trades even if that means occasionally watching a mediocre setup take off without me.”

You’re thinking about a setup. Are you feeling “ho-hum” or “F-yeah?” Is it really worth putting your hard-earned capital into harm’s way, or could you walk away and be okay? Pay careful attention to your internal dialog. Is it "yeah baby!" or "yes, but.." Play the trade out in your head. Time travel. Do a pre-mortem about how you’re going to feel in your trade postmortem. If it stops out at a loss, would you feel like so what, it looked fantastic! That’s just part of the game! And, if I saw this same trade again, I would take it. Or, would you feel like, this dang thing wasn’t really that great. Continue to play it out in your head. Is the potential upside worth the potential downside-both mentally and monetarily? If you can’t stand it and feel that if you didn’t take this trade, you would regret it, then take the trade. However, anything less than an f-yeah!, you should pass. I know it’s cliché, but you must pick the best and leave the rest.

Proper stock selection is an art, but it can be taught. 80% of stock selection is simple things such as making sure the stock is persisting and accelerating in the intended direction, the pullback is deep enough (but not too deep)/the transition is an obvious one off of major lows (or highs for shorts), there’s no significant overhead supply (for longs), and the stock generally trades cleanly. Essentially, the things I point out week in and week out in the Week In Charts. The other 20% will take some experience. You’ll have to learn from honest postmortems on losing trades. The experience adage comes to mind: good decisions come from making a lot of bad decisions. You’ll also have to learn how to separate pure luck from skill on mediocre setups that took off. That’s easier said than done, but if you’re brutally honest, you’ll get there.

“I will review my plan, the Landry List, and Trading Service spreadsheet before, during, and after the open.”

Over my career, I’ve received emails thanking me for great stock picks that through distraction and losing focus, I’ve forgotten to take for myself. It’s great that someone was able to profit from my analysis, but that someone should also be me. And, with my style, the occasional big outlier is key. It can make the difference between a great month, or even a great year versus a mediocre one. With all the shiny objects out there along with business “fires,” maintaining focus is vitally important. Although I have built focus into my routine (e.g., setting up my monitors before the open), I still have to remain vigilant. About 90% of my trading is done at the open. And, as Murphy would have it, the sh*t tends that the fan around 08:29:59 AM (I’m in Central time)-my website crashes, my wife sticks her head into my office to tell me about a plumbing problem, an accounting problem, or just wants to say goodbye for the day and she’s looking extra hot. Some of the stuff that has happened you can't make up. As just one of many examples, years ago, it was options expiration and I knew that I had to take advantage of the opening gaps. My dog comes into the office and leaned against the on/off button on my trading computer. This was back when it took what seemed like an eternity to boot a PC. Arrg!

Safeguards have to be put into place to make sure that I don’t miss great opportunities and to protect me from me. These are simple little things like placing alerts to alert me when action needs to be taken, and when possible, using hard orders to get me into or take me out of a stock. For instance, one of my general rules is to only enter a trade that I want to be in on a stop order. For potential longs, this means placing an order above the market. This has saved me in many cases from jumping in too early. I’m amazed at how many times my stop entry is never hit-often within a penny!-on trades that I was very tempted to hit the bid. This is especially true in something like opening gap reversal (OGRe) trading, where it’s very easy to get caught up in the euphoria. Other times, on position trades, I’ve found myself receiving fill notices on stocks that I otherwise may have overlooked. Occasionally, I’ll notice that I’m having a great day even though my stocks aren’t doing so well. Puzzled, I pull up my portfolio to find that it was a new stock that was providing the day’s gains-one that I could have easily forgotten about since it didn’t trigger around the open.

Again, you have to remain vigilant. Case and point: Before I wrote the trading portion of my mission statement, I had placed an order for eight days in a row for a stock that I recommended. On the ninth day, I figured that it had no chance of triggering, so I didn’t bother the few clicks it would take to resubmit my orders. Luckily, I got a notice from my Facebook group peeps that it was triggering. I scrambled to get my orders in and only had to “pay up” a few cents. The stock rallied 60% that same day. I nearly missed it. Although I was relieved, I found myself feeling the psychological impact of nearly missing the trade-sort of the same feeling you get when you have a near-miss in traffic-you feel grateful that you’re okay, but the “what ifs” swim around in your head.

Before each and every trade, especially those that were not part of the original plan, I will read my 3x5 (trader's journal) bookmark card.

Another tiny affirmation or so-called “commitment device” is to simply read my 3 x 5 bookmark in my trading journal before each trade, especially if that trade is an unplanned one or one that could not have been planned ahead of time (e.g., an OGRe). I’m amazed at how this has kept me out of a lot of trouble. Just yesterday, I was super tempted to jump in on a late-day reversal in bonds. I read my card over and over and decided that I must walk away, and I would be okay.

As I compose this prose, I’m wondering if I’m coming across as someone who doesn’t have it all figured out, and struggles with trading. Well, like everyone (except for those guys who pose in front of rented private jets, sarcasm implied), I don’t have all the answers and I do often struggle. In general though, I do feel that I know what I should do. "Should" being the keyword in that sentence. One of my minor epiphanies, as discussed in this Week In Charts, is that trading is so dang easy when I just let the market come to me. "When" being the keyword in that sentence.

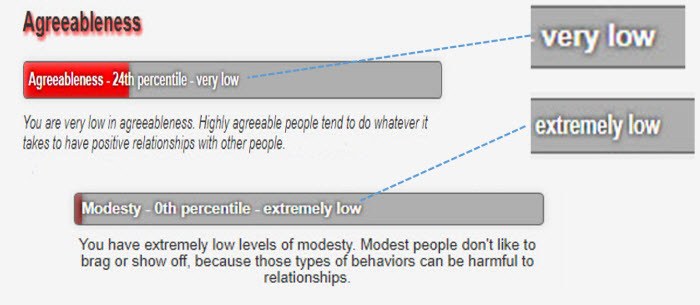

As also discussed in the Week In Charts, I have a big ego, and I’m not very agreeable. These are two bad traits for trading. I know that I must continuously work to protect myself from myself. One other point (hey, what do you expect when the name of the column is random thoughts?), when I do feel like I have the best of the best trades, even if I lose in a trade, I’m pretty good at shouting next-knowing that I did my best. Yes, I might drop in F-bomb, but I quickly move on, knowing that it was just part of the process and knowing with the loser out of the way I’m one step closer to the next winners. Conversely, off-the-cuff unplanned trades, while exciting, lead to the most angst. I’m still mad at myself for some stupid things that I did months ago. I know that I got a little too full of myself and pushed the envelope. Had I had my bookmark reminder, I wonder if I would’ve still gotten myself into trouble? What would the world be without hypothetical questions? (Wright?)

Reading a card before each trade doesn’t sound like that big of a deal, but it is. Not to go all-freshman neurology on you, but the few seconds it takes to read the card is enough to bypass the small emotional part of your brain to get to the rest of what sloshing around up there. The aforementioned tiptoeing past the panic monster, if you will. As mentioned often, the next time you want to make a quick barbed quip back at your spouse or significant other, don’t! (don’t worry, I’m not going to make the "you probably shouldn’t be trading if you have both" joke) Count to three instead. More often than not, you won’t say something that you can’t take back. You’re welcome.

Read And Act!

"I will read daily to improve myself on a personal, business, and trading level. I will put into action these things and not just read them once."

The “in return” is key. Take some action. I have a metric sh*t ton of books here that I've read, underlined, earmarked, and placed back on the shelf (or still remain boxed). They have been collecting dust for years. Adding Hill’s thoughts about “in return” to my affirmations has gotten me thinking. How much more productive would I be if I put some of these things into action?

Again, affirmations seem to create attractions-some obvious and some coincidental. For example, as I'm finishing up this column, my wife got a hankering for some Chinese food. Below is my fortune.

In Conclusion

So, there’s my trading mission statement. Feel free to take what you like. Dream and dream big. Create your affirmations, but make sure you take action. Affirmations without action are just pipe dreams. The actions don't have to be drastic changes. It's better if they aren't. Come up with your own small changes to achieve your goals. Dream big, act small.

May The Trend Be With You!

Dave Landry

Notes And References

1. Obviously, I have an exact amount in mind, but want to avoid friends and family tracking me down in 2024 for loans. I’m half kidding. Seriously, it should be large enough so that if achieved, you'll know that all the little actions taken really did pay off. You must be specific. You need to have an exact amount in mind. You also need a date. A goal without a deadline is just a dream.

2. Opening Gap Reversals. A trade where you look to capitalize on overnight overreaction. This is covered in detail in the learning management system and occasionally in the Week In Charts such as this one.

3. Inspiration here and Wooden quote comes from The Kaizen Way: One Small Step Can Change Your Life by Dr. Robert Maurer. A book that I would urge you to read. See www.davelandry.com/books-to-read

4. From The Kaizen Way: "tiptoe past your fears" combined with the "Panic Monster" from waitbutwhy (Youtube and Waitbutwhy.com)