Random Thoughts (classic)

By Dave Landry

Here's a Big Dave "classic" that I found while cleaning up the back end of my website:

There are simple steps that you can take to make your portfolio great again. However, before you can take those steps, you first need to understand the basic neurology of decision making, and why and how you should reduce the number of trading decisions that you make.

Trading, like life, is simply making decisions and living with them. Making decisions is easy. Living with them is not. Making the decision to marry the most beautiful woman that I ever met was pretty darn easy. Don’t worry, I’m not stupid enough to make the living with her is not joke. I just built a chicken coop. It's really nice but I don't want to sleep in it.

Anyway, we all have a pulse. And, with that pulse comes emotions. It’s part of what makes us tick. It’s been proven that without emotions we cannot make a decision, any decision. (Damasio, Shull) Therefore, we have to embrace, not try to eliminate our emotions when it comes to trading decisions.

The living with the decision part has a consequence. And, the uncertain consequence is what creates the stress and emotions in the first place. Yogi was right: “Predictions are tough, especially about the future.”

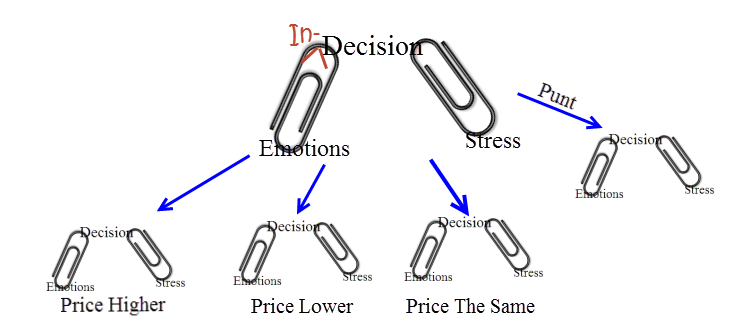

Notice That Indecision Has The Word Decision In It

Rush (the aging band on their 401k tour) once said: “If you choose not to decide you still have made a choice.” Amen! Indecision is still a decision nonetheless. Let’s say that you decide that you’re going to enter XYZ if it hits an entry of $6. The next day, the stock triggers but you choose not to act. This indecision now leaves you with more choices: If the price continues higher, you now have to decide if you’re going to “chase the stock.” If the price is lower, then you begin to wonder if you were lucky and missed a potential loser. Or, should you get in at a “bargain” and "beat the system?" And, if the price is roughly the same, you wonder if taking a position would be “dead money?” As you can see, this “mental masturbation” can create a negative feedback loop, leading to even more decisions.

Let’s say that you do take the trade and enter exactly as planned. So far, so good. You made a decision. Congratulations! Now you have to live with it. If you don’t continue to follow the rest of the plan, then you have now produced a plethora of new decisions. I get emails all the time saying, “Dave, you said take partial profits at $8, the stock hit $8 yesterday, and I didn’t take profits. It’s dropping in early trading! What should I do now?” Or, worse, “Dave I didn’t honor my stop in ABC 6-months ago, and now I’m down 50%. What should I do now!?”

Let’s say that you fully intend on following the original plan. The stock triggers, you enter. So far, so good. However, the stock just sits there or worse, it begins to go against you. What do you do? Nothing. If not stopped out then stay the course. We’ve had huge winners that have gone against us at some point or, at the least, gone flat. And, without these winners, the year would be mediocre at best.

Okay Big Dave, we get it. You’ve identified a major problem. Now, how do we fix it? Well, obviously, as my wife tells me when faced with an “easy fix” plumbing problem, “All you have to do is…” Hours later, soaked, frustrated, and finally giving up and using my “phone a friend” option or simply throwing some cash at it, the problem is solved. Well, trading is one of those “all you have to do is” things. It looks a lot easier on the surface than it really is. However, when you boil it down, “all you have to do is:” plan your trade and trade your plan. So, how do you do that?

1. Believe And You Will Receive

You have to truly believe in what you’re doing. If you truly believe in your methodology and more importantly, have embraced both the good and the bad, then it will be much easier to execute. Winning salesman get a lot more rejections than the losing salesman who quits after a few rejections. The greatest hitters in baseball have far more strikeouts than homeruns.

So, how do you become a believer? Well, experience helps. Do your homework. As mentioned often, I’ve looked at over 10 million charts so far in my career. This has helped me to recognize patterns of what works and what doesn’t. I know. 10 million sounds like a lot but, that's only a couple of thousand a day. And, after a little practice, you'll learn how to get through them quickly.

If you're newer to trading, then make that sure you play devil's advocate. Good traders know that the highs are high and the lows are low because they've been there. Without going off on a tangent (imagine that!), I've seen people do stupid things in great conditions like telling the boss to F off or quitting profitable businesses. In more than one case, I've begged these people to scale down, pay off the mortgage/sock some money into a fixed income account, etc. And, if they are that great, just "rinse and repeat!" None have listened because they've figured out how to print money. Unfortunately, when, not if!, the next drawdown hits they are up the proverbial vile tributary without propulsion.

On the flip side, I've seen many people give up right before the next big trend develops. I've dubbed this "African Queen Syndrome"-borrowed from the movie "African Queen." Set during World War I, Charlie (Bogie) and Rose (Hepburn) shoot rapids, fight off leaches, Germans, and host of other adverse conditions in an attempt to reach the lake downriver. They give up. Reminiscent of Hill's "Three Feet From Gold," when the camera pans out, you'll see that they were only a few feet from their destination (oh, sorry, did I spoil it for you?). One of my ongoing lessons to the frustrated newbies is that "you are closer than you think."

FWIW, most of the successful traders that I've had the privlage of working with started during less-than-ideal conditions and toughed it out until conditions improved. They become seasoned, but first they are battered and fried. Their expectations are tempered.

Here's a relevant quote I found by accident just this morning:

Big Dave

"If you ever meet someone in this business that isn’t humble, they either don’t know what they are doing, or they are delusional."

2. Garbage In, Garbage Out

Way back when the earth was still cooling, and I was programming computers, we used to say "garbage in, garbage out." The same applies to stocks (and other markets). You must pick the best and leave the rest. If you’re picking the best stocks to begin with, then you’ll have more winners hence more confidence in the system. You’ll also be making fewer decisions. You’ll know that some days, as I often preach, the best new action might be no new action.

Once the confidence builds and the inevitable losing trades do come along, you’ll be willing to toss them out knowing that they’re stinking up your portfolio. You realize that these stocks aren’t your children. You don’t give them second (and third, and fourth) chances. They’re your little workers. You simply say: “YOUR FIRED!” and “make your portfolio great again.”

3. Don't Micromanage

Roth Metal Flake Dude

Watching every tick doesn’t help the trade. I've ruined a perfect set of eyes trying-but I’m getting better-although admittedly, I've already dropped two (okay, four) F-bombs this morning, and the market's only been open for 30-minutes. Watching the screen too much creates an emotional rollercoaster by living and dying by the tick. You must be "as close to the market as you need to be, but no closer."

So, how do you resist the Siren call of micromanaging? That’s easy. Turn off your screen(s). Make decisions passive ones and not active ones. Place your orders and get on with your life. Use a stop order to enter a trade and use a stop order to take you out. You can also occasionally use a limit order to take partial profits.

Wait Big Dave, don’t you preach using a little discretion? Yes, I do, but you have to get to the point where you’re not micromanaging and obsessing over every tick before you can even think about applying a little discretion.

4. Just On The Next Trade And Only That One Trade

My “just on the next trade” column struck a chord with you. I’ve gotten emails promising me that just on the one next trade you will plan the trade and more importantly, follow that plan. You make me proud! Rather than re-invent the wheel, read the column here.

5. Get Small

If you’re still having problems, reduce your share size down to a size that’s nearly meaningless. It’ll be much easier to follow the plan if the trade only “monetizes” into a nice meal or a round of golf.

If you’re still having trouble then, again, go back to the books. It amazes me how many people throw thousands of dollars at the market on mediocre stocks. I know this because they ask me for my 2 cents after the fact. Yes, it’s self-serving, but I truly believe that the money would be much better spent on a course to get educated to pick better stocks to begin with. I know that I’m being redundant here, but I think if you do the above and “rinse and repeat,” eventually you’ll become successful.

I watched the stock selection course again last weekend. It's amazing how it seems so "basic" the first time I watched it long ago but now after looking at lots and lots of charts and re-watching the course several times I see the genius of the methods. Great course!!

In Summary

Recognize that all decisions come with stress and consequences. Believe and receive by gaining experience and playing devil's advocate. Trade through a variety of conditions so that you won't be tempered by the ups and downs. Pick the best and leave the rest. Sometimes that means doing nothing. Tom Petty got it right "The waiting is the hardest part." Don't micromanage. Turn off your screens. Use orders to get you in and take your out. On your next trade, follow your plan. If you can't do all that, reduce your share size down until you can.

May the trend be with you!

Dave Landry