Random Thoughts

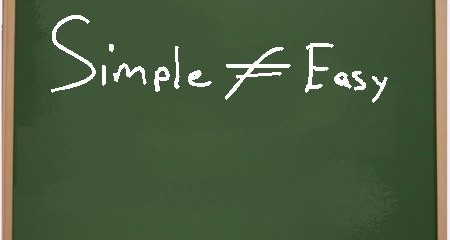

Random ThoughtsTrading is simple, not easy. One thing that never eludes me is the fact that all you have to do to be successful as a trader is to sell higher than you buy or cover lower than you short. I think about this a lot in my downtime. I can be piddling in the garage, having a beer, and/or firing up the pit. It seems to be always with me. The question I often ask myself is how can something so simple often be so elusive?

The answer is that once money is involved along comes emotions. Logic and reasoning comes soon thereafter. There’s often no good reason why a stock is going up—but it is. Conversely, there’s often no good reason why a stock is going down—but it is. You can cry and try to justify but the charts do not lie (I think I just channeled Jessie Jackson). As I preach, unless you’re Bill Clinton, what is, is.

BTW, I’m the guest host today for Timing Reasearch.com’s weekly webinar. One of the subjects for today’s panel will be trading psychology. So, we’ll flesh out the above in more detail. See the countdown to the right of this column to participate.

Now, let’s get to the market.

The Ps (S&P 500) ended in flatsville. They have had an upward drift as of late. I don’t like this “wedging” action after such a big up move. True, the index remains at all-time highs.

Well, you certainly don’t want to fight it. And trust me, I will not. After all, it “IS” going up. My concern is that it remains overbought, it hasn’t cleared the recent peaks decisively, and (again) the momentum has slowed. This is the tough part for the trend guy. Darned if you do and darned if you don’t. If you jump in, it’ll correct and take you out with it. If you don’t it’ll keep going without you.

One additional concern is that each day seems to bring a new crop of debacle de jours—stocks getting taken out to the woodshed and shot.

The good news is that you don’t have to get the overall market precisely correct. In fact, predicting the overall market is much harder than predicting the direction of individual issues. This doesn’t mean all issues, all of the time. My point is that it’s easier to sift through a couple thousand stocks, looking for the one that’s just right vs. timing the overall market. So, while the market finds its way, we are going to take things on a setup-by-setup basis.

With the above said, we are starting to see a few setups. There seems to be a bit of a rolling correction happening. Right now, the database is starting to produce a few Trend Knockouts. These are strongly trending stocks that have had sharp corrections. This action knocks out the weak hands and attracts some eager shorts. Should the setup trigger, the stock can often be propelled higher by the predicament of the aforementioned players. “Trigger” is the key word in that sentence. That’s the beauty of the setup. Often the stock continues to implode. No trigger, no trade. So, often no capital is put into harm’s way. You’re wrong but not long.

So what do we do? In spite of the indices hovering near new highs, I am seeing some internal signs of deterioration. Now, I’m not going to go all “Chicken Little” on you. And, please don’t email me telling me that I’m a bear. I’m actually looking to buy, not sell. I’m just going to be cautious. I certainly will wait for entries and once triggered, I will honor my stop. Easy huh? Well, not easy, simple.

Best of luck with your trading today!

Dave

P.S. Toot Toot! I hate to blow my own horn but I’m very excited that Amazon has picked The Layman’s Guide To Trading Stocks as one of their favorites for 2014. I’m excited about this, especially since the book was published 4-years ago.

Free Articles, Videos, Webinars, and more....