Random Thoughts

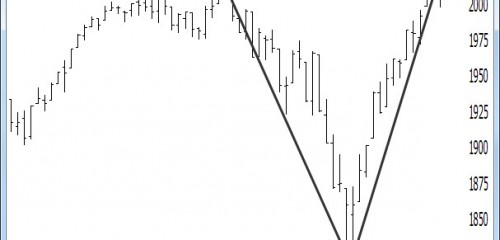

Random ThoughtsI’m not a big fan of “V” shaped recoveries at high levels. At low levels it is one thing. The market is sold out longer-term. Buying can sometimes beget more buying as the longer-term shorts get squeezed, the bottom fishers begin rushing in, and the value players begin accumulating (provided they are not broke from previously accumulating at “low” levels but I digress). The trend guys, who are usually always a little late to the party, then begin buying. At high levels, the dynamics are a little different. The market has a lot of existing longs already from the previous extended trend. The bottom fishing isn’t as prolific since it isn’t a longer-term bottom and there are fewer shorts to squeeze. This action can still create an overbought market very quickly but it often fizzles just as quick. It also has the market flirting with its prior highs, creating the potential for a double top.

I get a lot of questions about gauging overbought. It is simply a sharp rally that’s likely not sustainable longer-term. I tend to eyeball this but just for fun I did a little math. If the Ps kept past with their last leg up, they would be trading at around 6,500 a year from now. Markets can do whatever they want, but I’d be willing to bet that we won’t see a triple+ between now and next November. So, based on this metric, we are overbought.

Overbought markets created a darned if you do and darned if you don’t environment. If you buy, the market promptly corrects from being overbought. If you short, overbought becomes even more overbought.

It is times like these where listening to your database can pay off. Right now it’s saying to wait. Wait for setups. The sharp recovery in both duration and magnitude has left us with very few meaningful potential shorts. The fact the market has gone straight up and not had a significant pullback just yet leaves us with virtually no meaningful potential longs. The database is saying to wait.

I don’t wanna wait (in my best whiney voice) but that’s what I sometimes get paid to do. Well, the market’s not paying me during the waiting phase but I know if I’m patient new opportunities will eventually come along. I know that sometimes I need to keep some powder dry.

This is not an easy market for the trend guys. The good news is, no new capital will be put into harm’s way until things shake out.

With essentially a flat day, not much changes in the sectors. Some like Chemicals, Shipping and the Energies continued lower. Metals & Mining made new multi-year lows-again. This is why we do not bottom fish.

Other than the aforementioned weak areas, like the overall market, most areas still remain strong. Unfortunately, like the market, many remain overbought and/or are bumping up against their prior highs.

So what do we do? In your day job, you get paid to take action. Unfortunately, as trader, sometimes no new action needs to be taken. It comes with the territory. We wait. We wait for setups. We then wait for entries. Until those things happen, we need to sit on our hands.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....