Random Thoughts

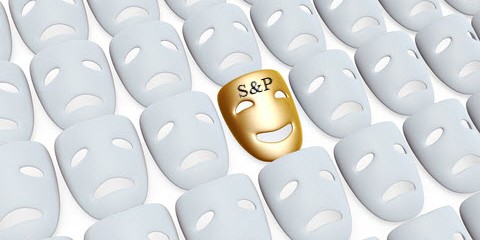

Random ThoughtsThe Ps (S&P 500) continue to shrug things off in a “what, me worry?” fashion. The overall market sold off hard on Wednesday. The Ps? They were down a smidge, not even ¼%.

In Wednesday’s column I discussed the fact that it has been mostly defensive issues that have been propping up the Ps as of late. And, lately, I have been wondering what’s going to happen when those areas have a normal correction. I would imagine that this will have a material impact on the index. The question then becomes, will this selling beget even more selling?

The Ps continue to mask what’s really going on beneath the surface. Other than the aforementioned Defensive issues, some Commodities, and a few REITs, the majority of stocks remain in downtrends.

The Quack (Nasdaq) is more indicative of what’s really going on. It lost over ¾% on Wednesday. It appears to be attempting to resume its recent slide out of a pullback. Ditto for the Rusty (IWM).

Again, I’m just not sure you can build a bull market on defensive issues, a few commodities, and some REITS.

And once again, my database has been producing a plethora of shorts and very few longs. Usually this is a sign to play the short side. It’s also a sign that the market could be in trouble in spite of what the Ps might be saying. I don’t want to fear monger but I haven’t seen it this bad since October of 2007. Back then I remember apologizing to my clients for recommending shorts even though the S&P was right at new highs (you can download the archives if you would like to study them).

You know me. I’m a one-day-at-a time kind of guy. Yes, I’m concerned about the internals but I’m not going to make any drastic decisions. Yes, I will continue to look to add on the short side. And, yes, I will honor my stops on existing longs. If a great looking long comes along, then I’ll take it. As I preach, this ebb and flow will control the portfolio and help keep it on the right side of the market—or at least, in the right stocks in spite of the market.

So what do we do? By now, you’ve probably realized that most of today’s column is a cut and paste from Wednesday. Well, since nothing has changed, the game plan remains the same: Defensive issues haven’t pulled back lately, so you’re going to have to wait for setups there. On the short side, continue to focus on areas in downtrends or that have recently rolled over like much of technology—especially Drugs, Biotech, and Software. Whatever you do, (warning speech ahead) make sure you really like the setup and, of course, wait for an entry. Once triggered, use protective & trailing stops and take partial profits as offered. See my videos under Education on my website for the basic money & position management.

Futures are firm pre-market.

Best of luck with your trading today!

Dave

P.S. Chart show today! Hope to see you there!

Free Articles, Videos, Webinars, and more....