Random Thoughts

Random ThoughtsSomeone quit the newsletter yesterday, saying it was too wordy. So I come into today and think, maybe I should tighten it up. I then think about what a wonderful learning example the market could be providing us and think…naaaaah.

So, here is your lesson de jour. I only put into my column what I wish someone would have told me 25 years ago. With that said:

Technical analysis does not have to be that technical. The net net price change is TA in its most simplest form. Where is the market at the close today relative to yesterday’s close? And where is it relative to a week ago?, a month ago? several months ago? etc…

Considering the above, on May 15th the Ps closed at 1650. Yesterday they closed at 1655. So, net net, the market basis the Ps hasn’t made any forward progress in nearly 5 months. Said alternatively, the intermediate-term trend remains sideways.

Looking back a few weeks, the highest close was 1725 on September 18th-the day the Fed said they’d leave the faucet running. Subtract yesterday’s close (1665) from that number and you get a net change of -60 points/a little more than -4%. This isn’t the end of the world but shorter-term, based on the most simplest of all metrics, the trend is down.

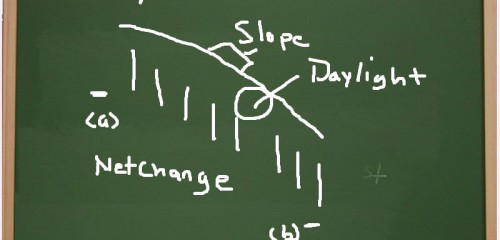

For those keeping score, the Ps are now well below their 50-day moving average. There’s nothing magical about this average but “daylight” and slope can help to keep you on the right side of the market. Downside daylight means that the highs are less than the moving average. Upside daylight means that the lows are greater than the moving average. Slope is just that. The angle of the moving average: up, down, or sideways. Bull markets will have lots of upside daylight and a positive slope in the moving average. Conversely, bear markets will have downside daylight and a negative slope in the moving average. Study the major bull and bear markets of the past and you’ll get it. As an example, from mid-June of 2008 until March of 2009 the market lost nearly 50% of its value (basis the Ps). During that entire period there were only a few days of positive daylight and the moving average slope stayed negative. The subsequent 40%+ upside move had just the opposite-upside daylight and a positive slope.

Speaking of moving averages, the “Bowtie” moving averages-email me if you need the pattern-have turned down and on the verge of crossing over. There’s nothing magical about this pattern but it can help to keep you on the right side of the market. This is especially true when the signals come off of all-time highs (or lows).

Although net net, the Quack looks a lot better than the Ps longer-term, Tuesday’s slide put the index all the a way back to its pre-break out levels-about where it was trading August. It now has some resistance in the 3750 to 3800 to overcome.

Tuesday was ugly. There were only a few areas that ended higher-and not by much. The bigger they were, the harder they fell. For instance, Biotech which had been in a longer-term trend, got clocked for nearly a 5% loss.

So what do we do? It is very important for the market to stabilize at this juncture. I wouldn’t sell the farm just yet but it wouldn’t hurt to get it appraised. Seriously, honor your stops on existing longs but keep your positions just in case this turns out to be only a correction or just in case you have some issue(s) that decide they can defy gravity. This will keep you long should the market turnaround. And, if it doesn’t, it will help to mitigate losses. On new positions, be extremely selective. Also, use liberal entries. That, in and of itself, will often keep you out of new trouble. Trail your stops lower on existing shorts and start keeping an eye out for a few new ones. As mentioned recently, previous high fliers, especially in big cap issues, might be your best bet here. As I preach, let stops and entries control your portfolio ebb and flow. If this turns into something bigger, you’ll end up net short. If it goes straight back up, you’ll stay net long. And, if it goes sideways, you’ll end up flat. It is that simple. I never said it was easy. Just because you decided to become a trader doesn’t mean that no longer have a pulse. Trust me, a lot of “F-bombs” get dropped in this office.

Futures are flat to firm pre-market.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....