“Is You Is Or Is You Isn’t A Trader?”

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

Long before I left for Hong Kong, I intended to do a piece on what I learned from my Asian brethren upon return. Once there, I soon realized that it would end up looking a lot like my “What I Learned From My German Brethren” columns. The continent may change but human nature doesn’t. I do think there are some salient points that are worth repeating.

Just Like U.S.

In a nutshell, they, like many of us, tend to overcomplicate things-searching for the Holy Grail. Trading is far from easy but it’s not nearly as difficult as many of us try to make it. As I wrote in the aforementioned column: “Never forget that you must make a trade off of price and the only way to profit is to capture a change in price. Therefore, be careful not to venture too far from price itself.”

Not That Far

The distance between you and your success is the distance between your ears. Many, not unlike many of us here, seemed to be more concerned with being right and looking smart than making money. I was hurt and quite offended with someone once called me a “trend following moron.” Soon thereafter though, I began to embrace it. The next time I found myself trying to outsmart the market I realized that I maybe I should just follow along. And, maybe there was nothing wrong with being a trend following moron. TFM t-shirts and buttons soon followed. I also added up, down, and sideways arrows to the back of my business cards. I keep one taped to each of my monitors to serve as constant reminder whenever I begin to lose my way.

The distance between you and your success is the distance between your ears. Many, not unlike many of us here, seemed to be more concerned with being right and looking smart than making money. I was hurt and quite offended with someone once called me a “trend following moron.” Soon thereafter though, I began to embrace it. The next time I found myself trying to outsmart the market I realized that I maybe I should just follow along. And, maybe there was nothing wrong with being a trend following moron. TFM t-shirts and buttons soon followed. I also added up, down, and sideways arrows to the back of my business cards. I keep one taped to each of my monitors to serve as constant reminder whenever I begin to lose my way.

Is You Is Or Is You Isn’t A Trader?

Is You Is Or Is You Isn’t A Trader?

One thing that’s assuring when it comes to the markets is that human nature of the participants never changes. Some may argue that technical analysis will stop working but as long as I keep meeting people who follow their emotions vs. their plan, I can rest assured. Through charts we can read the emotions of the players and benefit from what we see, provided of course, that we keep or own emotions in check.

Being smart and making money/surviving adverse conditions are often two diametrically opposed things. Unless you’re Bill Clinton, what is, “is.” Sometimes, you just have to be a TFM and follow along. Follow your plan, even if that plan means you have to take a loss and get out of the way. I know, I beat the dead horse here, but never forget the old hedge fund adage: “he who fights and runs away, lives to fight another day.” And, as my buddy Greg Morris says: “Whipsaws are frustrating. Bear markets are devastating.”

One of the traders I met was very smart, obviously successful in his prior career. Unfortunately though, the Hang Seng is now down over 30% and so was he. He now felt that he was down too much to sell. Never forget that “it’s always darkest right before it gets more dark.” If you’re buying and hoping (oops, I mean holding), that’s fine but if you’re a trader, you trade-like Kenny Rogers being a pain in the ass to play cards with, it’s what you do. You allow yourself to be stopped out and if an opposite trend develops, you then follow it. As I preach, stealing from Stills: “If you can’t be in the trend you love, love the trend you’re in.” So, ask yourself, are you a trader or not? (Warning, tough love just ahead) If you’re still 100% long in this market, you’re probably not a trader. That’s okay. Just like the world still needs ditch diggers, the market needs participants who hold on no matter what. Just make sure you look in the mirror and ask yourself, “is you is or is you isn’t a trader?” (somewhat stealing a line from Steve Todd, originally published in my Markets Go Up And Markets Go Down-Duh But Are You Agnostic column)

Source: Geico

Whether you’re here or there: keep it simple, have a plan, and follow that plan. That’s all you have to do.

To The Markets

The Ps (S&P 500) remain in a serious slide and have only pull backed back—somewhat anemically I might add-as of late. If you back the chart way out, it’s beginning to look like the mother-of-all tops, something you’d see in a classical book on technical analysis written over a half a century ago.

Ditto for the Quack (Nasdaq).

Things are always cut and dry when it comes to markets. You can’t flip a switch and say, oh, it’s a bull/bear market. The media does tends to label things though. So, by their own metric, a market down 20% is a bear market. Well, the Rusty (IWM) is down more than that since peaking last summer. So, it’s a bear folks.

As I’ve been preaching, the Rusty has been the poster child for what I’ve been seeing internally for a long long time. The major indices, thanks to their capitalization weightings, have been masking what’s really going on. And, as I’ve also been preaching as the last of the Mohicans go, so will the market. Watch the last couple of Dave Landry’s The Week In Charts and you’ll be up to speed here.

Nearly all sectors are in bona fide downtrends. And, the remaining few that are still at high levels such as Retail are beginning to look dubious at best.

Gold the commodity (GLD) is waking up, rallying nicely from a recent Bowtie off of major lows. Unfortunately though, it’s likely going to be met with a lot of resistance along the way. There are a few super duper speculative stocks that have taken off here but for the most part, most of the stocks will have their work cut out for them as they try to work their way through overhead supply.

So What Do We Do?

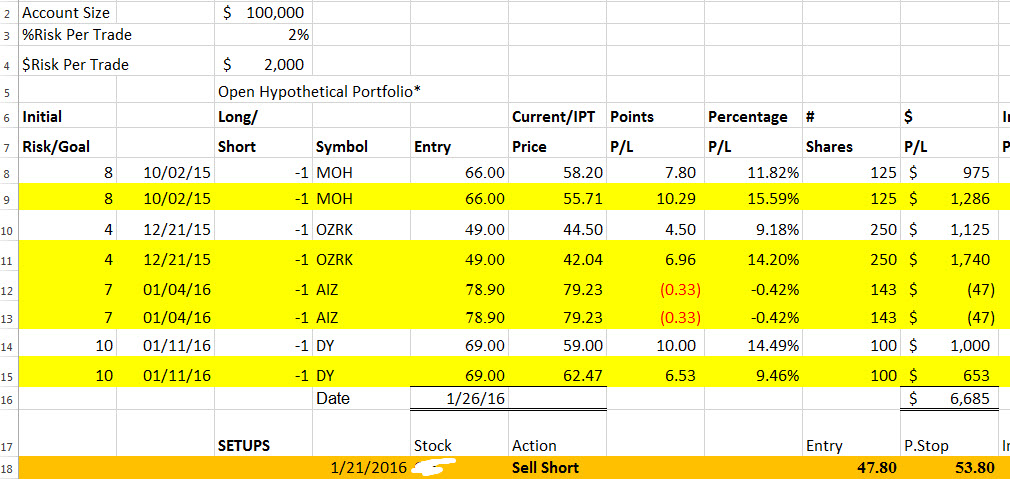

With the market and virtually all sectors in downtrends, the short side remains the obvious side to play. Make no bones about it, playing the short side isn’t easy. Quite frankly, it can suck when the retrace rallies hit. Above is the actual open portfolio (based on a hypothetical 100k account). “-1” means the position is a short. So, as you can see, the portfolio is now made up entirely of shorts and the new recommendation for today is also a short. Even though the portfolio is doing well, sooner-or-later I know what we’ll be hit with the mother-of-all retrace rallies-it comes with the territory. This is why we have been taking partial profits along the way and trailing stops—and so should you. The market remains oversold longer-term but unless you’re firing off a daytrade, that in and of itself isn’t reason to buy. The market is headed lower folks. That might change tomorrow but so far, I’m not seeing any signs to the contrary. If you are a trader you should be either flat or short by now. And if you’re still long, ask yourself, “is you is or is you isn’t a trader?”

Best of luck with your trading today!

Dave

P.S. And last, but certainly not least, I’d like to thank Teresa Blair Wong for her wonderful hospitality and Greg Morris for recommending me to her in the first place. I’d also obviously like to think those who attended the full-day conference and those who attended the pre-conference, including the members of the Hong Kong MTA. Friend me on Facebook for more pictures and updates from the trip.