Random Thoughts

Random ThoughtsThe Ps (S&P 500) had a great day, gaining over ½%. They not only closed at all-time highs but exceeded all previous highs. This is the first day that the index has been out of its range in a long-time. As usual, follow through will be key. It certainly is off to a good start.

Yesterday, I said that the Quack (Nasdaq) would have to make new highs for me to get excited about it. Although this seemed like a long ways away 24 hours ago, it doesn’t seem as far now. For the day, it gained nearly 1 ¼%. This action has it breaking out above its recent sideways trading range.

The Rusty (IWM) put in an impressive day too. It ended the day nearly 1 ½% higher. This action puts it just above its 50-day moving average. It still looks a little dubious and might just be rallying to “kiss the 50 goodbye.” However, I wouldn’t fight the short-term uptrend here just yet, especially since it gapped higher on Tuesday.

An uptrend is a string of up days. And, so far, we’ve had a few. Let’s hope we have more.

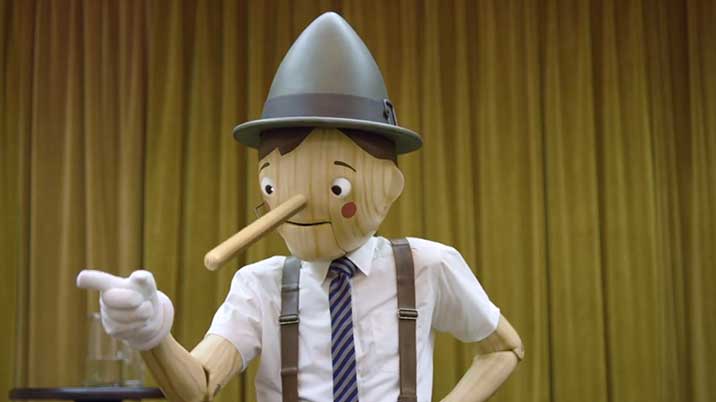

In the meantime, don’t get too caught up in the breakout in the Ps. Yes, it looks great, but like Pinocchio being a bad motivational speaker, everybody knows that. Now is the time to wait for follow through. If it can leave the previous range well behind and then have orderly pullbacks, we might just have resumption of the longer-term trend.

Obviously, I’d like to see the other two amigos—the Rusty and the Quack—join in the party and make new highs too.

The point is to take things one day at a time (stop me if you’ve heard that before). It’s not as easy as switch being flipped.

So what do we do? I’m encouraged that the market is improving. As usual though, follow through will be key. I’d feel much better once I can resume drawing big and not so big up arrows on the charts. The good news is that I’m not seeing a whole lot of meaningful setups. This is the database saying to hold off a bit and confirms my thinking to let things shake out. For now, it remains a market where you can’t just throw darts. Therefore, pick your spots very carefully. Make sure you really really like a setup before you take it. Regardless of what you do, make sure you wait for entries. That, in and of itself, will often keep you out of new trouble on a lack of follow through. And, as usual, honor your stops once triggered.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....