A lot of long lost friends came out of the woodwork over the weekend. Half of my friends are worried about what to do with their retirement. As one good friend pointed out, I've always been in for the long-term, but I'm running out of longer-term. The other half of my friends are wanting to bargain hunt. I wanted to get my thoughts out as early as possible, so be kind to me about my grammar.

Some thoughts:

Out Of Bullets

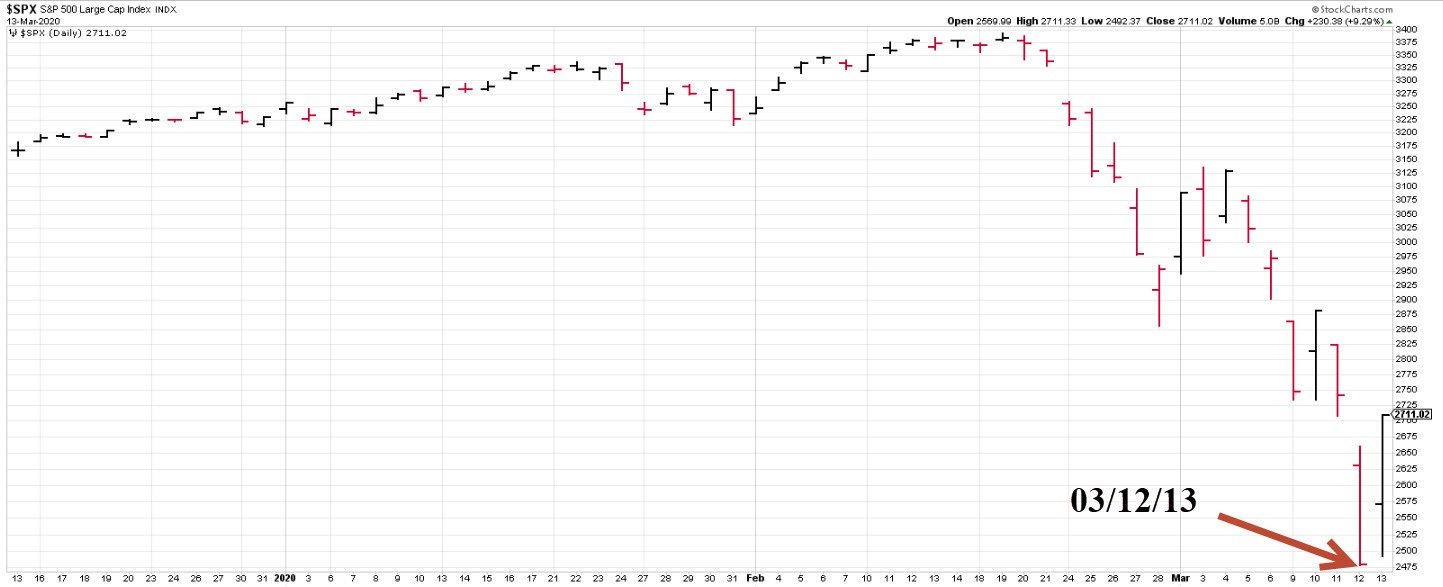

My biggest concern going into the weekend was a potential sell off after the government through everything and the kitchen sink at this market. I told all my friends to watch Thursday's (03/12/20) low. The government is throwing "everything at the wall" in attempt to stop this thing. Buying oil for the strategic reserves, flooding the market with liquidity, bailouts, and, of course, lowering rates to zero. If Thursday's low gets taken out, it could get ugly, especially now that the Fed is out of bullets. Can rates go below zero? Technically, yes, but that's another problem altogether. Stock futures touched limit down so we're going to take out Thursday's low on the open.

What Do I Do With My 401K?

Since the "bomb's already blown up," this puts me in a very difficult position. As a trader, I played the 2020 bear market like any other downturn. I let my stops take me out and I started shorting. Although this doesn't help you in this situation, look at what I've been doing for the last 20-something years. It's hard to write without coming across as pouring salt into wounds. So my apologies ahead of time. ANY time you invest in ANY thing, you have to have a plan on where you will GTFO. All asset classes will lose half of their value at some point in your lifetime (see the Cash Is Not Trash article under 2020 Bear Market Updates). This is why I spend SO much time on money management-and having the right mindset to follow the plan (i.e., trading psychology). As I've been preaching lately, I'm amazed at how much time my friends will spend on hobbies, but are not willing to invest a tiny bit of their time to understand the basics of markets. Simple things like if a market is going to drop 50%, it's going to have to drop 10% first. This is the basis of my TFM 10% system. Again, I guess my point is that I don't have the answer now that the bomb's already blown up. I'm in a damned if I do and damned if I don't situation. If I tell you to bail, then the market will bottom. If I tell you to wait for the retrace, that never comes. You'll have to make those tough decisions. Depending on your situation, you might have to "sell down to the sleeping level"

It's Always Darkest Right Before It Gets More Dark

I received a call from "in law of an in law" Friday after the close. She wanted to buy airlines because "they are cheap." Yeah, they look cheap, but that doesn't mean that they won't get cheaper. If you want to trade, that's awesome! Just make sure you treat it like any other venture. Learn how markets work. "Buy low and sell high" has ruined many of lives. It's always darkest right before it gets "more dark." As I wrote recently, the Nasdaq seemed cheap in 2000 when it was down 50%. It then went down to drop another 50%. As a card carrying Trend Following Moron, I'd be willing to bet that the airlines will be lower. I'm no Nostradamus, just a TFM drawing big blue arrows.

One more point, I don't predict, I follow, but I'm willing to bet that if the stock market loses half of it's value in this mess, the most popular value fund out there will lose half of its value too.

Avoid Big Picture Longer-term Prognostications

It's amazing the amount of people making all these predictions. Predict early and often I suppose! NO ONE KNOWS WHAT HAPPENS NEXT. This is why I take a "dumb" approach and just draw my arrows.

Take Everything With A Grain Of Salt

Sunday morning the news announcer said to stop buying groceries and take your family out to eat. Sunday afternoon some states started closing restaurants. Just breathe (but make sure you at least 6' away from anyone else who's also breathing).

Y'all hang in there! We're going to get through it!

May the trend be with you!

Dave Landry