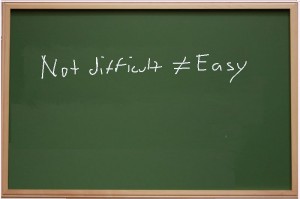

Not Difficult Is Not The Same As Easy

By Dave Landry | Uncategorized

The Ps continue to rally after recently “kissing” there 50-day moving average. For the day, they closed up over 1%. Again, there’s nothing magical about “da fidy” but it can help to keep you on the right side of the market. See Thursday’s (06/06/13) chart show.

The Ps continue to rally after recently “kissing” there 50-day moving average. For the day, they closed up over 1%. Again, there’s nothing magical about “da fidy” but it can help to keep you on the right side of the market. See Thursday’s (06/06/13) chart show.

The Nasdaq also had a decent day, it too closed up over 1%. The Rusty lagged a bit but still managed to tack on ¾% nonetheless. As you would expect with strength in the broadly based Quack and Rusty, internally the market was strong.

So what do we do? It’s good to see the market continuing to bounce. We still don’t know for sure if it is just bouncing or if it is resuming its longer-term trend. This doesn’t mean you can’t trade it. As I have been preaching, you want to err on the side of the longer-term trend. This is especially true with the major indices only 1-2% off of their old highs. There are some caveats though. Waiting for entries will help to keep you out of new trouble if the market turns back down. And, stops on existing positions will help to mitigate losses if that occurs. I wouldn’t completely eliminate the short side just yet. I think areas such as the REITs might continue to implode. Just make sure you wait for entries there too. Again, letting the ebb and flow ebb and flow of money and position management help to keep you on the right side of the market. And once again: It is not difficult. Notice I said “not difficult” and not easy.

Futures are flat to firm pre-market.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....