Random Thoughts

Random ThoughtsYou hate to read too much into a holiday shortened session but you certainly can’t ignore the action. So with that said….

Friday was a little mixed.

The Quack plowed ahead to close at multi-year highs, gaining over 1/3%.

The Ps tried to rally but came back in to close slightly in the minus column.

The Rusty put in a similar performance but managed to finish in the black, albeit barely. Nevertheless, this is enough to keep it at all-time highs. Better-than-a-poke-in-the-eye is what I say.

With the broad based Rusty hovering around new highs, it is no big shocker that internally things are still looking pretty good.

Drugs, led by Biotech, managed to bang out all-time highs.

The Semis, which have been trading mostly sideways as of late, ended slightly higher. This action has them probing the top of their trading range.

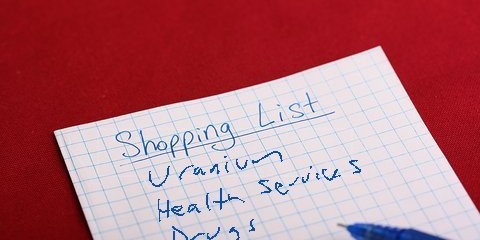

Defense, Regional Banks, Conglomerates, Computer Hardware, and Health Services to name a few remain in uptrends and at or near new highs.

Some slightly more obscure areas such as Uranium appear to be bottoming out and starting a new uptrend. You might want to right that down.

Again, overall, things still look pretty good.

So what do we do? Even though the uptrend remains intact, I’m still not seeing a whole lot of meaningful new longs. This is perfectly normal since the methodology requires a pullback. So, on the long side, continue to get ready to get ready. Continue to build your shopping list but wait for setups before you buy. While waiting, you know the routine, take partial profits as offered (see Layman’s for money & position management planning) just in case the market does not follow through. On the short side, don’t fight the overall trend and go after a bunch of setups. However, if you really really like a setup, then take it. Again, see my 11/26/13 column for a philosophical discussion on this. Just make darn sure you wait for entries. That, in and of itself, has kept us out of a few short side positions as of late.

Futures are flat pre-market.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....