Random Thoughts

By Dave Landry

I have a brother-in-law named Andy. I love 'em to death, but he does have a slightly annoying minor quirk. When Andy asks for your opinion, he's already formulated your proper reply. Should you not agree with him, he will, albeit very convincingly, argue his case. I have dubbed this telling me what you already want to hear vs. your honest opinion "Andy-ing." The term stuck.

I was taken aback. I was fishing for a compliment but only caught criticism.

Do I Preach Too Much Or Am I Preaching Enough?

Bill micromanaged himself out of a big winner that I recently recommended. He wanted to know if he should jump back in.

Jose didn't honor his stop on a stock I recommended that went south weeks ago (yes, even I occasionally have losing trades). He wanted to know if I still liked the stock.

Sam was system surfing and wanted my opinion of the system de jour.

SSDD

After 45 minutes of reiterating my gospel to these people, it hit me. I do say a lot of the same shit. And, I'm going to keep saying the same shit until you people get it!

With that said, let's beat the dead horse.

Honor your stops.

Pick the best and leave the rest. Only put capital into harm's way when you are confident that the odds are stacked in your favor.

Constantly identify the extraneous to trading (e.g., a fight with your spouse, significant other, or both!) and make darn sure that it is not affecting your trading. Wanting money and needing money are two more big examples of the extraneous. And, let's be frank, why on earth would you subject yourself to all the troubles of trading if you didn't want or need money?

What does the guy on the opposite side of your trade know? And, assume that "Opposite George" knows a lot more than you.

On a similar vein, the only way to profit from a trade is for a "greater fool" to come along. Therefore, always ask, "Is there a greater fool?" And, more importantly, "Am I THE Greater fool?

Do you have time for an anecdote? Great! A few years back, my mother-in-law and father-in-law expressed an interest in buying physical gold. Since gold was in a serious downtrend, I told them to hold off, and I'd let them know when to buy. Months passed, and gold finally began to trend higher. At their weekly dinner visit, I told them that now would be a good time to buy. I expected them to "Andy me" with something like, "Dave, you're THE best son-in-law! Thank you for your knowledge! We are SO LUCKY to have you!" To my surprise, my father-in-law berated me: "WHY WOULD THEY BE SELLING IT TO ME!?" (repeatedly). WTF, I thought! I tried various answers like "They're in the business of selling gold," "You were in business, you understand markups?" All of this fell on deaf ears as he continued to repeat the question (looks like Andy gets it honestly!). "Grump-paw" was not backing down any time soon! Note: that's pretty much how most dinners go with them, but I digress. Anyway, I was initially annoyed, but the next day I began to ponder his question. Why would they be selling the gold? If they thought that gold was headed higher, as all the buy-gold-before-it's-too-late radio ads pontificate incessantly, then why would they be selling it? Again, always ask why they would be selling it (gold, stocks, commodities, Crypto, etc..) to me?

Don't micro-manage: in for a penny, in for a pound!

Wait for entries. That, in and of itself, will keep you out of a lot of trouble.

Do nothing unless there is SOMETHING to do. Busy traders make good traders. As I preach, when there's nothing worthwhile doing, they're off saving lives, repairing automatic transmissions, or defending good guys (although I've later learned from a lawyer that lawyers make a lot more money defending bad guys, but I digress). A doctor friend/client phoned me a while back to tell me that his trading had vastly improved. Excited because I assumed some compliments were coming my way, I asked him what had changed. He said that he had no time for mediocre trades or unnecessary hyperactivity (e.g., day trades) because he was literally working night and day. He explained that the doctor covering his nightly rounds recently quit.

Believe in what you see and not in what you believe.

"Don't confuse the issue with facts:" Focus on what price IS doing, not what it logically SHOULD be doing.

Don't worry about the "SITUATION IN NIGERIA!*" (ignore all news)

Keep it simple, be patient, pick the best/leave the rest, sprinkle in proper money management, and understand that you WILL be your own worst enemy (so, learn about trading psychology and trading neurology).

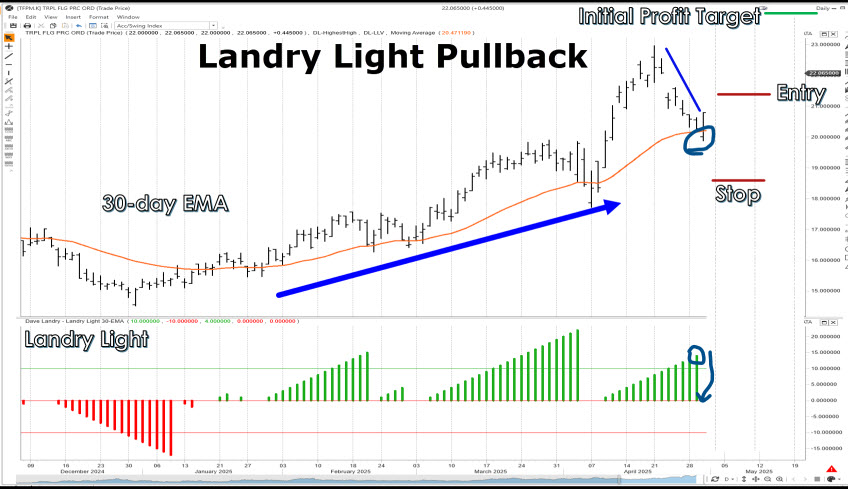

Not The Grand Poobah, But I Do Have Something Viable

As I preach, I am NOT the Grand Poobah. I don't have the Holy Grail. If I did, you'd never see my fat ass again! And, no, I wouldn't sell you my "golden goose" for a couple of K. What I do have is a viable, very simple, conceptually correct approach to the markets that includes money management and a ton of trading psychology. And, I do believe that if you took just one of my patterns (Landry Light Pullbacks would be a great place to start, scroll down), researched the heck out of it, picked the best/sat on your hands when there was nothing worthwhile, and worked hard to understand the perverse nature of trading psychology (you're dealing with the emotions of the markets and worse, you're own emotions) you would become successful. You could then build from there.

But, You Probably Won't Do It

There's a much better-than-average chance that you won't heed what I'm saying. You'll think that there HAS to be something more complex out there that will catch every zig and zag while avoiding all pain. You'll chase rabbits, rainbows, and often your own tail in search of THE Grail. This process will take 3 to 10 years and, occasionally, much longer. You don't have to waste years searching, but you probably will. Most clients try me out for a brief period and have a little success, but as soon as things turn sour - and they will (as we say in the South, "The sun doesn't shine on the same dog's ass every day.")-they go back to chasing rainbows. They become the proverbial blind man in a dark room looking for a black cat that doesn't exist.

Photo of a blind man in a dark room looking for a black cat that doesn't exist.

Although it's an exercise in futility to try to find something that isn't there, they "hit and miss" just enough to keep the dream alive. And yes, I've been there, done that! In a place wrought with paradoxes and dilemmas, occasional success becomes the enemy. It keeps the unattainable dream alive. The epiphany finally comes - much sooner for those who realize they just want to make money and much later for those who would rather look smart.

Channeling Eckhardt, be promiscuous in your research but not in your trading.

Don't Despair, There Is Hope

My best clients go through the aforementioned try-me-out phase, move on, then come back years later. They realize that there is no Holy Grail and, above all, simpler is better. You don't have to go through years of searching. Just start with something simple and once you're successful with that, look to build. Otherwise, you might end up like a blind man in a dark room looking for a black cat that doesn't exist.

Notes And References:

*"Long story endless," many years ago, I was speaking at a Traders Expo NY. I showed my open portfolio and pointed out that it contained two shorts in the oil service sector. I then began to show some potential oil service short-side setups that I also liked. I was in mid-sentence when someone in the back blurted out, in what can best be described as a very angry Henry Kissinger, "WHAT ABOUT THE SITUATION IN NIGERIA!" He then said it again, even louder, just in case the people in Nigeria didn't hear him. After an awkward pause, I rhetorically said, "What about the situation in Nigeria?" Mr. Kissinger explained emphatically about how Nigeria, along with Venezuela, were manipulating the oil supply, implying that shorting oil stocks was stupid (he might have actually said that I was stupid). The positions, along with my suggested setups, did work. Yet another example of "don't confuse the issue with facts."