Q. Okay, I signed up for Dave Landry’s Core Trading Service. Now what?

A. You should have received a logon. The service is located here:

www.davelandry.com/core-trading-service

You can always “forget password” and a new one along with your username will be emailed to you automatically. Be sure to “whitelist” [email protected] as a trusted contact.

I do not send out emails with the Service. You must log in. The Service normally posts around 2-3 hours after the close.

Take a look at recent services (located below the daily video). Watch these to get a feel for current market conditions. Watch as many of the older archives as you can stand, and virtually all of your questions will be answered. In the meantime, see the rest of the FAQ below.

Q. Landry List- What exactly is the Landry List (LL)?

A. The Landry List is a list of stocks that I am watching. Those with checkmarks are potential shorts. It is the exact list that I am watching for opportunities. Nearly all of my Core trend trades come from this list. Occasionally, I may trade (and obviously, reserve the right to trade) stocks not on the list. For example, I sometimes may trade a thinner, less-than-ideal (doesn’t exactly fit the methodology), cheap stock, or other “non-Core” trade (e.g., an IPO breakout). Most in the Landry List are usually set up, but I will often include stocks that are in the process of setting up to make sure that they are on my radar. In these cases, I will often point this out.

Q. Where is the LL?

A. The Landry List is to the left of the spreadsheet in the service video. After discussing the open and potential positions, I then discuss the LL.

Q. How should I use the LL?

A. That’s up to you! Different members use it as they see fit. Some aggressive traders use the list for day trades (e.g., Russian Dolls-see the Week In Charts for more on this), intra-day relative strength following when conditions are trending strongly, take thinner setups, trade more volatile stocks on the list etc.

Get a feel for it. Watch, watch, and watch the list.

Watch and keep old lists. Sometimes the market doesn’t move on our timeframe. These stocks may no longer fit the exact “Core” methodology, but might still have potential. Some of these have gone on to be huge winners.

See what’s working now and what isn’t. See what triggered and what didn’t. Traders newer to the methodology should stick with the official recommendations before “venturing out” into the LL.

Q. What’s the difference between an “official” recommendation and the rest of the LL?

A. An “official recommendation” is a setup that I think has the best chance to work that’s not extremely volatile and has adequate volume. Other stocks on the LL might be worthwhile, but they could be riskier by being thinner or more volatile. They may also be on the cusp of setting up (or not a “perfect” setup).

Q. Are official recommendations better than the rest of the LL?

A. Not exactly. I think they have the best potential keeping the above parameters in mind (thick enough to easily trade, move but aren’t super volatile, etc..). My goal is to consistently show stocks to prove that the methodology works (over time, not all the time, obviously).

Q. Can I download the LL?

A. Unfortunately, no. Due to a few bad apples who decide to share it with 1,000 of their closes friends, I do not make the LL downloadable. Obviously, I have a vested interest in the list not being shared, but it also hurts you.

Q. XYZ was on the LL yesterday, but I see that it’s no longer on the list today. What gives?

A. The stock no longer fits the Core methodology or there could just be many other stocks that look much better. It could also have triggered a reasonable entry based on the setup.

Q. Can you tell me exactly why you took XYZ off the LL?

A. With dozens of stocks coming and going daily, it’s physically impossible to answer everyone individually as to why stocks were added or subtracted to the list. In some cases, I’ll mention the reasoning during my service recording, especially if it was a former official recommendation that didn’t trigger. Study the archives to get a feel for my “rhyme and reason” on how I pick and cull the list.

Q. I got a “Landry List violation” from you when discussing a stock on the LL in the Facebook group. What’s that?

A. Due to courtesy of my other clients, I ask that you don’t discuss stocks on the LL until they have had a reasonable trigger. If an official recommendation triggers, feel free to discuss it.

Q. So, everyone in Facebook isn’t on your service?

A. Correct! Gold (only, i.e., not on service) members are welcomed in the Facebook group.

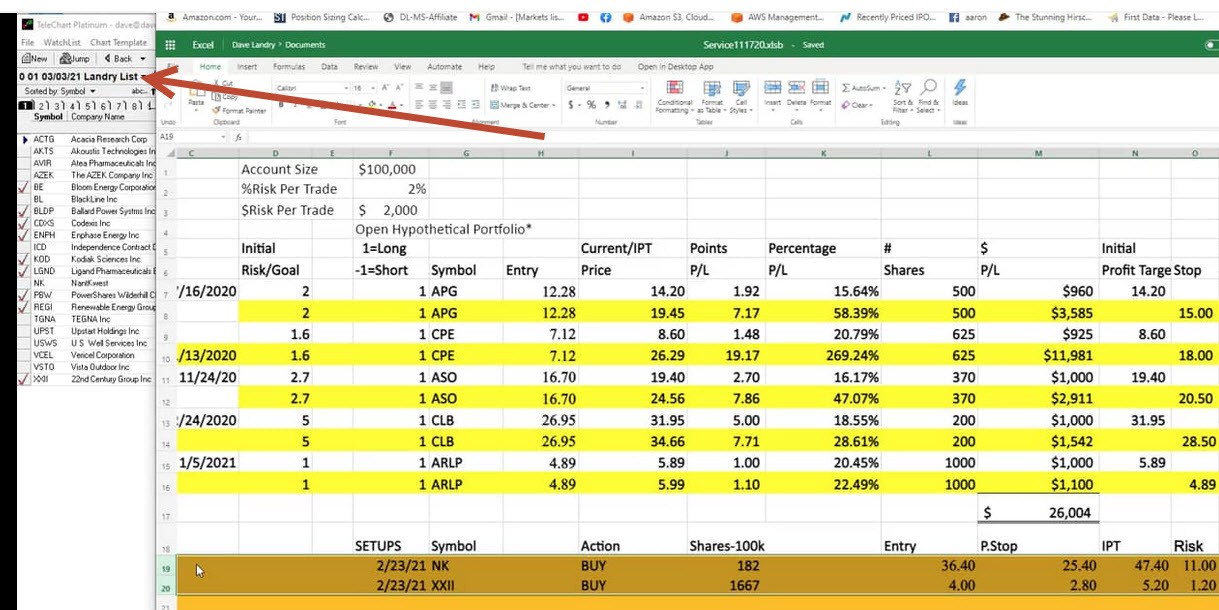

Q. Half of XYZ has hit the initial profit target (IPT) and has been exited. Why do you still show it in the open portfolio? Doesn’t that overstate the current performance?

A. The trade is to be viewed as a complete trade (i.e., a swing trade plus a trend trade). This way, you see the taken profits and open profits. When the trade eventually stops out, both the IPT portion and the stopped trend trade portion are removed. The real money is in the trend trade, so the IPT trade doesn’t really improve performance by that much. If it is a concern, just mentally subtract the IPT trades from the open P/L. For instance, if two stocks in the portfolio have the IPT (usually 1% of 100k=$1,000) then mentally subtract that from the total. A sample tracking sheet is available under Member’s Resource so that you can track the portfolio any way that you see fit.

Q. I missed the XYZ trade yesterday. Should I get in today?

A. It depends. If the stock is still set up, then yes. If it is trading below the entry (for longs), do not take the trade trying to “beat” the system. Wait for it to “retrigger” by trading ABOVE the highest high since the entry. If the stock is still in the LL after triggering, this means that it is still setup and worthy of trading if missed. Also, usually, I will point out those in the open portfolio that are setup. DO be careful not to add too many additional decisions to your process. It’s hard enough to trade without adding additional decisions. If you’re going to take a setup, then take it. Don’t let it trigger and then later decide. Doing this sets you up for failure.

Q. I’m new to the service, should I buy/short shares in my portfolio to mimic the open portfolio?

A. No. Wait for the next round of new picks. The one exception would be if the position is still a viable setup (like the answer above).

Q. I like XYZ on the Landry List. Can you give me the parameters for entry, protective stop, and initial profit target?

A. Unfortunately, I cannot. Unless someone is being mentored, my official policy is that I can not give one-on-one trading coaching. Study older services, the member’s courses, and premium courses to understand how to enter, set stops, and IPTs. I will be happy to discuss it in an open forum such as webinars and Q&A sessions so that all can benefit. Some members bring up the proposed ticker “crypted” (e.g. AZEK would be A**K) in the Facebook group for discussion. If you do, make sure that you tell us what you think the parameters should be. You can also “submit” the trade in the member’s area and I can then discuss your parameters to all. Unfortunately, sans a live webinar, it is likely not possible to do this on a timely basis (while the stock is still set up). I will occasionally give some suggestions in my nightly video on stocks that I like in my Landry List.

Q. Do you take all “official” recommendations?

A. I do. I try to adhere to the parameters as close as possible so that I’m doing the same thing that I am recommending. I do apply discretion on stop nicks, near misses on profit targets, use damage control and other discretionary things often discussed. For the most part, I work to adhere to my trading plan in the Service. In general, it you’re doing well with the stock, I’m doing well with the stock, and occasionally, vice versa

I do reserve the right to make trading decisions that might not fit the exact service trading plan. Like the Marian McClellan quote, I might buy stocks when I have money (maybe get a little more aggressive on position sizing) and sell stocks when I need money (or lighten up when I’ve been too aggressive, need to raise margin for other positions-whether the initial profit has been hit or not, or if the SHTF in my personal life). I usually will never enter before official triggers, but do reserve the right to do so. For instance, there might be special cases where stop entry orders aren’t accepted and am unable to wait for an alert on a trigger. In cases like these, when possible, I will wait for the stock to be trading for at least 15 minutes.

To avoid handicapping my trading in any way, shape, or form, as a general rule, any time 15 minutes after the first open after mentioned (i.e., you have “first dibs”), I reserve the right to trade “official” recommendations in any way that I deem necessary. Again though, I will work to adhere to the official parameters as much as possible. And, again, I will rarely enter before an official trigger.

Q. What type of performance should I expect?

A. It depends. In great trending markets, the service does amazingly well. In less-than-ideal conditions (i.e. choppy), not so much. Usually, during these times, I will show no or few setups. We mostly wait while I continue to look for opportunities. Keep in mind that with momentum trading, it can take 6 months or longer to capture a good cycle. Review the archives to get a feel for momentum cycles.

Q. Do you publish results?

A. No. I don't publish "official" results due to the amount of discretion involved (e.g., simple things like staying with a "stop nick" or taking profits on a "near miss"). Keep in mind that discretion is needed only every so often (maybe a few times a quarter). However, it can make a big difference. Also, there are times where you can "swing trade around a core position." This has been discussed in detail in the Week In Charts. Essentially, you're putting on shares and "flipping" them out while maintaining the core position. Due to the complexity of this advanced technique, I do not make official recommendations to do this. However, I will often point out what stocks in the portfolio are set up for an "add on."

I like to see the service as more than just a "tip sheet." I have daily education and show ancillary setups-such as those in the LL. Occasionally, stocks on the LL will really take off. I don’t “count” this, but to many it’s obviously worthwhile. I also analyze indices, sectors, commodities, bonds, etc.... I like to provide the fish but also teach you how to fish.

There are plenty of archives available so that you can get a feel for the service, warts and all.

There's no guarantees, and you won't get rich overnight but longer-term, most are pleasantly surprised. My best clients are those who chase others with inflated results and then come back to a reality-based system like mine. One other point, the open portfolio does not account for compounding. Obviously, this cuts both ways, but longer-term, compounding should be very beneficial.Ask others in the Facebook group for their 2 cents and ask how long they’ve been on the service. I think that you’ll get a vote of confidence.

Don't see the answer to your question?

Bring it up in Facebook and we'll address it there.