Random Thoughts

Random ThoughtsOn Monday, the market sold off hard and the naysayers came out of the woodwork-AGAIN. They also continue to poo poo the incredible bull market in China. Predict early and often I suppose. Me? I just follow along. As I have mentioned ad nauseam, I’ve given up trying to look smart years ago.

Yes, sooner or later the Chicken Littles will be right. The sky will fall but so what. Stops will take us out of our winners and we might just fire off a short or two. Like Salt-N-Pepa pushing it, it’s what we do—we follow “real good.”

Let’s look at the scoreboard.

The Quack (Nasdaq) sold off fairly hard but recovered to close flat on the day.

The Ps (S&P 500) and Rusty (IWM) were a little bit more impressive. They also sold off hard but reversed to close in the plus column by over ½%. Although they have been sideways as of late, I’d continue to err on the side of the longer-term uptrend as long as they are just shy of new all-time highs.

And now, for something completely different, here is the recording to Tuesday’s Getting Started Trading IPOs Webinar:

Looking to the sectors:

Metals & Mining continue to bang out new highs. Steel has been especially strong here (you’re welcome). And, Brazil (EWZ) has been strong (read further). So, what could be better than a Brazilian steel company? I’ll walk you through this one in tomorrow’s chart show.

Banks, which looked pretty dubious not that long ago, have continued to claw their way higher. I wouldn’t rush out and buy them but this certainly scores as a positive.

The bull market in IPOs continues. Lately there’s been a demarcation between the good guys and the bad guys. This is a good thing! Channeling Will Rogers, buy the ones that go up and avoid the ones that go down. See last night’s webinar for more on this and the P.S. below. I’ll also cover ones that are currently set up in tomorrow’s chart show.

Again, China (FXI) is still on fire.

Brazil (EWZ) took a breather but so far, a major bottom appears to remain in place here.

All wasn’t great in the world. Drugs and especially the Biotech subsector continued their slide. They did manage to close off their worst levels but they were still down significantly nonetheless. Make darn sure you wait for entries on any new positions here in light of this action. And, of course, honor your stops on existing positions.

Bonds (TLT) sold off fairly hard (bonds down means interest rates up). As I told my peeps last night in my Core Trading Service, a top appears to remain in place here basis a Bowtie off of all-time highs. Pay attention to what’s going on here but remember that intermarket technical analysis only matters when it matters. Hopefully, and I hate to use the word hope in this business, the market can continue to shrug this off.

We could be seeing the beginning of a so called rolling correction. This means that stronger areas begin to sell off while the torch is passed to those emerging from lower levels. That’s fine with me. We’ll get stopped out of some drugs/biotech and other technology and our Latin America Stocks, Steels, lower level Chinese stocks, and Energies will become our next homeruns—hopefully (oops, I said it again, Ni! “What sad times are these…Even those who arrange and design shrubberies are under considerable economic stress…”; remember, this piece is called Random Thoughts—what did you expect?).

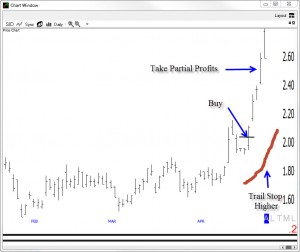

So what do we do? I’m still liking the emerging trends in second tier (lower level) Chinese stocks, Energy Stocks, Steel Stocks, Brazil, and of course Brazil Steel stocks. For now, I think these areas offer the best opportunities while the previously strong areas such as Drugs/Biotech find their way. As usual, continue to practice sound money and position management. Stops will take you out when the trend ends and waiting for entries can often help you avoid stinkers altogether.

Best of luck with your trading today!

Dave

P.S. Thanks to everyone who attended the Getting Started Trading IPOs webinar last night. I really appreciate you taking time to listen to what I have to say. We had a good bunch with great questions. Anyway, I’m putting together the list of things promised (IPOs that are currently setup, IPO watchlists, the recorded link, promo code etc…) and will be sending it out later this morning. If you registered for the webinar, you’re already on the list. If not, Click Here to be added to the list (register even though the webinar has ended).

Free Articles, Videos, Webinars, and more....