One Last Shake Out?

As I have been saying, I think the best thing for this market would be one last big shake out and then go on to make new highs. This would take out the nervous nellies, Jonny-come-latlies, and insert-your-favorite-name-for-the-so-called-fast-money here. These are the fickle traders that are the last in and first out. And, they can really mess up perfectly good positions. It would also attract some eager shorts. All of this would help clear the way for a leg higher. That’s what I’ve been hoping for.

It’s okay to hope, just don’t make that your strategy. As I wrote back in May, (read the full column here) quoting an email from Tom McClellan:

I’ll add one more for your quotations list, from my cavalry squadron commander in Buedingen, Germany, Lt. Colonel Don McFetridge: “In military operations, as in birth control, ‘hope’ is not a strategy.”

Getting back to the “shake out” thing, I think Thursday’s action on top of recent weakness qualifies as an enough to raise an eyebrow.

Let’s Look At The Carnage

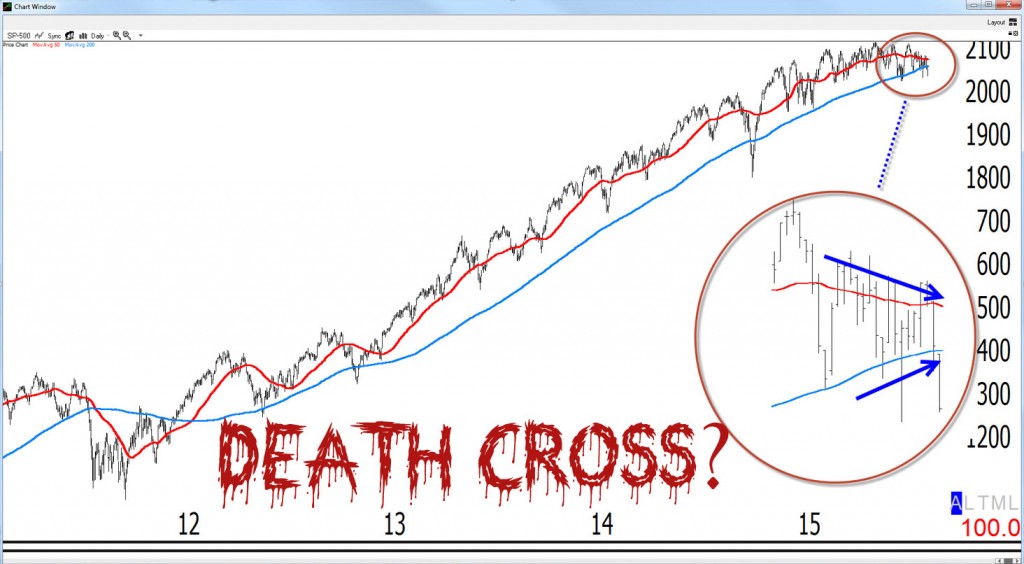

The Ps (S&P 500) sold off hard, losing over 2%. This action puts them below the well watched 200-day moving average.

The Quack (Nasdaq) lost nearly 3%. This action has it closing below its 200-day moving average. This scores as a bummer because exactly a month ago it was at all-time highs.

The Rusty (IWM) is looking pretty ugly—how’s that for an oxymoron from a Trend Following Moron? It lost 2 1/2%+. That means that it’s down nearly 10% in less than 2-months. This action keeps it well below its 200-day moving average. It now has 3-days of “daylight”—highs below the moving average.

The sector action was also pretty ugly. I thought about giving you a detailed breakdown but I didn’t want to bum you out. Just know that Gold and Silver ended higher but that’s about it. The selling was indiscriminate.

The 50-day moving averages and the 200-day moving averages are converging in the indices. This could create the so called “death cross.” I don’t pay a lot of attention to the Dow but for those keeping score it has already crossed over.

I think this pattern gets a lot of coverage because of its silly name. I should probably name the next pattern that I discover “The Hot Chick In A Little Bikini.” Oh, my apologies, I got distracted looking for some clip art to match that-I know, tough job I have here (btw, sorry guys and those girls who are into that, I had to black out the interesting bits to keep my column PG-13). Where was I? Oh, it doesn’t mean the end of the world. We actually had 2 death crosses in the S&P since 2009 and nothing really happened. This was covered in the last couple of Dave Landry’s The Week In Charts. Here’s the latest. Check it out and let me know what you think.

I think this pattern gets a lot of coverage because of its silly name. I should probably name the next pattern that I discover “The Hot Chick In A Little Bikini.” Oh, my apologies, I got distracted looking for some clip art to match that-I know, tough job I have here (btw, sorry guys and those girls who are into that, I had to black out the interesting bits to keep my column PG-13). Where was I? Oh, it doesn’t mean the end of the world. We actually had 2 death crosses in the S&P since 2009 and nothing really happened. This was covered in the last couple of Dave Landry’s The Week In Charts. Here’s the latest. Check it out and let me know what you think.

Is This Time Different?

Will this time be different? I dunno. Any trend following signal that signals the market has been heading lower, or simply a net net negative change (e.g. like the aforementioned Rusty down 10%) is not a good thing. Unfortunately, there are no lines in the sand or a place with the switch will get flipped.

How Do You Know If You Don’t Know?

Simple (notice I didn’t say easy), you let stops take you out of existing positions and be super selective on new ones.

So What Do We Do?

Again, make sure you honor your stops on existing positions. I’m totally okay with getting stopped out and being flat when conditions worsen. Oh, trust me, I’m not that calm. I’ll drop an F-bomb or two in the process but after all is said and done (and isn’t a lot more usually said than done?), I’m okay we being flat in less-than-ideal conditions. As I showed in yesterday’s chart show, sometimes it’s always darkest right before it gets more dark. Sometimes, you have to sell first and then ask questions later. “Selling first” does not mean that you exit at the first signs of adversity. If you always did that, you’d never ever catch a trend. That, I can guarantee. What it means is that you honor your stops and let the market take you out if that’s what it wants to do. Making the decision a passive one vs. an active one will keep you from hoping if things truly do get uglier. If you do end up flat, you’ll soon find that you’ll be able to see conditions more clearly now that your bias has been removed. Do be super selective on new positions. If you’re new to my chart shows, you’d think, like Mikey, he hates everything! It’s not that. It’s just that a setup would really have to knock my socks off before I put capital into harm’s way in this market. If the market doesn’t snap back, and soon, we’ll likely start adding on the short side.

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....