Random Thoughts

by Dave Landry

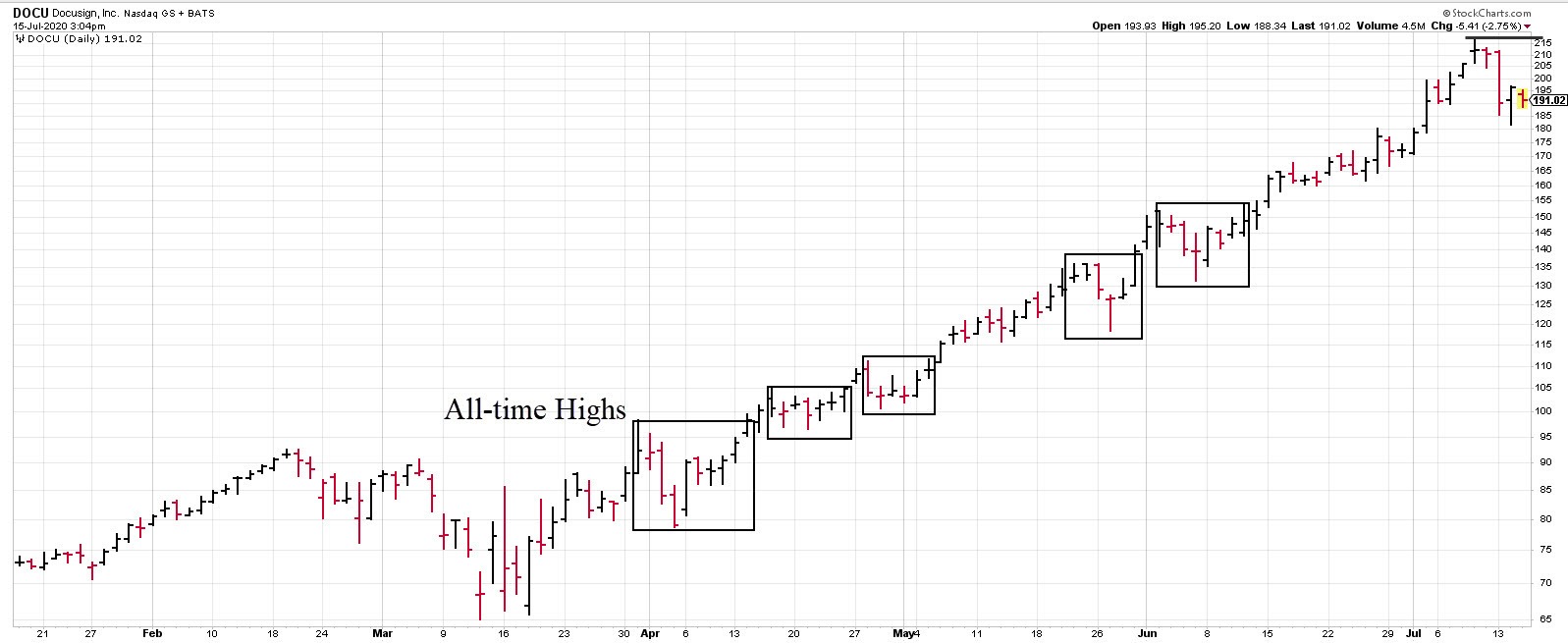

A client recently pointed out DOCU-a stock that had been trending nicely for a long, long time. I explained that although I can see a TKO, I didn’t take it (although it did make the cull*). I went on to explain that DOCU reminds me of a “box stock.” These are stocks that just trend and trend and trend, making “boxes” (i.e., trading ranges) on top of “boxes,” often without obvious setups to help you get in. This prompted me to dust off my well tattered and torn copy of “How I Made $2,000,000 In The Stock Market” by Nicholas Darvas. Despite sounding like a cheesy YouTube stock market "guru" salesman (aka a "false prophet," or better yet a "false profit"), the book’s actually pretty good with a few caveats.

Spoiler Alert

Okay, since the book was first published 60-something years ago, I’m going to go out on a limb and say it’s been out long enough to give up the plot. If you don’t like surprises, get the book here, then come back reading it.

“Dancing With The Trend**”

Darvas was a dancer who traveled the world in the 50s and stumbled into the stock market. He was once offered stock in lieu of payment by “the Smith brothers,” and he agreed. Although he later wasn’t able to dance the gig, being a forthright gentleman, he decided to pay the Smiths in full for the stock with one caveat. He asked the Smith brothers to cover any losses below his purchase price. They agreed for up to 6-months.

Darvas had all but forgotten about the stock until he saw the stock’s price in the newspaper two months later. His profits were nearly $8,000. He promptly sold the stock and wondered, “How long has this been going on?” Willy nilly, he began trading and systematically lost money. Like many of us who chase our initial success (guilty), he started his quest to figure out stock trading.

Like virtually all of us (my trading office is littered with trading books), his initial success followed by failure put him on a Grail hunt-reading over 200 books.* (note: I haven't verified this, the book only list 7).

Slowly but surely he began learning expensive lessons. These included, but not limited to: Don’t chase tips. Don’t buy companies just because they’re considered good companies fundamentally. The attitude of the market affects your stock price. And, you make a lot more money in one stock that’s going up and keeps going up longer-term than you do trying to trade many stocks shorter-term.

Although he would later interject fundamentals back into his methodology (which I take issue with), early on, he learned that you could make money in stocks that are going up without knowing anything about the company. This led to his “box theory-“stocks in great trends went higher and higher, forming “boxes” along the way.

He would go on to make millions with his boxes while he danced around the world (and lost money when he wasn’t dancing, keep reading).

Trading Outside The Box

Before we get into my interpretation of the Darvas’ methodology, just know that a quick Google shows that it’s open to a lot of discussions. Also, the Q&A in the book shows that there is a lot left to interpretation. The scope of this article is not to define his methodology to a “T” but rather to discuss lessons that can be learned from him. Could it still work? And, if not, is it still of some use?

The Box Defined

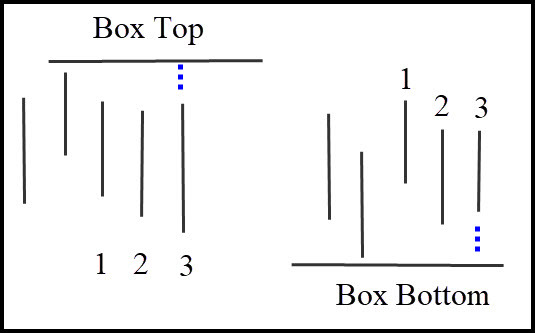

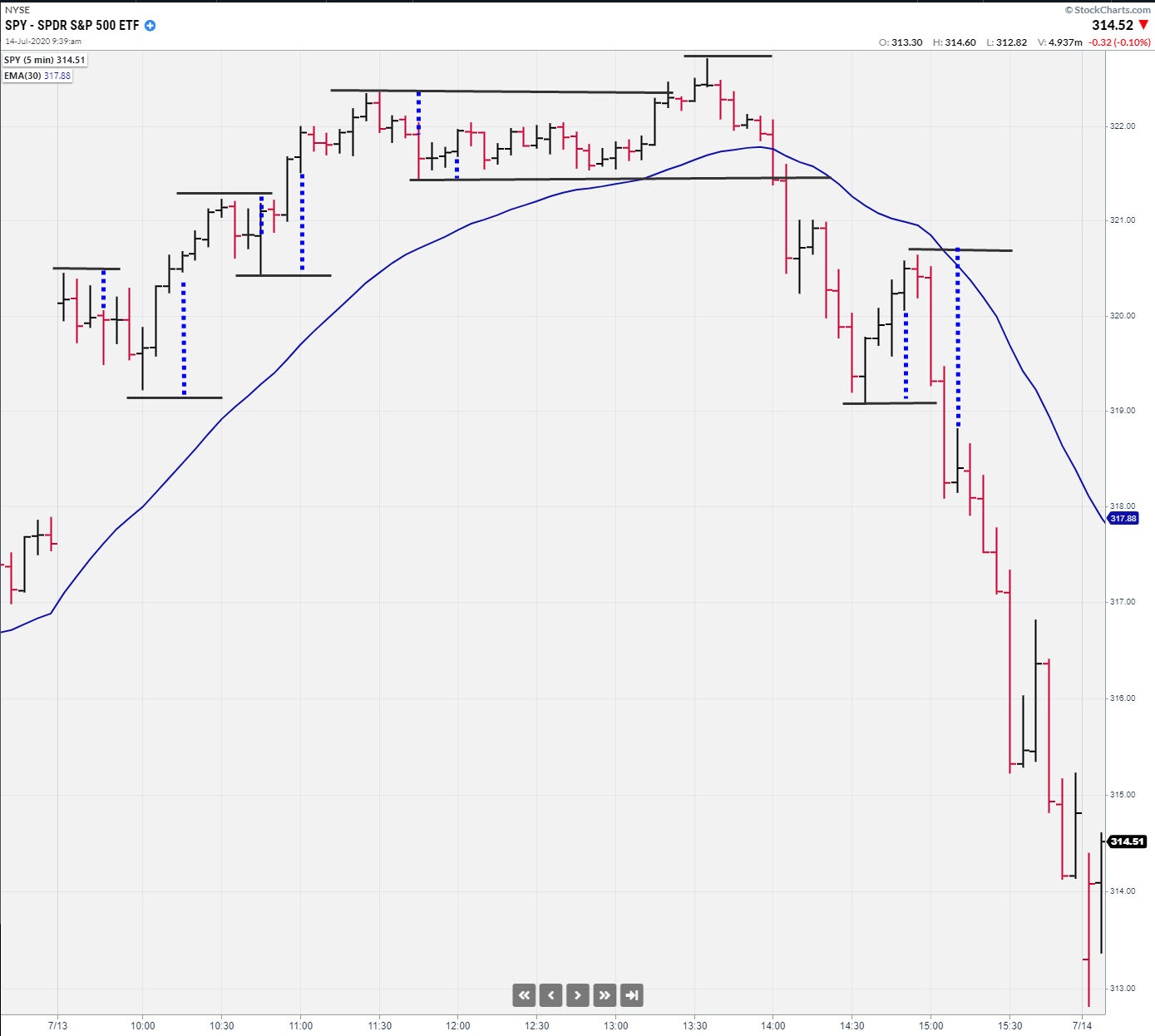

Darvas defined the top of a box as a high “that was not touched for three consecutive days.” Conversely, the low of the box was a low that wasn’t touched for three consecutive days. Below is my “take” on what Darvas defines as a box. Keep in mind that the box top or bottom is unknown until a minimum of three days after a new high/low. The blue dotted line below defines when the box top/bottom is confirmed.

Darvas would buy stocks when they were making all-time highs and breaking out of the top of their box. He instructed his broker to buy when the stock rallied 1/8th above the box and then to immediately place a stop 1/8th below the top of the box. BTW: To you whippersnappers, stocks used to trades in eights. And yes, I remember when decimalisation came along!

By accident, Darvas discovered a simple trend following system which made him millions while he danced around the world. Like many, including Jessee Livermore, he assumed he'd make much more if he were closer to New York, so he set up shop there. He quickly learned that being too close to the markets lost him money. The zigs and zags caused him to chase his own tail.

Be As Close To The Market As You Need To Be, But No Closer

I think we've all been there, sucked in by the "flickering ticks." I know this all too well! In the early 90s, I turned in my resignation from my dayjob and went sailing in the West Indies. Back then, there were no cell phones. The captian had a rented satelitte phone but it was a little spotty and was $20 a minute--and that's when $20 was still worth $20! Even though I assured him that I'd re-imburse him, he wasn't very keen on me checking in often. When I returned to the states, I grabbed an IBD in the airport and was thrilled at how much money I made while on vacation. When I got home, I sold everything-feeling like a genius! I then watched in anquish as my postions took off without me. I would have made many times my booked profit had I stayed on vaction. This was my first lesson in being as close to the market as you need to be, but no closer. Over the next few months, I found that I did much worse staring at a screen all day than sneaking a peek here in there at work-or in the West Indies!

Some Critisisms

Funny Mentals

Since many of the stocks in the book have doubled and even quadrupled before Darvas began trading them, one has to wonder did fundamentals caused him to be late to the game? Yes, these were big winners for Darvas but you could’ve made 10 times as much by applying a system earlier in the trend.

I often joke that one day I’m going to create a system that requires a stock to have bad fundamentals. I suppose I already have. Virtually all of my great winners would know fundamental if it hit them in the ass. The reason I like the stocks so much is that they trade purely on emotions. There is no fundamentals to muck things up. Not making a dime off of their holograms or unmanned aerial business. However, obviously many think that someday they will. Apparently, there’s a bright future for holograms and unmanned aerials!

Think about why you buy a stock. When I speak in person I often ask why should you buy a stock? Most of the time I get several well thought reasons until finally someone says “to make money.” And that’s the only reason to ever buy stock. There has to be a potential for greater fool to buy it from you in the future. No one would ever buy a stock because they think it will be worth less in the future. So the only reason to ever buy a stock is because you think it will be worth more in the future . Here’s only one reason to ever buy a stock. I know by now you’re thinking big Dave need to change his name to Capt. Obvious, but you be surprised at the reasons people give for why they bought a stock.

The promise of the future is key

Darvas was in the right place at the right time

Long story endless, I had some brief business dealings with a trader who made $80 million. When we met, the first thing I did was ask about the $80 million. He told me that the story was true. As my eyes lit up, he then said "Dave, there's no way that I could do that again in today's markets." He truly was in the right place at the right time.

Now the proof is in the pudding-you can’t take away the fact that he made $80 million. There were a lot of other people that were in that same right place at the same right time. Obviously, some of that 80 million came from the pockets of traders who missed this golden opportunity. You have to recognize the opportunities as they occur. The trader told me that truly was man with one eye in the land of the blind. The point is that being in the right place at the right time does you absolutely no good unless you realize where you are. True, Darvas was in the right place at the right time, but he was smart enough to recognize where he was. As a side note, I’m seeing some “church of what’s happening now” opportunities. As traders we must be vigilant to recognize when we are in the right place. With many speculative stocks blasting higher, now could be one of those times. As speculators, we must constantly ask ourselves, are we in the right place at the right time?

In addition to recognizing that you're in the right place at the right time, you also have to recognize when you're no longer in that place and time. I've had a few clients and one good friend (keep reading) who have done some amazing things by being at the right place at time but then subsquently blow up. Darvas himself got a little too full of himself and nearly lost it all.

Everything works better with trend

I’ve seen some amazing things in the markets. I was up close and personal with close friend who parlayed roughly 5K into nearly a million (I saw statement at $985k, so I'm assuming at some point, it was likely well over 1M). Unfortunately, he round-tripped the account (and showed up on my doorstep on the way down-two drink minimum on that story). The last statement I saw was less than a thousand. The broker had shut down his account because he obviously didn’t know what he was doing (I seem to remember nearly those exact words). Their paternalism was just a tad bit late, don’t you think? Sheez, it sure would’ve been nice for them to shut him down when he was down half a million so he still had half a million left to maybe re-think his stock market prowless. Anyway, I digress. Hey, what do you expect from a column named “Random Thoughts?” The point is a) recognizing when you're in the right place at the right time and b) not letting it go to your head--because eventually, you will no longer be in the right place at the right time.

Repeatability is key. The aforementioned edge exploited to make $80 million no longer exists. Darvas’ concepts, sans his later addition of fundamentals, remains conceptually correct-be willing to be wrong small in attempt to be right big, and be willing to hold big winners because they have the potential to become even bigger winners (although he did occasionally violate these rules). Unfortunately, at least in it’s present form, it would not likely allow you to turn 10k into 2m.

Critisisms

Darvas Micromanaged

Darvas caught some big winners, but some of these could have been even bigger winners. He violated his rules and sold some of these positions way too early. He micromanaged. For instance, on his first big hit, he made $21,000. He cashed out early to prusuit another opportunity. Had he stayed with this one stock, he would have made nearly double that amount.

Darvas Overleveraged

At several times, Darvas had his entire account times two via leverage in one stock. Should a trading halt go against him, he could have easily blown up. The quickest way to make a fortune on Wall Street is to bet big on one thing. It's also the quickest way to blow up. As an example, Larry Williams claim to fame was turning $10K into $1M in a trading contest. However, at one point during the year, he was up over $2M. Larry's wife refers to this year as "the year he lost a million dollars."

by cashing out d Dor although darkness is could have used a little more money management. Taking partial profits and sticking with the huge winners I think his initial Simple TFM stuff such as taking partial profits

when faced with the decision model the

I’m not a big fan of pyramiding. I believe that you should enter your entire position at once and then look to take money off the table once the initial profit is hit. All this is fodder for another conversation and debate. My take is that “all in” in the beginning allows you to look to establish a “free” position and reduce exposure. Put the risk on and then look to reduce it as opposed to adding risk. This free position, barring overnight gaps, has the potential to turn it’s a homerun. Darvas pyramiding his positions, but he did so properly. He only added to winning positions. The worse could happen is that you scratch out on the remainder of the position you have a chance at a homerun Divers

as force loss during their

2 ¼ million in one stock (TXN) alone.

Darvas claimed to put in a stop just below the breakout point. I find it hard to believe that he wasn’t nearly always stopped out. And, many of the questions to him asked the same. In today’s day and age, I can all but guarantee that 95% of the trades would likely stop out.

“poor darvas” someone said because he didn’t have today’s technology. The “poor Darvas” aspect is what made him rich. Is what made him rich!

Daravs’ initial stop loss was “1/8th below the ceiling through which the stock broke through.” He went on to say that he instructed his broker to place the stop order immediately after the purchase of the stock. I would imagine that more often than not he would’ve been stopped out on positions due to normal backing and filling. True, usually your best positions trigger never look back, but a “look back” of at least an eight would seem virtually inevitable. Jeez, I remember “1/8ths!” and years later what a big deal it was when decimilazation came along, but I digress. More to the point. Darvas said that he “expected” to be wrong at least half the time. With such a tight stop, I find it hard to believe that he wasn’t stopped out much more. Maybe conditions in the late 50s were so great that enough stocks triggered and never look back to make such a tight stop viable. And, with a breakout methodology, you win in the end by being wrong the majority of the time while waiting for the occasional homerun.

. In today’s day and age, I can all but guarantee that 95% of the trades would likely stop out.

If I can figure out a way to identify back stocks I ahead time, you never see my fat ass again. What I have accomplished, to some degree, is a method for getting in the stocks that have both short-term and long-term potential. Through good stockpicking of stocks in solid or emerging trends that are set up for a great swing trade with the hopes of returning in something bigger in writing that something bigger via taking initial profits and trailing an ever loosening stop higher. As you

Die a death of 1,000 cuts.

At one point, Darvas was stressed because he had a big winner wasn’t sure what to do with it. He held on in the big winner turned into a much bigger winner. True, I believe in holding you winners as long as possible, but in the case of a huge windfall you should sell down to the sleeping level.

Excessive risk was taken. Sooner or later, you’ll get a 50% haircut overnight in the stock. "IT", spell the silent SH, happens. Darvas, at one point with over 2 million in one stock alone, could have been nicked for million dollar loss. True, the odds of this happening might be low, but still possible. A rouge CEO who decides to fondle his secretary or cook the books could decimate a stock. There are at least “50 ways to lose your money” in the stock. The company could get sued, their product could fail, and a plethora (well, at least 46 more) of other bad things could happen.

One of the first things I learned in technical analysis is to pay attention to pivot points. A pivot point is a high “surrounded” by two lower highs (one on each side) or a low surrounded by two higher lows. I’ve always paid attention to pivots since if the market is to begin trending it has to take out a pivot point. Darvas, defined the top of his box as a high that is not touched for three consecutive days in the bottom of his box as a low that is not touched with three consecutive days.

Breakouts, especially in today’s markets where everyone has a computer sitting on the desk (or phone in their hands!), are prone to failure. I have crossed paths few successful breakout traders, but they’ll tell you flat out that they might be wrong 9/10 times.

I like to flip the script a bit and Darvis boxes are quite simply just pivot points to help keep me out of markets when they are just shopping around. For instance, let’s say the futures are a big and I’m looking to play an intraday opening gap reversal or possibly a gap and go trade. I know that I must be extremely careful to jump in on the first move because that often can be a false one.

Doris waited for all-time highs before entering a stock. Conceptually, I get it. The stock has to really prove itself. However, the big opportunities come long before a stock hits all-time highs. A stock may double triple or even quadruple before begins to bang out new highs. This is why I like Bowties of major new lows. Stocks can rise from the ashes for a long time before making it back to all-time highs. This is especially true in commodity related stocks or stocks that have just gotten really beaten up due to a sector or secular bear market.

I think the big opportunities come long before I can’t fault him for

If it seems like I’m being over critical of Jarvis, I’m not. Reading his book early in my career really got me thinking about technical analysis. Although I could pick things apart quite a bit, the bottom line is every time I see a box stock I’m reminded of Doris and how simple techniques can help to get you into amazing trends.

In summary

although I picked apart Mr. Jarvis a bit, I actually like the book and have re-read it several times. I also recommend to all traders, old and new alike. The bottom line is that there’s something there. Figure out how to get into and hang onto “box stocks” and you’ll own the world. Obviously, knowing what stocks will become box stocks would be a holy Grail. No one knows the future brings. Conceptually buying stocks that are rising and exiting them when they are dropping makes a lot of sense. Unfortunately, the breakout characteristic of the methodology could have you dying a death of 1,000 cuts. Use setups to get you into trending stocks with solid money management and you just might catch the next box stock.

No one knows what the future brings.

Takeaways

Takeways And My 2 Cents

Although Darvas did incorporate fundamentals, he recognized the fact that he made money on some of his early trades without knowing that they

A Fundamental Argument

Darvas would later add back fundamentals to his trading. I would venture to say that caused him to miss a lot of great stocks. In fact, stocks without fundamentals trend purely on emotions. And, stocks that trade purely on emotions are a technicians dream. I often joke about creating a trend following methodology that requires a stock to have poor fundamentals. I suppose because most the stocks I trade would no fundamental that in the ass, I already have.

Without going off to far on a tangent on an anti-fundamental rant: With fundamental analysis you buy something that you believe is of value and you hope that someone will recognize that value and bid up the stock price. With technical analysis vis-à-vis trend following, somebody already has. Trading, like life, is all about timing. If you time your trades right you make money – assuming that you have the discipline to take partial profits and trailer stop higher for when, not if, the trend ends.

I recently heard of the fundamental base system designed to get you into big winners. This piqued my interest. In the “fine print,” so to speak, they mentioned that it might take 27 years for one of the stocks to pay off big. Channeling Sweet Brown: “Ain’t nobody got time for that!”

Channeling Schabacker, fundamentals suggests what a stock ought to do whereas technical analysis is what a stock IS doing.

Darvas would "pyrimid" his winners. He would buy more stock as the position moved more and more in his favor. I "get it." He felt that he felt that pressing would parlay his winners-and it did. It's certainly a much better strategy than averaging down. Unfortunately, prymidding is one of those "that'll work until it don't." A 50% overnight haircut in a huge position can reak some serious damage to an account. At one point, he had over $2,000,000 in one stock alone.

I believe in putting on the entire position at once and then looking to take risk off.

and, there was a TKO. I did a quick check of my “Landry List” for that day and the stock made the cut. Unfortunately, I liked other stocks better , but since I didn’t tthere was nothing really glaring that would’ve jumped out at me as a set up that I would have had to take (there was a Trend Knockout after a persistent trend, but checking my watch list for that day I noticed that the stock didn’t make the cut)

could probably point out a few of my patterns such as a TKO that would have got you into the trend*, but I didn’t personally take it nor did I recommend it.* -

I do like the way Darvas kept his new positions on a short leash and then later losened the reigns as they began to trend in his favor...

Open profits, Dennis.

Psychology Is Key

Through making and losing money, Darvas learned a lot about trading psychology. "The truth was that as my pocket had strenthened, my head had weakened." As anyone who has been trading more than a month knows, your biggest losses tend to come right after your confidence skyrockets from making a lot of money.

Enter On Stop Orders

Darvas would telegraph his stop entries and then go about his life. I fully agree! I do the same. Many times, I'll discover a new stock in my portfolio that I have all but forgotten about. And sometimes, it's a nice little present-I'm alread up nicely. Using a stop entry order lets the market "make the decision for me." As I preach, you can't make a decision without emotions. And, the more decisions that you make, especially in the heat of battle, the more stress you put onto yourself. This is why inner city ER doctors, air traffic controllers, and daytraders have a high burntout rate. Entering on a stop entry order ensures that the stock is moving in the right direction. True, it could promply reverse, but at least at that moment it's headed higher.

Use Strict Money Management

Darvas instructed his broker to immediately place a stop loss order upon getting filled.

With the exception of IPOs, I'm not a big fan of breakouts. More often than not, breakouts fail. I've crossed paths with a few successful breakout traders throughout my career. They'll tell you flat out that their win rate is abysmal. However, we they do win, they will big.

Alternate Uses

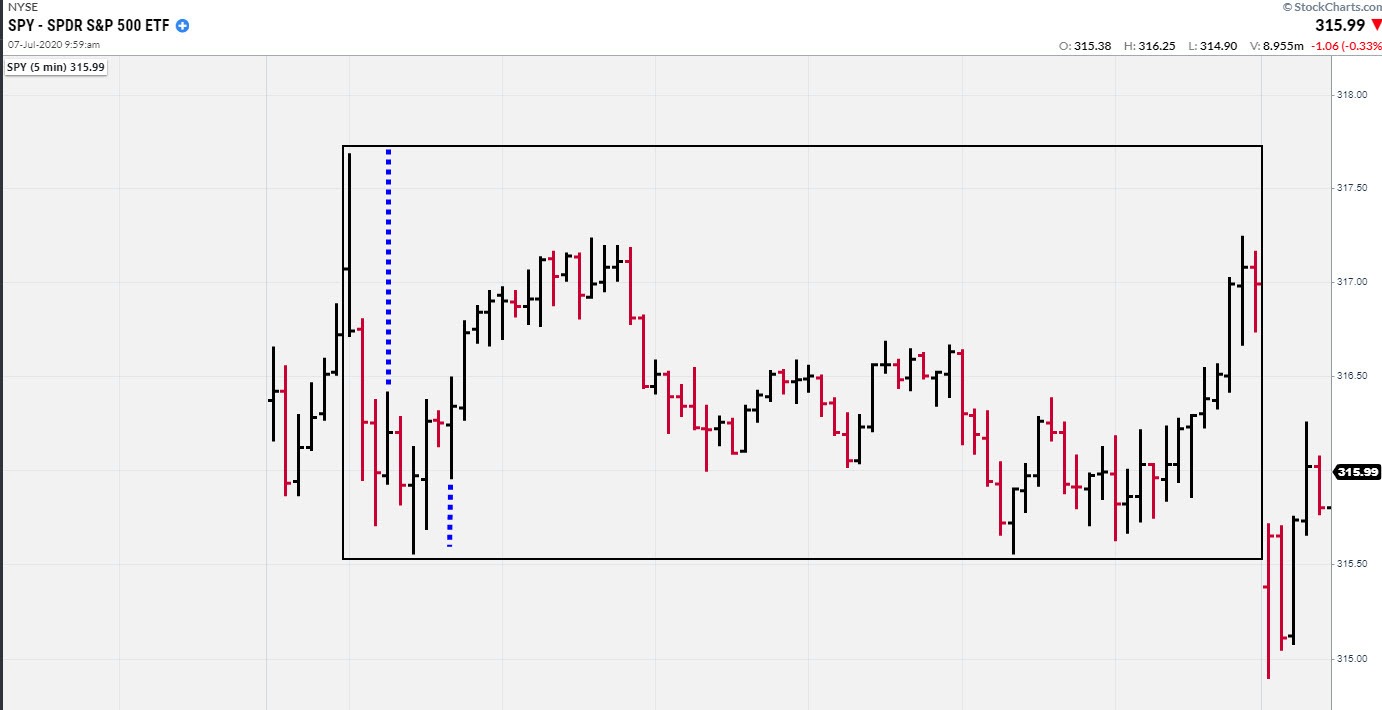

I've learned early in my trading career (and occasionally re-learn often in the S&P Futures!) that choppy markets will chew you up. And, knowing when to stay out of the market is just as important-or even more important!-as knowing when to get in. In fact, if you could avoid choppy markets, you'd own the world. Obvioulsy, the goal of the Darvas Box is to get you into a trend, but what if you flipped the script and used it to keep you out of choppy markets? I like to draw ranges on the SPYs once they are established intra-day. This helps me to realize that I probably should sit on my hands as long as they are rangebound. Using Darvas' technique, notice that an hour or so of trading, the SPY stayed within the box for the remainder of the day.

Now, everything works better with trend. Notice "Landry Light:" lows > the moving average for uptrends and highs < moving average for downtrend, would have done a fantastic job of keeping you on the right side of the market all day. Reduced further, just a simple moving average crossing would have done an even better job of keeping you on the right side of the trend. Again, everything works better with trend.

Notice the green Landry Light below would have kept you in the marked while it was going up and the red Landry Light would have kept you out or short the market.

Everything works better with trend. Notice that 30ema Landry Light would have kept you on the right side of the mareket all morning and all afternoon on 07/12/20.

My way of getting into hopefully-soon-to-become box stocks is to simply trade pullbacks (e.g. TKOs) or transitional patterns (e.g., Bowties).

A Good Place To Start

I have a new client that's new to trading. He devouring text after text on trading. He's a sponge. This is typical pattern which often results in a Grail hunt and the lenghty trader's journey. Instead of trying to learn everything, why not learn one thing first?

Darvas' book should be book read early in the trader's journey and re-read when you begin to stray into multiple indicators or the arcane. Learning that stocks can move without meaningful fundamentals and "all you have to do" to profit from a trade is to capture a price move (i.e., don't confuse the issue with facts), have a money management plan in place-ride your winners and cut your losses short, trade in more volatile issues (within reason, although now, there is NO reason!), stocks often move in the same direction as the overall marekt-even good stocks!-so know if the tide is rising or falling, avoid tips and rumors, one good stock held for a long time is better than juggling a "dozen stocks for a short period of time," when you find a stock you like, see if it has any sexy sisters or brothers that might look even better, a stock can do anything, you're going to be wrong-a lot!, pride and ego must be kept in check, trade when the odds are stacked in your favor, "hold rising stocks and sell the ones that fall"

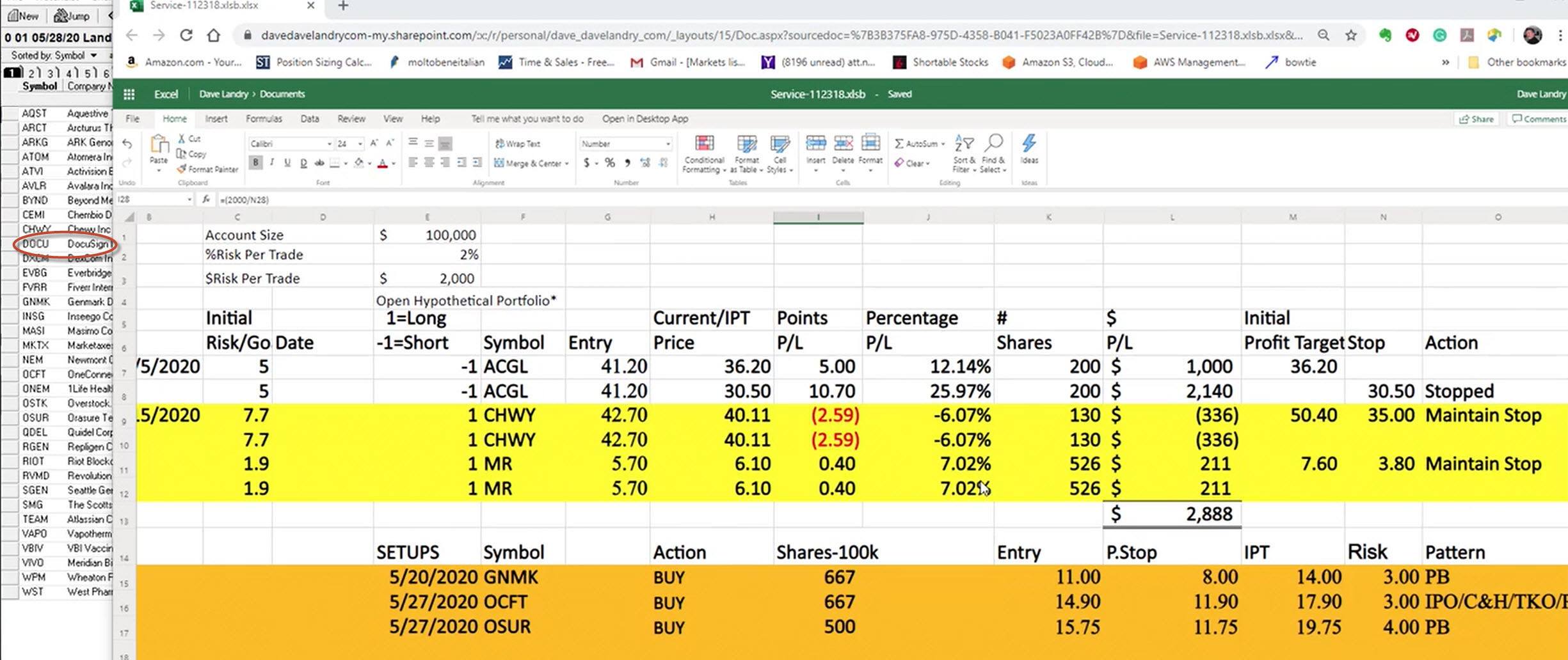

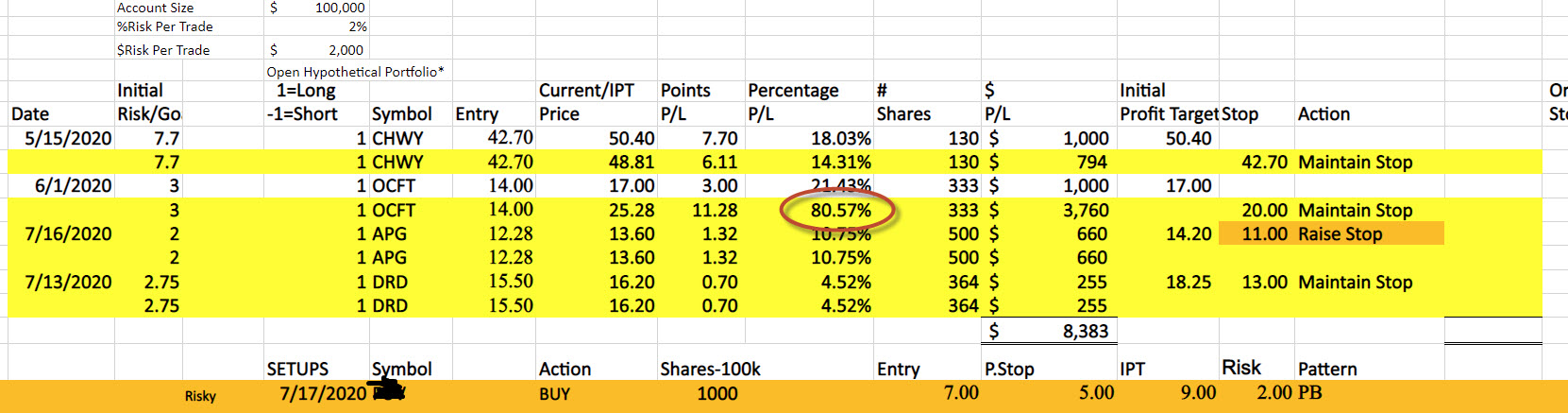

*Looking to my Landry List from 05/28/20 (published on 05/27/20), I was please to find that DOCU did make the cull as a TKO-at least it was on my radar! Now, my list was pretty big that day, so I'm not bragging. The reason I didn't take the trade was because I liked GNMK, OCFT, and OSUR better-making them official recommnedations. GNMK later took off but never triggered within my parameters of my Core methodology :(. OSUR didn't trigger either. Fortunately, OCFT triggered and took off (scroll down) and knock on wood, so far is approaching triple digit gains.

Here is a portfolio snapshot as of 07/21/20. Notice OCFT, picked over the DOCU "box stock," has done well so far (still knocking on wood!)

Commited To Commitment Devices

..built an iron fence...

**A line borrowed from Greg Morris. Fun fact: Greg wanted to name his latest book this, but the publisher decided against it. He did title his blog over at StockCharts.com "Dancing With The Trend."

*I saw a blog post on this but cannot confirm. The book only list seven books.