Random Thoughts

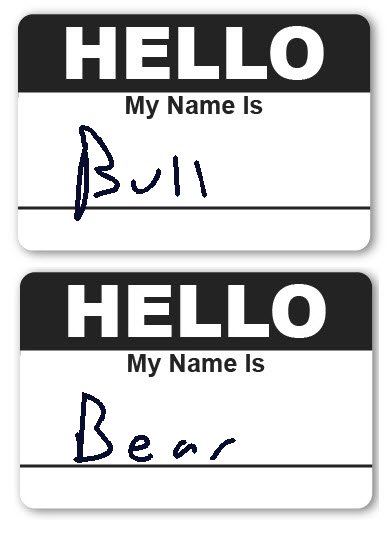

Random Thoughts“Be like water” is a common analogy used in trading. You really do have to go with the flow. You have to be careful not to label yourself. If you are a bull then you find reasons to justify a market’s slide-“Notice the 50 (or 200 or 500) day moving average has held”, “This is a positive development, just what the market needed, a healthy correction.” The converse is true if you consider yourself a bear-“This is only a corrective wave”, “This rally is a gift, a chance to get in at better prices.”

Believe in what you see and not in what you believe.

So, how do you go with the flow? You do your analysis, listen to the database, and let the market prove you right or wrong. Make decisions passive ones and not active ones. On new positions, resist the temptation to get in early, to seek a bargain. Let entries trigger you in. There’s no guarantee that the position will continue to move in your favor, but at least it going in the right direction when you first get in. On existing positions that aren’t currently performing, let your protective stop keep you in just in case the market is correcting or consolidating. And, let the stop take you out if it is not.

The S&P is down 1% since late May. In the same time frame, we have one long position that is up nearly 90% since then (I’m not saying this to brag, I wish there were a lot more). The point is, if I would have bailed as soon as things got a little iffy in the market, I would have missed out on one of the (admittedly few!) big winners of the year. And, these outliers are crucial for the methodology.

Don’t micromanage and/or try to outsmart the market. Again, let the market make as many passive decisions for you as possible. Avoid labels and be like water.

I have an article in this month’s Traders’ magazine Click Here-“Doing The Right Thing,” pg. 22

Now, to the markets:

The Ps put in a decent rally, gaining over 3/4%. So far though, the recent slide/Bowtie remains intact and they only appear to be pulling back.

The Quack managed to tack on just over 1%, continuing its recent rally from the bottom of its trading range. So far though, it remains in that range.

The database often speaks. And, more often than not, it pays to listen. Right now, I’m still not seeing many meaningful longs other than in the Metals & Mining stocks, specifically, Gold & Silver. I am continuing to see more and more shorts.

Considering the above, I think the plan remains the same.

So what do we do? Honor your stops on existing positions and wait for entries on new ones (that horse has been sufficiently beaten). Outside of the aforementioned selected M&Ms, continue to avoid the long side for now unless you really (really really) like a setup. And, continue to look to fire off a short or two but only on entries (more beating).

If you’re not saving lives, building buildings, repairing automatic transmissions, or doing other great things, then come to the chart show today!

Best of luck with your trading today!

Dave

Free Articles, Videos, Webinars, and more....