Avoid Labels And See Both Sides

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

“BTW, that’s bullshit someone dropping newsletter because they said you are negative . The other side of this is that you start to see why you say what you say every night . I take it just because the market indicators state that we may be turning over but we don’t doesn’t mean you should ignore the fact that it is possibly turning over . Those transitional bow tie situations I realize can be powerful , we saw that in the spring with the Landry list shorts . Also people who are heavily leveraged getting greedy to the long side want to seek out info that tells them they are doing the right thing and almost get offended when someone tells them the opposite . Trust me I know . I was him in the summer of 2000 ! I didn’t want to believe I needed to get out . I will be ready this time , it’s great you have the system that allows you to be flexible . It’s amazing how well we have done in the long side even though you were saying be careful . ZEN JD EGO GDXJ now TQNT , they all allowed me to make money long while stopping out if just a couple shorts .”

Dr. T.

Thanks for the kind words Dr. T. It’s a game of clues. You have to take things one day at a time and put the puzzle together. I look at several thousand charts daily. I see when individual stocks are rallying or getting torpedoed. I see if the majority of sectors are going up or just a few. Looking at everything truly does give you a feel for what’s going on.

With that said, we have had quite a few sell signals that did not materialize over the last few years. Sooner or later they will. It is never “different this time.” This is why I occasionally get a little cautious. To the permabull, this might seem like I’m getting bearish.

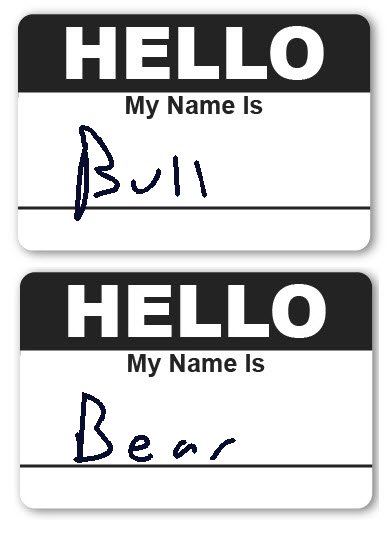

Call me what you want, bullish, bearish, but please don’t call me late for dinner. Seriously, I try to avoid labeling myself at all cost. The second you do, you no longer see the other side.

Now, let’s get to the markets.

The Ps (S&P 500) bounced around but after all was said and done, it turned into another one of those a lot more was said than done type of days. It ended in flatsville. This action has the volatility continuing to compress. As I have been saying, traders don’t agree for long so we should see a big move soon. Often after a volatility compression, you get a fakeout move and then the real move. Considering this, provided that it is not too painful, I’d like to see a fakeout/shakeout to the downside and then the real move higher. Just a possible scenario, not a prediction.

The Quack (Nasdaq) was a bit of a different story. It gapped higher to 14-year highs but it immediately found its high and sold off hard. This action forms an outside day down at new highs. I think in candle speak this is the dreaded baby with a poopy diaper, or something like that. Now before you start writing me a nastygram, keep in mind that my picking on the candle people is all in fun. The point is that you don’t want to flip the switch from bullish to bearish based on just one day. Yes, be careful and wait for entries on new longs but don’t rush out and call a top because of one less-than-ideal day.

The Rusty (IWM) also formed an outside day down. In candlespeak I think it’s a sumo wrestler engulfing a burrito. So far though, it still looks like the 2 step forward, 1 step backwards pattern I’ve been taking about as of late.

The sector action was decent on Wednesday. Many continue to hover at or around new highs. Some like Telecom actually broke out to new highs decisively. Ditto for Banks.

Lately, this has been a market where you should not fight the tape.

So what do we do? Since the methodology requires a pullback, I’m still not seeing a whole lot of new setups just yet. Therefore, continue to manage what you already have. Trail your stops higher and take partial profits as offered. And, continue to get ready to get ready for the next leg by maintaining your momentum list.

Best of luck with your trading today!

Dave