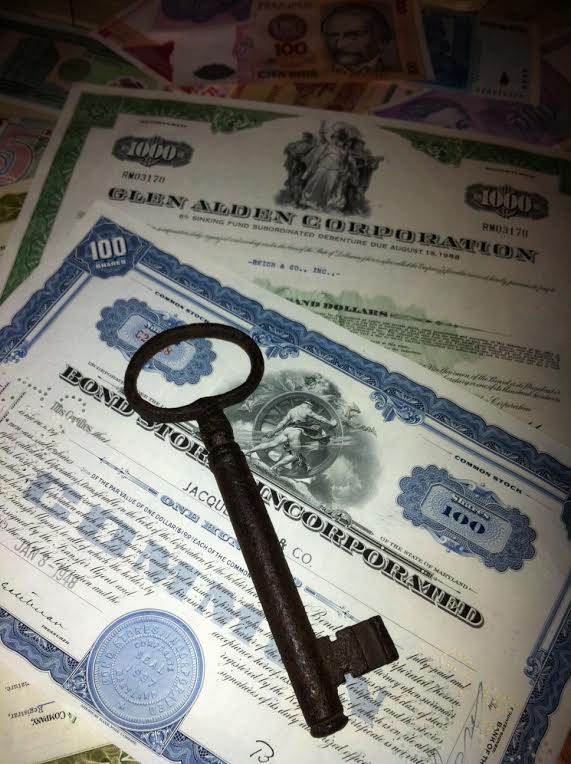

The Key To The Markets

By Dave Landry | Random Thoughts

Random Thoughts

Random Thoughts

As I preach, follow through is key. The Ps (S&P 500) tried to break out but came right back into their trading range.

The Quack (Nasdaq) lost nearly 3/4%. It remains in a downtrend but has been choppy and trading mostly sideways as of late.

The Rusty (IWM) sold off hard, losing over 1 ½% for the day. This action gives back all of the early week rally and then some. It also keeps its downtrend intact.

The Rusty remains the poster child for this market. Most stocks are in downtrends as defined by the Bowtie moving averages being in downtrend proper order (10SMA<20EMA<30EMA). By “most” I mean stocks that I (and most traders) would be likely to trade. These are stocks that are higher in volatility relative to the overall market and liquid enough to trade. It’s probably safer to say that most stocks are not in uptrends. Only 23% of the more volatile stocks in my tradable universe are in uptrends.

This is a market where the more you dig, the more you find.

You look at a sector like the Banks and think that Banks are going most sideways. However, when you look within you see that the Regionals and S&Ls have been decimated.

Even within the strong defensive issues such as Foods, Utilities, and Energies there have been quite a few debacle de jours.

So what do we do? I think the song remains the same: As I preach ad nauseam, follow through is key. Overall, things have been very choppy as of late. Usually, this is a sign to stay mostly out and let things unfold. Most of the stocks that have been trending are Defensive related such as the Energies, Utilities, and Foods. I’d avoid getting too aggressive here since the trends might be mature ones. And, it’s the only game in town. Said alternatively, I’d like all stocks to be rising so that the rising tide would help to lift my boat too. Also, as mentioned lately, there have been quite a few debacle de jours here. Therefore, make sure you wait for entries. On the short side, not to talk out of both sides of my mouth, but the aggressive traders might want to keep an eye out for transitional setups (early trend) in these same issues. Look for setups here and in any other previous high flyers that have recently begun to roll over. Again, it could be a case of the bigger they are, the harder they fall. For the most part, again, let things unfold. Take things on a setup-by-setup basis and avoid any big picture predictions. As mentioned recently, trend following should be easy. And right now, it is not.

Futures are soft pre-market.

Best of luck with your trading today,

Dave