Random Thoughts

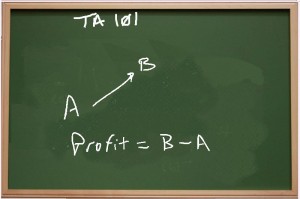

Random ThoughtsOn Tuesday, I discussed how price is the truth, the light, and the way. The only way you can profit is to capture a price move. This is an inescapable fact regardless of your methodology. You can be a contra-trend player, count waves, count beans, count complex number series, or even look to the stars. It doesn’t matter. You can’t escape the fact that you have to capture a price move to profit. Write that down. And, the next time you find yourself plotting the 15th oscillator or trying to determine if it’s a 5th of a 5th or just an ABCD correction of a 3rd just take a look at a blank chart and ask yourself 3 questions: Is price going up? Down? Or, sideways?

That is why I use price and only price to tell me what to do.

What about:

P/E? Well, I use the numerator only (I learned that trick from Greg Morris. Check out his new book. Nice work Greg!).

Earnings? No.

Valuations? No.

Growth? No.

News? No.

And, in my best Henry Kissinger voice: What about the situation in Nigeria!?! Nope.

Follow the bouncing price ball and your life will get a lot easier.

Does it always work? Nope. That’s where money management comes in. As I wrote in Layman’s: “Money management will cure a multitude of sins.”

Trade at a small and consistent size on any individual trade. Use entries to get you in and stops to take you out. Take partial profits on a swing move just in case the trend doesn’t materialize and use trailing stops just in case it does.

And, of course, as I preach, your best defense is a good offense. Pick the best stocks to begin with. Watch the intro video on stock selection here.

Do the above and do it well. My work is done. Dave has left the building.

Naah, my work is not done. People are people. They’re going to chase gurus, arcane and complex methodologies, get caught up in the news etc… So, I continue to fight the good fight. My best clients are those who start with my simple stuff then go off to chase rainbows for 10 years before coming back. They learn that there is no Holy Grail and that simple, while not perfect, systems can work.

Before I digress any further, let’s look at the scoreboard.

The market continues to shrug off world events.

The Ps tacked on nearly ¾%. They continue to rally off recent support (circa 1850) and are now getting close to all-time highs. And, as a trend guy, I’m not going to argue with new highs.

The Quack had a decent day, gaining 1 ¼%. It is closing in on multi-year highs.

The Rusty (IWM) did a good job of indicating what happened internally. It tacked on nearly 1 ½% and is a gnat’s eyelash away from all-time highs. As you would expect, most areas ended higher.

Well, most but not all. Gold continued to drop. This action puts it back into its prior short-term trading range. I wouldn’t get too excited about this just yet. It can often have 9 lives. So far, the longer-term major bottom (you’re welcome) remains in place here.

Back to the good: Biotech had a decent day, gaining over 2 ½%. This is good news since it has been losing steam as of late. Do continue to focus on the smaller capped/lower tiered and more speculative stocks since many of the bigger cap stocks that have been in extended runs might be priced for perfection. See my talk about efficiency in the aforementioned intro to stock selection webinar.

For those keeping score, the Transports are just shy of all-time highs.

Quite a few areas are still short of their prior highs. Areas such as Manufacturing, Retail, and Banks still have a potential double top appearance. Most rallied yesterday but will have to keep on keeping on to get to new highs and beyond.

Stronger areas such as the Semis are rallying out of their pullbacks.

So what do we do? Not much has changed: Yet again, forget about the news and focus exclusively on price. Yes, sooner or later the market’s reaction will be adverse to your position but so what. If things were always rosy then everybody would be doing it. Continue to follow the plan. Again, let the market tell you via stops which positions to keep. And, on new positions, wait for entries. Stop me if you heard all that before. Why am I so redundant? Because hearing and listening are two different things.

Futures are firm pre-market.

Best of luck with your trading on today!

Dave

Free Articles, Videos, Webinars, and more....