Random Thoughts

I'm probably the last person in the U.S. to watch Game Of Thrones but I finally caved. A friend of mine insisted that I watch it due to complex plot lines, character development, people going medieval on each other, dragons, and the gratuitous soft porn. I'm always skeptical of investing my time getting hooked into a series. I have to admit this one has been quite cerebral. At least that's the excuse that I'm telling everyone. Anyway, I really have been enjoying the quotes. My favorite so far is from Lord Tywin Lannister, the richest man in the kingdom:

Substitute "trader" for "king" and you have some sage advice. Let's explore this further.

A Wise Trader Knows His Methodology

I have a brother-in-law named Andy. He's awesome and a blast to hang out but occasionally will draw you into a heated debate. When he asks for your opinion and you give it to him, he not only tells you that you're wrong but how wrong you are. I have dubbed this "Andying." The term has stuck so much within our family that we often tell each other "Look, I really do want an opinion. I'm not Andying you." Where was I? Oh, people occasionally send me their methodologies for my 2 cents. I've learned that they really don't care what I think. They're Andying me. They seem to get offended and defensive when I point out the shortcomings. The interaction often goes something like this:

Me: Look, you had a 50% drawdown. And, since a hypothetical system is based on 100% hindsight (AKA "curve fitting") your biggest drawdown is yet to come.

Them: Yeah, but by the end of the year, it actually ended in the black.

Living through something on paper and then living through

I Know My Methodology Is NOT Without Its Nuances

My methodology is not without its nuances. It's streaky. I was once told by a mentor to stop making it sound so elusive. Unfortunately, sometimes it is. You print money for a while and then go back to grinding it out, wondering when the next print money phase will return. BTW, the day I solve for the streaky nature is the last day you'll see my fat ass. Anyway, the making money phase doesn't define you. It's the in between. This leads us to my next point.

A Wise Trader Knows That Patience Is A Virtue

From the Kirk Report, I picked up this gem referencing Brett Steenbarger's blog: (btw, both are worthy reads!)

Applied to trading the "folding" is twofold. One, it's not playing when conditions aren't conducive. For instance, I couldn't find a setup to save my life recently. Although I felt a little performance anxiety, I was able to take solace in the fact that maybe a trend trader should be super selective while the overall market is trading sideways. When last Friday's spanking came along*, I realized yet again that sometimes it's better to be on the dock drinking beer wishing that you were out to sea than out to sea wishing that you were back on the dock drinking beer (Something I can attest to! I was once on a boat that nearly sank 400 miles off the coast of Bermuda).

*the original version of this column was published on 09/16/16.

The other "folding" is using stops for when you're wrong. Stops let the ebb and flow control the

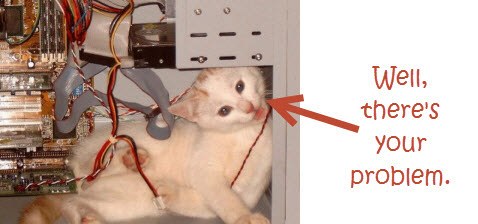

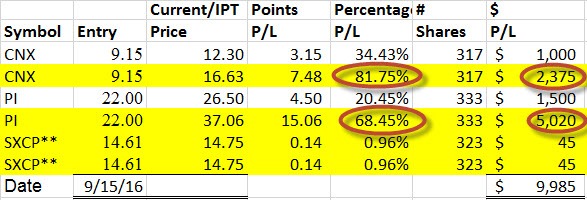

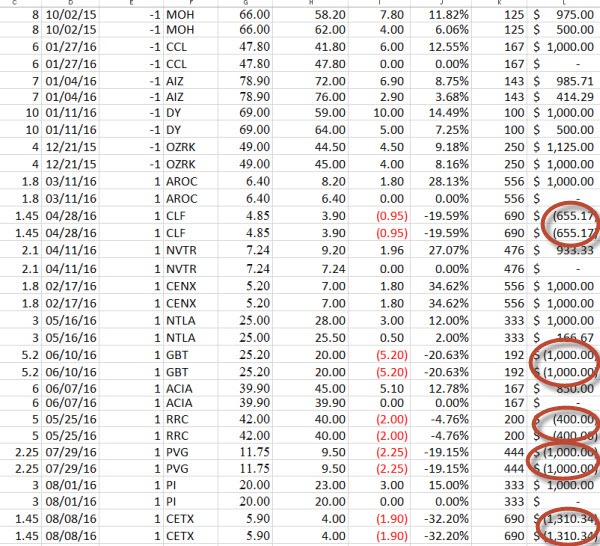

A Wise Trader Knows That Trend Following Is A Game Of Outliers

Trend follownig is anything but "push a button, get a peanut." Often a few big trades define your year. As mentioned above, we don't always print money (dang, there I go again!) but when we do I'm often surprised that some clients tell me that it doesn't work. I ask them, did you take the trade that's now up triple digits? No, but I took those stinkers that you recommended. Well, there's your problem. The outliers make your year. Without them, your performance will be mediocre at best. It truly is a game of outliers.

Ironically, I just received the following email :

"I did not make any money following some of your picks." (when asked about renewing my Core Trading Service)

Well, I don't make money following some of my picks either. The money's made by following all of the picks (yours or mine). As Greg Morris says, "People tend to sharpshoot signals." Miss some outliers and numerous small winners and yes, all you're left with is a loss. Looking back over the closed trades over the last 6-8 months, yes, there were some losing trades:

A Wise Trader Knows Money Management & Position Management

A wise trader knows that he can be wrong on any position even though it sure seemed like the mother-of-all setups at the time. Provided that you have picked the best and left the rest, you then let the chips fall where they may. Something as simple as a stop will keep you in when you are right and take you out when you are wrong or no longer right. And, quite often a somewhat liberal entry can keep you out of a bad trade altogether.

A Wise Trader Knows Himself

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Sun Tzu

In the Art Of War Sun Tzu wrote about the importance of knowing yourself. A wise trader knows the markets but more importantly, knows himself. Can you wait patiently for the next big winners to come along knowing that they will but not knowing when? I see it all too often. Many don't stick around long enough to reap the fruits of their labor. Can you grind it out and not give up right before the next big trend comes along? Most can't but if you are going to be successful in this business, you can't be like most. Write that down.

"A wise trader knows what he knows and what he doesn't."

A wise trader knows his methodology-both the good and especially the bad. He knows to be patient while waiting for setups and to be patient once he enters. He knows that he doesn't know exactly what a market will do next but proper money and position management will take care of that. And, above all, a wise trader knows himself.

I explored all of the above and then some in Thursday's (09/15/16) Dave Landry's The Week In Charts. Borrowing a line from my friend Greg Morris, just don't operate any heavy machinery after viewing....

So, KNOW These Things

If you know yourself, your methodology, and your money management, you will succeed at trading. This is, providied of course, that you know what you don't know.

May the trend be with you!

Dave Landry