Random Thoughts

The distance between you and your trading success is the distance between your ears. Your mindset is key. Trading isn’t easy, but it’s not nearly as difficult as many try to make it. Understanding these 7 psychological facets of trading is crucial. Let’s dive in.

1. "We Are Not Made To Trade"

That statement is fodder for an entire book, even volumes. The bottom line is that as human beings we don’t operate well in environments where we don’t have a reasonable amount of control over the situation. Many of the same things that make you successful in life are the exact things that will hinder your success as a trader. This can be tough for the educated and motivated-which you are, otherwise, you wouldn't be reading this column. You became successful by taking action, controlling the situation, and applying a high degree of logic. Unfortunately, these traits can often be detrimental to your trading account.

At times when there are no opportunities you’ll feel pressure to do something. You’re not lazy. You’ll also feel pressure to figure out exactly what happens next. Unfortunately, as I preach, no one knows exactly what a market will do next-not you, not me, and not the guy who screams on TV. This is actually liberating. The pressure’s off. Since no one knows you can embrace the fact that “not knowing” is okay.

2. When It Comes To Trading, Experience Isn’t Always The Best Teacher

As a kid, I have fond memories of trips to the beach and not so fond memories of chaff nipples. We would “surf” on cheap Styrofoam surf boards all day. Styrofoam doesn’t seem that abrasive but trust me it is, especially when you throw in a sunburn (I never dreamed I’d be one of those “when I was a kid” kind of guys but: You people worry about things like gluten …we didn’t even have sunscreen…or seatbelts). Anyway, I remember sleepless nights due to chaff nipples. Fast forward a few years and I was waterskiing with an older friend of mine. In between runs I noticed a bunch of kids playing on a-in my best Donald Trump voice-“YUGE” block of Styrofoam. They were climbing on it, sliding off of it, and generally rubbing all over that thing. I begin to putter over to provide them with some sage advice. My older sensei brethren inquired as to my actions. I explained the physics of how Styrofoam, sun, and nipples just don’t mix. These kids must be warned! He calmly grabbed the wheel and pointed us back toward the middle of the bayou. I looked at him perplexed. He looked back and calmly said “experience is the best teacher.”

Dave your chaff nipple story is fascinating but what does this have to do with trading? Well, you’ll obviously need experience in the markets but you must know that the market can often be a bad teacher. It’ll encourage you to take small profits before they evaporate, exit at the first signs of adversity, hold on to big losing trades, and a plethora of other bad behaviors. My point is that here we have yet another example of what makes you successful in life (and keeps your nipples from further chaffing) –experience-- could actually make you unsuccessful as a trader.

3. Trading Is Harder Than It Looks

On the surface, trading looks pretty easy. As mentioned quite often, my wife often goats me into a "honey do" by starting with “all you have to do is….” Last weekend for instance, she explained to me that “all you have to do is go zip zip with the hedge trimmer at the entrance of the property.” Well, we ended up blowing much of the weekend-and we’re not even close to being done. Once we got into it we found an overgrown rotten fence that had to be removed, limbs that had to be trimmed on nearby trees, and that the shrubs had to be cut back and not just trimmed. In the end we, or more accurately she, decided that a ground zero approach might be our best bet. So, I got to keep my reputation as quite the redneck by doing burnouts in attempt to yank out the shrubs.

Where was I? Oh, trading on the surface looks pretty easy. “All you have to do is” find a trend and get in. Plan the trade and trade the plan. That’s pretty much it. I know, easier said than done. “I’ve never met an unsuccessful paper trader” (The Layman's Guide To Trading Stocks). Once real money is on the line things begin to change.

4. You Make Trading Harder Than It Really Is

“All you have to do is?” Well, the bottom line is all you have to do is to identify a trend and determine where you will get in. And, what better way to do that than to simply look at the price chart and first start by checking the "net net" move? Is the stock higher, lower, or about the same as it was? In spite of something so simple and obvious, I’m repeatedly asked about stocks that have gone sideways for weeks and even months. I suppose the motivated and educated are just trying to make something that isn’t there.* There’s nothing wrong with being an optimist (better than being a pessimist..I was going to be a pessimist but I figured it wouldn’t work out..I think that's Wright). However, in markets, unless you’re Bubba, what is, is.

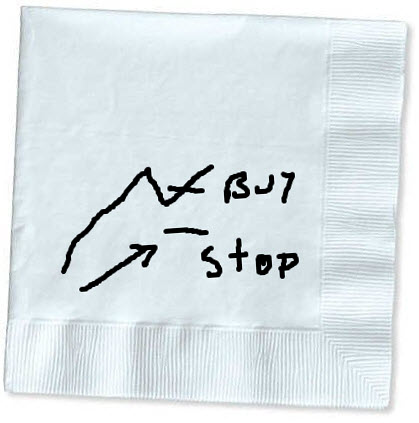

In spite of all my teaching and preaching on keeping it simple, I get email after email from people who are building complex systems. Why not see if you can make a simple system work first? Trust me, if you can’t make a simple system like mine work, then adding complexity won’t help. And, even if you do have something complex that you believe is viable, I’m willing to bet that I can reduce that down to something much more simpler. If your methodology can’t easily pass the cocktail napkin test, then toss it out.

5. Money Management Will Cure A Multitude Of Sins

Before we get into money management being a saving grace, I’d be remiss if I didn’t mention that you must be adequately capitalized to begin with. If you’re farting around with the rent money or Jr.’s college fund then you’re doomed from the start.

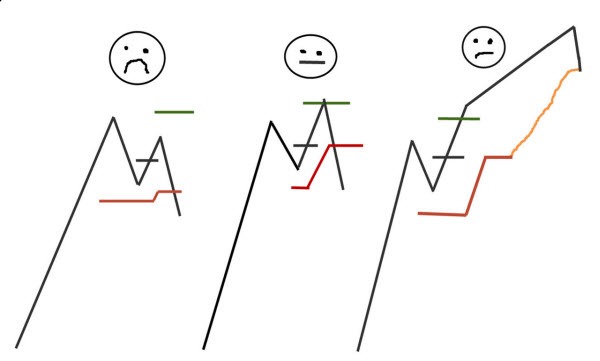

Now, assuming that you are adequately capitalized, proper money management will make it much easier to follow your plan. It will help you to resist the urge to mentally monetize open profits or losses. If the trade, winning or losing, only equates to a round of golf or a nice meal, it’ll be much easier to stay the course. Once you get the “reps in” then you can build from there--add to your account and or work up to the (in my case) 2% per trade if stopped out.

One other thing: Yes, money management will cure a multitude of sins but if you are following the plan and still getting stopped out repeatedly, then your stock selection could probably use a little work.

6. All Trades Eventually End Badly

As I often preach, trading is like buying a pet, “it’s going to end badly.” (Carlin) ALL trades eventually end badly. Either you’re going to get stopped out at a loss or you’re going to give up some open profits along the way. This is actually liberating. Knowing ahead of time that there will be some adversity makes it much easier to deal with provided of course, that you embrace and accept this.

7: Attitude Is WAY More Important That Aptitude

Again, the distance between you and your success is the distance between your ears.

A few years back, I started working on a beginner’s course. Initially, my approach to this was to show the mechanics from the ground up but it quickly became something much bigger (which eventually became Trading Full Circle). My thinking quickly became what would I want to tell that younger punk version of me that would save me years of heartache? I would tell him that, above all, your mental attitude toward the markets is crucial. Yes, mechanics are important but they’re simple and straightforward. It’s the mindset that’s key. If I can get the beginner thinking properly then they’ll avoid the psychological pitfalls down the road-or, at the least, recognize and adjust when they occur. You must have the proper mentality. I poked around the net until I found the definition that drives the point home.

As you know, markets can often be choppy during the summer months. So, I tend to work on courses during this time to avoid the Siren call of watching my screens and trying to force a trade. Last summer I started a course on trading psychology which I thought I could bang out in a few weeks. Around a month later, all I had to show for my hard work was a 14-page “to do” list of what I felt MUST be covered. I realized that I might have slightly underestimated the project (I know, I have some of that "all you gotta do" in me too!). Yes, all of the material must be covered but if you can’t wait for me to get around to finishing it I have some really good news: You know what you’re doing wrong? Well, you know what you’re doing wrong. Assuming that you have the mechanics down pat and have experienced a variety of market conditions, then I’m willing to bet that you know what you’re doing wrong. And, if you don’t, I’m guessing that a quick look at your trades will reveal the problem.

Quite often I receive emails from people telling me that they’re not honoring their stops, they’re cutting their profits short, they’re over trading trying to force something to happen and so on and so forth.

Like the "doctor, doctor it hurts when I do this" joke, my solution is simple: DON'T DO THAT!

As mentioned ad nauseam, if they "truly don't know," when I unearth their problems their reply is "I know, I know." So, you know.

Still Having Trouble With Your Trading?

If you're still having trouble with your trading, make sure that you have truly embraced and accepted aforementioned 7 psychological facets of trading.

May the trend be with you!

Dave Landry

After Thoughts

*Note: since this column was originally published, I found the answer for why successful people do this . A client of mine, who is also a psychiatrist, explained to me why this is so. I covered it in detail in the Trading Full Circle course.