Now with Dave Landry-Random Thoughts On What Dave's Doing

What I'm Reading

Once again, I've been so slammed with the Member's area that I haven't had much time to read. I did manage to finish, The Art Of Thinking Clearly by Rolf Dobelli. As mentioned last week, one of my problems with all of the behavioral finance books is that after a while, they all start to sound the same. And, they all draw heavily upon the same research (e.g. Thinking Fast and Slow)-see books to read for more on this. Overall though, I think that it's worth reading. The stories are divided in to bite sized "one sitters." I believe that it's going to be a great reference for future presentations Or, at the least, a reference back to the original source(s).

What I'm Thinking About

I'm thinking that this market move could be the start of something much bigger. Ideally, I would prefer if the market just went up for eternity, but unless you're Bubba Clinton, what is, IS!

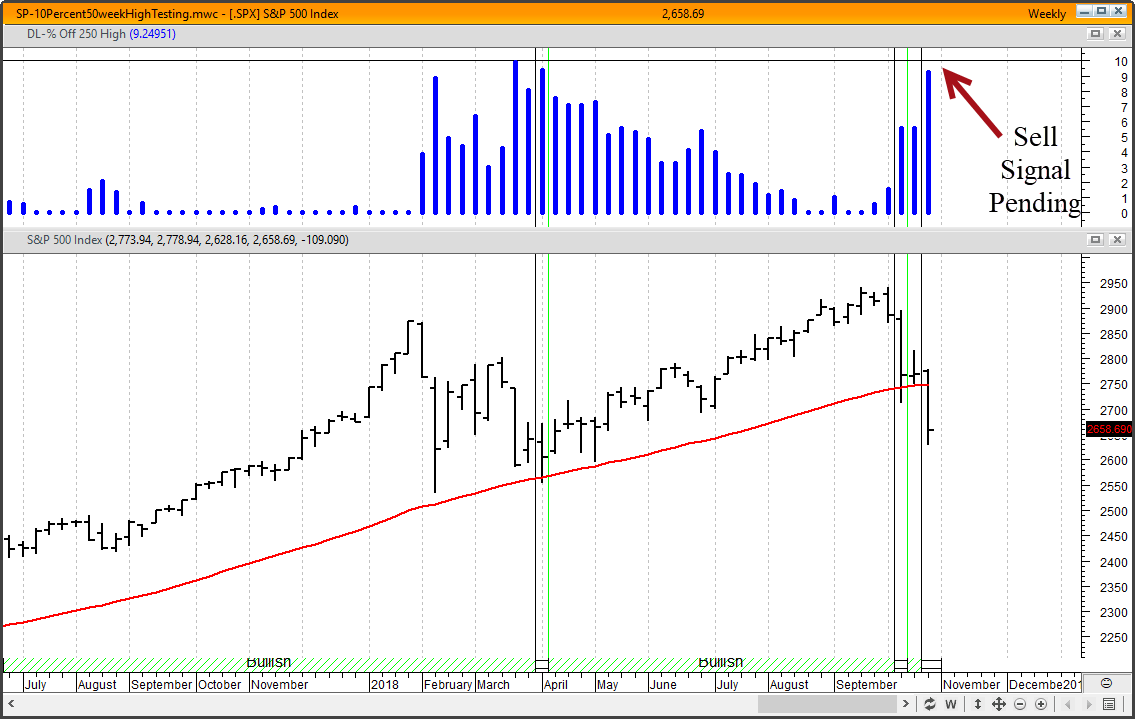

Notice below that we are approaching a sell signal in the TFM 10% system. See the Market Timing Mini Course (free, see the signup further down) for more on this. Also, watch the latest Dave Landry's The Week In Charts for an update on my thoughts, analysis, and market timing research

I'm continuing to think about what I'm going to bring to Charles Kirk's peeps for his upcoming traders' retreat in St. Lucia. And, I continue to come back to the basics-is the market (or stock) in an obvious trend or transition in trend? Does it trade cleanly? Is there an easy-to-recognize simple setup that would get you on that trend/emerging trend? Are you going to carefully plan your trade and then follow that plan? We're not made to trade from a physiological and psychological level, so you better be willing to do the thing that often feels unnatural: following the plan! In a nutshell, attitude is far more important than attitude.

What I'm Trading

With this segment, my goal is to not report my trading on a blow by blow account, but to rather shed some light on lessons and my thought process. With that said, I stopped out of my hourly Bowties (see the trading efficient markets like Forex lessons under the member's area) in the AUD/USD and NZD/USD-one for a loss and one for a small profit overall. I have a love/hate relationship with these two pairs. I love 'em and they hate my account! Anyway, as I preach, this isn't my bread and butter, just something that I do when the opportunities present themselves. Speaking of S&G type of trades, I was able to pick up a couple of points in the intra-day reversal in the SPY on Tuesday (10/23/18). I'm anti-daytrading but I can't resist these opportunities when they present themselves. I know myself so I know that I have to pick my spots carefully for daytrades, otherwise I'll be hunched over my screens chasing shiny objects all day and miss the bigger picture. With a few of you asking about taking some daytrades, this has me thinking how important it is to stay in your lane! If that's what you want to do, then do it. Just make it your life.

In stocks, I'm getting a lot of questions on whether or not you should exit positions (longs) when the market becomes "iffy." Well, we're certainly "iffy" now! My answer is no. Let the ebb and flow control your portfolio. The market, via a protective stop, is the final arbiter. I still have one lonely long in my portfolio (IIIV). It's not setting the world on fire but so far, it has survived the overall downturn. Maybe, just maybe, it can continue to defy gravity. And, if I get stopped out, so what (okay maybe one F-bomb), I can still proudly say that I followed my plan.

I have been using deep-in-the-money put options in some cases as a "substitution for stock." I'm not a huge fan of options (even though I spent 14-years consulting with a hedge fund that traded options exclusively) but put options can be useful in certain cases. Tread very lightly if you're new to options. DO read the options chapter in my first book. Also, speaking of which, if you're not familiar with shorting, read the appendix. Hey Big Dave, I don't have your first book! Well, even though the book is nearly 20-years old, the info is timely. So, I'm going to give it to you for free! Just sign up below for the member's area and you'll get access under the Bonus section.

The model portfolio is now is short GDDY, INTU, NTAP, and (recently) long UGP. Again, my job is not to report every trade but rather to give you a feel for things. We're playing the ebb and flow game. We got stopped out of our last long, long before the market tanked, and as the market tanked, we begin adding shorts. I know eventually that the mother-of-all short covering rallies is going to suck, but so far, it has been really nice to be able to keep my head while everyone else is losing theirs! The point is that following along is always the thing to do. Of course it doesn't always work (if it did, you'd never see my fat ass again!) but it works a heck of a lot better than fighting trends or becoming the proverbial deer in the headlights.

This Week's Content

The aforementioned Week In Charts is VERY timely. I would urge you to watch it this weekend given current conditions-just don't operate heavy machinery after viewing. I also edited and re-published a video from a presentation that I did last year: "To Short or Not To Short." This is another timely video that I think you should watch. On Wednesday, I did another live Q&A session. In this one, I covered hourly Bowties, whether or not I take my own recommendations, trading the news (or not!), the TFM 10% market timing system, and using the VIX (or not?) to help time the market. This will be edited soon and post early next week. See the Q&A archives.

Around DaveLandry.com

Again, I continue to add to the Member's area. As mentioned previously, the ultimate goal is to enhance the user experience. And, based on the feedback, so far, so good!

"....when you launched the Learning Management portion of your site earlier this month I became a member to check it out. I can’t tell you how much fun and educational it has been to work though the different modules. It has been almost addicting, once I start one video I just can’t stop, really awesome work you did on it. It is clear you put a tremendous amount of time and effort into it and your members are really going to benefit from the information, I know I have.....just wanted to say hi and let you know I really look forward to finishing the Learning Management modules"

I think I've succeeded in have everything there that you need to become a better trader and have answered 95% of all questions. For the other 5%, I'm working on that through the bi-weekly Q&A and adding new content almost daily.

The Holistic Trader

As mentioned before "holistic" means a combination of psychology, money management, methodology, and as I have learned over the last year or so, YOU. Take care of YOU. This isn't an easy business and certainly not without stress. You have to make sure you're operating at peak performance.

I walked around 10 miles and logged 40 miles on so on the Peloton and dieted (a bit). My goal is to fit in my bikini before St. Lucia!

Upcoming Appearances

I'll be playing the role of Dave Landry in this week's Dave Landry's The Week In Charts. Other than that, my dance card is open. Anyone need a clown (or moron, lol) for their kid's birthday party?

May the trend be with you!

Dave Landry

P.S. Now that you know what I've been up to, leave me a comment below to let me know what you've been doing.