Random Thoughts

By Dave Landry

Flip The Script

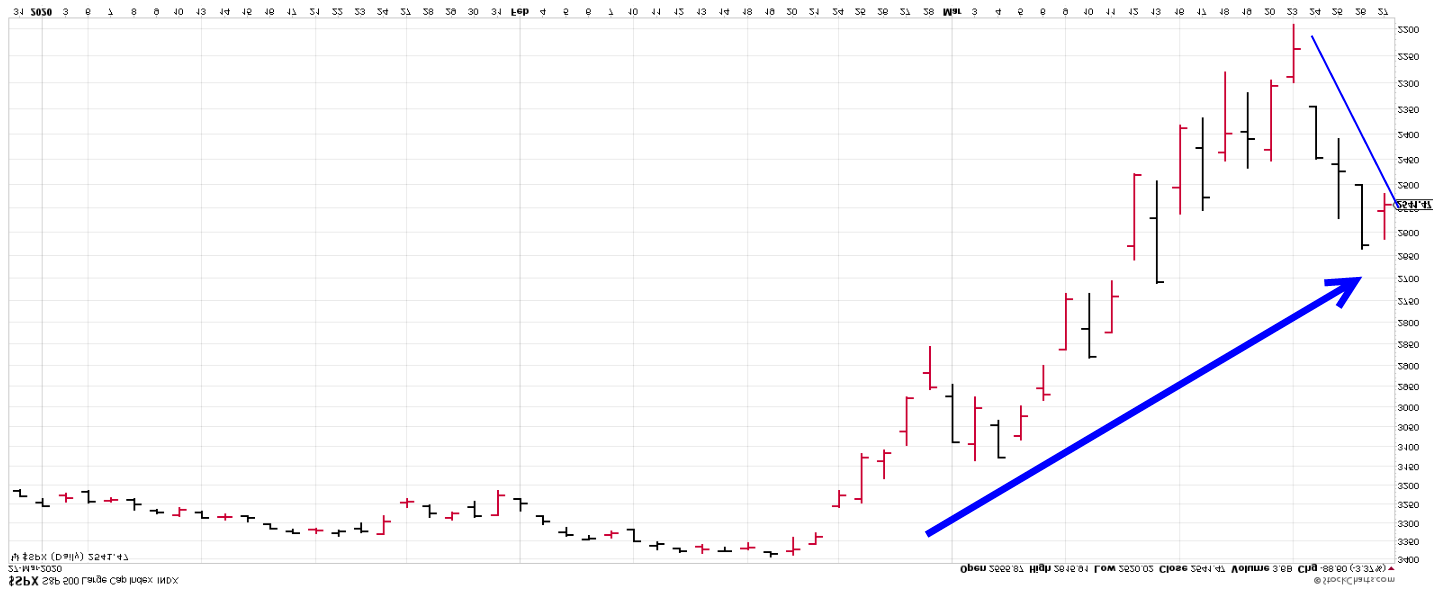

Years ago, I had an app that would flip my screens. Every now and then, to gain perspective, I'd flip the charts. Standing the charts on their head can give you some perspective.

Notice above the Ps (S&P 500) are in a nice "uptrend" and have recently pulled back.

Business As Usual

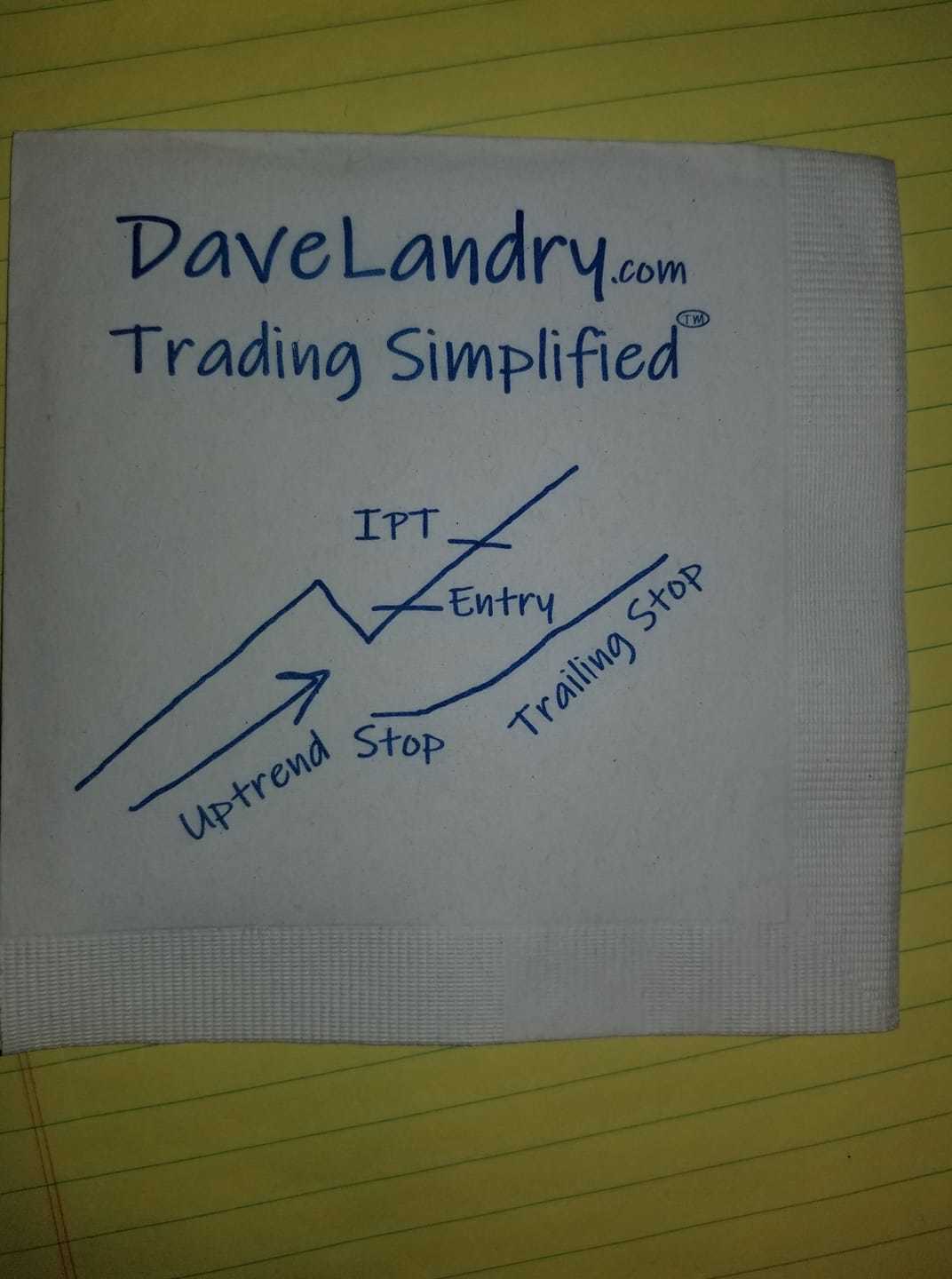

For the trend follower, it's business as usual: thrust, pullback, thrust, pullback-rinse and repeat. This is NOT to say that the short side is easy. Borrowing a line of reasoning from Authur Hill (from the StockCharts.TV special presentation), learning to trade in a bear market is like learning to sail in a hurricane-"You better be a good skipper, and have a really strong boat."

As someone who has been in storms and sinking boats hundreds of miles from short, I can attest to the fact that sometimes "it's better to be on the dock drinking beer, wishing you were out to sea than out to sea, wishing that you were on the dock drinking beer." If you're new to trading, now's not the time to "take the boat out." DO learn everything that you can during this bear market because I can assure you, markets go up and markets go down-this will NOT be our last bear market.

The Emotional Nature Of Markets..And You

Markets are emotional. And, so are you! As I preach, if you didn't have emotions, you'd be dead in a day-or put in a "box" where you couldn't harm yourself. ALL decisions are emotionally based. It's neurology. One way to wrap your head around that is to be cognizant of your emotions--both in the markets and life. Once you realize how truly emotional you are, then know that the market is a collective of "yous."

Markets do not trade on reality. Markets trade on the perception of reality. In bull trends, that positive perspective gets stretched-and stretched. Of course, companies don't deserve their lofty valuations, and those little super speculative stocks will probably never turn a profit. However, the perception that these companies will turn big (or bigger) profits keeps them afloat. Good news is good news in bull trends, and bad news is good (i.e., shrugged off) in bull trends. Conversely, just the opposite is true in bear trends. Bad news is bad, and good news is bad.

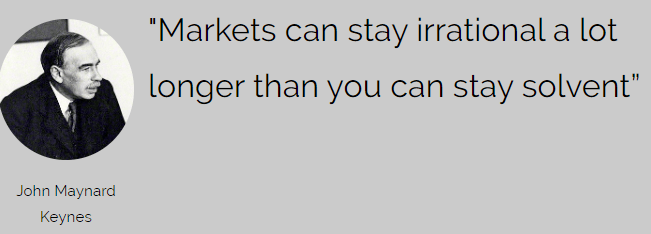

Things get overdone to the upside and overdone to the downside. Keynes' quote comes to mind. Those who stayed out of the irrational dot.com markets in the late 90s missed the boat-or worse, sank by interjecting logic. As I preach, "don't confuse the issue with facts."

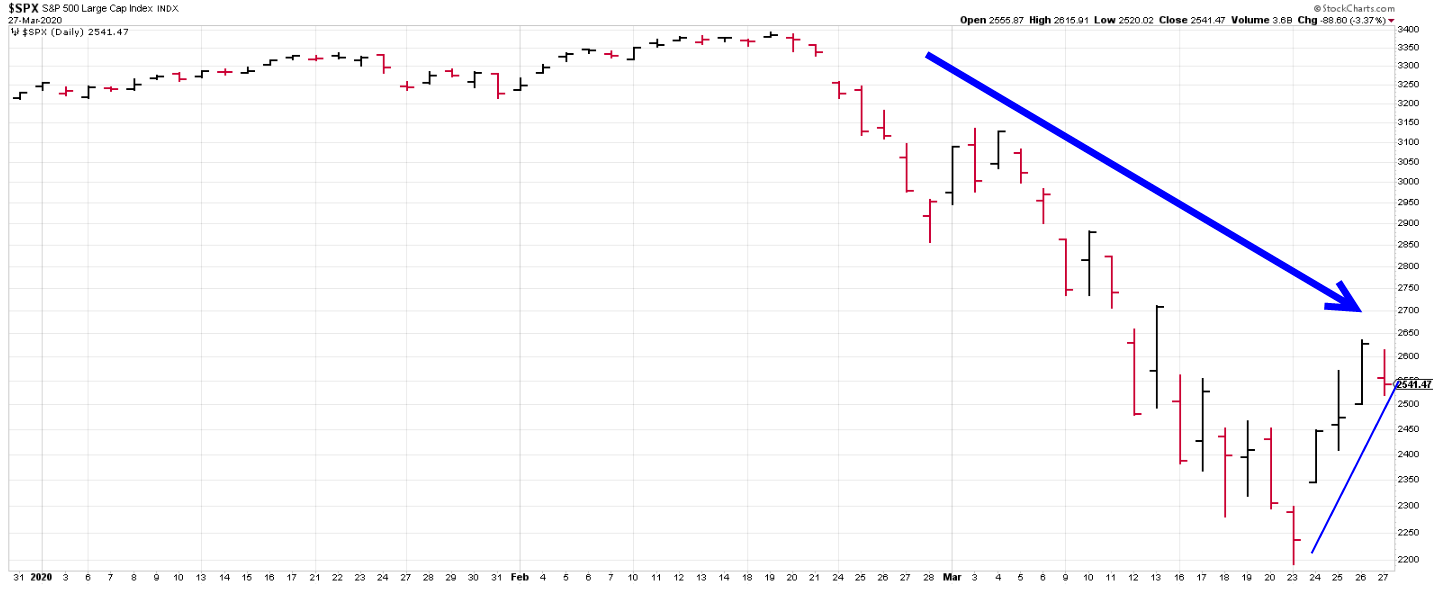

So are we overdone? I dunno. I'm just a card-carrying Trend Following Moron, and for now, the big blue arrow continues to point lower. Please don't blame me. I'm just the messenger.

The market looks ahead. At some point, the market will see the blue skies behind the hurricane. So when will that be? The charts will tell us. For now, as a trend follower, we just follow along. Although the short side is not nearly as easy as the long side, trend following prevails. Trade in the direction of the major trend (i.e., the big blue arrow).

On A Side Note....

Thanks so much for all your well wishes! I'm 30 miles north of the latest epicenter across the lake (New Orleans), but there is a bridge between us. So, we are being vigilant. And, like other epicenters, there's definitely a GTFO mentality! So, it's coming. Again, thanks for the concerns. I know that everybody is fighting their own battles. So, back atcha!

In Summary

The market remains in a downtrend until it starts going up again-for more than just a pullback. I think like Justice Potter Stewart, "well know it when we see it." For now, it just looks like a garden variety pullback. Don't fight it! If you are new to all this and want to jump in, don't. Sit on the dock. Learn.

Stay safe and sane!

May the trend be with you!

Dave Landry