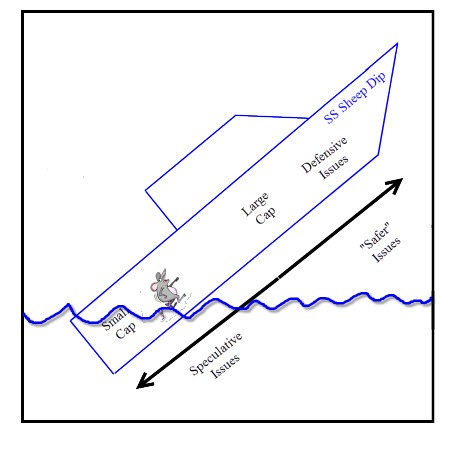

As the SS Sheep Dip sinks, the rats run from the stern to the bow. The speculative issues are the first to go. Then, there is a flight to the perceived safety in the larger cap stocks. Finally, there is a rush towards the “so called” defensive stocks—Utilities, Foods, etc… Unfortunately, as the name implies, the ship eventually sinks.

It often becomes a case of the bigger they are, the harder they fall. This is why larger cap stocks are now showing up on the radar as potential shorts. And, the smaller cap stocks are beginning to look a little sold out-at the least, they aren’t dropping as fast as they were. One of my peeps astutely pointed this out just yesterday. The problem is that you can’t live off relatively strength. If the ship’s sinking, then eventually all the rats drown.

I live near New Orleans. We had a hot summer. It was hot, really hot, Africa hot. If you were an alien visiting for the summer, you’d say, oh, New Orleans is hot. Well this morning, we’re in the 40s. It’s not exactly freezing, but it certainly not Africa hot. What does this have to do with markets? Well, if you started trading in 2009, you probably think that markets just go up. Yes, they have a little so called “correction” now and then but for the most part, they go up. You haven’t weathered a bear market.

There’s a new crop every cycle. “It’s different this time” or the Fed will continue to keep the boat afloat. Whatever the reasoning, markets never change. True, they can be exuberant for long times—a propensity that us TFM’s (see below) use to our advantage—but they never change. Markets go up and markets go down. Those who drank the permanent income hypothesis Kool-aid for the last 5-years are now faced with a harsh reality.

Hey Big Dave, why are you acting like this is end of the world? Well, as my friend Greg Morris pointed out in a recent interview (see yesterday’s column for a link), “we treat all sell signals as if it will be the big one.” I fully agree. BTW, he asked me to stop mentioning him in columns where I use the world moron. So, don’t tell him he made today’s column.

Don’t be a bull, don’t be a bear, be aware is what I always preach. The beauty of trend following is that you don’t have to be a genius. This is how I got the not-so-glamorous-at-the-time nickname of Trend Following Moron back in the late 90s. I just followed the market higher, drawing my arrows being careful not to confuse the issue with facts. The market was going higher. Who cares why? Although I was initially offended, being called a moron was a pivotal point in my career. This spawned T-shirts, coffee mugs, etc..but I digress. As trend followers our job is not to try to outsmart the market. I’m guessing this gentleman, who told me where I could stick my big blue arrows*, was short the market—and with likely very good reasoning. Well, don’t confuse the issue with facts (and if you ever do, visit www.dontconfusetheissuewithfacts.com or www.donotconfusetheissuewithfacts.com, note: it’ll bring you back to davelandry.com).

Okay, let’s look at the market. The Ps (S&P 500) imploded on Wednesday. They found their low and begin to rally sharply. It’s amazing that it almost felt like a victory but the market, basis the Ps, still ended down over ¾% nonetheless.

Most sectors recovered just like the market. They tailed lower and then reversed to close well-some even made it back to the plus column. What was concerning is that there was an underlying new round of selling. A lot of areas such as Health Services, Insurance, and Banks were hit hard. Some previously strong—at least on a relative basis-such as Utilities have begun to break down. The aforementioned ship is sinking and the last of the rats are bailing out.

Jeez, Big Dave, you’re bumming me out. Well, believe in that you see and not in what you believe.

So, what do we do? Well, the market remains very oversold coming into today and it looks like oversold is going to become even more oversold. The futures are getting creamed pre-market. Therefore, you might want to hold off on new shorts for now or, at the least, make sure you don’t get caught up in a potential opening gap reversal (OGRE). Speaking of OGREs, I’m not a big fan of daytrading, but this might be an opportunity watch for an OGRE in the Ps. See my articles under education for more on playing gaps. Yes, I’m actually thinking we could see a bounce today–at least from the open. For the most part though, we just follow the plan. We have one long leftover and several shorts. Honor your stops and let the market weed out any stocks that can’t defy gravity. Take partial profits as offered and trail your stops lower on the shorts. I’d use the opening weakness as more of a chance to lighten up than to add. Don’t be greedy. This is a gift. Wait for the next bounce for looking to establish new shorts.

Best of luck with your trading today!

Dave

*My paint program defaulted to blue. So, my arrows are blue.

Free Articles, Videos, Webinars, and more....