Ready To Become A

Better Trader?

Become A Better Trader

Become A Member Of DaveLandry.com

Which Trader Are You?

Can Anyone Become A Successful Trader?

YES!*

I believe with 100% conviction that anyone can learn to trade. There is one small caveat: *You have to want to be successful. You may be thinking, wait, doesn’t everyone want to be successful? I’m not so sure. The biggest problem that I see with many traders is that they abandon their plan in attempt to outsmart the markets. They refuse to give up on pre-conceived notions and aren’t willing to ignore much of what has been taught as “conventional wisdom. ” They tend to interject logic into what the market should be doing vs. accepting what the market is doing. The good news is that these problems are easily fixed through understanding how markets really work and accepting what is.

Are You Searching?

If you're like me, you probably weren't exactly sure how to get started trading. It's tough. There's so much noise out there. And, like me, you found yourself spending a lot of time and your hard earned cash chasing empty promises. For me, my true enlightenment finally came when I realized that simple techniques could actually work in real markets.

Theodor Seuss Geisel, source: goodreads.com

"When you are in a slump, you're not in for much fun. Unslumping yourself is not easily done"

Have You Lost Your Way?

Even if you've been trading for a while, at some point, you'll hit some tough times. We all do. It's what happens during those tough times that defines us. There are pitfalls that we can easily fall into in order to "get back" what the market "took" from us. This could be using excessive risk, trading in less-than-ideal conditions, attempting to use complex methods to outsmart the market, and a host of other bad behaviors. If we're not careful, we could easily spiral downward during these inevitable bad times.

"I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times"

Bruce Lee

Or, Do You Just Want To Become Better At What You Do?

Do you ever get aggravated when you miss a big winning trade that was your radar? Does the Siren call of day trading draw you in when you know that you should just follow your longer-term plan? Do you occasionally abort your trading plan in attempt to outsmart the market and then watch the market take off without you? Let's face it, in spite of what the get rich quick gurus spout, trading is often a constant struggle. None of us are immune. Therefore, we must constantly strive to get better at what we do to operate at peak performance. Structured lessons, getting your questions answered, one-on-one consulting, and interacting with other like-minded traders will help you to become a better trader.

Over the years, I've answered tens of thousands of emails from those who are struggling. In virtually all cases, their problems were solved by simply getting back to the basics. All that was needed to return to profitability was to exercise proper money management, trade only in trending markets, and follow the trading plan vs. giving into inevitable psychological and physiological urges that come with bad times.

Do You Have To Be Really Smart To Trade Successfully?

NO!

Highly intelligent people can often make for bad traders - This is because they fail to accept the fact that markets are often irrational and always emotional.

NOT Rocket Science

I once received an email from someone from a rocket scientist, literally. He said: “Rocket science is not rocket science. Trading is rocket science!” I explained to him that his difficulties stemmed from the fact that he was trying to interject logic and reasoning into the equation. These things might help to get a rocket off the ground but don’t always apply to trading.

It’s not just rocket scientists that struggle. The same often holds true for doctors, lawyers, automatic transmission mechanics, and any others who are highly skilled or educated. It’s not your fault. In fact, once we get deep into trading psychology, you'll discover that you may have had years and years of “bad training” for the markets. This can be easily undone. So, if you're smart, don't worry. You're not doomed! You’re just going to have to accept the fact that logic doesn’t often apply. Once you understand how markets actually work, then you just have to be willing to follow along.

Trading is far from easy but it's not nearly as hard as many try to make it. The mechanics are actually quite simple. In fact, it never ceases to amaze me how the simplest of concepts can work quite well in real markets. This inspired me to trademark “Trading Simplified.”

"Take The Easy Route"

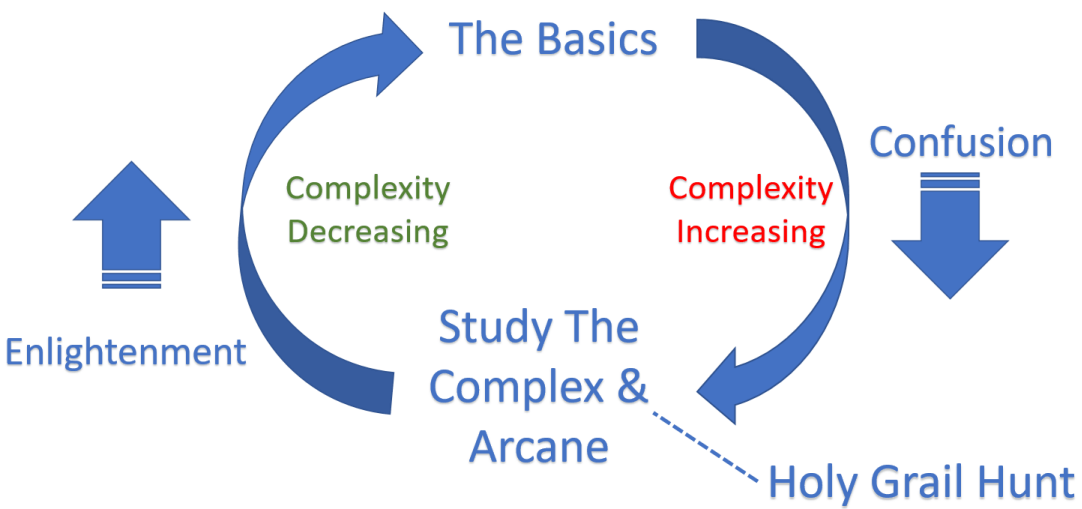

There are two ways to become a successful trader-an easy way and a hard way. The hard, and very expensive, way is to abandon the basics and try out numerous methodologies that seem to be “too good to be true.” And, then later find out that they truly are too good to be true. This journey can take years and provided that you don’t go broke and/or give up in frustration, you reach true enlightenment when you return back to the basics.

The journey of becoming a successful trader is often long and difficult, but it doesn't have to be.

My advice is simple - Take the easy route. Start with a simple methodology and stick with it until you become successful. Once you accomplish that, then, and only then, you can slowly add slightly more advanced strategies. Skipping the typical trader's journey will save you a lot of time and money. Never forget that if you're not successful with the basics, you won't be successful with more complex methods. You might want to write that down.

Some Hard Realities

You're Not Going To Get Rich Overnight

Good trends don't come along every day - It will take some time to catch good market trends. The good news is that if you learn how to recognize and get aboard them, you’ll be ready for when they do. You’ll limit your losses in less-than-ideal conditions and do extremely well in great conditions.

So You're Not Selling The Golden Goose?

If someone had a goose that laid golden eggs why would they sell it? Good question! If you're like me, you've probably ended up on a few marketing lists. And, like me, you probably get emails daily with inflated promises. Here are just two of my favorites:

“Make 10-million in 10 minutes a day”

“Make 2-4% every day.”

Obviously, “make 10 million in 10 minutes a day" is complete and utter BS but, how about 2%-4% every day? Well, with simple compounding, a $10,000 account would be worth between 1.4 million and 181 million in less than one year. That’s returns in the 14,000% to 1,800,000% range. Again, these claims are slightly exaggerated-sarcasm implied. And, if they were true, why would you tell anyone?

The Trader's Dilemma

"You cannot predict trends but you can follow them forever"

Dave Landry

Predicting the markets is akin to predicting the weather. Only short-term forecasts are viable. If it's cloudy and thundering there's a good chance that it will rain soon but you don't know if it will be raining this time next week or next month.

Short-term trading has higher accuracy and the risks are generally lower. Unfortunately, gains are often limited. Big trends take time to develop. And, the really bad news is that something bad can still happen. Trading where the gains are limited and the losses are potentially unlimited is a recipe for disaster-with ANY methodology.

The real money is in longer-term trading. Unfortunately, so is the risk. The longer that you're in a market the better the chances are that you will get soaked. We all read about these famous long-term traders, but a quick Google search shows that many of them subsequently blow up.

This creates a dilemma. Short-term trading has its problems as does longer-term trading. In order to be successful trading, you must control losses while still allowing for the potential for longer-term gains. So what's a trader to do? Both! It doesn't have to be a mutually exclusive decision. You truly can have your cake and eat it too by trading for both short-term AND longer-term gains. Through proper money and position management you can take short-term profits just in case the trend is a short one but stay with the remainder of the position should it turn into the mother-of-all trends.

I Have Some Good News But First,

The Bad News

"We have found the enemy and he is us"

Pogo

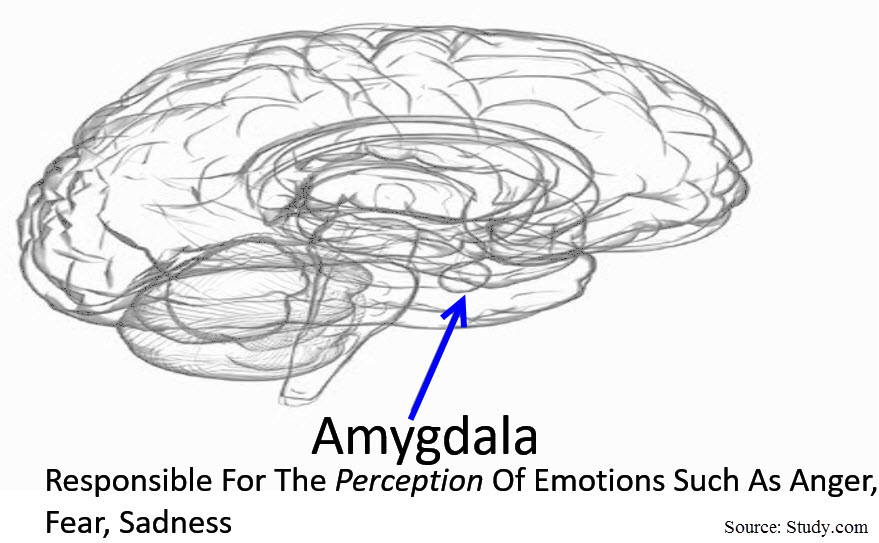

The bad news is that we’re simply not made to trade. This is on both a psychological and a physiological basis. The things that are keeping you alive and making you successful in your career are detrimental to your trading account. Once you accept these facts you'll instantly be able to identify the bad-for-trading behaviors and take simple steps to correct them.

When, not if, you find yourself struggling with your trading, it could have absolutely nothing to do with you. During these times you must identify anything in your life that has nothing whatsoever to do with trading that could be coming between you and your success. Correcting these things in your life will vastly improve your trading.