Random Thoughts

by Dave Landry

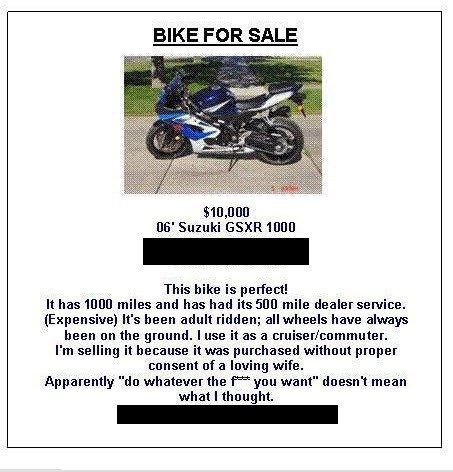

If you could go back in time, what would you tell the younger version of yourself? I would say, look, Dave, at some point, Marcy (my wife) will tell you to "do whatever the hell you want." That does not mean do whatever the hell you want. I would also say, Dave, don't bother chasing Holy Grails. Instead, spend most of your time working on your attitude towards the markets. And, you’ll also need a little money management. Let’s explore this further.

Mentality Vs. Methodology

Borrowing the reasoning from the late great Mark Douglas, you don't see markets as they are, but rather your interpretation of them.

How you think about markets and yourself is more crucial than your actual methodology. True, the mechanics are important, but your mentality is key. The best methodology in the world is useless without the proper mindset to follow it. Write that down. If I could go back and talk to that young punk version of me, I’d tell him not to focus so much on figuring out the exacts of markets but rather himself. And, this is what I would say….

It’s Going To Be A Lot Harder Than It Looks

On the surface, all you have to do is figure out where the little electronic blips are headed and get on board. That's easier said than done. The market will often fake you out and shake you out. Markets will often do the obvious but in an unobvious manner. And, they’ll also do whatever it takes to cause the most pain to the most participants (I borrowed these “floor-isms” from Linda Raschke). This brings to mind a corollary from Bill Dunn: "Trend following is like riding a bucking bronco." Amen!, my brother from another mother.

Curtis Faith

It takes a lot of time and study before one realizes just how simple trading is, but it takes many years of failure before most traders come to grips with how hard it can be to keep things simple and not lose sight of the basics.

It’s Not Going To Be Nearly As Hard As You Try To Make It

Wait Big Dave, isn’t that a contradiction? Nope. Trading is far from easy, but it’s not nearly as difficult as many try to make it. Whenever you find yourself plotting that 15th oscillator, a derivative of a derivative, or trying to determine if it’s a 5th of a 3rd or a 3rd of a 5th in your wave count, come back to the fact that “all you have to do is” catch a trend—sell higher than you buy. And, price does not lie. If you must use indicators, then realize that they don’t actually indicate what will happen. They simply illustrate what has happened. Has is the key word in that sentence. Since indicators are derived from price, they will have lag. Other than the occasional moving average-e.g. Bowties-scroll down to get my books for free (for a limited time), I do not use any indicators. As I preach, unless you’re Bubba Clinton, what is, is. Ask yourself, "self, is the market generally heading higher, lower, or just plain sideways?"

There Is No Holy Grail

Suppose that you’ve built a system that appears to print money. Congratulations! You have just perfectly curve fit to the past. Unfortunately, the future curve will be different—one of the few things that I can guarantee. No, you won’t be able to “push a button and get a peanut.” I’ve been there, done that, and got the T-shirt (not the peanut). I did a lot of Grail searching with mechanical systems. I’d wake up early and program for hours. I tested everything and many variations thereof. Once you put these into practice, you quickly learn that the map is not the territory.

Without digressing too far, recently, I have been receiving emails about a system that would have generated 4.5 million dollars from just a measly $10,000 investment. I have to admit; I was intrigued! So, I read the (really) fine print, and they explain that the results are hypothetical. I guarantee you that the future curve won't be quite the same as the hypothetical one. But heck, "what would the world be without hypothetical questions?" Wright?

A market is composed of a bunch of emotional beings and guess what (no, not chicken butt)? You're one of them. The way I wrap my head around the emotional makeup of markets is to be cognizant of my own emotions. This is both inside and outside of trading. How many times a day am I tempted to follow emotionally charged decisions? I've been working on a massive trading psychology course on and off for years. One of the exercises is to mark an "F" on open trades every time you drop an "F-bomb." Doing this myself, I'm embarrassed to see my charts littered with Fs--even on good trades! My point is that it's tough enough keeping your own emotions in check, let alone trying to control what others might do. So don't.

The Pressure's Off

As I often preach, the fact that NO ONE knows exactly where a market is headed is liberating (I bet you thought I was going to say, no one knows exactly what a market will do: not you, not me, and certainly not the guy who screams on TV!). Anyway, that means we’re all on a level playing field. The little guy can compete with the big boys. In fact, in some cases, you actually have an advantage. For instance, I occasionally recommend hot IPOs in my Core Trading Service. My Registered Investment Advisor (RIA) clients often can’t take them, but you, the nimble small trader, certainly can.

Keep It Simple

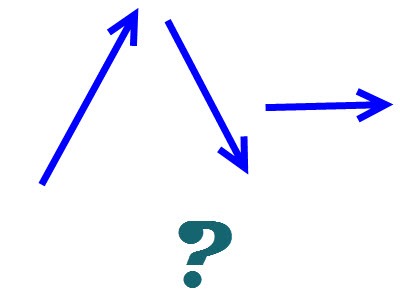

If you can’t follow a simple system, then you certainly won’t be able to follow a more complex one. Further, I’d be willing to bet that I could reduce a complex trend following system into something much simpler. I’ve been in many presentations where the chart is littered with numerous buy and sell arrows. The presenter is quite proud of their system. However, in reality, they could have avoided all those unnecessary trades by following something much simpler such as a moving average (which is usually already plotted on their chart), or even better, the big blue arrow. Simple things like this, not complex formulas, will help to keep you on the right side of the market.

The Battle Is Often Within

I’m proud to have helped some kids become wildly successful in their school’s stock picking projects. The reason that they succeeded was not because they had the Grand Poombah as their mentor but rather because they just followed my simple plan: In a nutshell, buy things that are going up and purge the losers. They don’t think about how they feel, how smart they look, how much money they need to “make back” from prior losses, or that junior’s hungry and there’s an upcoming mortgage payment. Nope, they just follow the plan.

Being Right And Making Money Are Often Two Diametrically Opposed Things

You’re going to be wrong a lot. This doesn’t mean that you’re an idiot. Provided that you’ve picked the best and left the rest, congratulate yourself for your execution, not the outcome. As I preach, the market can be a really bad teacher. Terrance Odean quotes come to mind. BTW, Annie Duke wrote an excellent book on being process oriented vs. outcome oriented: Thinking In Bets for a lot more on this.

You’ll Have To Approach Trading Holistically

I assumed that being able to go fast was the most important part of racing. In my first spin around the track (in the “girl’s seat,” thanks Peter Mauthe!), I quickly learned that being able to slow down was as important. Yes, you have to get to the curves as fast as possible, but you better be able to slow down quickly so that you can make the turn.

There’s a saying in the hotrod community: if you’re going to put in the “go” you better also put in the “whoa.” Going fast is fun, but you also have to be able to stop. Likewise, in trading, you’ll have to have a stop in place for when, not if, you’re wrong. As I have said ad nauseam, ALL trades will eventually end badly. You’re either going to lose flat out, or you’re going to give up some open profits in the end. So, money management cannot be separated from the methodology.

Snoop Dogg, source SnoopDogg.com

"Money management will cure a multitude of sins." Assuming that you are adequately capitalized to begin with, and trading at a proper size, then a loss is just a cost of doing business. You shrug your shoulders and shout: “NEXT!” I know, yeah right! Okay, maybe drop an F-bomb first (often guilty as charged!), but the point is that it doesn’t ruin your life. Once again, paraphrasing Mark Douglas: A bad salesman gets rejected on a few calls and then drinks his lunch. A good salesman gets rejected on a few calls, grabs a cup of coffee, and returns to making calls, knowing that it’s a number’s game and he’s getting closer and closer to making a sale. Likewise, a good trader gets smacked around a bit and then, channeling Peter Tosh: "picks himself up, dusts himself off, and starts all over again"-knowing that he's getting closer to the prize. So, in addition to money management, you must have the proper mentality. And, proper money management will help you with that proper mentality. Again, you must approach trading holistically (see "The Holistic Trader under Members). Yes, the methodology is important, but you'll also find that you'll have your "mind on your money and your money on your mind" (Snoop).

In Summary

Keep it simple. Don't overthink it. Sprinkle in a little money management. And, above all, just remember that your attitude is far more important than your aptitude.

May the trend be with you!

Dave Landry