Random Thoughts

by Dave Landry

I have some bad news. We’re not made to trade. The mechanisms that are keeping you alive and allowing you to function as a normal human being are the exact same mechanisms that come between you and your success. This is on a psychological and even on a physiological level. But, first, I digress...

I hate accounting. I'd much rather study markets, trade, write, give webinars, and travel the world speaking the good gospel of trend following—anything but accounting. However, if my educational business is to remain a business, then it’s a necessary evil. And, I really enjoy it-the business that is, not the accounting. Yes, it makes money and gets me out of the office. There’s more to it than that, though. It serves as a constant reminder of what not to do. It also inspires me to become better. “You make me want to be a better trader." You do!

I'm just getting around to finishing up months of accounting (thanks to a nudge from my smokin' hot bookkeeper-I love ya babe!). I've been contacting clients to see if they’re ready for me to continue to provide market color commentary, teachable moment “walk throughs,” pointing out potential opportunities, and when necessary, suggesting that we just wait until conditions improve. Through this process I’m getting a lot of confessions:

“I held on to longs too long.”

“I over-leveraged.”

“I over traded.”

“I sought action over opportunity.”

“I confused the need to be right vs. making money.”

“I day traded when I should have just stuck to position trading.”

The list goes on and on. Some are willing to turn over a new leaf. And, unfortunately, others are done, realizing that they’re not made to trade. Well, the bad news is, none of us are. We all have to overcome this human flaw. Let’s break it down.

1. Letting The Little Brain Control The Big Brain

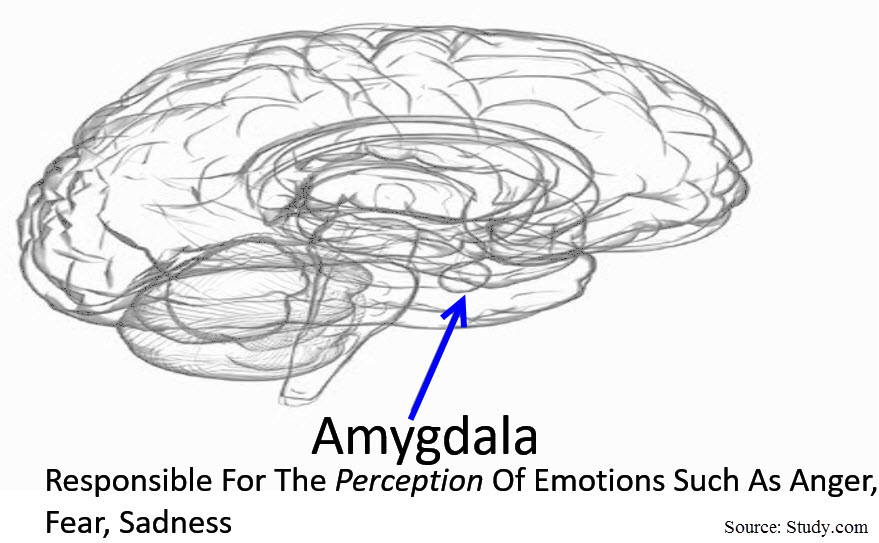

Our decisions are often made by a very small part of our anatomy. I know there’s a joke in there somewhere, but I’m actually referring to the amygdala-the tiny almond-shaped part of our brain. I discussed this in detail in the Trading Psychology Micro Course. In a nutshell, it’s the emotional part of our brains that make snap decisions. These are often decisions that we need to survive when faced with imminent danger.

What's interesting is that we can’t make any decisions without emotions (Damasio, Shull). So, we have to recognize and embrace but not try to eliminate emotions from our trading. As discussed in the aforementioned course, sometimes all we need is a few seconds to get past the little so-called lizard brain to use the rest of what’s sloshing around up there. As an experiment, count to three the next time you find yourself tempted to make a quick quip back at your spouse/significant other. Congratulations! You've just avoided the doghouse. You're welcome!

2. Confusing The Issue With Facts

In life, logic applies. And, as a general statement, you better follow logic if you are to function as a normal human being. However, in trading there often is none. You’re dealing with the emotions of the participants. Their reasoning, which often has no logic, is what makes the markets go up and down. As often mentioned Marian McClellan (the late mother of Tom McClellan) said it best:

“People buy and sell stocks for a variety of reasons. Some people buy when they have money. Some people sell when they need money. And, others use far more sophisticated methods.”

The media would leave you to believe that you can connect the dots by using news. You can’t. Markets sometimes go up on bad news and down on good news. I recently saw a headline that read: “Market Goes Down On Low Oil Prices.” Huh? I thought high oil prices were bad for markets and low oil prices were good? Again, since you are dealing with the emotional nature of the participants, logic doesn’t often apply. If there was a way to connect the dots, a lot more journalist would become traders.

3. Trying To Control The Situation

In life, controlling the situation as much as possible is what made you successful. Yet in markets, you have no control. You can only control you. As the late and great Mark Douglas once said, “All it takes is one a-hole to screw up a perfectly good trade.” And, guess what? You have absolutely no control over him. Giving up control isn’t easy but it’s necessary.

4. Being Under Capitalized

If you’re trading a million dollar account and lose $10,000, provided you followed your plan, then it’s no big deal. If you’re trading a $20,000 account and lose $10,000, then you feel like you’ve been wiped out. So how did it go from 20k to 10k in the first place? What about money management? Well, the money management is a little tougher with a small account. The frictional costs (e.g., slippage, commissions) are relatively higher. And, from a psychological standpoint, it’s harder to follow the plan once the account begins to erode, thereby often creating a downward spiral.

I quickly learned about the psychology of stock trading during my first foray into the markets. I sold a boat that I wasn’t using for $1,000. I bought 100 shares of my first stock with that. Within days, the stock was down 1 ½ points. I was only down $150, but I felt like I was wiped out, even though I was making more than that per day in my day job.

“I’ve never met an unsuccessful paper trader.” (Layman’s) When real money is on the line, things change. And, unless you view a small account as “tuition,” then it’s not going to be easy.

Unfortunately, even if you do hit it right with a small account, you might still put psychological pressures on yourself because it’s not enough. I made this point in this Dave Landry’s The Week In Charts, re-telling a story from Nick Radge about a friend of his (warning, it doesn’t end well).

5. Looking For Action And Entertainment

If you’re looking for action, the markets are a very expensive place to look. It’s much cheaper to go to Vegas. At least there, a pretty girl will bring you a drink while you lose your money. As I often preach, trading, done properly, can be quite boring. A lot of times, we’re more “wait-ers,”-waiting for opportunities than traders.

It’s not your fault. We’re wired to take action. We have to in order to survive. Unless you’re a toll taker, you aren’t going to get paid to just sit on your ass. However, in trading, that’s often exactly what you should do.

Speaking of doing nothing, I lose more clients when I suggest that they sit on their hands than when I recommend stocks that don't work. That’s okay. I can sleep at night knowing that sometimes return of capital is more important than seeking return on capital. First, do no harm. And, I’m in for the long haul. The lost clients often go off to "Grail hunt," and, provided they don’t blow up in the process, they will eventually “get it” and return. They then become my favorite clients. They learn that simple is better, there’s no secret sauce, and sometimes, you just have to wait for your pitch.

Speaking of the Holy Grail, this brings us to number 6, Holy Grail hunting.

6. Holy Grail Hunting

Trading with charts is the art of reading the emotions of others while embracing your own. No one knows what the other participants will do. Will Joe stick something somewhere he shouldn’t and lose half of his stuff thereby being forced to sell his stocks? (reminds me of the “pickle slicer” joke, yeah, "she got fired too") My apologies for being crude but you get the idea. Selling often occurs for no logical reason. So, you mean to tell me that there is some magical indicator, numerology, or arcane system that predicts what the “Joes” (or pickle slicers) will do next? Of course not!

Let’s assume that you have a simple, viable system and happen to hit conditions just right. You’re trend following, and the market is trending. Permanent income hypothesis (read further) creeps into your head. Now let’s assume that conditions began to change and you’re money machine grinds to a halt—or worse, you begin losing money. What do you do now? Do you tweak your system? Add a layer of complexity? Or, go off to find the next thing that works?

Again, I see quite a few people who have some initial success with my Trading Simplified™ techniques but then go off to chase rainbows as soon as the markets get a little choppy. Many end up perpetually out of phase.

7. Fear Of Being Wrong Or Looking Stupid

Markets go up, and markets go down. I know, duh, huh? Yet, when a position is going sharply against you, you reason why it should not be doing that. And, you might be right, it should not be going against you but it is. And, unless you’re Bill Clinton, “What is, is.” Don’t worry about being wrong or looking stupid. Sometimes, you just have to get out of the way. Here it comes:

“He who fights and runs away lives to fight another day.”

8. Attempting To “Transfer” Success

The market attracts those who are motivated. And, the motivated often make for the worst traders. You weren’t born with a scalpel in your hand. You had to learn and earn it. Unfortunately, those who are or have been successful in their other life automatically think that transfers to trading. It doesn’t. It appears much easier on the surface that it really is. Like anything, you have to work at it. It’s really not hard but it’s far from easy. You become successful the same way you did in your career-lots of hard work combined with experience. Trading is no different.

9. Convincing Yourself That What You See Is All There Is (WYSIATI)

Source: Nature.com, G. Renee Guzlas, artist

In Thinking Fast And Slow, the author writes about how people draw conclusions based on a very limited set of data. They make assumptions that what they see is all there is. The problem with markets is that conditions can exist for a long time, giving you more than just a limited set of data. I once knew a trader who did exceptionally well following a technical/fundamental hybrid system in the late 90s. When the market began to tank, I was curious how the system would handle this. So, I asked him about his exit strategy. He replied, "Oh no, you don't want to lose your position!"

Since '09, the market has bounced back from sell-offs. This action has rewarded the "buy and hope," oops, I mean, "buy and hold" crowd. I can assure you that this won't always be the case. As I preach, markets often reward bad behavior.

There are a lot of things that “work until they don’t” when it comes to markets (trust me, I have a few T-shirts). If you do hit upon something that’s working quite well, congratulations! Just, don’t let it go to your head. Avoid getting sucked into a so-called permanent income hypothesis. Play devil’s advocate. As youself: What could go wrong? Did I happen to just hit it just right?

10. Winging It/Lack Of Planning

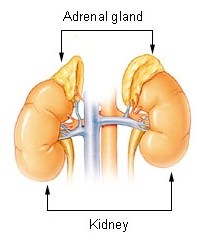

In the beautiful design which keeps us alive, chemicals are dumped into our system to give us the boost we need in “flight or fight” situations. When faced with danger, we don’t want to sit around contemplating our navel. The adrenal glands dumping the steroid cortisol into our blood stream can save our life-allowing us to run away from the bear or jump out of the way of a speeding car. Unfortunately, this same hormone is also triggered under stress. And, when does stress occur? According to Montier, stress occurs when information is unknown and/or changing. This sounds like the exact moment you enter a trade, stepping from the known into the unknown.

11. You Do It Anyway

You know what you’re doing wrong? Well, provided you have a little experience, you KNOW what you’re doing wrong. Livermore once said that traders make mistakes and know that they are making them. We know we shouldn’t be firing off day trades if we are position traders. We know we shouldn’t be buying because a market is “low enough” or selling because it is “too high.” We know that we shouldn’t “invent trades” (Mauthe) when there are none. We know that we should honor our stops vs. hoping the market will come back. As I preach, whenever I work with someone and wonder how I’m going to figure out what they’re doing wrong, I just ask. 99% of the time they tell me. On the other 1%, when I identify the questionable trading practices, a confession follows shortly thereafter.

Great Big Dave, You Did A Good Job Telling Me About My Problems. Now, How Do I Fix Them?

Assuming that you’ve done your homework and have some experience, then the solution is simple. Notice that I used the word “simple” and not “easy.” Just like the old “Doctor, doctor, it hurts when I do this” joke, quite often the answer is “Don’t do that.” If you are a position trader, then resist the Siren call of daytrading. If there’s nothing to do, then do nothing. When you do think you really have the mother of all setups, then plan your trade while things are static. Plan before going into the trade when all information is known. Then, trade your plan. Have a stop in place because guess what, you will be wrong sometimes. That goes for you, me, and that guy who screams on T.V. And, if you’re right over the short-term, take partial profits just in case you cease being right and then, trail a stop higher on the remainder, so hopefully, you ride out the trend for a long long time. When you find yourself tempted to make an emotionally charged decision outside of your trading plan just pause long enough to make sure you're using your whole brain and not just the tiny emotional part. Simple huh? Simple yes, but I never said it was easy.

May the trend be with you!

Dave Landry

After Thoughts...

So Big Dave, Are You Holier Than Thou?

Hell no! The name Israel literally means “struggles with God.” I’m the Israel of markets. When I’m hot, I feel like God. When I’m cold, I wonder if flipping burgers is above my pay grade. When there’s nothing to do, I think there has to be something that I can do. When positions go against me I reason why the market is wrong and I’m right. I cuss and I fuss. I’m emotional, probably too emotional—I cry like a school girl when forced to watch a Nicholas Sparks’ movie. I’m not perfect but through my own mistakes and constantly watching those of others, I know that I must put metrics in place. Like So-Crates, “I know that I do not know.” And, neither do you. So we follow along.

Are you making any of the aforementioned mistakes? Let's discuss this! Scroll down and leave a comment.